TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company)

today announced net income attributable to common shares for third

quarter 2021 of $779 million or $0.80 per share compared to net

income of $904 million or $0.96 per share for the same period in

2020. Comparable earnings for third quarter 2021 were $1.0 billion

or $0.99 per common share compared to $893 million or $0.95 per

common share in 2020. TC Energy's Board of Directors also declared

a quarterly dividend of $0.87 per common share for the quarter

ending December 31, 2021, equivalent to $3.48 per common share on

an annualized basis.

"During the first nine months of 2021, our diversified portfolio

of essential energy infrastructure assets continued to perform very

well and reliably meet North America's growing demand for energy,"

said François Poirier, TC Energy’s President and Chief Executive

Officer. "Comparable earnings of $3.21 per common share were five

per cent higher compared to the same period last year while

comparable funds generated from operations totaled $5.3 billion.

Both amounts reflect the strong performance of our assets and the

utility-like nature of our business together with contributions

from projects that entered service in 2020 and 2021."

Our results are underpinned by strong demand for our services

along with a constant focus on operational excellence. Flows and

utilization levels across many of our systems are higher than

historical norms despite the ongoing impacts of COVID-19 and energy

market volatility. Given the strong performance year-to-date, we

now expect full-year 2021 comparable earnings per share to be

modestly higher than last year's record results.

"We are advancing our $22 billion secured capital program and

working on a substantive number of other similarly high-quality

opportunities," continued Poirier. "Importantly, all of our secured

capital projects are underpinned by long-term contracts and/or

regulated business models highlighting the fundamental need for

this critical new infrastructure while at the same time giving us

visibility to the earnings and cash flow they will generate as they

enter service."

Looking forward, TC Energy expects its industry leading

portfolio of secured capital projects to grow substantially in the

coming years as it continues to expand, extend and modernize its

existing natural gas pipeline network, advances the Bruce Power

life extension program and progresses plans to use renewable energy

to power certain of its proprietary energy loads. The Company is

also working on numerous other renewable energy projects – from

pumped hydro storage to solar to wind and progressing new

initiatives in carbon transportation and sequestration as well as

large-scale hydrogen production hubs. Success in advancing our

current slate of secured projects and various other growth

initiatives is expected to support long-term growth in earnings

before interest, taxes, depreciation and amortization, or EBITDA,

as well as earnings and cash flow per share. Given the capital

required to prudently fund this program, TC Energy is modifying its

dividend growth outlook.

“We are in the midst of an unprecedented period that is

providing a significant number of investment opportunities driven

by both the growing demand for energy and the transition to a

cleaner energy future,” added Poirier. “We expect to

sanction approximately $7 billion of new projects in 2021 with

a risk-adjusted return profile that is consistent

with previous investments and anticipate annual amounts of

more than $5 billion will be added to our secured projects

portfolio in each of the next several years.”

“In order to judiciously fund our attractive suite of growth

opportunities, maintain a strong financial position and enhance our

already conservative, utility-like dividend payout ratios, we have

modified our near-term dividend growth outlook,” continued Poirier.

“We now expect to increase our common share dividend at an average

annual rate of three to five per cent. While our previous outlook

remains affordable and supported by the strong underlying

performance of our business, we believe a modest change is

prudent given our vast opportunity set. It will allow us to fund a

larger portion of our future capital programs through internally

generated cash flow, moderate our leverage and continue to deliver

superior long-term total shareholder returns.”

TC Energy remains committed to the sustainable development of

its business. To be truly sustainable, we will continue to evolve

and innovate by finding creative ways to deliver the energy people

need while being positive agents of change within our society.

Modernizing our existing systems and assets, decarbonizing our own

energy consumption, and driving digital solutions and technologies

are some of the areas we are focused on while also seeking

opportunities to invest in low-carbon energy and infrastructure. We

recently released our 2021 Report on Sustainability which includes

targets for all our sustainability commitments. Notably we have set

Scope 1 and Scope 2 GHG reduction targets, including reducing the

emissions intensity from our operations 30 per cent by 2030 and

positioning to achieve net zero emissions from our operations by

2050. We are advancing numerous renewable energy projects and

proceeding with new ventures, like our partnerships with Pembina

Pipeline Corporation to jointly develop a carbon transportation and

sequestration system in Alberta, Irving Oil to jointly develop

clean energy projects in eastern Canada, and Nikola Corporation to

co-develop large-scale hydrogen production facilities in the United

States and Canada, while remaining committed to important projects

like Bruce Power’s multi-billion dollar life extension and

uprate programs which will continue to be a source of significant

emission-less power in Ontario for decades to come.

