true

This amendment is being filed to comply with regulations.

0000945617

false

false

false

false

false

0000945617

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND

EXCHANGE COMMISSION

FORM 8-K/A

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): November

8, 2024

AMERICAN

CANNABIS COMPANY, INC.

(Exact Name of Registrant

as Specified in its Charter)

Delaware

(State

or other jurisdiction of incorporation or organization) |

Commission

File Number

000-26108 |

90-1116625

(I.R.S.

Employer

Identification

Number) |

1004

S Tejon St Colorado

Springs, CO

80903

(Address of

Principal Executive Offices and Zip Code)

(303)

974-4770

(Issuer's telephone

number)

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[

] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbols |

Name of Exchange on Which Registered |

| Common |

AMMJ |

None |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [

]

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry into a Material Definitive

Agreement

On November 20, 2024, the Board of Directors

of American Cannabis Company, Inc. (the “Company”) approved entry into the following material definitive agreements:

1. Binding

Letter of Intent

The Company entered into a binding Letter of

Intent (“LOI”) with Credex Corp. Under the terms of the LOI, the Company will acquire all of Credex's assets and assume certain

mutually agreed-upon debts. The LOI obligates the Company to perform due diligence and negotiate and execute material definitive agreements,

which will be subject to further independent determination and approval. The proposed transaction aligns with the Company’s strategic

goals and will be disclosed in detail in subsequent filings upon execution of the definitive agreements.

2. Services

Contract with Joseph Cleghorn

Concurrently, the Company entered into a services

contract with Joseph Cleghorn, who was recently appointed Chief Executive Officer, interim Chief Financial Officer, and Director. Under

the contract, Mr. Cleghorn will serve in these roles for a one-year term. Notably, the contract stipulates that no cash or equity consideration

will be provided, reflecting a favorable arrangement for the Company and its shareholders.

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers

Effective November 11, 2024, the Company appointed

Mr. Joseph Cleghorn as Chief Executive Officer, interim Chief Financial Officer, and Director. Mr. Cleghorn’s appointment was disclosed

in the Form 8-K, filed on November 8, 2024. The approval of his services contract, as outlined above, further formalizes his roles, responsibilities,

and compensation.

Section 9 – Financial Statements and

Exhibits

Item 9.01 Financial Statements and Exhibits

Exhibit Index:

Exhibit Number Description

10.1 Binding LOI (filed herewith)

10.2 Contract with Joseph Cleghorn (filed herewith)

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated

November 21, 2024

AMERICAN CANNABIS COMPANY, INC.

(Registrant)

By: /s/ Joseph Cleghorn

Joseph Cleghorn

Chief Executive Officer

Principal Executive Officer

Exhibit

10.1

BINDING

LETTER OF INTENT

This

Binding Letter of Intent (“LOI”) sets forth the principal terms and conditions under which American Cannabis Company, Inc.

(“ACC” or the “Buyer”), a Delaware corporation, intends to acquire substantially all of the assets and debts

of Credex Corp. (“Credex” or the “Seller”), a Florida corporation, subject to the execution of definitive transaction

documents.

| (a) | Assets

to be Acquired: The buyer intends to acquire all tangible and intangible assets of Credex,

including, but not limited to, intellectual property, contracts, licenses, inventory, equipment,

goodwill, and any other assets identified during due diligence. |

| (b) | Assumed

Debts: The buyer will assume certain specified debts and liabilities of Credex, as listed

in an agreed-upon Schedule of Assumed Liabilities. |

| (c) | Excluded

Assets and Liabilities: The definitive agreement will identify and exclude any excluded

assets or liabilities. |

The

total consideration for the transaction (the “Purchase Consideration”) will be determined through mutual agreement during

the due diligence and negotiation process. The structure of the Purchase Consideration may include, but is not limited to:

| (a) | Cash

Payment: An agreed-upon cash amount payable at closing; |

| (b) | Equity

Issuance: Shares of ACC common stock or other securities issued to Credex or its shareholders; |

| (c) | Assumption

of Liabilities: An allocation of assumed debts and obligations of Credex; and/or |

| (d) | Other

Consideration: Any additional forms of compensation to be negotiated in good faith. |

The precise

allocation and form of the Purchase Consideration will be outlined in the definitive agreements following the conclusion of due diligence.

The Buyer

shall have a period of 60 days from the date of this LOI to conduct financial, operational, legal, and regulatory due diligence of Credex.

The Seller shall provide full access to all necessary documents, records, and personnel to facilitate this process.

