Avante Logixx Inc. (TSX.V: XX) (OTC: ALXXF) (“Avante” or the

“Company”) is pleased to announce its financial results for the

fiscal year ended March 31, 2022 (all amounts in Canadian dollars

thousands, unless otherwise indicated).

SUMMARY FINANCIAL RESULTS FOR THE YEAR

ENDED MARCH 31, 2022:

|

|

|

|

|

|

$ thousands unless otherwise noted |

|

March 31, 2022 |

March 31, 2021 |

| Revenues, continuing

operations(1) |

|

$18,156 |

$17,134 |

| Gross profit, continuing

operations(1) (3) |

|

$7,848 |

$7,320 |

| Gross profit margin, continuing

operations(1) (3) |

|

43.2% |

42.7% |

| |

|

|

|

| RMR in the period, continuing

operations(1) (3) |

|

$9,648 |

$8,543 |

| |

|

|

|

| EBITDA(2) (3) |

|

$187 |

$3,793 |

| Adjusted EBITDA(3) |

|

$4,200 |

$6,666 |

| Adjusted EBITDA, Avante Security

Segment(1) (3) |

|

$1,402 |

$1,750 |

| |

|

|

|

| Net Income (loss), continuing

operations(1) (2) |

|

$(5,937) |

$(3,990) |

| Net Income (loss)(2) |

|

$(4,392) |

$(2,803) |

| |

|

|

|

| Total Funded Debt as reported per

IFRS(4) |

|

$8,865 |

$15,548 |

| Total Funded Debt & Lease

Obligations per IFRS(1) (4) |

|

$9,706 |

$17,729 |

| Total Common Shares outstanding

at period end |

|

26,489,438 |

21,192,004 |

| Average Common Shares outstanding

during the period |

|

21,830,599 |

21,192,004 |

|

(1) |

The Company sold Logixx Security Inc. (“Logixx Security”) on June

1, 2022. Its financial results are treated as discontinued

operations for this reporting period. |

|

(2) |

Net income (loss) and EBITDA in each period also reflect

significant gain or loss amounts attributable to the derivative

component of convertible debentures that were converted into common

shares on February 16, 2022. The net loss during fiscal 2022

also reflects significant costs related to the Board’s strategic

review. |

|

(3) |

EBITDA, Adjusted EBITDA and Recurring Monthly Revenue (“RMR”) are

non-IFRS financial measures that have no standard meaning under

IFRS and as a result may not be comparable to the calculation of

similar measures by other companies. See Description of

Non-IFRS Financial Measures. Reconciliations of EBITDA,

Adjusted EBITDA and RMR to Net Income or Revenues, as applicable,

are provided in the Company’s Management Discussion & Analysis

(“MD&A”). |

|

(4) |

Funded Debt was fully repaid on June 1, 2022, upon receipt of

proceeds from the sale of Logixx Security. |

Under IFRS reporting standards, the Company is

required to remove the financial results of Logixx Security Inc.

(“Logixx Security”), that was sold on June 1,

2022, in respect of the reporting periods ended March 31, 2022 and

March 31, 2021. However, the expenses of the corporate head

office, that supported a larger enterprise prior to the sale of

Logixx Security, remain within the reported financial results for

such periods. Significant cost reduction measures were

implemented by the Company after March 31, 2022, and funded debt

was fully repaid on June 1, 2022. In addition, reported net

income (loss) during each fiscal period reflected significant gains

or losses attributable to the derivative component of the

convertible debentures that were converted into common shares on

February 16, 2022. Significant costs related to the former

Board’s strategic review initiated in August 2021, as well as

acquisition costs, are also reflected within the IFRS net loss

during fiscal 2022. Therefore, readers are cautioned that

IFRS reported consolidated financial results and balance sheet

amounts in respect of the fiscal years ending March 31, 2022 and

2021 may not be reliable predictors of financial results or

balances for the Company during subsequent fiscal periods.

“The business has been significantly transformed

since the Board and management changes implemented by the Company

on March 30, 2022.” said Manny Mounouchos, Founder, CEO & Board

Chair of Avante. “During March to June 2022, we closed the

corporate office, eliminated redundant vehicle leases, removed

several senior level positions and completed the sale Logixx

Security. Management is now focused on a new strategy to

leverage the Company’s valuable residential security business

within Avante Security currently serving the Toronto and Muskoka

regions of Ontario.”

