Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a

leading developer of technologies targeting low-cost and clean

extraction of heavy oil and bitumen, today announced its financial

and operating results for the year ended December 31, 2021 (all

figures are in Canadian dollars unless otherwise noted).

Acceleware’s year end results reflect contributions from the

Company’s two business units, comprised of radio frequency heating

technology (“RF Heating”), which supports a cost-effective and

environmentally friendly alternative to steam assisted gravity

drainage (“SAGD”) for the extraction of heavy oil and bitumen

through its proprietary RF XL heating technology, along with

high-performance scientific computing applications (“HPC”). This

news release should be read in conjunction with the Company’s

audited financial statements and the accompanying notes for the

year ended December 31, 2021, and management’s discussion and

analysis (“MD&A”) thereto, all of which are available on

Acceleware’s website at www.acceleware.com or on SEDAR at

www.sedar.com.

HIGHLIGHTS

Acceleware completed the drilling and

completions program during Q4 2021, a major milestone in the

execution of the commercial-scale RF XL pilot project at Marwayne,

Alberta (the “RF XL Pilot”). The RF XL Pilot is also the final step

before commercialization of the Company’s patent-protected Clean

Tech Inverter (“CTI”), a novel electrification “engine” for

industrial heating. Subsequent to the drilling and completions

work, facilities installation began and was completed in the first

quarter of 2022. As of March 2022, Acceleware announced that

heating had commenced, and as such the RF XL Pilot entered the

final milestone.

On March 1, 2022, the Company launched a

non-brokered private placement of 10% unsecured convertible

debentures due 2026 for approximate gross proceeds of $1,500,000.

Each debenture matures four years after the issue date and is

convertible into units of the Company at a conversion price of

$0.80. Each unit consists of one common share and one-half of one

common share purchase warrant. Each whole warrant entitles the

holder to acquire one common share, at an exercise price equal to

200% of the conversion price of the debentures for a 24-month

period following the distribution of the debentures. Net proceeds

from the offering shall be used to fund the further development and

testing of the Company’s RF heating technology and for general

corporate purposes. The Company expects to close the private

placement no later than April 15, 2022.

Acceleware estimates the net cost to construct

and operate the RF XL Pilot for six months to be in the range of

$21 million to $22 million. These costs are net of an estimated $2

million to $3 million from the sale of produced oil. While

construction costs have increased due to delays caused by COVID-19,

supply chain disruptions, an extended drilling and completions

program, and weather-related issues, the Company now also estimates

a meaningful contribution from the sale of oil production. The

majority of construction costs had been incurred as at December 31,

2021, while operating cost estimates remain subject to fluctuating

commodity prices in particular electricity. There is also

uncertainty in estimated proceeds from the sale of produced oil due

to fluctuating oil prices and simulated production volumes. As of

December 31, 2021, total direct funding committed to the RF XL

Pilot included $5 million from Alberta Innovates, $5.5 million from

Sustainable Development Technology Canada (“SDTC”), $5 million from

Emissions Reduction Alberta (“ERA”), and $6 million from three

major oil sands producers.

FINANCIAL SUMMARY

R&D spending has increased significantly, in

lockstep with completion of the drilling program and the purchase

and manufacture of surface and sub-surface components. Cumulative

RF XL Pilot expenses as at December 31, 2021 were approximately

$20.4 million (December 31, 2020 – $7.6 million). The

remaining cash committed but not yet received from SDTC, ERA and

Alberta Innovates, including holdbacks receivable was $2.9 million

as at December 31, 2021 (December 31, 2020 – $4.2 million) and

amounts committed but not yet received from three major oil-sands

producers were $2.8 million as at December 31, 2021 (December 31,

2020 – $3.2 million).

QUARTER IN REVIEW

Revenue of $0.1 million was generated in the

three months ended December 31, 2021 (“Q4 2021”) compared to $0.1

million in the three months ended December 31, 2020 (“Q4 2020”).

