Royal Bank of Canada to Buy Brewin Dolphin for $2.1 Billion -- Update

31 March 2022 - 6:10PM

Dow Jones News

By Ian Walker and Sabela Ojea

Brewin Dolphin Holdings PLC said Thursday that it has agreed to

a 1.6 billion-pound ($2.10 billion) takeover by Royal Bank of

Canada after being hit by the effects of Russia's invasion of

Ukraine.

The wealth-management firm has suffered a financial hit from the

geopolitical situation. According to Brewin Dolphin, for the

two-month period ended Feb. 28, assets under management declined to

GBP55 billion, with discretionary funds falling to GBP48.3 billion

due to market performance.

This compares with the fact that assets under management grew by

3.7% to GBP59 billion and discretionary assets under management

increased by 4.4% to GBP52 billion as at Dec. 31 when compared with

Sept. 30.

Under the deal, accepting shareholders of Brewin Dolphin will

get 515 pence for each share held. The price is a 62% premium to

the company's closing price of 318 pence on Wednesday.

Royal Bank of Canada said it is strategically focused on

evaluating opportunities to grow its wealth-management operations

in its core markets--Canada, the U.S. and Europe.

"Although there is continued volatility in the markets, the

strength of Brewin Dolphin's brand, client proposition and

relationships demonstrate resilience in its business model and make

Brewin Dolphin well placed to capture future market growth," it

said.

Write to Ian Walker at ian.walker@wsj.com; Sabela Ojea at

sabela.ojea@wsj.com

(END) Dow Jones Newswires

March 31, 2022 02:55 ET (06:55 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

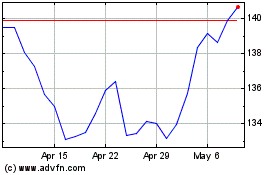

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024