In all our operations and projects, we remain focused on

managing and reducing our GHG emissions and building constructive,

enduring relationships with our communities and stakeholders. We

believe our creativity, technical strength and unparalleled market

connectivity provide us the ability to prosper regardless of the

pace and direction of energy transition.

Highlights

(All financial figures are unaudited and in Canadian dollars

unless otherwise noted)

- Third quarter 2021 financial results

- Net income attributable to common shares of $779 million or

$0.80 per common share

- Comparable earnings of $1.0 billion or $0.99 per common

share

- Comparable EBITDA of $2.2 billion

- Net cash provided by operations of $1.7 billion

- Comparable funds generated from operations of $1.6 billion

- Declared a quarterly dividend of $0.87 per common share for the

quarter ending December 31, 2021

- Continued to advance our $22 billion secured capital program by

investing $1.7 billion in various growth projects

- Began construction on the 2022 NGTL System Expansion

Program

- Continued to actively develop projects on our U.S. Natural Gas

Pipeline network that will replace and upgrade certain facilities

while reducing emissions including the US$0.8 billion WR

project on ANR

- Uncontested GTN rate settlement filed with FERC which would set

new recourse rates for GTN effective January 1, 2022

- Filed Columbia Gas rate settlement with FERC in October which

includes continuation of its modernization program with approval

expected in early 2022

- Executed a 15-year Power Purchase Agreement (PPA) in September

for 100 per cent of the power produced and the rights to all

environmental attributes from the 297 MW Sharp Hills Wind Farm

- Advanced the Bruce Power Unit 6 MCR program on budget and on

schedule

- Project 2030 launched by Bruce Power with the goal of achieving

a site peak output of 7,000 MW by 2030 in support of climate change

targets and future clean energy needs

- Continued to develop a 1,000 MW pumped hydro storage project in

Meaford, Ontario which is designed to provide emission-free

electricity to the province while reducing greenhouse gas

emissions

- Signed a memorandum of understanding in August with Irving Oil

to explore the joint development of a series of proposed energy

projects focused on reducing greenhouse gas emissions and creating

new economic opportunities in New Brunswick and Atlantic

Canada

- Partnered with Nikola Corporation in October to collaborate on

developing, constructing, operating and owning large-scale hydrogen

production facilities in the United States and Canada

- Issued US$1.25 billion of 3-year and US$1.0 billion of 10-year

fixed rate Senior Unsecured Notes in October

- Released our 2021 Report on Sustainability in October which

includes targets for our sustainability commitments, including

reducing the emissions intensity from our operations 30 per cent by

2030 and positioning to achieve net zero emissions from our

operations by 2050.

Net income attributable to common shares decreased by $125

million or $0.16 per common share to $779 million or $0.80 per

share for the three months ended September 30, 2021 compared to the

same period last year. Per share results include the impact of

common shares issued for the acquisition of the remaining ownership

interests in TC PipeLines, LP in first quarter 2021. Net income

attributable to common shares includes a number of specific items

that we believe are significant but not reflective of our

underlying operations in the period. More information on these

items, which are excluded from comparable earnings, can be found in

the table entitled "Reconciliation of net income to comparable

earnings" in our third quarter MD&A.

Comparable EBITDA of $2.2 billion decreased by $54 million for

the three months ended September 30, 2021 compared to the same

period in 2020 primarily due to the net effect of the

following:

- lower EBITDA from Canadian Natural Gas Pipelines largely

attributable to the impact of lower flow-through depreciation and

financial charges on the Canadian Mainline, partially offset by

increased flow-through depreciation and income taxes along with

higher rate-base earnings on the NGTL System

- decreased earnings from Liquids Pipelines as a result of lower

contributions from liquids marketing activities, mainly

attributable to lower margins

- lower Power and Storage results attributable to decreased

earnings at Bruce Power in 2021 due to lower volumes resulting from

greater planned outage days and higher operating expenses,

partially offset by higher realized power prices

- increased earnings in U.S. Natural Gas Pipelines from Columbia

Gas following the application for higher transportation rates

effective February 1, 2021 and the settlement-in-principle that was

reached on July 28, 2021, subject to refund upon completion of the

current rate proceeding

- foreign exchange impact of a weaker

U.S. dollar on the Canadian dollar equivalent segmented earnings in

our U.S. dollar-denominated operations. U.S. dollar-denominated

comparable EBITDA increased by US$53 million to US$1.1 billion

compared to 2020, however, this was translated at a rate of 1.26 in

2021 versus 1.33 in 2020.

