Arras Minerals Corp. (TSX-V: ARK) (“Arras” or “the

Company”) is pleased to announce assay results from holes

Bg21003 and Bg21004 from the ongoing drill program at the Beskauga

copper-gold deposit and surrounding area (“Beskauga” or the

“Project”).

Highlights:

- Hole Bg21004 returned a significant

intersection of 1120.4 meters of mineralization grading

0.59 % copper-equivalent (“CuEq”) or 0.73 g/t

gold-equivalent (“AuEq”) (0.39 g/t gold

(“Au”), 0.25 % copper (“Cu”), 1.31 g/t silver (“Ag”) and 22.3 ppm

molybdenum (“Mo”)) starting at 43.9 meters from surface to end of

hole.

- Including 465.1 meters grading 0.81 % CuEq

or 1.00 g/t AuEq (0.52 g/t Au, 0.36 % Cu, 1.70 g/t

Ag and 25.6 ppm Mo) from 43.9 meters depth down-hole.

- And including 35 meters grading 0.76 % CuEq or 0.94 g/t

AuEq (0.46 g/t Au, 0.37 % Cu, 2.0 g/t Ag and 26.2 ppm Mo)

from 741 meters depth down-hole.

- And including 207 meters grading 0.73 % CuEq or 0.90

g/t AuEq (0.55 g/t Au, 0.26 % Cu, 1.68 g/t Ag and 23.7 ppm

Mo) from 863 meters depth down-hole.

- The hole demonstrates the continuity of high-grade

mineralization to depth, up to 460 m beneath the base of the block

model of Arras’ recently announced Mineral Resource

Estimate for Beskauga (see Arras’ news

release dated June 20, 2022). The hole was terminated at a depth of

1164.3 m due to the capacity of the drill rig and ended in

porphyry-style mineralization with mineralization remaining open at

depth.

- The top of Hole Bg21003 returned 83.1

meters of mineralization grading 0.51% CuEq (0.33 g/t Au,

0.23 % Cu, 1.19 g/t Ag, and 13 ppm Mo) starting at 49.5 meters from

surface before the hole entered an unmineralized post-mineral

porphyritic diorite.

- Drilling is ongoing at Beskauga with further assay results

expected in the coming weeks.

Commenting on the results, Tim Barry, CEO of

Arras stated, “When considering the copper-equivalent grade

multiplied by the length of the intercept, hole Bg21004 represents

one of the best holes ever drilled on the Beskauga property, second

only to hole Bg21001 that returned an impressive 973.2 meters @

0.82 % CuEq [for further details, see Arras’ press release dated

January 31, 2022]. Perhaps more significantly, hole Bg21004 drilled

460 m below the base of our current resource block model,

substantially expanding the potential volume of high-grade

mineralization to depth in the southwest part of the main deposit.

Our Beskauga project continues to deliver, demonstrating the

large-scale characteristics of the deposit. We expect further drill

assays to be finalized over the coming weeks which we will report

as they become available.”

A summary of the results announced in this news

release is outlined in the table below.

Table

1. Summary table for holes Bg21003 and

Bg21004.

Notes: Copper Equivalent

(“CuEq”) grades reported for the drill holes at Beskauga were

calculated using the following formula: CuEq % = Copper (%) + (Gold

(g/t) x 0.8264) + (Silver (g/t) x 0.0107) + (Molybdenum (ppm) x

3.3333). Gold Equivalent (“AuEq”) grades reported for the drill

holes at Beskauga were calculated using the following formula: AuEq

g/t = Gold (g/t) + (Copper (%) x 1.2100) + (Silver (g/t) x 0.0129)

+ (Molybdenum (ppm) x 4.0334). Assumptions used for the copper and

gold equivalent calculations were metal prices of US$3.00/lb.

Copper, US$1,700/oz Gold, US$22/oz Silver, US$10/lb. Molybdenum,

and metallurgical recoveries were assumed to be 100%.

Drill Program: In October 2021,

Arras announced the start of a planned 30,000-meter diamond drill

program targeting the extensions of the Beskauga deposit both

laterally and at depth (see Figure 1). The drill program is being

conducted under the Option to Purchase agreement (“Option

Agreement”) executed on January 26, 2021, with Copperbelt AG

(“Copperbelt”), a private mineral exploration company registered in

Zug, Switzerland.

In addition to testing the extents of the

Beskauga deposit, the drilling program is also targeting a series

of previously undrilled targets in the wider area. These wider

targets are supported by both ground and recently flown airborne

geophysics, as well as in-situ geochemistry, derived using “KGK”

drilling (a drilling method akin to 'wet' reverse circulation

drilling, that recovers a 1-3 m core sample from the top of the

underlying bedrock which is used by Arras to efficiently map

lithology, alteration, and geochemistry across the property beneath

overburden).

