AIP Realty Trust (“AIP”) (TSXV: AIPV.U) is pleased to announce that

its wholly-owned subsidiary AIP Realty Management, LLC has entered

into membership purchase agreements (the “Agreements”) with

AllTrades Five Properties, LLC (“AT5P”), to acquire up to five

additional companies, each of which owns a light industrial flex

property in the Dallas-Fort Worth (“DFW”) area of Texas. Each of

the Agreements provide AIP with the exclusive option, subject to

certain conditions, to acquire (i) AIP Mesquite, LLC, (ii) AIP

Lewisville Main, LLC, (iii) AIP Carrollton Briercroft, LLC, (iv)

AIP Frisco, LLC, and (v) AIP Plano, LLC (collectively, the “Texas

LLCs”) , each of which owns a light industrial flex property in

Mesquite, Lewisville, Carrollton, Frisco and Plano, Texas,

respectively (collectively, the “Properties”).

The Agreements align with AIP’s strategy and

business objectives discussed in AIP’s filing statement dated March

31, 2022. Upon completion of construction, each of the Properties

will address the underserved needs for new generation, high quality

light industrial flex space of the large, diverse and growing

market of trades and services businesses in the US.

As previously disclosed, AIP has the exclusive

right to finance a portion of the development costs of and to

purchase the newly constructed and leased properties built by

AllTrades Industrial Properties, Inc. (“AllTrades”). This structure

provides AIP unitholders with the benefits of development upside

while minimizing risk.

The Properties represent an aggregate

approximate 376,000 square feet of gross leasable area, comprised

of 108 WorkSpace ShopsTM and 44 WorkSpace StudiosTM as well as 209

WorkSpace Secured ParkingTM spaces, and are targeted at the trades

and services sectors and small businesses which are often

underserved and relegated to older buildings with outdated

amenities. The AllTrades facilities offer modern, appealing spaces

that can be readily adapted to multiple uses. The Properties were

developed with equity capital from AllTrades and Trinity Investors

(a $4 billion Dallas-based real estate private equity fund)

(“Trinity”).

“AIP has taken a significant step forward in

securing additional high quality light industrial flex properties

in Texas towards the planned national rollout,” said Leslie Wulf,

Executive Chairman of AIP. “The acquisition of some or all of the

five properties, will provide AIP with a substantially increased

quality, size and diversity of cash flow for the portfolio.”

The Mesquite Property

The facility owned by AIP Mesquite, LLC (the

“Mesquite Property”) is located in an attractive market in southern

eastern part of the Dallas Fort Worth market. Construction of the

Mesquite Property is expected to be completed in July of 2022. The

Mesquite Property will be comprised of 49,713 rentable square feet

across 12 WorkSpace Shops™, 10 WorkSpace Studios™ and 32 WorkSpace

Secured Parking™ spaces. The Mesquite property is currently in the

pre-leasing phase.

The membership purchase agreement pertaining to

the acquisition of AIP Mesquite, LLC provides for the purchase of

all of the membership interests of AIP Mesquite, LLC, for a

purchase price of up to US$12 million, excluding closing costs

(the “Mesquite Purchase Price”). The acquisition of AIP Mesquite,

LLC by AIP Realty Management, LLC is subject to certain conditions,

including but not limited to completion of the construction of the

facility, receipt of audited financial statements of AIP Mesquite,

LLC, receipt of a satisfactory third-party appraisal supporting the

Mesquite Purchase Price, receipt of regulatory approvals, including

the approval of the TSX Venture Exchange (“TSXV”), approval of the

independent trustees of AIP and customary closing date and

post-closing adjustments. The purchase price is expected to be

satisfied by a combination of the assumption of a mortgage of

approximately US$5.95 million and cash.

