AIP Realty Trust (the “

Trust” or

“

AIP”) (TSXV: AIP.U) through its exclusive

development partner, AllTrades Industrial Properties, Inc.

(“

AllTrades”) continues to grow its acquisition

pipeline of new light industrial flex facilities properties in the

Dallas-Fort Worth (“

DFW”) area of Texas. The Trust

is pleased to announce that its wholly owned subsidiary AIP Realty

Management, LLC (“

ARM”) has entered into forward

purchase agreements (the “

Agreements”) to acquire

up to seven additional companies, each of which are developing one

new AllTrades-branded light industrial flex property in DFW

(collectively, the “

Properties”). The Agreements

provide AIP with the exclusive option, subject to certain

conditions, to acquire (i) AIP Roanoke, LLC, (ii) AIP Keller Hicks,

LLC, (iii) AIP Justin, LLC, (iv) AIP North Freeway, LLC, (v) AIP

Alliance Gateway, LLC, (vi) AIP Mesquite #2, LLC, and (vii) AIP

McKinney, LLC (collectively, the “

LLCs”). All

dollars are stated in U.S dollars.

The seven Properties represent an aggregate of

approximately 466,165 square feet of gross leasable area, comprised

of 83 WorkSpace Shops™ and 92 WorkSpace Studios™ as well

as 130 WorkSpace Secured Parking™ spaces, all targeted at the

trades and services sectors and small businesses which are often

underserved and relegated to older buildings with outdated

amenities. The AllTrades facilities offer turnkey modern, appealing

spaces that can be readily adapted to multiple uses. The facilities

are intended to address the underserved needs for new generation,

high-quality light industrial flex space by the large, diverse, and

growing market of trades, services, and small businesses in the US

seeking locations close to their customer base, following the

growing trend of last mile service. With the construction of the

first of these seven new facilities beginning in October, the

Properties are being developed with equity capital from AllTrades

and Trinity Investors, a $6 billion Dallas-based real estate

private equity firm (“Trinity”).

AIP Roanoke The facility owned by AIP Roanoke,

LLC (the “Roanoke Property”) is located in an

attractive market in the northwestern part of the DFW market. The

Roanoke Property will be comprised of 51,370 rentable square feet

across 9 WorkSpace Shops™, 9 WorkSpace Studios™ and 22 WorkSpace

Secured Parking™ spaces. The estimated purchase is projected to be

$13,000,000 and financed with 50% equity and 50% permanent

debt.

AIP JustinThe facility owned by AIP Justin, LLC

(the “Justin Property”) is located in an

attractive market in the northwestern part of the DFW market. The

Justin Property will be comprised of 97,650 rentable square feet

across 42 WorkSpace Studios™ and 21 WorkSpace Secured Parking™

spaces. The estimated purchase is projected to be $23,000,000 and

financed with 50% equity and 50% permanent debt.

AIP McKinney The facility owned by AIP McKinney,

LLC (the “McKinney Property”) is located in an

attractive market in the northeastern part of the DFW market. The

Justin Property will be comprised of 113,750 rentable square feet

across 33 WorkSpace Shops™ and 31 WorkSpace Secured Parking™

spaces. The estimated purchase is projected to be $28,000,000 and

financed with 50% equity and 50% permanent debt.

AIP Mesquite #2The facility owned by AIP

Mesquite #2, LLC (the “Mesquite #2 Property”) is

located in an attractive market in the central-eastern part of the

DFW market. The Mesquite #2 Property will be comprised of 85,550

rentable square feet across 35 WorkSpace Shops™, and 32 WorkSpace

Secured Parking™ spaces. The estimated purchase is projected to be

$21,000,000 and financed with 50% equity and 50% permanent

debt.

AIP Keller HicksThe facility owned by AIP Keller

Hicks, LLC (the “Keller Hicks Property”) is

located in an attractive market in the northwestern part of

the DFW market. The Keller Hicks Property will be comprised of

46,050 rentable square feet across 15 WorkSpace Studios™ and 10

WorkSpace Secured Parking™ spaces. The estimated purchase is

projected to be $11,000,000 and financed with 50% equity and 50%

permanent debt.