While the weakening of the U.S. dollar in 2021 compared to the

same periods in 2020 had a considerable negative impact on 2021

comparable EBITDA, the corresponding impact on comparable earnings

was not significant due to offsetting natural and economic

hedges.

Due to the flow-through treatment of certain expenses including

income taxes, financial charges and depreciation in our Canadian

rate-regulated pipelines, changes in these expenses impact our

comparable EBITDA despite having no significant effect on net

income.

Comparable earnings of $1.0 billion or $0.99 per common share

increased by $79 million or $0.04 per common share for the three

months ended September 30, 2021 compared to the same period in

2020 and was primarily the net effect of:

- changes in comparable EBITDA described above

- lower Depreciation and amortization primarily in Canadian

Natural Gas Pipelines on the Canadian Mainline, partially offset by

higher depreciation on the NGTL System from expansion facilities

that were placed in service

- decreased Non-controlling interests following the March 3, 2021

acquisition of all outstanding common units of TC PipeLines, LP not

beneficially owned by TC Energy

- higher Interest income and other mainly attributable to

realized gains in 2021 compared to realized losses in 2020 on

derivatives used to manage our net exposure to foreign exchange

rate fluctuations on U.S. dollar-denominated income

- higher Interest expense primarily

due to lower capitalized interest as a result of its cessation for

the Keystone XL pipeline project following the revocation of the

Presidential Permit in January 2021, partially offset by the

foreign exchange impact from a weaker U.S. dollar on translation of

U.S. dollar-denominated interest.

Comparable earnings per share also reflects the impact of common

shares issued for the acquisition of the remaining ownership

interests in TC PipeLines, LP in first quarter 2021.

Certain of our businesses generate all or most of their earnings

in U.S. dollars and, since we report our financial results in

Canadian dollars, changes in the value of the U.S. dollar against

the Canadian dollar directly affect our comparable EBITDA and may

also impact comparable earnings. As our U.S. dollar-denominated

operations continue to grow, this exposure increases. A portion of

the U.S. dollar-denominated comparable EBITDA exposure is naturally

offset by U.S. dollar-denominated amounts below comparable EBITDA

within Depreciation and amortization, Interest expense and other

income statement line items. The balance of the exposure is

actively managed on a rolling two-year forward basis using foreign

exchange derivatives, however, the natural exposure beyond that

period remains. As noted previously, the net impact of the U.S.

dollar movements on comparable earnings for the three months ended

September 30, 2021 compared to 2020, after considering natural

offsets and economic hedges, was not significant.

NOTABLE RECENT DEVELOPMENTS INCLUDE:

Canadian Natural Gas Pipelines

- Coastal GasLink: As a result of

scope changes, previous permit delays compared to the original

construction schedule and the impacts from COVID-19, including a

British Columbia provincial health order, we continue to expect

project costs to increase significantly along with a delay to

project completion compared to the original project cost and

schedule. Coastal GasLink has sought and will continue to mitigate

cost increases and schedule delays. Coastal GasLink expects

incremental costs will be included in the final pipeline tolls,

subject to certain conditions.Coastal GasLink is in dispute with

LNG Canada with respect to the recognition of certain costs and the

impacts on schedule. Construction activities continue and, at this

time, we do not expect any suspension of these activities while the

parties work toward a resolution. During this time, construction is

being funded in part by a subordinated demand revolving facility

with TC Energy which provides the project with additional

short-term funding and financial flexibility and, on which, $840

million was drawn at September 30, 2021. In October 2021, this

amount was fully repaid and further draws were made which resulted

in an outstanding balance of $175 million at October 29, 2021. As a

further interim measure, TC Energy has committed to providing

additional temporary financing to the project, if necessary, of up

to $3.3 billion as a bridge to a required increase in project-level

financing to fund incremental costs. This financing is expected to

be provided at market-based returns. While we do not anticipate our

future equity contributions will increase significantly, the

portion of this temporary financing that will ultimately be

required to be contributed as equity by Coastal GasLink LP

partners, including us, will be determined by the substance of a

resolution with LNG Canada.

