Neptune Digital Assets Hits Record Income of $6 Million for the Second Quarter 2021

15 March 2021 - 10:00PM

Neptune Digital Assets Corp. (TSX-V:NDA) (OTC:NPPTF) (FSE:1NW)

(“

Neptune” or the "

Company"), a

cryptocurrency leader in Canada, is pleased to announce it has

achieved its highest income results since its initial listing in

January 2018. These are preliminary results for the second quarter

ended on February 28, 2021.

“We are extremely pleased with our record

setting quarter. We are continuing to strengthen our foundation in

decentralized finance (DeFi), staking, and blockchain technologies

which is proving to be a solid growth strategy. With our bitcoin

mining operations coming online in a matter of weeks, we expect

substantial income growth and our asset base to continue on this

trajectory,” stated Cale Moodie, Neptune CEO.

Below are a number of financial highlights

pertaining to the three months ended February 28, 2021:

- The Company

has achieved a positive net comprehensive income of $6.07 million

for the 3 months ended February 28, 2021,

- Neptune had a

200% growth in total assets from November 30, 2020 to February 28,

2021,

- The Company’s

largest digital asset holdings as of the date of this release are

82 BTC, 139,150 ATOM, 1.44 million FTM, 210 ETH, and 2,030 DASH.

The Company also holds positions in BCH, Litecoin, Stellar, NEO,

OMG, QTUM as well as the investment in the Protocol Fund,

- Neptune’s

investment in the Protocol Fund of $250,000 USD is now valued at

$1.8 million USD as of February 28, 2021,

- Neptune’s

investment in Fantom (FTM) has increased over 1,000% in value,

- DeFi and

proof-of-stake earnings have doubled over the same period last year

and as of the date of this news release earnings related to defi

and staking have increased 500% over prior year,

- Neptune is

continually purchasing crypto in order to dollar cost average and

is always optimizing its crypto portfolio in order to maximize

growth for shareholders,

- Neptune’s cash

operating costs were approximately $226,000 for the 6 months ended

February 28, 2021 or roughly $37,000 per month.

“We have now shown the earnings and asset growth

potential when investing in viable cryptocurrency ecosystems. We

also continue to operate Neptune on a very lean budget in an effort

to maximize shareholder value and bring on new revenue streams

reflecting those same cost efficiencies, as we intend to do with

our mining operations,” stated Cale Moodie, Neptune CEO.

All financial information in this press release

is prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards

Board. The Company will file its consolidated interim financial

statements for the six-month period ended February 28, 2021 and

associated management discussion and analysis under the Company's

profile on SEDAR at www.sedar.com on or before March 30,

2021.

About Neptune Digital Assets

Corp.

Neptune Digital Assets aims to be a

cryptocurrency leader with a diversified portfolio of investments

and cryptocurrency operations across the digital asset ecosystem

including Bitcoin mining, tokens, proof-of-stake cryptocurrencies,

decentralized finance (DeFi), and associated blockchain

technologies.

ON BEHALF OF THE BOARD

Cale Moodie, President and CEONeptune Digital

Assets Corp.1-800-545-0941

www.neptunedigitalassets.com

Forward-Looking Statements

This release contains certain “forward looking

statements” and certain “forward-looking information” as defined

under applicable Canadian securities laws. Forward-looking

statements and information can generally be identified by the use

of forward-looking terminology such as “may”, “will”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”,

“proposes” or similar terminology. Forward-looking statements and

information include, but are not limited to, the Company’s future

earnings and operating costs; the Company’s future growth in total

assets; the Company’s strategy to purchase crypto currency and

optimize its crypto portfolio; the Company’s ability effectively

dollar cost average its purchases of crypto currency; and the

future outlook of the crypto currency market generally.

Forward-looking statements and information are based on forecasts

of future results, estimates of amounts not yet determinable and

assumptions that, while believed by management to be reasonable,

are inherently subject to significant business, economic and

competitive uncertainties, and contingencies. Forward-looking

statements and information are subject to various known and unknown

risks and uncertainties, many of which are beyond the ability of

the Company to control or predict, that may cause the Company’s

actual results, performance or achievements to be materially

different from those expressed or implied thereby, and are

developed based on assumptions about such risks, uncertainties and

other factors set out herein, including but not limited to: the

inherent risks involved in the cryptocurrency and general

securities markets; the Company’s ability to successfully mine

digital currency; revenue of the Company may not increase as

currently anticipated, or at all; the Company may not be able to

profitably liquidate its current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on the Company’s operations; the volatility of

digital currency prices; uncertainties relating to the availability

and costs of financing needed in the future; the inherent

uncertainty of production and cost estimates and the potential for

unexpected costs and expenses, currency fluctuations; regulatory

restrictions, liability, competition, loss of key employees and

other related risks and uncertainties. The Company does not

undertake any obligation to update forward-looking information

except as required by applicable law. Such forward-looking

information represents management's best judgment based on

information currently available. No forward-looking statement can

be guaranteed and actual future results may vary materially.

Accordingly, readers are advised not to place undue reliance on

forward-looking statements or information.

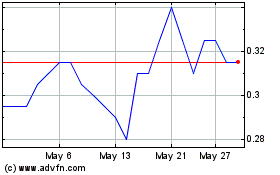

Neptune Digital Assets (TSXV:NDA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Neptune Digital Assets (TSXV:NDA)

Historical Stock Chart

From Nov 2023 to Nov 2024