AIP Alliance Gateway The facility owned by AIP

Alliance Gateway, LLC (the “Alliance Gateway

Property”) is located in an attractive market in the

northwestern part of the DFW market. The Alliance Gateway Property

will be comprised of 40,050 rentable square feet across 17

WorkSpace Studios™ and 17 WorkSpace Secured Parking™ spaces. The

estimated purchase is projected to be $10,000,000 and financed with

50% equity and 50% permanent debt.

AIP North Freeway The facility owned by AIP

North Freeway, LLC (the “North Freeway Property”)

is located in an attractive market in the northwestern part of the

DFW market. The North Freeway Property will be comprised of 31,745

rentable square feet across 6 WorkSpace Shops™, 9 WorkSpace

Studios™ and 7 WorkSpace Secured Parking™ spaces. The estimated

purchase is projected to be $8,000,000 and financed with 50% equity

and 50% permanent debt.

To date, AIP has now entered into forward

purchase agreements to acquire a total of 12 light industrial flex

properties totaling 841,109 square feet of leasable space,

comprised of 191 WorkSpace Shops™, 136 WorkSpace Studios™ and

339 WorkSpace Secured Parking™ spaces. This includes the

previously disclosed agreements to acquire up to five properties in

the DFW area, representing an aggregate of approximately 374,935

Square feet of gross leasable area (the “Original

Properties”). The aggregate projected purchase price

assuming that all of the properties are acquired by AIP would be

$205,500,000.

“We are pleased to further solidify our

acquisition pipeline with the announcement of seven additional

purchase agreements,” said Leslie Wulf, Executive Chairman.

“Together with the earlier agreements, we now have clear sightlines

to acquiring 12 properties which would significantly increase AIP’s

scale and diversity of cash flow. The first of these twelve

facilities, located in the Mesquite submarket of DFW, was completed

in August and is 100% leased achieving a NNN Rental average of

$15.04 Per Square Foot above proforma rentals. A second facility

located in Plano, TX is scheduled to be completed in approximately

40 days and is already 90% pre-leased. The pre-leasing activity on

the other three of the first five facilities scheduled for

completion between this fall and the first quarter of 2023 are

tracking similarly, continuing to demonstrate the demand for the

AllTrades branded market specific asset class.”

The acquisition of each of the Properties by ARM

is subject to certain conditions, including but not limited to

completion of the construction of each facility, receipt of audited

financial statements for each facility, receipt of a satisfactory

third-party appraisal supporting the purchase price for each

facility, receipt of regulatory approvals, including the approval

of the TSXV, approval of the independent trustees of AIP and

customary closing date and post-closing adjustments.

Loan and Security Documentation AIP is also

pleased to announce that, as part of its planned long-term growth

strategy to provide mezzanine loans to its exclusive development

partner, AllTrades, the Trust has executed the master loan and

security documentation between its subsidiary ARM and AllTrades

Industrial Development LLC (“AID”), a subsidiary

of AllTrades. These agreements include: (i) Master Loan Agreement,

(ii) Pledge and Security Agreement, (iii) Guaranty Agreement and

(iv) form of Promissory Note (collectively, the “Loan

Agreements”, and together with the Agreements, the

“Transaction Documents”). The

mezzanine loans granted will serve as all or a portion of the

equity, which in conjunction with traditional construction loans,

will finance the development of AllTrades branded light industrial

flex facilities, designed to address the long-overlooked needs of

small businesses and trades and services companies, across target

growth markets in the U.S. In order to ensure all agreements and

documentation relating to the Original Properties are consistent

with the newly created Transaction Documents, the Trust also

entered into amended and restated (i) master exclusive funding and

forward purchase agreements and (ii) a rental income protection

agreement to reflect general housekeeping changes. Copies of the

Transaction Documents as well as the amended and restated

agreements have been filed on SEDAR at www.sedar.com.