- NGTL System: In the nine months

ended September 30, 2021, the NGTL System placed approximately $0.5

billion of capacity projects in service.Construction activities

began in September 2021 for the 2022 NGTL System Expansion Program

which received federal approval in second quarter 2021. With an

estimated capital cost of $1.1 billion, the program will provide

incremental capacity to meet firm-receipt and intra-basin delivery

requirements and consist of approximately 166 km (103 miles) of new

pipeline, one new compressor unit and associated facilities.

Anticipated in-service dates commence in fourth quarter 2022.

U.S. Natural Gas Pipelines

- Delivery Market Projects: We are

actively developing projects that will replace and upgrade certain

facilities while reducing emissions along portions of our pipeline

systems in principal delivery markets. The enhanced facilities will

improve reliability of the systems and allow for additional

transportation services to address growing demand under long-term

contracts while reducing direct carbon dioxide equivalent (CO2e)

emissions. Consistent with this initiative, the VR project on

Columbia Gas has been sanctioned, subject to customary conditions

precedent and normal-course regulatory approvals. This project

represents an approximate US$0.7 billion capital investment and is

targeted to be placed in service during the second half of 2025. In

addition, the WR project on ANR has also been sanctioned and will

serve markets in the midwestern U.S. This project has an estimated

capital cost of approximately US$0.8 billion and is expected to be

placed in service in fourth quarter 2025.

- GTN Rate Case Settlement: On

September 29, 2021, GTN filed an uncontested rate settlement which

would set new recourse rates for GTN effective January 1, 2022 and

institute a rate moratorium through December 31, 2023. The revised

rates are not expected to have a significant impact on our U.S.

Natural Gas Pipelines segment comparable earnings. In addition, GTN

must file for new rates no later than April 1, 2024.

- Columbia Gas Section

4 Rate Case: Columbia Gas filed a Section 4 Rate Case with FERC in

July 2020 requesting an increase to its maximum transportation

rates effective February 1, 2021, subject to refund upon completion

of the rate proceeding. On July 28, 2021, Columbia Gas notified

FERC that it reached a settlement-in-principle with its customers

addressing all remaining issues in the case, including but not

limited to the resolution of rates and continuation of Columbia

Gas's modernization program. On October 29, 2021, Columbia Gas

filed its settlement with FERC, and is now awaiting Commission

approval, with 2021 revenues expected to be generally consistent

with estimates recorded to date. We expect FERC approval of the

settlement in early 2022.

Mexico Natural Gas Pipelines

- Tula and Villa de Reyes: The CFE

initiated arbitration in June 2019 for the Tula and Villa de Reyes

projects, disputing fixed capacity payments due to force majeure

events. Arbitration proceedings are currently suspended through

December 31, 2021 while management advances settlement discussions

with the CFE.

Liquids Pipelines

- Northern Courier: On September 16, 2021, we announced the sale

of our remaining 15 per cent equity interest in Northern Courier

Pipeline to Astisiy Limited Partnership, comprised of Suncor and

eight Indigenous communities in the Regional Municipality of Wood

Buffalo, for gross proceeds of approximately $30 million before

post-closing adjustments. The transaction is anticipated to close

in fourth quarter 2021, subject to customary closing conditions and

the receipt of the required regulatory approvals.

Power and Storage

- Bruce Power Life Extension: The Unit

6 MCR program continues on budget and on schedule. The program is

nearing the end of the Inspection Phase and is about to enter the

Installation Phase. Preparation of the Unit 3 MCR program, which is

the next scheduled MCR outage, continues and Bruce Power expects to

submit its final cost and schedule duration estimate to the IESO in

fourth quarter 2021.

- Bruce Power Uprate Initiative: Bruce

Power recently launched Project 2030 with the goal of achieving a

site peak output of 7,000 MW by 2030 in support of climate change

targets and future clean energy needs. Project 2030 will focus on

continued asset optimization, innovation and leveraging new

technology, which could include integration with storage and other

forms of energy, to increase the site peak output at Bruce

Power.

- Bruce Power Outage: As part of the

planned inspections, testing, analysis and maintenance activities

at Bruce Power during the current Unit 6 MCR outage and the

recently completed Unit 3 planned outage, higher than anticipated

readings of hydrogen concentration in pressure tubes were detected.

