Melcor Reports Record Results for Its 89th Year of Business

07 March 2013 - 10:55AM

Marketwired Canada

Melcor Developments Ltd. (TSX:MRD), an Alberta-based real estate development

company, today reported record results for the year ended December 31, 2012.

Melcor earned net income of $105.02 million or $3.49 per share (basic), an

increase of 29% from 2011. Revenue was $274.93 million, an increase of 25% from

2011. Total assets grew 19% to 1.45 billion with fair value gains of $59.10

million or $1.96 per share (basic) compared fair value gains of $41.70 million

or $1.39 per share (basic) in 2011.

Record fourth quarter results contributed to Melcor's strong performance for the

full year. Fourth quarter net income was $55.47 million or $1.84 per share

(basic) on revenue of $141.96 million compared to net income of $51.82 million

or $1.73 per share (basic) on revenue of $129.43 million in the fourth quarter

of 2011.

Funds from operations (FFO) was $2.22 per share in 2012, an increase of $0.42

per share or 23% from 2011. FFO per share adjusts for all non-cash items

included in income such as fair value adjustments on investment properties and

stock based compensation expense.

Brian Baker, Melcor's President and Chief Operating Officer commented on the

year: "Top and bottom line growth in 2012 was a result of the coordinated

efforts and diligence of all operating divisions. Our company is comprised of

the most talented and hardest working team in the industry: a reality that is

reflected in our record results for 2012. As we enter our 90th year, we are

eager to compete and win in each of our divisions. With a solid base of assets

and a strong financial position, managed by effective leaders and dedicated

employees, we are well positioned for continued growth and success."

2012 Highlights

-- Melcor achieved several records in 2012:

-- Record consolidated revenues of $274.93 million

-- Record basic earnings per share of $3.49

-- Fair value gains of $59.10 million or $1.96 per share

-- Total assets of $1.45 billion (up 19%)

-- Revenues were higher across all divisions in 2012 as a result of

increased activity and growth.

-- The Community Development division had a record year, starting four

new residential communities and continuing to build out existing

developments. They also acquired strategic land parcels to maintain

inventory levels and support future growth.

-- The Property Development division completed 11 buildings totalling

125,000 square feet. These projects have been leased predominantly

to well-recognized national and multinational tenants. In addition,

the Property Development division broke ground on three new large-

scale projects that will provide the division with a sustained

activity pipeline. The division was also successful in advancing

several future projects through the land use and development

approvals process.

-- Leasing activity in the Investment Properties division was strong

with portfolio-wide occupancy rates rising to 89%. The division

continues its capital expenditure strategies to enhance the

efficiency and market desirability of existing assets through on-

going improvements.

-- The Recreational Properties division increased both revenue and

earnings in 2012 through effective and efficient operations

management and an increased emphasis on its food and beverage

operation. The number of rounds played at its four championship golf

courses also increased by 3.4%.

-- Melcor paid an annual dividend of $0.45 per share to shareholders. The

company has been paying dividends since 1969.

-- Subsequent to the end of the year, Melcor announced that it had

initiated a strategic process to advance its business interests through

the potential creation of a Real Estate Investment Trust (REIT).

Investing in the Future

The company continues to invest in land inventory, develop commercial properties

and improve and lease its portfolio of income-producing properties.

-- The Community Development division added several parcels of raw land for

future development including:

-- a 50% interest in 166 acres of land in St. Albert in the first

quarter; and

-- 233 acres of land in the third quarter, strategically located near

existing land holdings in St. Albert and Red Deer.

-- The Property Development division had projects totaling over $62 million

under development in 2012, compared to projects under development of $28

million in 2011. The division completed development of 125,000 sq. ft.

(11 buildings) in 2012 compared to 69,500 sq. ft. (9 buildings) in the

same period last year.

-- The Investment Property division acquired a multi-tenant industrial

warehouse in Lethbridge in the second quarter and took over management

of approximately 70,000 square feet (including four free-standing bank

buildings) transferred from the Property Development division.

Building Capacity

-- Brian Baker was appointed to the position of President and Chief

Operating Officer on June 1, 2012. Mr. Baker was previously Executive

Vice President and Chief Operating Officer.

-- The company expanded its production capacity in 2012 by expanding its

team via the addition of 18 new staff in 2012. This resulted in an

increase in overall headcount by 21%. This positions the company to

execute on its growth strategies.