Revenue of $0.3 million was generated in the previous quarter ended

September 30, 2021 (“Q3 2021”). Revenue is attributable to

software, maintenance and services with the largest amount

attributable to software. Higher revenue in Q3 2021 compared with

Q4 2021 and Q4 2020 is attributable to a significant contract in

the HPC segment and sales of RF simulation services within the RF

Heating segment.

Total comprehensive loss for Q4 2021 was $1.8

million compared to a comprehensive loss of $1.0 million for Q4

2020 and a comprehensive loss of $1.1 million for Q3 2021. The

higher comprehensive loss in Q4 2021 compared to Q4 2020 and Q3

2021 is due to an increase in spending for R&D on the RF XL

Pilot in Q4 2021.

Gross R&D expenses incurred in Q4 2021 were

$5.2 million compared to gross R&D expenses in Q4 2020 of $0.8

million and $4.0 million in Q3 2021. The increase in Q4 2021 and Q3

2021 over Q4 2020 is due to significant investment in the RF XL

Pilot activities in 2021. During Q4 2021, a significant portion of

the drilling activity was completed, and the majority of surface

and sub-surface components were manufactured and received. Federal

and provincial government assistance of $3.9 million was recognized

in Q4 2021 compared to $0.5 million in Q4 2020 and $3.0 million in

Q3 2021, offsetting gross research and development costs.

General and administrative (“G&A”) expenses

incurred in Q4 2021 were $0.5 million compared to $0.7 million in

Q4 2020 and $0.4 million in Q3 2021. The Company continues to

prioritize cost control given uncertain economic conditions.

YEAR TO DATE IN REVIEW

Revenue of $0.8 million was generated from the

Company’s software, maintenance and services revenue streams for

the year ended December 31, 2021 compared to $0.9 million for the

year ended December 31, 2020. The lower revenue in the year ended

December 31, 2021 compared to the year ended December 31, 2020 is

due to recognition of a large HPC contract in 2020. In addition to

recognized revenue, Acceleware has also received non-refundable

milestone cash payments of $2.4 million for the year ended December

31, 2021 (December 31, 2020 – $0.3 million) which are recorded in

deferred revenue. Data revenue equal to the amount recorded in

deferred revenue will be recognized as revenue at the end of the RF

XL Pilot or when the data contracts are terminated, whichever is

earlier. Total deferred revenue recorded on the statement of

financial position as at December 31, 2021 is $3.05 million

(December 31, 2020 – $0.75 million).

Total comprehensive loss for the year ended

December 31, 2021 was $4.1 million compared to $2.1 million for the

year ended December 31, 2020 due to higher R&D spending for the

RF XL Pilot.

Gross R&D expenses for the year ended

December 31, 2021 were $12.6 million compared to $2.5 million

incurred during the year ended December 31, 2020 due to increased

R&D activity noted above. Federal and provincial government

assistance of $9.6 million was recognized in the year ended

December 31, 2021 compared to $1.5 million for the year ended

December 31, 2020.

G&A expenses incurred during the year ended

December 31, 2021 were $1.8 million compared to $2.1 million for

the year ended December 31, 2020, a decrease of $0.3 million due

primarily to lower payroll and payroll related costs. The Company

continues to prioritize cost management.

As at December 31, 2021, Acceleware had negative

working capital of $0.9 million (December 31, 2020 – positive

working capital of $0.03 million) including cash and cash

equivalents of $1.9 million (December 31, 2020 – $1.9 million). The

decrease in working capital is attributable to timing of receipt of

funding and higher R&D spending for the RF XL Pilot. Increasing

the deficit is deferred revenue of $3,050,000 as at December 31,

2021 (December 31, 2020 – $750,000). Despite receiving

non-refundable cash payments for these amounts, the milestone

payments have not met all requirements for revenue recognition

under IFRS 15 Revenue from Contracts with Customers. These amounts

will be recognized as revenue and increase shareholders’ equity

when RF XL Pilot heating is complete or the data revenue contracts

are terminated, whichever is earlier.