These readings were limited to a very small area of the respective

pressure tubes and did not impact safety nor pressure tube

integrity as concluded following an assessment of all of the Bruce

Power units. On October 9, 2021, Unit 3 returned to service after

the Canadian Nuclear Safety Commission approved Bruce Power's

restart request following extensive inspections which demonstrated

that safety and pressure tube integrity continued to meet

regulatory requirements. Bruce Power will be incorporating

additional inspections as part of their normal surveillance

programs to address the new findings while progressing further

programs that demonstrate fitness for service at elevated hydrogen

concentration levels.

- Sharp Hills Wind Power PPA: On

September 20, 2021, we executed a 15-year PPA for 100 per cent of

the power produced and the rights to all environmental attributes

from the 297 MW Sharp Hills Wind Farm located in eastern Alberta.

The Sharp Hills Wind Farm is anticipated to be operational in 2023,

subject to customary regulatory approvals and conditions.

- Ontario Pumped Storage Project: As

part of our strategy to capture opportunities that capitalize on

the transition to a less carbon-intensive energy mix, we are

developing a 1,000 MW pumped hydro storage project in Meaford,

Ontario near Bruce Power. Once complete, this facility is designed

to provide emission-free electricity to the province while reducing

greenhouse gas emissions by an expected 490,000 tonnes and

delivering more than $250 million in annual electricity savings to

Ontario ratepayers. On July 28, 2021, we reached an agreement with

the Department of National Defence that, subject to conditions and

regulatory approval, allows for the development of this project on

the Meaford base. We will continue to consult with the Saugeen

Ojibway Nation, other Indigenous Rightsholders and communities

along with other local stakeholders as we continue to advance this

project, which remains subject to a number of conditions and

approvals, including approval of our Board of Directors.

- Renewable Energy Requests For

Information (RFI): Through an RFI process in second quarter 2021,

we announced that we were seeking to identify potential contracts

and/or investment opportunities in up to 620 MW of wind energy

projects, 300 MW of solar projects and 100 MW of energy storage

projects to meet the electricity needs of a portion of our U.S.

pipeline assets. The project team is currently evaluating

proposals, has commenced negotiations and expects to finalize

contracts by the end of the year.

Other Energy Transition Developments

- Irving Oil Decarbonization: On

August 12, 2021, we signed a memorandum of understanding to explore

the joint development of a series of proposed energy projects

focused on reducing greenhouse gas emissions and creating new

economic opportunities in New Brunswick and Atlantic Canada.

Together with Irving Oil, we have identified a series of potential

projects for exploration focused on decarbonizing current assets

and deploying emerging technologies to reduce overall emissions.

The partnership’s initial focus will consider a suite of upgrade

projects at Irving Oil’s refinery in Saint John, New Brunswick,

with the goal of significantly reducing emissions through the

production and use of low-carbon power generation.

- Hydrogen Hubs: On October 7, 2021,

we announced a partnership with Nikola Corporation to collaborate

on developing, constructing, operating and owning large-scale

hydrogen production facilities (hubs) in the United States and

Canada. We are actively collaborating to identify and develop

projects to establish the infrastructure required to deliver

low-cost and low-carbon hydrogen at scale in line with each

company’s core objectives. A key objective of the collaboration is

to establish hubs producing 150 tonnes or more of hydrogen per day

near highly traveled truck corridors to serve Nikola’s planned need

for hydrogen to fuel its Class 8 fuel cell electric vehicles

(FCEVs) within the next five years. Our significant pipeline,

storage and power assets can potentially be leveraged to lower the

cost and increase the speed of delivery of these hubs. This may

include exploring the integration of midstream assets to enable

hydrogen distribution and storage via pipeline and/or to deliver

carbon dioxide to permanent sequestration sites to decarbonize the

hydrogen production process.

Corporate

- Common share dividend: Our Board of

Directors declared a quarterly dividend of $0.87 per common share

for the quarter ending December 31, 2021. The quarterly amount is

equivalent to $3.48 per common share on an annualized basis.

- Voluntary Retirement Program (VRP):

In mid-2021, we offered a one-time VRP to eligible employees.

Participants in the program will retire by December 31, 2021 and

receive a transition payment in addition to existing retirement

benefits. For the three and nine months ended September 30, 2021,

we have expensed a total of $89 million before tax, mainly related

to the VRP transition payments, which was included in Plant

operating costs and other. Of the total program costs, $71 million

was excluded from comparable earnings and $18 million was recorded

in Revenues related to costs that are recoverable through

regulatory and tolling structures on a flow-through basis.