The Lewisville Property

The facility owned by AIP Lewisville Main, LLC

(the “Lewisville Property”) is located in the northern area of the

DFW market. Construction of the Lewisville Property is expected to

be completed in October of 2022. The Lewisville Property will be

comprised of approximately 69,000 rentable square feet across 22

WorkSpace Shops™, 6 WorkSpace Studios™ and 27 WorkSpace Secured

Parking™ spaces.

The membership purchase agreement pertaining to

the acquisition of AIP Lewisville, LLC provides for the purchase of

all of the membership interests of AIP Lewisville, LLC, for a

purchase price of up to US$15 million, excluding closing costs

(the “Lewisville Purchase Price”). The acquisition of AIP

Lewisville, LLC by AIP Realty Management, LLC is subject to certain

conditions, including but not limited to completion of the

construction of the facility, receipt of audited financial

statements of AIP Lewisville, LLC, receipt of a satisfactory

third-party appraisal supporting the Lewisville Purchase Price,

receipt of regulatory approvals, including the approval of the

TSXV, approval of the independent trustees of AIP and customary

closing date and post-closing adjustments. The purchase price is

expected to be satisfied by a combination of the assumption of a

mortgage of approximately US$7.50 million and cash.

The Carrollton Property

The facility owned by AIP Carrollton Briercroft,

LLC (the “Carrollton Property”) is located in the north central

area of the DFW market. Construction of the Carrollton Property is

expected to be completed in December of 2022. The Carrollton

Property will be comprised of approximately 100,000 rentable square

feet across 22 WorkSpace Shops™, 22 WorkSpace Studios™ and 54

WorkSpace Secured Parking™ spaces.

The membership purchase agreement pertaining to

the acquisition of AIP Carrollton, LLC provides for the purchase of

all of the membership interests of AIP Carrollton, LLC, for a

purchase price of up to US$24 million, excluding closing costs

(the “Carrollton Purchase Price”). The acquisition of AIP

Carrollton, LLC by AIP Realty Management, LLC is subject to certain

conditions, including but not limited to completion of the

construction of the facility, receipt of audited financial

statements of AIP Carrollton, LLC, receipt of a satisfactory

third-party appraisal supporting the Carrollton Purchase Price,

receipt of regulatory approvals, including the approval of the

TSXV, approval of the independent trustees of AIP and customary

closing date and post-closing adjustments. The purchase price is

expected to be satisfied by a combination of the assumption of a

mortgage of approximately US$11.25 million and cash.

The Frisco Property

The facility owned by AIP Frisco, LLC (the

“Frisco Property”) is located in the north central area of the DFW

market. Construction of the Frisco Property is expected to be

completed in December of 2022. The Frisco Property will be

comprised of approximately 75,000 rentable square feet across 22

WorkSpace Shops™, 6 WorkSpace Studios™ and 45 WorkSpace Secured

Parking™ spaces.

The membership purchase agreement pertaining to

the acquisition of AIP Frisco, LLC provides for the purchase of all

of the membership interests of AIP Frisco, LLC, for a purchase

price of up to US$20.5 million, excluding closing costs (the

“Frisco Purchase Price”). The acquisition of AIP Frisco, LLC by AIP

Realty Management, LLC is subject to certain conditions, including

but not limited to completion of the construction of the facility,

receipt of audited financial statements of AIP Frisco, LLC, receipt

of a satisfactory third-party appraisal supporting the Frisco

Purchase Price, receipt of regulatory approvals, including the

approval of the TSXV, approval of the independent trustees of AIP

and customary closing date and post-closing adjustments. The

purchase price is expected to be satisfied by a combination of the

assumption of a mortgage of approximately US$9.22 million and

cash.

The Plano Property

The facility owned by AIP Plano, LLC (the “Plano

Property”) is located in the east central area of the DFW market.

Construction of the Plano Property is expected to be completed in

September of 2022. The Plano Property will be comprised of

approximately 82,000 rentable square feet across 30 WorkSpace

Shops™ and 51 WorkSpace Secured Parking™ spaces.