When credit facilities are granted to facilities

that AIP has underwritten and have provided a forward purchase

agreement to acquire upon completion and all required conditions

are met, the credit facilities will bear current pay interest of

10% on the drawn-down portion and AIP will also receive up to 50%

of the sales profit generated from the prorated portion of the

mezzanine financing to the overall equity in the project.

“We are pleased to have the loan documentation

and related security agreements in place,” said Leslie Wulf,

Executive Chairman of AIP. “This will enable us to efficiently

seize upon opportunities that meet our underwriting criteria, which

is key to building a secure pipeline to grow the business as

rapidly as is practically and prudently possible. AllTrades, our

exclusive development partner, continues to grow its pipeline of

new AllTrades-branded facilities on their national rollout.

After an extensive review and analysis of the

transactions contemplated by the Transaction Documents and

consideration of, among other things, the unanimous recommendation

of AIP’s governance committee (comprised of three independent

trustees of AIP) (the “Governance Committee”), the

Board of Trustees of the Trust (the “Board”), with

Leslie Wulf, Bruce Hall and Greg Vorwaller recused, unanimously

approved the Transaction Documents. Leslie Wulf, Bruce Hall and

Greg Vorwaller were not party to any discussions or deliberation

relating to the approval of Documents. No securities of AIP will be

issued, nor will any finders fees be paid by AllTrades or AIP in

connection with the transactions contemplated in the Transaction

Documents. The transactions will not result in the creation of new

insiders or a new control person of AIP.

Upon completion of construction of each of the

facilities, the Governance Committee will obtain independent

appraisals and audited financial statements pertaining to each of

the LLCs. In the event that each appraisal and set of audited

financial statements support a purchase price that is within the

range set out in the Agreements, the Governance Committee will make

a recommendation to the Board, with Leslie Wulf, Bruce Hall and

Greg Vorwaller recused, and AIP will then seek regulatory

approvals, including approval of the TSX Venture Exchange to

proceed with the acquisition of each of the LLCs, in turn.

The Governance Committee is responsible for

supervising the process to be carried out by AIP and its

professional advisors in connection with the Transaction Documents,

making recommendations to the Board, with Leslie Wulf, Bruce Hall

and Greg Vorwaller recusing, in respect of matters that it

considered relevant with respect to the Transaction Documents, and

ensuring that AIP performs its obligations as contemplated in the

Transaction Documents in compliance with the requirements of

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”),

AIP’s declaration of trust and applicable policies of the TSXV. The

transactions contemplated in the Transaction Documents may

constitute a “related party transaction” under MI 61-101 as the

LLCs are current owned by AIP DFW II, LLC

(“AIPDFW”), an entity owned indirectly by Trinity

and directly by AID, a subsidiary of AllTrades. Three of the

trustees and officers of AIP, namely Leslie Wulf, Bruce Hall and

Greg Vorwaller, are directors and officers of AllTrades. Bruce

Hall, also serves as Chief Financial Officer of AID, manager of

AIPDFW. Leslie Wulf, Greg Vorwaller and Bruce Hall collectively own

approximately 15.8% of AIP. Pursuant to subsections 5.5(e) and

5.7(1)(c) of MI 61-101, AIP was exempt from obtaining a formal

valuation and approval of AIP’s minority shareholders because AIP’s

units trade on the TSXV and, pursuant to subsection 5.5(e) of MI

61-101, the Transaction Documents were supported by Alpha Carta

Ltd., AIP’s controlling unitholder.

About AIP Realty TrustAIP

Realty Trust is a real estate investment trust with a growing

portfolio of light industrial flex facilities focused on small

businesses and the trades and services sectors in the U.S. These

properties appeal to a diverse range of small space users, such as

contractors, skilled trades, suppliers, repair services, last-mile

providers, small businesses and assembly and distribution firms.