For both the diamond and KGK drilling, Arras is

using the local company “Tsentrgeolsemka LLP”. Tsentrgeolsemka LLP

is independent of Arras. Arras plan to mobilize diamond drill rigs

with the capacity to drill deeper to enable the Company to fully

evaluate the continuation of the high-grade mineralization to

depth.

Results:

Bg21003 was collared 340 m

south-west of Bg21004 and drilled at an angle of -70 o towards the

south to a final depth of 404.7 m. The hole was designed to test a

clustering of Au-Cu-As-Bi anomalies within top of bedrock samples

retrieved through historical KGK drilling by Copperbelt. The hole

started in reasonably strong mineralization, up to 0.8 g/t Au, 0.62

% Cu, 2.45 g/t Ag, and 75 ppm Mo within a diorite with strong to

very strong argillic alteration comprising of illite and smectite

with subordinate kaolinite, before entering an unmineralized

post-mineral xenolithic porphyritic diorite dyke with strong to

moderate argillic alteration at a depth of 132.6 to 185.3 meters

down-hole. After the porphyritic diorite dyke, the hole entered a

weakly porphyritic, moderately argillic altered late-mineral

diorite variant with very weak mineralization (with sporadic higher

grades up to 0.75 % CuEq, dominated by copper over gold) in which

the hole was terminated. The porphyritic diorite dyke is

interpreted to have filled a pre-existing E-W trending fault zone

that has juxtaposed the strongly Cu-Au mineralized diorite of the

main Beskauga deposit to the north, with a distinct weakly

mineralized diorite variant to the south and may have structurally

offset the southern portion of the orebody. The presence of two

distinct diorite variants is further supported by trace element

lithogeochemistry.

Bg21004 (see Figures 2 and 3)

was collared 100 m west of Bg21001 (for results of Bg21001, refer

to Arras’ press release dated January 31, 2022), and drilled at an

angle of -70 o towards the south to a final depth of 1164.3 m where

it was terminated due to maximum depth capacity of the drill rig.

The mineralization observed in hole Bg21004 is hosted within a

sodic (strong albite alteration with a characteristic reddening

caused by hematite dusting**) altered diorite that has been later

overprinted by moderate, to very strong, argillic alteration

comprising of illite and smectite; with subordinate kaolinite and

dickite present at shallow levels (confirmed by Arras using

TerraSpec SWIR/NIR spectroscopy). Mineralization occurs as a

mixture of disseminated, vein, and fracture-controlled zones of

chalcopyrite, tennantite, and pyrite with minor bornite, covellite,

and molybdenite. Zones of sheeted and/or intense stockwork

quartz-Cu sulfide veins correlate with high-grade gold and copper

assays up to 4.5 g/t Au and 3.01 % Cu, respectively (see Figure 4).

Higher Mo grades up to 833 ppm occur sporadically but are more

abundant in the deepest parts of the hole. An unmineralized

post-mineral, yet argillic altered, xenolithic porphyritic diorite

dyke was intersected in two intercepts at depths of 586.85 to 623.7

meters and 640.5 to 715.0 meters down-hole. When removing the grade

dilution resulting from the unmineralized dyke, it leaves a

residual intercept of 1010.4 meters of mineralization grading 0.65

% CuEq or 0.80 g/t AuEq within the mineralized diorite.

** Sodic (and potassic) alteration in many

alkalic porphyry systems is characterized by hematite dusting of

feldspars and the zone of “reddening” can provide a useful vector

toward mineralization. In alkalic porphyry systems, sodic

alteration can occur in the upper levels of the system, which is in

accord with the epithermal overprinting observed within the

Beskauga deposit. Arras recently initiated petrological and

lithogeochemical studies to fully characterize the alteration,

evaluate the alkalic or high-K calc-alkaline nature of the Beskauga

deposit, and inform continued exploration.

Figure

1. Location of the holes completed to date

as part of Arras’ planned 30,000 meter drill program on the

Beskauga Main deposit and the wider area.

Figure 2. Cross-section showing hole

Bg21004 in relation to several historical holes drilled by

Copperbelt. Also shown are grade contours based on the Beskauga

block model for copper (only) developed for the

purposes of the current Mineral Resource Estimate for Beskauga (for

further details, please see Arras’ press releases on June 20,

2022). CuEq grades of key intercepts in Bg21004 and historical

holes are shown. Note that hole Bg21004 demonstrates the continuity

of high-grade mineralization to depth, up to 460 m beneath the base

of the current block model. The cross-section demonstrates the

steep, southeast dipping high-grade copper-gold-silver trend

observed through Arras’ exploration to date. This trend is observed

beginning at the paleo-bedrock surface (44m in depth), to average

between 200-300m wide and to be consistently mineralized down to at

least 1000 meters. Mineralization remains untested at

depth.