The membership purchase agreement pertaining to

the acquisition of AIP Plano, LLC provides for the purchase of all

of the membership interests of AIP Plano, LLC, for a purchase price

of up to US$20 million, excluding closing costs (the “Plano

Purchase Price”). The acquisition of AIP Plano, LLC by AIP Realty

Management, LLC is subject to certain conditions, including but not

limited to completion of the construction of the facility, receipt

of audited financial statements of AIP Plano, LLC, receipt of a

satisfactory third-party appraisal supporting the Plano Purchase

Price, receipt of regulatory approvals, including the approval of

the TSXV, approval of the independent trustees of AIP and customary

closing date and post-closing adjustments. The purchase price is

expected to be satisfied by a combination of the assumption of a

mortgage of approximately US$9 million and cash.

Mezzanine Financing

Pursuant to a commitment, AIP Realty Management

LLC, a wholly-owned subsidiary of AIP, has agreed to lend mezzanine

financing (the “Credit Facility) of up to US$12 million to

AllTrades Industrial Development LLC, (“AID”) a wholly owned

subsidiary of AllTrades, which will be used in conjunction with

additional equity funding provided by Trinity along with

construction loans to fund special purpose LLCs to build and

develop up to 12 further facilities in the DFW area by a subsidiary

of AID. The credit facilities will be granted for facilities that

AIP has underwritten and provide a forward purchase commitment to

acquire upon completion after all required conditions being met.

The Credit Facility will bear current pay interest of 10% on the

drawn down portion and AIP will also receive up to 50% of the sales

profit generated from the prorated portion of the mezzanine to the

overall equity in the project. The Credit Facility will be secured

by the assets of AID.

After an extensive review and analysis of the

transactions contemplated by the Agreements and the Credit Facility

and consideration of, among other things, the unanimous

recommendation of AIP’s governance committee (comprised of three

independent trustees of AIP) (the “Governance Committee”), the

board of trustees of AIP, with Leslie Wulf, Bruce Hall and Greg

Vorwaller recused, unanimously approved the Agreements and the

Credit Facility. Leslie Wulf, Bruce Hall and Greg Vorwaller were

not party to any discussions or deliberation relating to the

approval of Agreements and the Credit Facility.

No securities of AIP will be issued, nor will

any finders fees be paid by AllTrades or AIP in connection with the

transactions contemplated in the Agreements. The transactions will

not result in the creation of new insiders or a new control person

of AIP.

Upon completion of construction of each of the

facilities, the Governance Committee will obtain independent

appraisals and audited financial statements pertaining to each of

the Texas LLCs. In the event that each appraisal and set of audited

financial statements support a purchase price that is within the

range set out in the Agreements, the Governance Committee will make

a recommendation to the board of trustees of AIP, with Leslie Wulf,

Bruce Hall and Greg Vorwaller recused, and AIP will then seek

regulatory approvals, including approval of the TSX Venture

Exchange to proceed with the acquisition of each of the Texas LLCs,

in turn.

The Governance Committee is responsible for

supervising the process to be carried out by AIP and its

professional advisors in connection with the Agreements and the

Credit Facility, making recommendations to the board of trustees of

AIP, with Leslie Wulf, Bruce Hall and Greg Vorwaller recusing, in

respect of matters that it considered relevant with respect to the

Agreements and the Credit Facility, and ensuring that AIP completes

the acquisitions of the Texas LLCs and provides that the Credit

Facility is being provided to AllTrades in compliance with the

requirements of Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions (“MI 61-101”),

AIP’s declaration of trust and applicable policies of the TSXV.