They typically offer attractive fundamentals including low tenant

turnover, stable cash flow and low capex intensity, as well as

significant growth opportunities. With an initial focus on the

Dallas-Fort Worth market, AIP plans to roll out this innovative

property offering nationally. AIP holds the exclusive rights to

finance the development of and to purchase all the completed and

leased properties built across North America by its development and

property management partner, AllTrades Industrial Properties, Inc.

For more information, please visit www.aiprealtytrust.com.

For further information from the Trust,

contact:Leslie WulfExecutive Chairman(214)

679-5263les.wulf@aiprealtytrust.com

Or

Greg VorwallerChief Executive Officer(778)

918-8262Greg.vorwaller@aiprealtytrust.com

Cautionary Statement on

Forward-Looking InformationThis press release contains

statements which constitute “forward-looking information” within

the meaning of applicable securities laws, including statements

regarding the plans, intentions, beliefs and current expectations

of AIP Realty Trust with respect to future business activities and

operating performance. Forward-looking information is often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or

similar expressions and includes information regarding, the

expected timing and completion of the acquisition of the LLCs, the

effect of the acquisitions of the LLCs on AIP’s financial

performance, the ability to secure the funding required to complete

the acquisition of the LLCs, the satisfaction of the conditions

precedent to consummation of the acquisition of the LLCs, including

the ability to obtain required regulatory approvals, the ability of

AIP to execute its business and growth strategies, future

acquisitions by the Trust, the ability to obtain regulatory and

unitholder approvals and other factors. When or if used in this

news release, the words “anticipate”, “believe”, “estimate”,

“expect”, “target, “plan”, “forecast”, “may”, “schedule” and

similar words or expressions identify forward-looking statements or

information. These forward-looking statements or information may

relate to proposed financing activity, proposed acquisitions,

regulatory or government requirements or approvals, the reliability

of third-party information and other factors or information. Such

statements represent the Trust’s current views with respect to

future events and are necessarily based upon a number of

assumptions and estimates that, while considered reasonable by the

Trust, are inherently subject to significant business, economic,

competitive, political and social risks, contingencies and

uncertainties. Many factors, both known and unknown, could cause

results, performance or achievements to be materially different

from the results, performance or achievements that are or may be

expressed or implied by such forward- looking statements. Such

factors include, but are not limited to, the following: (i) AIP

will receive financing on favourable terms; (ii) the future level

of indebtedness of AIP and its future growth potential will remain

consistent with AIP’s current expectations; (iii) there will be no

changes to tax laws adversely affecting AIP’s financing capacity or

operations; (iv) the impact of the current economic climate and the

current global financial conditions on AIP’s operations, including

its financing capacity and asset value, will remain consistent with

AIP’s current expectations; (v) the performance of AIP’s

investments in Texas will proceed on a basis consistent with AIP’s

current expectations; and (vi) capital markets will provide AIP

with readily available access to equity and/or debt. The Trust does

not intend, and do not assume any obligation, to update these

forward-looking statements or information to reflect changes in

assumptions or changes in circumstances or any other events

affecting such statements and information other than as required by

applicable laws, rules and regulations.

The forward-looking statements contained in this

news release are expressly qualified in their entirety by this

cautionary statement. All forward-looking statements in this press

release are made as of the date of this press release. AIP does not

undertake to update any such forward- looking information whether

as a result of new information, future events or otherwise, except

as required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release is not an offer of securities

for sale in the United States. The securities may not be offered or

sold in the United States absent registration or an exemption from

registration under U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Trust has not registered and will not

register the securities under the U.S. Securities Act. The Trust

does not intend to engage in a public offering of their securities

in the United States.

Source: AIP Realty Trust

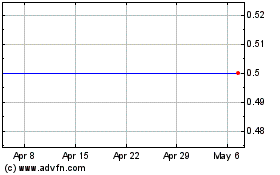

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Mar 2024 to Apr 2024

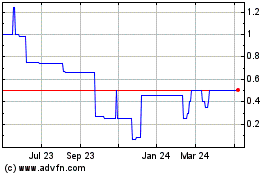

AIP Realty (TSXV:AIP.U)

Historical Stock Chart

From Apr 2023 to Apr 2024