Toronto Stocks Climb as November CPI Is Steady, G2 Goldfields Rises on New Investment

20 December 2023 - 4:54AM

Dow Jones News

By Adriano Marchese

Canadian stocks were sharply higher, hoisted by strength across

all sectors.

Materials was the main leader in Tuesday's session, followed by

consumer discretionary and tech.

On the economic front, Canada's annual inflation rate

unexpectedly held steady at 3.1% in November as consumers continue

to be squeezed by higher mortgage interest costs, food prices and

rent. This was higher than the 2.9% the market was expecting,

according to economists at TD Securities.

At midday, Canada's S&P/TSX Composite Index was 0.95% higher

at 20819.49 and the blue-chip S&P/TSX 60 rose by 0.93% to

1256.43.

G2 Goldfields shares were 15% higher at 77 Canadian cents (57

cents) after the company said AngloGold Ashanti intends to make a

C$22.1 million investment in the company.

Other market movers:

HIVE Digital Technologies shares were 8.7% higher at C$5.60

after the company said that it plans to raise $25 million on a

bought-deal basis private placement. Shares are up 8.5% in Toronto

at C$5.59.

Shares in Global Atomic were 6.1% lower at C$2.63 after it said

that it expects to raise C$15 million by way of a strategic

investment, in part from privately owned Bermuda-based Regent

Mercantile Holdings and certain related companies.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

December 19, 2023 12:39 ET (17:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

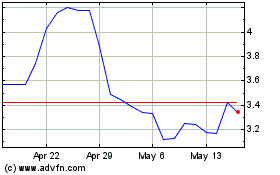

Hive Digital Technologies (TSXV:HIVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

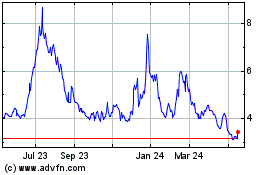

Hive Digital Technologies (TSXV:HIVE)

Historical Stock Chart

From Nov 2023 to Nov 2024