Added Stephen Rotz, Chief Financial Officer of

the Company, “We anticipate releasing our financial results in

respect of the first fiscal quarter ended June 30, 2022 during late

August 2022 and expect to report June 30th cash balances of

approximately $11.9 million. Settlement of working capital with the

purchasers of Logixx Security is expected to yield an additional $1

million during September. While some integration costs remain

to be paid from the Company’s cash balance, the Company is well

positioned to capitalize on opportunities going forward given its

significant cash balances, its debt free balance sheet along with

access to an unused $2 million, senior secured revolving credit

facility with its bank and a $10 million unsecured, non-revolving

term loan facility provided by the Company’s largest

shareholder.”

FINANCIAL HIGHLIGHTS FOR THE FISCAL YEAR

AND QUARTER ENDED MARCH 31, 2022:

Within continuing operations, the Company

reported year-over-year revenue growth of 6.0% (or $1.0 million)

during fiscal 2022 increasing to $18.2 million from $17.1

million. Gross profit margins within continuing operations

improved to 43.2% of revenue, versus 42.7% during the prior year,

with total gross profit increasing by $0.5 million.

The Avante Security segment delivered growing

recurring monthly revenues (“RMR”) within the

Company’s continuing operations, totaling $2,488 of revenue during

the fourth quarter of fiscal 2022, from $2,314 during the prior

year’s fourth quarter, representing growth of 7.5%. During

the full year of fiscal 2022, RMR was $9,648 versus $8,543 during

fiscal 2021, representing an increase of 12.9%.

As summarized in the table below, the Company’s

RMR (from continuing operations) has been growing throughout the

last eight quarters, and total revenues grew sequentially over each

of the last three fiscal quarters. In addition, gross profit

margins over the last eight quarters have ranged between 40.1% and

46.7% with a tighter range during fiscal 2022:

| Avante

Security |

|

Fiscal

2021(1) |

Fiscal

2022(1) |

|

$ thousands |

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

| RMR in the period |

|

$2,033 |

$2,070 |

$2,126 |

$2,314 |

$2,372 |

$2,372 |

$2,416 |

$2,488 |

| Other revenue |

|

1,674 |

2,376 |

2,202 |

2,339 |

1,657 |

2,066 |

2,335 |

2,450 |

| Total revenue |

|

$3,707 |

$4,446 |

$4,328 |

$4,653 |

$4,029 |

$4,438 |

$4,751 |

$4,938 |

| |

|

|

|

|

|

|

|

|

|

| Total Gross Profit |

|

$1,733 |

$1,874 |

$1,848 |

$1,865 |

$1,776 |

$1,842 |

$2,143 |

$2,087 |

| Gross Profit % |

|

46.7% |

42.2% |

42.7% |

40.1% |

44.1% |

41.5% |

45.1% |

42.3% |

|

(1) |

The Company’s fiscal year end is on March 31 of each year. |

During the fourth quarter of Fiscal 2022, the

Company experienced strong sequential and year-over-year growth in

both Protective Service revenues and Monitoring & Managed

service revenues. However, this growth was partially offset

by sequential declines in Electronic Services implementation

revenues. Similar trends occurred on a year-over-year basis

in respect of the entire fiscal year ended March 31, 2022.

SEGMENT

RESULTS:

The Company’s total Adjusted EBITDA, including

discontinued operations, decreased $2.5 million from $6.7 million

during fiscal 2021 to $4.5 million during fiscal 2022. As

summarized in the tables at the end of this news release under

“Reconciliation of EBITDA and Adjusted EBITDA by Segment”, the

year-over-year decline in Adjusted EBITDA during fiscal 2022 was

due to reduced earnings within both the Avante Security and

Discontinued Operations segments, offset by a lower loss within

corporate costs of continuing operations.

The Avante Security segment reported reduced

Adjusted EBITDA of $1.4 million during fiscal 2022, versus $1.8

million during fiscal 2021. This decrease of $0.4 million was

largely due to higher operating expenses, as the prior year

benefited from temporary COVID-19 salary cuts and fiscal 2022

absorbed higher costs for salary increases, insurance premiums and

allocated overhead expenses for audit and incremental IT security

costs. The Company’s new management team, as of March 30,

2022, has addressed these cost pressures within Avante Security by

reducing headcount and overhead costs and by implementing pricing

and fuel levy charges to customers as of June 2022.