- Issuance of long-term debt: On

October 12, 2021, TCPL issued US$1.25 billion of Senior Unsecured

Notes due in October 2024 bearing interest at a fixed rate of 1.00

per cent and US$1.0 billion of Senior Unsecured Notes due in

October 2031 bearing interest at a fixed rate of 2.50 per

cent.

Teleconference and Webcast

We will hold a teleconference and webcast on Friday, November 5,

2021 to discuss our third quarter 2021 financial results. François

Poirier, President and Chief Executive Officer; Joel Hunter,

Executive Vice-President and Chief Financial Officer; and other

members of the executive leadership team will discuss TC Energy's

financial results and company developments at 9 a.m. (MDT) / 11

a.m. (EDT).

Members of the investment community and other interested parties

are invited to participate by calling 1.800.319.4610. No pass code

is required. Please dial in 15 minutes prior to the start of the

call. A live webcast of the teleconference will be available on TC

Energy's website at www.TCEnergy.com/events or via the

following URL: http://www.gowebcasting.com/11358.

A replay of the teleconference will be available two hours after

the conclusion of the call until midnight (EST) on November 12,

2021. Please call 1.855.669.9658 and enter pass code 7145.

The unaudited interim condensed consolidated financial

statements and Management’s Discussion and Analysis (MD&A) are

available on our website

at www.TCEnergy.com and

will be filed today under TC Energy's profile on SEDAR at

www.sedar.com and with the U.S.

Securities and Exchange Commission on EDGAR at

www.sec.gov.

About TC EnergyWe are a vital part of everyday

life – delivering the energy millions of people rely on to power

their lives in a sustainable way. Thanks to a safe, reliable

network of natural gas and crude oil pipelines, along with power

generation and storage facilities, wherever life happens – we’re

there. Guided by our core values of safety, innovation,

responsibility, collaboration and integrity, our 7,500 people make

a positive difference in the communities where we operate across

Canada, the U.S. and Mexico.

TC Energy's common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at www.TCEnergy.com.

Forward-Looking InformationThis release

contains certain information that is forward-looking, including the

sustainability commitments and targets contained in our 2021 Report

on Sustainability and our GHG Emissions Reduction Plan, and is

subject to important risks and uncertainties (such statements are

usually accompanied by words such as "anticipate", "expect",

"believe", "may", "will", "should", "estimate", "intend" or other

similar words). Forward-looking statements in this document are

intended to provide TC Energy security holders and potential

investors with information regarding TC Energy and its

subsidiaries, including management's assessment of TC Energy's and

its subsidiaries' future plans and financial outlook. All

forward-looking statements reflect TC Energy's beliefs and

assumptions based on information available at the time the

statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the

forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and Annual Report filed under TC Energy's

profile on SEDAR at www.sedar.com and with the U.S. Securities

and Exchange Commission at www.sec.gov and the

"Forward-looking information" section of our 2021 Report on

Sustainability and our GHG Emissions Reduction Plan which are

available on our website at www.TCEnergy.com.

Non-GAAP MeasuresThis release contains

references to non-GAAP measures, including comparable earnings,

comparable earnings per common share, comparable EBITDA and

comparable funds generated from operations, that do not have any

standardized meaning as prescribed by U.S. GAAP and therefore are

unlikely to be comparable to similar measures presented by other

companies. These non-GAAP measures are calculated on a consistent

basis from period to period and are adjusted for specific items in

each period, as applicable except as otherwise described in the

Condensed consolidated financial statements and MD&A. For more

information on non-GAAP measures, refer to TC Energy's most recent

Quarterly Report to Shareholders.

Media Inquiries:Jaimie Harding / Hejdi

Carlsenmedia@tcenergy.com403.920.7859 or 800.608.7859

Investor & Analyst Inquiries:David Moneta /

Hunter Mau investor_relations@tcenergy.com403.920.7911 or

800.361.6522

Download full report

here: https://www.tcenergy.com/siteassets/pdfs/investors/reports-and-filings/annual-and-quarterly-reports/2021/tc-2021-q3-quarterly-report.pdf

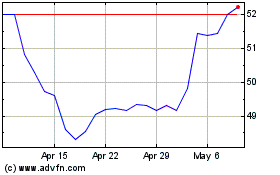

TC Energy (TSX:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024