Figure 3. Cross-section showing hole

Bg21004 in relation to several historical holes drilled by

Copperbelt. Also shown are grade contours based on the Beskauga

block model for gold (only) developed for the

purposes of the current Mineral Resource Estimate for Beskauga (for

further details, please see Arras’ press releases on June 20,

2022). AuEq grades of key intercepts in Bg21004 and historical

holes are shown. Note that hole Bg21004 demonstrates the continuity

of high-grade mineralization to depth, up to 460 m beneath the base

of the current block model. The cross-section demonstrates the

steep, southeast dipping high-grade copper-gold-silver trend

observed through Arras’ exploration to date. This trend is observed

beginning at the paleo-bedrock surface (44m in depth), to average

between 200-300m wide and to be consistently mineralized down to at

least 1000 meters. Mineralization remains untested at

depth.

Figure 4. Photos of the diamond drill

core from Bg21004 showing the typical styles of veining,

mineralization and alteration observed throughout the

hole.

About the Beskauga Deposit:

The Beskauga deposit is a gold-copper-silver

deposit with a NI 43-101 compliant “Indicated” Mineral Resource of

111.2 million tonnes grading 0.49 g/t gold, 0.30% copper, and 1.34

g/t silver for 1.75 million ounces of contained gold, 333.6

thousand tonnes of contained copper, and 4.79 million ounces of

contained silver and an “Inferred” Mineral Resource of 92.6 million

tonnes grading 0.50 g/t gold, 0.24% copper and 1.14 g/t silver for

1.49 million ounces of contained gold, 222.2 thousand tonnes of

contained copper, and 3.39 million ounces of contained silver. This

resource is based on 122 drill holes completed between 2007 and

2021. For further details regarding the Mineral Resource estimate

at the Beskauga project, please see the technical report entitled

“Beskauga Copper-Gold Project, Pavlodar Province, the Republic of

Kazakhstan," dated February 20, 2022, and filed on the Company’s

website and on the Company’s SEDAR profile at www.sedar.com.

The constraining pit was optimized and

calculated using an NSR cut-off based on a price of: $1,750/oz for

gold, $3.50/lb for copper, $22.00/oz for silver, and with an

average recovery of 85% for copper and 74.5% for gold and 50% for

silver.

Based on exploration undertaken to date, the

Beskauga deposit is interpreted by Arras to represent a gold-rich

porphyry copper-gold deposit that has been overprinted by

high-sulfidation epithermal mineralization, either through

telescoping or due to clustering of multiple porphyry centers

within the Beskauga license that have superimposed alteration and

mineralization upon earlier phases. Beskauga is located within the

highly under-explored Bozshakol-Chingiz Volcanic Arc, which hosts

KAZ Minerals’ Bozshakol porphyry Cu-Au mine only 130 km west of

Beskauga. Bozshakol is one of the largest copper resources in

Kazakhstan with 1.123 billion tonnes at 0.35% Cu, 0.14 g/t Au and

1.00 g/t Ag in Measured and Indicated Resources. The mine has a 30

Mtpa ore processing capacity and a remaining mine life of >40

years.

Contrary to many porphyry copper deposits being

developed in other jurisdictions globally, the Beskauga project

benefits from excellent modern infrastructure and accessibility and

is located at 350m above sea level. The region is mining-friendly

and hosts several large-scale mining operations. Arras’ operations

are based out of the nearby mining town of Ekibastuz, which

services the largest coal mine in Kazakhstan and provides a highly

trained workforce for the Company to draw upon. Paved road access,

1100 KVA power lines, heavy rail, and the Irtysh–Karaganda

irrigation canal all lie within a 25-kilometer radius of the

project. The capital city of Nur-Sultan, located approximately 300

kilometers along a four-lane highway to the west of the project,

has a major international airport allowing for easy access and

administration of the Beskauga project.

Assay and QAQC Procedures:

Diamond drill core was sampled in 1-meter

intervals (except were shortened by geological contacts) using a

rock saw. Core diameter is a mix of HQ and NQ depending on the

depth of the drill hole. Samples were cut and sampled at Arras’

operational base in the town of Ekibastuz, Kazakhstan by Company

personnel. All sample preparation and geochemical analysis of the

diamond drill core were undertaken by ALS Global at its

laboratories in Karaganda (Kazakhstan) and Loughrea (Republic of

Ireland), respectively. ALS Global is an accredited laboratory that

is entirely independent of the Company.

After drying and fine crushing, a 250 g split

was pulverized to 85 % passing a -75-micron screen. A 30 g split of

the pulp was analyzed for gold using fire assay and Atomic

Absorption Spectroscopy (AAS) finish (ALS method: Au-AA25™) at ALS

Karaganda. A second pulp split was then air freighted to ALS

Loughrea and analyzed for 48 elements by Inductively Coupled Plasma

Mass Spectrometry (ICP-MS) after 4-acid digestion on a 0.25 g

aliquot (ALS method: ME-MS61™). Samples exceeding 1% copper were

re-analyzed using a 4-acid digest ICP-MS ore grade method (ALS

method: Cu-OG62™).