Outlook

The majority of Melcor's business operations and assets remain focused on

Alberta. Alberta economic fundamentals remain strong, with low unemployment

rates, net in-migration, higher than the national average weekly earnings,

strong capital investment, stabilizing inflation and relative stability in the

price of oil. These fundamentals create a favorable environment for both

residential and commercial property development.

The company continues its focus on US expansion by increasing its stable of

residential rental properties, serviced lot inventory and raw development land.

These assets now comprise approximately 8.5% of the company's total assets.

Management believes that the economic indicators in its US regions provide a

strong outlook for overall business success for the foreseeable future. The US

continues its gradual economic recovery with clear signs of strengthening in the

housing market and capitalization rate compression in the residential rental

asset class.

With Melcor's inventory of raw and developed land, financial resources and

strong management group, the company is well positioned to take advantage of

market opportunities.

Annual Results

Complete financial statements, notes to the financial statements and

management's discussion and analysis will be filed on SEDAR (www.sedar.com) on

March 6, 2013 and is available at www.melcor.ca. Melcor's information circular

and other material will be mailed on or about March 30, 2012.

Annual General Meeting

We invite shareholders to join us at Melcor's annual meeting on April 25, 2013

at 11:00 am MDT. The meeting will be held at The Fairmont Hotel Macdonald,

Wedgewood Room, 10065 - 100 Street NW, Edmonton, Alberta

About Melcor Developments Ltd.

Melcor is a diversified real estate development and management company with a

rich heritage of integrity and innovation in real estate since 1923.

Through four integrated operating divisions, Melcor manages the full life cycle

of real estate development: from acquiring raw land, to community planning, to

construction and development, to owning and managing leasable office, retail and

residential sites. Melcor develops and manages mixed-use residential

communities, business and industrial parks, office buildings, retail commercial

centres and golf courses.

Melcor's headquarters are located in Edmonton, Alberta, with regional offices

throughout Alberta and British Columbia. Company developments span western

Canada and the US. Melcor has been a public company since 1968 and trades on the

Toronto Stock Exchange (TSX:MRD).

Forward Looking Statements

In order to provide our investors with an understanding of our current results

and future prospects, our public communications often include written or verbal

forward-looking statements.

Forward-looking statements are disclosures regarding possible events,

conditions, or results of operations that are based on assumptions about future

economic conditions, courses of action and include future-oriented financial

information.

This news release and other materials filed with the Canadian securities

regulators contain statements that are forward-looking. These statements

represent Melcor's intentions, plans, expectations, and beliefs and are based on

our experience and our assessment of historical and future trends, and the

application of key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to, comments with

respect to our strategic initiatives for 2013 and beyond, future development

plans and objectives, targets, expectations of the real estate, financing and

economic environments, our financial condition or the results of or outlook of

our operations.

By their nature, forward-looking statements require assumptions and involve

risks and uncertainties related to the business and general economic

environment, many beyond our control. There is significant risk that the

predictions, forecasts, valuations, conclusions or projections we make will not

prove to be accurate and that our actual results will be materially different

from targets, expectations, estimates or intentions expressed in forward-looking

statements. We caution readers of this document not to place undue reliance on

forward-looking statements. Assumptions about the performance of the Canadian

and US economies and how this performance will affect Melcor's business are

material factors we consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions, please see the

discussion under Business Environment and Risk in our annual MD&A.

Readers should carefully consider these factors, as well as other uncertainties

and potential events, and the inherent uncertainty of forward-looking

statements. Except as may be required by law, we do not undertake to update any

forward-looking statement, whether written or oral, made by the company or on

its behalf.

FOR FURTHER INFORMATION PLEASE CONTACT:

Melcor Developments Ltd.

Business Contact

Brian Baker

President & COO

780-423-6931

Melcor Developments Ltd.

Investor Relations

Jonathan Chia, CA

CFO

780-423-6931

www.melcor.ca

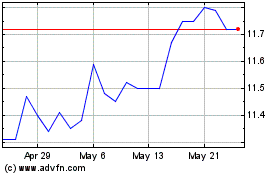

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

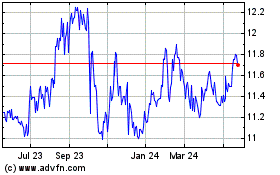

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Dec 2023 to Dec 2024