Boeing Beats on Higher Deliveries - Analyst Blog

30 January 2013 - 9:18PM

Zacks

In the fourth quarter of 2012, The Boeing

Company (BA) soaring on higher deliveries of commercial

airplanes posted strong operating EPS (excluding special items) of

$1.46, beating the Zacks Consensus Estimate of $1.19. However, this

came below the year-ago EPS of $1.92. The company’s strong numbers

came from higher commercial planes deliveries which more than

offset a tepid quarter for defense.

On a reported basis, Boeing reported quarterly EPS of $1.28 per

share versus $1.84 in the year-ago quarter. The 18-cent difference

between reported and operating earnings, during the reported

quarter, was owing to the effects of an unallocated

pension/postretirement expense.

Full year 2012 operating EPS (excluding special items) came in at

$5.88, above the Zacks Consensus Estimate of $5.00 and full year

2011 earnings of $5.79. On a reported basis, earnings came in at

$5.11 in 2012 versus $5.34 in 2011.

Operating Statistics

On the revenue front, higher airplane deliveries pulled up the

quarterly revenue year over year by 14% to $22.3 billion, in line

with the Zacks Consensus Estimate. Full-year 2012 revenue rose 19%

to $81.7 billion, moderately above the Zacks Consensus Estimate of

$81.6 billion.

Segment Results

Commercial Airplane segment

Boeing’s Commercial Airplane segment in the reported quarter saw a

29% rise in deliveries to 165 units. As a result, Commercial

Airplanes revenue increased by 32% to $14.2 billion on higher

delivery volume and mix. In the reported quarter the company

delivered 10 747 series and 23 787 series airplanes versus 9 and 2

deliveries, respectively, in the year-ago period.

The company also delivered a higher number of 737 (105 versus 91

units) and 777 airplanes (21 versus 20). However, 767 deliveries

were constant at 6 units in both the reported and year-ago

quarters.

Operating margin fell 30 basis points to 8.9%, reflecting the

dilutive impact of initial 787 and 747-8 deliveries and higher

period costs. This was partially offset by higher volume and lower

Research & Development expenditure.

Commercial Airplanes booked 394 net orders during the reported

quarter. Backlog at 2012 end remained strong with more than

4,400 airplanes valued at a record $319 billion.

Boeing Defense, Space & Security

Boeing Defense, Space & Security segment witnessed a 2% fall in

its quarterly revenue to $8.3 billion. Of these sub-segments only

Boeing Military Aircraft (BMA) witnessed a top-line climb of 5%.

However both the Global Services & Support (GS&S) and

Network & Space Systems (N&SS) registered fall of 11% and

2%, respectively.

Quarterly operating margin shrunk by 120 basis points to 9.0%. This

was due to lower margins in its two sub-segments. BMA margin

decreased due to delivery mix while N&SS margin fell due to

lower earnings on Ground-based Midcourse Defense and several

satellite programs. However this was partially offset by GS&S

which posted higher margins owing to improved performance in

integrated logistics programs.

Backlog at Defense, Space & Security was $71.0 billion, more

than two times the projected 2013 revenue.

Boeing Capital Corporation (BCC)

Boeing Capital Corporation reported quarterly revenues of $116

million compared with $104 million in the year-ago quarter. The

segment digested a loss of $20 million in both the reported and the

year-ago period. At 2012 end, BCC's portfolio balance was $4.1

billion, flat versus the beginning of the year.

Financial Condition

Boeing ended 2012 with cash and cash equivalents of $10.3 billion

and short-term investments of $3.2 billion. At year-end 2011, the

company had $10.0 billion in cash and cash equivalents and $1.2

billion of short-term investments.

The company generated more than $7.5 billion of cash from

operating activities in 2012, compared with approximately $4.0

billion generated in 2011. Long-term debt decreased to $9.0 billion

at the end of the reported period from $10.0 billion at the end of

2011.

Guidance

Boeing expects its full-year 2013 GAAP earnings in the range of

$5.00–$5.20 per share, and adjusted earnings of $6.10–$6.30 per

share. Revenue for 2013 is expected to be between $82 billion and

$85 billion.

Commercial Airplanes' 2013 deliveries are expected to be between

635 and 645 airplanes. This includes more than 60 units of 787

deliveries. Commercial Airplanes' 2013 revenue is expected to be

between $51 billion and $53 billion with operating margin of

approximately 9.5%.

In the defense space, the company also secured big contracts like

13 F/A-18 aircraft for U.S. Navy; Space Launch System (SLS) for

NASA; the C-17 Globemaster III Integrated Sustainment Program from

the U.S. Air Force; and a contract to upgrade 68 F-15s for an

international customer. However, the threat of defense cutbacks

will loom over the company going forward. Overall, the company

expects defense revenue for 2013 to be between $30.5 billion and

$31.5 billion with operating margin greater than 9%.

Boeing Capital Corporation expects that its aircraft finance

portfolio will continue to decline in 2013, as new aircraft

financing of less than $0.5 billion is expected to be lower than

the normal portfolio runoff through customer payments and

depreciation.

Boeing's 2013 R&D forecast is approximately $3.4 billion.

Capital expenditures for 2013 are expected to be between $2.3

billion and $2.5 billion.

Outlook

Boeing has a unique position as the largest aircraft manufacturer

in the world in terms of revenues, orders and deliveries, and is

one of the largest aerospace and defense contractors in the world.

Besides, its revenues are spread across more than 90 countries

around the globe.

Boeing’s presence in the two businesses of commercial airplanes and

defense insulates the performance of the company from U.S. defense

budget shock waves that are currently affecting all defense players

across the board.

However recently on Jan 16, the Federal Aviation Administration

(“FAA”) issued an airworthiness directive that resulted in all

in-service 787s temporarily ceasing operations. The pile of dominos

started tumbling from Japan when a 787 Dreamliner of Japanese

airline All Nippon Airways (ALNPY) made an

emergency landing at Takamatsu airport in Japan. The Dreamliner was

forced to land after an in-flight battery incident of smoke

appearing in the plane's cockpit.

As of now, while production continues on the 787, the company is

suspending deliveries until clearance is granted by the FAA

following ongoing investigation. Boeing currently retains a Zacks

Rank #3, which translates into a short-term Hold rating.

The fate of the Dreamliner would affect other aerospace players

like Rockwell Collins Inc. (COL) and

Precision Castparts Corporation (PCP) who have a

considerable stake in the airplane as suppliers.

(ALNPY): ETF Research Reports

BOEING CO (BA): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

PRECISION CASTP (PCP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

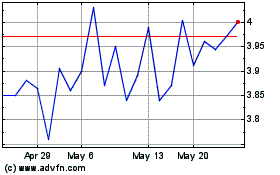

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

ANA (PK) (USOTC:ALNPY)

Historical Stock Chart

From Feb 2024 to Feb 2025