During fiscal 2022, Discontinued Operations

reflected the Logixx Security Segment for twelve months, while

during fiscal 2021, Discontinued Operations included the Logixx

Security Segment for twelve months as well as the City Wide Segment

for six months ending September 30, 2020. During Fiscal 2022,

Adjusted EBITDA of Discontinued Operations was $4.2 million,

compared to $7.4 million during fiscal 2021, a decrease of $3.1

million. Logixx Security’s prior year benefited more

significantly from strong margins on COVID-19 related service

revenues, while the current year’s gross profit was impacted

negatively by higher unbillable overtime costs due to labour

shortages from August 2021 to the end of fiscal 2022. In

addition, Discontinued Operations during the prior year benefited

from positive earnings of approximately $0.6 million generated from

the City Wide Segment.

The loss from central corporate costs, net of

eliminations, within continuing operations showed a positive

improvement of $1.0 million during fiscal 2022, as the prior year

reflected management bonuses that were not repeated in respect of

fiscal 2022.

OTHER

HIGHLIGHTS:

Effective February 16, 2022, the holders of the

Company’s convertible debentures elected to convert all outstanding

debentures into common shares. This eliminated reported debt

in respect of these debentures under IFRS standards as of the third

quarter ended December 31, 2022 of $8.6 million (face value $8.3

million) and increased outstanding Common Shares by

5,297,434. On June 1, 2022, all remaining funded debt of the

Company was repaid from proceeds of the sale of Logixx Security and

the Company was in a significant cash position as of that date.

Manny Mounouchos concluded by saying that “over

the coming months, we will articulate additional plans for growing

the business. However, our shareholders should not forget

that we are building upon strong recurring revenues, insignificant

customer attrition, low customer net acquisition costs and a highly

regarded portfolio of customers. I fully expect future

financial reporting to better reflect recent transformation

activities, to create a more balanced cost structure, and benefits

from additional plans for this great business.”

Readers should refer to the Company’s financial

statements and MD&A in respect of the fiscal years ended March

31, 2022 and 2021 for additional risk factors, accounting policies,

detailed financial disclosures, reconciliation of non-IFRS

financial measures to the most directly comparable IFRS financial

measures, related party transactions, contingencies and reporting

of subsequent events since the fiscal year ended March 31,

2022. Such financial statements and MD&A are incorporated

by reference into this news release and are filed electronically

through the System for Electronic Document Analysis and Retrieval

(“SEDAR”), which can be accessed at www.sedar.com.

This news release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities described herein in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This news release

does not constitute an offer of securities for sale in the United

States. The securities described herein have not been, nor

will they be, registered under the United States Securities Act of

1933, as amended, and such securities may not be offered or sold

within the United States absent registration under U.S. federal and

state securities laws or an applicable exemption from such U.S.

registration requirements.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

ABOUT AVANTE LOGIXX

INC.:

Avante Logixx Inc. (TSXV: XX), provides high-end

security services through its wholly owned subsidiary, Avante

Security Inc., serving residential customers located in Toronto and

Muskoka regions of Ontario, Canada. With an experienced team,

a focus on customer service excellence and development of

innovative solutions, we remain committed to providing our

shareholders with exceptional returns. Please visit our

website at www.avantelogixx.com.

Emmanuel Mounouchos Founder, CEO & Board

Chair, Avante Logixx Inc.416-923-6984manny@avantesecurity.com

Forward-Looking Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of the Company and the environment in

which it operates. Forward-looking statements are identified

by words such as “believe”, “anticipate”, “project”, “expect”,

“intend”, “plan”, “will”, “may” “estimate”, “pro-forma” and other

similar expressions. These statements are based on the

Company’s expectations, estimates, forecasts and projections.