In the interests of matching cash requirements

with a combination of cash generated from operations, external

funding, and capital raising activities, the Company actively

manages its cash flow and investments in new products. Acceleware

intends to maximize cash generated from operations through several

initiatives which include continuing to focus on higher gross

margin software products that are marketed through a combination of

direct and reseller models; minimizing operating expenses where

possible; and limiting capital expenditures. As the Company

continues to develop its RF Heating technology, new R&D

investments will be financed through a combination of internal cash

flow from the HPC business, project funding agreements, government

assistance and external financing, when available.

RF HEATING BUSINESS SEGMENT

SUMMARY

RF XL is Acceleware’s patented and

patent-pending RF Heating technology, designed to improve the

extraction of heavy oil and bitumen, with a cost effective and

environmentally friendly alternative to SAGD. When applied, RF XL

has the potential to reduce both capital and operating costs, while

offering significant environmental benefits, including:

- immediate GHG emission

reductions;

- a substantial decrease in land

use;

- the elimination of external water

use;

- no requirement for solvents;

and

- substantial elimination of water

treatment facilities and no need for tailings ponds.

The Company believes that its RF XL heating

technology, as an electrically-driven process, can provide a clear

pathway to zero-GHG production of heavy oil and oil sands and

provide optimal alignment with industry and government goals to

recognize innovation as a meaningful solution in the oil and gas

industry’s overall emission reduction plans.

RF Heating Results Summary

- RF

Heating revenue was $11,250 in Q4 2021 compared to $nil in Q4 2020

and $55,000 in Q3 2021 due to sales of RF simulation software and

services, a relatively new revenue stream attributable to

customers’ interest in applying RF XL to specific reservoirs and

operations. Since 2018, the Company has been successful selling

data revenue agreements to major oil sands producers which provide

the customer with the right to access and use data obtained from

the RF XL Pilot. Under IFRS 15 Revenue from Contracts with

Customers, these contracts do not meet all requirements for revenue

recognition over-time, therefore revenue recognition defaults to

the end of the contract. As at December 31, 2021, deferred revenue

of $3,050,000 (December 31, 2020 – $750,000) has been recorded

under these contracts for amounts that have been received in cash,

and will be recognized as revenue once heating is complete or the

contracts are terminated, whichever is earlier.

- RF

Heating expenses for the three months ended December 31, 2021, were

$1,724,818 or 116% higher than in Q4 2020 and 32% higher than in Q3

2021. R&D expenses were higher compared to both Q4 2020 and Q3

2021 due to higher contractor and materials costs related to the

significantly increased activity for the RF XL Pilot for drilling

and completion work. G&A expenses were lower compared to Q4

2020 and higher compared to Q3 2021 due to fluctuations in payroll

and payroll related costs.

- RF

Heating revenue was higher in the year ended December 31, 2021 at

$151,250 compared to $nil in the year ended December 31, 2020,

driven by higher software revenue from the sale in Q1 2021 of the

Company’s AxHEAT RF heating simulation software to a major oil

sands producer in connection with a data revenue agreement and due

to higher services revenue for sales of simulation services in Q3

2021.

- RF

Heating expenses increased 90% to $4,328,899 in the year ended

December 31, 2021 compared to $2,275,697 for the year ended

December 31, 2020 because of an 270% increase in R&D expenses

for increased activity on the RF XL Pilot as noted above. G&A

expenses for the year ended December 31, 2021 decreased 10%

compared to the year ended December 31, 2020 due to lower payroll

and payroll related costs.

HIGH-PERFORMANCE COMPUTING BUSINESS

SEGMENT SUMMARY

Acceleware's HPC business segment helps

customers meet their oil and gas exploration needs with seismic

imaging software that provides the most accurate and advanced

imaging available for oil exploration in complex geological zones

and formations. While the Company is focusing on energy markets, it

continues to develop and sell its electro-magnetic (“EM”)

simulation software FDTD (or finite difference time domain)

solution, AxFDTD, to end users primarily through independent

software vendors that have integrated Acceleware’s solution into

their software architecture.

HPC Results Summary

- HPC revenue remained relatively

consistent at $75,781 in Q4 2021 compared to $74,347 in Q4 2020.