The transactions contemplated in the Agreements

and the Credit Facility may constitute a “related party

transaction” under MI 61-101 as the Texas LLCs are currently owned

by AllTrades Five Properties, LLC, which is owned by AIP DFW I, LLC

(“AIPDFW”) and AllTrades Group Two Properties, LP (“ATG2”). AIPDFW

is majority owned by TPEG AllTrades DFW I Investors LLC with

AllTrades holding 5.73% of the Class B shares and 22.5% of the

Class C shares. The general partner of ATG2 is AllTrades Group Two

Management, Inc., a corporation wholly owned by AllTrades. Three of

the trustees and officers of AIP, namely Leslie Wulf, Bruce Hall

and Greg Vorwaller, are directors and officers of AllTrades. Bruce

Hall is also the manager of AT5P. Leslie Wulf, Greg Vorwaller and

Bruce Hall collectively own approximately 3% of AIP. Pursuant to

subsections 5.5(e) of and 5.7(1)(c) of MI 61-101, AIP was exempt

from obtaining a formal valuation and approval of AIP’s minority

shareholders because AIP’s units trade on the TSXV and, pursuant to

subsection 5.5(e) of MI 61-101, the Agreements and the Credit

Facility were supported by Alpha Carta Ltd., AIP’s controlling

unitholder.

About AIP Realty Trust

AIP Realty Trust is a real estate investment

trust with a growing portfolio of light industrial flex facilities

focused on small businesses and the trades and services sectors in

the U.S. These properties appeal to a diverse range of small space

users, such as contractors, skilled trades, suppliers, repair

services, last-mile providers, small businesses and assembly and

distribution firms. They typically offer attractive fundamentals

including low tenant turnover, stable cash flow and low capex

intensity, as well as significant growth opportunities. With an

initial focus on the DFW market, AIP plans to roll-out this

innovative property offering nationally. AIP holds the exclusive

rights to finance the development of and to purchase all the

completed and leased properties built across North America by its

development and property management partner, AllTrades. For more

information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:

Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements are based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond AIP’s control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking statements.

Forward-looking statements contained in this

press release include, without limitation, statements pertaining to

the expected timing and completion of the acquisition of the Texas

LLCs; the effect of the acquisitions of the Texas LLCs on AIP’s

financial performance; the ability to secure the funding required

to complete the acquisition of the Texas LLCs; the satisfaction of

the conditions precedent to consummation of the acquisition of the

Texas LLCs, including the ability to obtain required regulatory

approvals; and the ability of AIP to execute its business and

growth strategies. AIP’s objectives and forward-looking statements

are based on certain assumptions, including that (i) AIP will

receive financing on favourable terms; (ii) the future level of

indebtedness of AIP and its future growth potential will remain

consistent with AIP’s current expectations; (iii) there will be no

changes to tax laws adversely affecting AIP’s financing capacity or

operations; (iv) the impact of the current economic climate and the

current global financial conditions on AIP’s operations, including

its financing capacity and asset value, will remain consistent with

AIP’s current expectations; (v) the performance of AIP’s

investments in Texas will proceed on a basis consistent with AIP’s

current expectations; and (vi) capital markets will provide AIP

with readily available access to equity and/or debt.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. All forward-looking statements in this press

release are made as of the date of this press release. AIP does not

undertake to update any such forward- looking information whether

as a result of new information, future events or otherwise, except

as required by law.

Additional information about these assumptions

and risks and uncertainties is contained under “Risk Factors” in

AIP’s filing statement dated March 31, 2022, which is available on

SEDAR at www.sedar.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

NOT FOR DISSEMINATION IN THE UNITED STATES OR

DISTRIBUTION THROUGH UNITED STATES NEWS OR WIRE SERVICES.

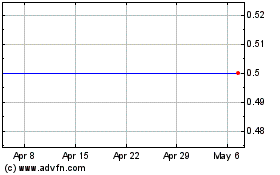

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Mar 2024 to Apr 2024

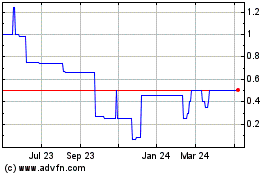

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Apr 2023 to Apr 2024