The forward-looking statements in this news release are based

on certain assumptions. They are not guarantees of future

performance and involve risks and uncertainties that are difficult

to control or predict. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements, including, but not limited to, the

Company’s ability to achieve the benefits expected as a result of

the sale of Logixx Security Inc., anticipated growth from

acquisitions, new service offerings and from development and

deployment of new technologies and the list of risk factors

identified in the Company’s Management Discussion & Analysis

(MD&A), Annual Information Form (AIF) and other continuous

disclosure documents available at www.sedar.com. There can be

no assurance that forward-looking statements will prove to be

accurate as actual outcomes and results may differ materially from

those expressed in these forward-looking statements. Readers,

therefore, should not place undue reliance on any such

forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, the Company assumes no

obligation to publicly update any such statement, whether as a

result of new information, future events or otherwise.

Non-IFRS Financial Measures

This press release includes certain measures

which have not been prepared in accordance with International

Financial Reporting Standards (“IFRS”) such as EBITDA, Adjusted

EBITDA and Recurring Monthly Revenue (“RMR”). These non-IFRS

measures are not recognized under IFRS and and do not have a

standardized meaning prescribed by IFRS. Accordingly, users

are cautioned that these measures should not be construed as

alternatives to net income determined in accordance with IFRS.

The non-IFRS measures presented are unlikely to be comparable

to similar measures presented by other issuers.

References to EBITDA are to net

income before interest, taxes, depreciation and amortization.

References to Adjusted EBITDA are to net

income before interest, taxes, depreciation, amortization of

intangibles & capitalized commissions, share-based payments,

acquisition, integration and / or reorganization costs, deferred

financing costs, loss (gain) in fair value of derivative liability

and expensing of fair value adjustments per IFRS.

Recurring Monthly Revenues, or

RMR, represent revenue during the fiscal period

that benefited from contractual periodic billing to customers,

typically monthly, quarterly or annually.

Management believes that Adjusted EBITDA and

Recurring Monthly Revenues are appropriate additional measures for

evaluating Avante’s performance. Readers are cautioned that

neither EBITDA, Adjusted EBITDA nor Recurring Monthly Revenues

should be construed as an alternative to net income or revenues (as

such financial measures are determined under IFRS), as an indicator

of financial performance or to cash flow from operating activities

(as determined under IFRS) or as a measure of liquidity and cash

flow. Avante’s method of calculating EBITDA, Adjusted EBITDA

and Recurring Monthly Revenues may differ from methods used by

other issuers and, accordingly, Avante’s reported Non-IFRS measures

may not be comparable to similar measures used by other

issuers.

RECONCILIATION OF EBITDA & ADJUSTED

EBITDA BY SEGMENT:

Continuing

Operations:

| |

Fiscal Year Ended March 31, 2022 |

|

Fiscal Year Ended March 31, 2021 |

|

|

Avante Security |

Corporate & Eliminations |

Total |

|

Avante Security |

Corporate & Eliminations |

Total |

|

|

|

|

|

|

|

|

|

| Revenue |

18,161 |

(5) |

18,156 |

|

17,142 |

(8) |

17,134 |

| Cost of sales |

(10,844) |

536 |

(10,308) |

|

(10,070) |

256 |

(9,814) |

| Gross profit |

7,317 |

531 |

7,848 |

|

7,072 |

248 |

7,320 |

| |

|

|

|

|

|

|

|

| Direct operating expenses |

5,931 |

2,241 |

8,172 |

|

5,326 |

2,844 |

8,170 |

| Other operating expenses |

709 |

639 |

1,348 |

|

717 |

547 |

1,264 |

| Total operating expenses |

6,640 |

2,880 |

9,520 |

|

6,043 |

3,391 |

9,434 |

| Other (income) expenses |

79 |

(282) |

(203) |

|

104 |

2,235 |

2,339 |

| Reorganization &

acquisition costs |

26 |

4,381 |

4,407 |

|

- |

196 |

196 |

| Provision for income

taxes |

144 |

(83) |

61 |

|

277 |

(937) |

(660) |

| |

|

|

|

|

|

|

|

| Net Income (loss),

continuing |

428 |

(6,365) |

(5,937) |

|

648 |

(4,637) |

(3,989) |

| |

|

|

|

|

|

|

|

| Current income tax expense

(recovery) |

- |

- |

- |

|

- |

- |

- |

| Deferred income tax expense

(recovery) |

144 |

(83) |

61 |

|

277 |

(937) |

(660) |

| Interest expense |

95 |

364 |

459 |

|

109 |

276 |

385 |

| Depreciation and

amortization |

709 |

532 |

1,241 |

|

717 |

474 |

1,191 |

| |

|

|

|

|

|

|

|

| EBITDA,

continuing |

1,376 |

(5,552) |

(4,176) |

|

1,751 |

(4,824) |

(3,073) |

| |

|

|

|

|

|

|

|

| Share based compensation |

- |

108 |

108 |

|

- |

73 |

73 |

| Reorganization and acquisition

costs |

27 |

4,380 |

4,407 |

|

- |

196 |

196 |

| Loss (gain), fair value of

derivative liability |

- |

(471) |

(471) |

|

- |

2,070 |

2,070 |

| Deferred financing fees |

- |

125 |

125 |

|

- |

49 |

49 |

| |

|

|

|

|

|

|

|

| Adjusted EBITDA,

Continuing |

1,403 |

(1,410) |

(7) |

|

1,751 |

(2,436) |

(685) |

Discontinued

Operations:

| |

Fiscal Year Ended March 31, 2022 |

|

Fiscal Year Ended March 31, 2021 |

|

|

Logixx Security |

Corporate & Eliminations |

Total |

|

Discontinued Operations |

Corporate & Eliminations |

Total |

| |

|

|

|

|

|

|

|

| Revenue |

76,446 |

(536) |

75,910 |

|

74,952 |

(371) |

74,581 |

| Cost of sales |

(64,277) |

2 |

(64,275) |

|

(61,187) |

120 |

(61,067) |

| Gross profit |

12,169 |

(534) |

11,635 |

|

13,765 |

(251) |

13,514 |

| |

|

|

|

|

|

|

|

| Direct operating expenses |

9,278 |

(2,150) |

7,128 |

|

9,810 |

(3,153) |

6,657 |

| Other operating expenses |

1,504 |

- |

1,504 |

|

3,707 |

- |

3,707 |

| Total operating expenses |

10,782 |

(2,150) |

8,632 |

|

13,517 |

(3,153) |

10,364 |

| Other (income) expenses |

1,338 |

- |

1,338 |

|

820 |

- |

820 |

| Reorganization &

acquisition costs |

217 |

- |

217 |

|

484 |

- |

484 |

| Provision for income

taxes |

(97) |

- |

(97) |

|

566 |

- |

566 |

| |

|

|

|

|

|

|

|

| Net Income (loss),

discontinued |

(71) |

1,616 |

1,545 |

|

(1,622) |

2,902 |

1,280 |

| |

|

|

|

|

|

|

|

| Current income tax expense

(recovery) |

22 |

- |

22 |

|

52 |

- |

52 |

| Deferred income tax expense

(recovery) |

(119) |

- |

(119) |

|

514 |

- |

514 |

| Interest expense |

1,039 |

- |

1,039 |

|

1,155 |

- |

1,155 |

| Depreciation and

amortization |

1,504 |

- |

1,504 |

|

3,868 |

- |

3,868 |

| |

|

|

|

|

|

|

|

| EBITDA,

discontinued |

2,376 |

1,616 |

3,991 |

|

3,967 |

2,902 |

6,869 |

| |

|

|

|

|

|

|

|

| Share based compensation |

- |

- |

- |

|

- |

- |

- |

| Reorganization and acquisition

costs |

217 |

- |

217 |

|

484 |

- |

484 |

| Loss (gain), fair value of

derivative liability |

- |

- |

- |

|

- |

- |

- |

| Deferred financing fees |

- |

- |

- |

|

- |

- |

- |

| |

|

|

|

|

|

|

|

| Adjusted EBITDA,

Discontinued |

2,593 |

1,616 |

4,209 |

|

4,451 |

2,902 |

7,353 |

| |

|

|

|

|

|

|

|

Note: During fiscal 2021,

Discontinued Operations included the financial results of the City

Wide Segment for six months ending September 30, 2020 as well as

the financial results in respect of the Logixx Security Segment for

twelve months ending March 31, 2021.

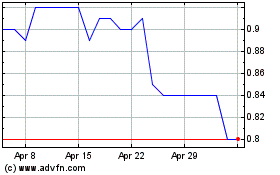

Avante (TSXV:XX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avante (TSXV:XX)

Historical Stock Chart

From Apr 2023 to Apr 2024