Revenue of $242,226 in Q3 2021 was due to higher software revenue

for a large seismic contract. The Company’s software revenue model

results in relatively few overall sales transactions with higher

overall revenue per transaction, which could potentially lead to

increased volatility in quarterly revenue. This was evident in Q3

2021 as revenue fluctuated relative to Q4 2021 and Q4 2020.

- HPC expenses for the three months

ended December 31, 2021 were $110,503 or 51% lower than in Q4 2020

and 15% higher than in Q3 2021. G&A expenses were lower

compared to Q4 2020 and 18% higher compared to Q3 2021 due to lower

payroll and payroll related expenses. R&D expenses were minimal

in all comparative periods as the Company focuses the majority of

all R&D on the RF XL Pilot.

- HPC revenue was $601,520 in the

year ended December 31, 2021, a decrease of 33% compared to

$899,281 in the year ended December 31, 2020 due to the

above-mentioned 2020 revenue contract, partially offset by

increased demand for software in the oil and gas sector in early

2021.

- HPC expenses were $469,849 in the

year ended December 31, 2021, a decrease of 37% compared to

$742,473 in the year ended December 31, 2020 as the Company

continues to focus the majority of resources on the RF XL

Pilot.

ABOUT ACCELEWARE:

Acceleware (www.acceleware.com) is an innovator

of clean-tech oil and gas technologies comprised of two business

units: Radio Frequency (RF) Enhanced Oil Recovery and Seismic

Imaging Software.

Acceleware is developing RF XL, its patented,

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy production

that can quickly bend the emissions curve downward. Further,

Acceleware’s RF XL technology could be a key component of an

end-to-end integrated carbon management system that can eliminate

greenhouse gas (GHG) emissions associated with heavy oil and oil

sands production, whether for fossil fuels, or for future clean

bitumen by-products such as petrochemicals, carbon fibre, and blue

or green hydrogen production. RF XL uses no water, requires no

solvent, has a small physical footprint, can be redeployed from

site to site, and can be applied to a multitude of reservoir types.

In shallow oil sands implementations, no tailings ponds will be

required.

Acceleware has partnered with Saa Dene

Group (co-founded by Jim Boucher) to create

Acceleware | Kisâstwêw to raise the profile, adoption,

and value of Acceleware technologies. The shared vision of the

partnership is to improve the environmental and economic

performance of the energy sector

by supporting ideals that are important to Indigenous

peoples, including respect for land, water, and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

NOTE REGARDING FORWARD-LOOKING

INFORMATION AND OTHER ADVISORIES

This news release contains “forward-looking

information” within the meaning of Canadian securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that are prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by terms such as “believes”, “estimates”,

“plans”, “potential”, and “will”, and includes information about

the expected cost of the RF XL Pilot, the amount of, and

realized price for the oil produced at the RF XL Pilot,

the timing of the execution of the RF XL Pilot,

and the anticipated economic and societal benefits of the

RF XL technology. Acceleware assumes that current cost

estimates are accurate, simulations of oil production at the RF XL

Pilot are accurate, the price realized for oil produced at the

pilot remain at or near current levels, current timelines will not

be delayed by either internal or external causes,

that research and development effort including the

commercial-scale test plans will result in commercial-ready

products, and that future capital raising efforts will be

successful.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release,

unless it is required to do so under Canadian securities

legislation.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this release in the United States. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information:Geoff ClarkTel: +1 (403)

249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3CanadaTel: +1 (403) 249-9099www.acceleware.com

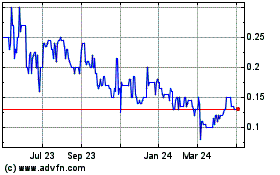

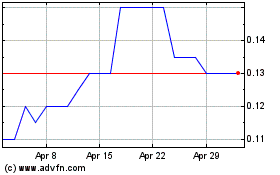

Acceleware (TSXV:AXE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acceleware (TSXV:AXE)

Historical Stock Chart

From Apr 2023 to Apr 2024