Arras Minerals operates according to its

rigorous internal Quality Assurance and Quality Control (QA/QC)

protocols, which are consistent with industry best practices. This

includes the insertion of certified standards, blanks, and field

duplicates comprising of quarter drill core at an insertion rate of

2.5%, 2.5%, and 5% respectively, which is deemed appropriate for

this stage of exploration. The blanks and standards are Certified

Reference Materials (CRM’s) supplied by Ore Research and

Exploration, Australia. Internal QA/QC samples were also inserted

by the analytical laboratories and reviewed by the Company prior to

release. No material QA/QC issues have been identified with respect

to sample collection, security, and assaying.

Qualified Person:

The scientific and technical disclosure for the

Beskauga Project included in this news release has been reviewed

and approved by Joshua Hughes, the Vice President Exploration, and

a full-time employee of Arras Minerals Corp., who is also a Member

and Chartered Professional Geologist (MAusIMM CP(Geo)) of the

Australasian Institute of Mining and Metallurgy, a Fellow of the

Society of Economic Geologists (FSEG) and a Fellow of the

Geological Society of London (FGS). Mr Hughes has sufficient

experience, relevant to the styles of mineralization and type of

deposits under consideration and to the activity that he is

undertaking, to qualify as a "Qualified Person" for the purposes of

National Instrument 43-101.

On behalf of the Board of Directors "Tim Barry"

Tim Barry, MAusIMM CP(Geo)Chief Executive

Officer and Director

INVESTOR RELATIONS: +1 604 687 5800

info@arrasminerals.com

About Arras Minerals Corp.

Arras Minerals Corp. is British Columbia

incorporated public company trading on the TSX-V exchange under the

symbol “ARK.” The Company is advancing a portfolio of copper and

gold assets in northeastern Kazakhstan, including an Option

Agreement on the Beskauga copper and gold project. Further

information can be found on the Company’s website

www.arrasminerals.com or follow us on LinkedIn:

https://www.linkedin.com/company/arrasminerals

Cautionary note regarding

forward-looking statements: This news release contains

forward-looking statements regarding future events and Arras’

future results that are subject to the safe harbors created under

the U.S. Private Securities Litigation Reform Act of 1995, the

Securities Act of 1933, as amended, and the Exchange Act, and

applicable Canadian securities laws. Forward-looking statements

include, among others, statements regarding the use of net proceeds

from the recent private placement, plans and expectations of the

drill program Arras is in the process of undertaking, including the

expansion of the Mineral Resource, and other aspects of the Mineral

Resource estimates for the Beskauga project. These statements are

based on current expectations, estimates, forecasts, and

projections about Arras’ exploration projects, the industry in

which Arras operates and the beliefs and assumptions of Arras’

management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “continues,” “may,” variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond management’s control,

including undertaking further exploration activities, the results

of such exploration activities and that such results support

continued exploration activities, unexpected variations in ore

grade, types and metallurgy, volatility and level of commodity

prices, the availability of sufficient future financing, and other

matters discussed under the caption “Risk Factors” in the

Non-Offering Prospectus filed on the Company’s profile on SEDAR on

May 31, 2022 and in the Company’s Annual Report on Form 20-F for

the fiscal year ended October 31, 2021 filed with the U.S.

Securities and Exchange Commission filed on February 17, 2022

available on www.sec.gov. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that actual results or developments may differ materially from

those expressed or implied in the forward-looking statements. Any

forward-looking statement made by the Company in this release is

based only on information currently available and speaks only as of

the date on which it is made. The Company undertakes no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments, or otherwise.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b358878-ea6b-4946-9f92-f1e79e451a6b

https://www.globenewswire.com/NewsRoom/AttachmentNg/33c63c38-9718-45d2-9e0e-7a7f0594d8f3

https://www.globenewswire.com/NewsRoom/AttachmentNg/b87876d4-c916-4548-8e9c-143abbe7ae1e

https://www.globenewswire.com/NewsRoom/AttachmentNg/2c5eb8a9-61ba-425e-841b-355f1ac2aab8

https://www.globenewswire.com/NewsRoom/AttachmentNg/49c1fee9-7e5b-4895-b56a-e9ccf729b505

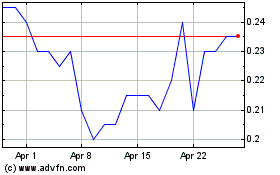

Arras Minerals (TSXV:ARK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arras Minerals (TSXV:ARK)

Historical Stock Chart

From Apr 2023 to Apr 2024