AIP Realty Trust (the “

Trust” or “

AIP

Realty”) (TSXV:AIP.U) today announced its financial

results for the three and six-month period ended June 30, 2022. All

dollar amounts are stated in U.S. dollars.

Q2 2022 Highlights

- Completed a

Qualifying Transaction through a reverse take-over on April 14,

2022 (the “Qualifying Transaction”), leading to

the listing of the Trust’s units on the TSX Venture Exchange with

trading commencing April 21, 2022.

- As part of the

Qualifying Transaction, the Trust acquired its first property, a

100% leased multi-tenant light industrial flex facility located on

Eagle Court in Lewisville, Texas (the "Eagle Court

Property").

- Entered into

agreements providing the Trust with the option to acquire up to

five additional properties being developed in the Dallas-Fort Worth

(“DFW”) area by AllTrades Industrial Properties,

Inc. (“AllTrades”), the Trust’s exclusive

development partner, and a related party of the Trust.

- Secured

unitholder approval for amendments to the Declaration of Trust to

enable the Trust to execute on its business model and capital

markets strategy.

- Generated rental

revenue of $103,643 from the Eagle Court Property, comprised of

tenant rental revenue and revenue from contracts with customers,

specifically common area maintenance.

- Incurred

property operating expenses of $25,507, resulting in net rental

income of $78,136.

- Declared an initial quarterly

distribution of $0.04 per unit, which was paid to unitholders

subsequent to the end of the quarter.

“We achieved several key milestones during the

second quarter, including completing our Qualifying Transaction,

becoming publicly traded and acquiring our initial property,” said

Les Wulf, Executive Chairman, AIP Realty Trust. “We have seen

strong demand for light industrial flex facilities in the rapidly

growing DFW area and throughout Texas, and our partner AllTrades is

executing on a solid development pipeline. Our focus remains on

continuing to demonstrate the strength of our business model.”

|

For the three months ended June 30

(unaudited) |

2022 |

|

2021 |

|

|

Rental revenue |

$103,643 |

|

– |

|

|

Property operating expenses |

($25,507) |

|

– |

|

|

Net rental income |

$78,136 |

|

– |

|

|

Other expenses |

($2,117,360) |

|

($98,739) |

|

|

Fair value adjustment to investment property |

$9,628 |

|

- |

|

|

Net loss and total comprehensive loss |

($2,025,068) |

|

($98,739) |

|

|

|

|

|

|

As at June 30 (unaudited) and December 31

(audited) |

2022 |

|

2021 |

|

|

Investment property |

$5,750,000 |

|

– |

|

|

Cash |

$1,583,861 |

|

$315,308 |

|

|

Secured bank indebtedness (net of debt discount) |

$3,133,672 |

|

– |

|

|

Subscription receipt liability |

– |

|

$5,505,000 |

|

|

Units outstanding |

$3,417,861 |

|

$72,861 |

|

Selected Financial

InformationThe foregoing is a summary of selected

information for the three months ended June 30, 2022 and is

qualified in its entirety by, and should be read in conjunction

with, the Trust’s condensed interim consolidated financial

statements and management discussion and analysis for the three and

six months ended June 30, 2022.

Readers should note that results for the three

months ended June 30, 2022 reflect approximately 11 weeks of

operations rather than the typical 13-week period that comprises a

fiscal quarter, since the Eagle Court Property was acquired on

April 14, 2022 with the completion of the Qualifying Transaction.

Furthermore, while figures are provided for the comparable prior

year period, it is noteworthy that the Trust did not yet own any

real property assets in 2021.

Related party

disclosuresThe executive management team of the Trust is

the same executive management team as AllTrades.

OutlookThe Trust intends to

finance the construction, acquisition and management of light

industrial flex multi-tenant properties. Through its agreement with

AllTrades, the Trust has been granted an exclusive right to

purchase all AllTrades completed and leased facilities, as well as

any facilities in development. The Trust will also provide

AllTrades with a percentage of the required funding for the

development of its national rollout.

As previously announced, AllTrades’ pipeline of

properties includes five DFW-area facilities already completed or

nearing completion, and six additional facilities on which

development is expected to commence in September. Development on

these facilities is being fully funded with equity capital from

AllTrades and Trinity Investors, a $6 billion Dallas-based real

estate private equity fund. AllTrades also plans on starting

another six facilities by the end of this year.

AIP Realty’s condensed interim consolidated

financial statements and management discussion and analysis for the

period ended June 30, 2022 are available on SEDAR at www.sedar.com,

and on the Trust’s website at www.aiprealtytust.com.

About AIP Realty TrustAIP

Realty Trust is a real estate investment trust with a growing

portfolio of light industrial flex facilities focused on small

businesses and the trades and services sectors in the U.S. These

properties appeal to a diverse range of small space users, such as

contractors, skilled trades, suppliers, repair services, last-mile

providers, small businesses and assembly and distribution firms.

They typically offer attractive fundamentals including low tenant

turnover, stable cash flow and low capex intensity, as well as

significant growth opportunities. With an initial focus on the

Dallas-Fort Worth market, AIP plans to roll out this innovative

property offering nationally. AIP holds the exclusive rights to

finance the development of and to purchase all the completed and

leased properties built across North America by its development and

property management partner, AllTrades Industrial Properties, Inc.

For more information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

Or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Cautionary Statement on

Forward-Looking InformationThis press release contains

statements which constitute “forward-looking information” within

the meaning of applicable securities laws, including statements

regarding the plans, intentions, beliefs and current expectations

of AIP Realty Trust with respect to future business activities and

operating performance. Forward-looking information is often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or

similar expressions and includes information regarding, future

acquisitions by the Trust, the ability to obtain regulatory and

unitholder approvals and other factors. When or if used in this

news release, the words “anticipate”, “believe”, “estimate”,

“expect”, “target, “plan”, “forecast”, “may”, “schedule” and

similar words or expressions identify forward-looking statements or

information. These forward-looking statements or information may

relate to the commencement of development on certain of the

AllTrades facilities, proposed financing activity, proposed

acquisitions, regulatory or government requirements or approvals,

the reliability of third-party information and other factors or

information. Such statements represent the Trust’s current views

with respect to future events and are necessarily based upon a

number of assumptions and estimates that, while considered

reasonable by the Trust, are inherently subject to significant

business, economic, competitive, political and social risks,

contingencies and uncertainties. Many factors, both known and

unknown, could cause results, performance or achievements to be

materially different from the results, performance or achievements

that are or may be expressed or implied by such forward- looking

statements. These forward-looking statements are made as of the

date hereof and are expressly qualified in their entirety by this

cautionary statement. The Trust does not intend, and do not assume

any obligation, to update these forward-looking statements or

information to reflect changes in assumptions or changes in

circumstances or any other events affecting such statements and

information other than as required by applicable laws, rules and

regulations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release is not an offer of securities

for sale in the United States. The securities may not be offered or

sold in the United States absent registration or an exemption from

registration under U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Trust has not registered and will not

register the securities under the U.S. Securities Act. The Trust

does not intend to engage in a public offering of their securities

in the United States.

Source: AIP Realty Trust

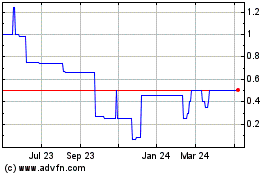

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Mar 2024 to Apr 2024

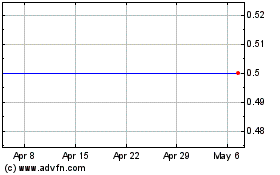

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Apr 2023 to Apr 2024