The Parties

shall negotiate in good faith to execute definitive transaction documents, including but not limited to:

| (a) | Asset

Purchase Agreement; |

| (b) | Assignment

and Assumption Agreement; |

| (d) | Ancillary

Agreements (as required); |

| (e) | SEC

filings (as required). |

The obligations

of the Parties to complete the transaction shall be subject to customary conditions, including but not limited to:

| (a) | Buyer’s

satisfactory completion of due diligence; |

| (b) | Necessary

approvals from each Party’s board of directors and shareholders (if applicable); |

| (c) | Receipt

of all required regulatory and third-party consents. |

The following

provisions are intended to be binding and enforceable:

| (a) | Exclusivity:

Credex agrees not to engage in discussions or negotiations with any other party concerning

the sale of its assets or debts during the exclusivity period of [XX] days. |

| (b) | Confidentiality:

Both Parties agree to maintain the confidentiality of all information exchanged during the

negotiation and due diligence process. |

| (c) | Governing

Law: This LOI shall be governed by and construed in accordance with the laws of the State

of Colorado. |

| (d) | Expenses:

Each Party shall bear its own expenses incurred in connection with this LOI and the transaction. |

This LOI

shall terminate upon the earlier of:

| (a) | Execution

of definitive agreements; |

| (b) | Expiration

of the exclusivity period; or |

| (c) | Mutual

written agreement of the Parties. |

Except for

the binding provisions set forth in Section 6, this LOI is not intended to create any binding obligation for either Party to consummate

the transaction described herein until the execution of definitive agreements.

For American Cannabis

Company, Inc.:

By: /s/

Ellis Smith

Name:

Ellis Smith

Title:

Director

Date:

11/20/2024

For Credex Corp.:

By:

/s/ Joseph Cleghorn

Name: Joseph Cleghorn

Title:

Chairman of the Board

Date:

11/20/24

Exhibit

10.2

Contents

| Article

I. Term of Employment. |

1 |

| Article

II. Duties and Obligations of Employee. |

1 |

| Article

III. Obligations of Employer. |

3 |

| Article

IV. Compensation of Employee. |

3 |

| Article

V. Employee Benefits. |

3 |

| Article

VI. Business Expenses. |

3 |

| Article

VII. Termination of Employment. |

3 |

| Article

VIII. Non-Competition and Non-Solicitation. |

4 |

| Article

IX. Representation of Employee. |

5 |

| Article

X. General Provisions. |

5 |

Senior

Executive Employment Contract

Employment Contract

for Director, Chief Executive Officer, Chief Financial Officer

This Employment

Agreement (“Agreement”) is entered into this November 20, 2024 (the “Effective Date”) between American

Cannabis Company, Inc. ("Employer"), a Delaware corporation located at 1004 S. Tejon Street, Colorado Springs, CO, 80903,

and Joseph Cleghorn ("Employee"), with a residence at 701 Waddell Avenue, Key West, FL 33040; Employer and Employee

are collectively the “Parties.”

In consideration of the mutual

promises made herein, the Parties agree as follows:

Article

I. Term of Employment.

Specified Term

Section

1.1. The Employer employs the Employee, who accepts employment with the Employer for one year,

beginning on November 11, 2024, and terminating on November 11, 2025.

Earlier Termination

Section 1.2.

This Agreement may be terminated earlier as hereinafter provided.

Article

II. Duties and Obligations of Employee.

Title and Description of Duties

Section

2.1. Employee shall serve as Director, Chief Executive Officer, and Chief Financial Officer of

the Employer. In that capacity, the Employee shall do and perform all services, acts, or things necessary or advisable to fulfill the

duties of a Director, Chief Executive Officer, and Chief Financial Officer. However, in his capacity as Chief Executive Officer and Chief

Financial Officer, the Employee shall always be subject to the direction and policies established by the Board of Directors of Employer.

Loyal and Conscientious Performance

of Duties

Section

2.2. Employee agrees that to the best of his ability and experience, he will at all times loyally

and conscientiously perform all of the duties and obligations required of him either expressly or implicitly by the terms of this Agreement.

Devotion of Time to Employer's

Business

Section 2.3.

| (a) | Employee

shall devote his productive time, ability, and attention to the business of Employer during

the term of this Agreement. |

| (b) | During

the term of this Agreement, Employee shall not engage in any other business duties or pursuits

that pose a conflict of interest to the Employer or the Employer’s business. Furthermore,

during the term of this Agreement, Employee shall not, whether directly or indirectly, render

any services of a commercial or professional nature to any other person or organization,

whether for compensation or otherwise, without the prior written consent of Employer's President,

which shall not be unreasonably withheld. However, the expenditure of reasonable amounts

of time for educational, charitable, or professional activities shall not be deemed a breach

of this section if those activities do not materially interfere with the services required

under this Agreement and shall not require the prior written consent of Employer. |

| (c) | This

Agreement shall not be interpreted to prohibit Employee from making passive personal investments

or conducting private business affairs if those activities do not materially interfere with

the services required under this Agreement. However, Employee shall not, directly or indirectly,

acquire, hold, or retain any interest in any business competing with or similar in nature to the business of Employer. |

Competitive

Activities

Section

2.4. During the term of this contract, Employee shall not, directly or indirectly, either as

an employee, employer, consultant, agent, principal, partner, stockholder, corporate officer, director, or in any other individual or

representative capacity, engage or participate in any business that is in competition in any manner whatsoever with the business of Employer.

Uniqueness

of Employee's Services

Section

2.5. Employee represents and agrees that the services to be performed under the terms of this

Agreement are of a special, unique, unusual, extraordinary, and intellectual character that gives them a peculiar value, the loss of

which cannot be reasonably or adequately compensated in damages in action at law. Employee, therefore, expressly agrees that Employer,

in addition to any other rights or remedies that Employer may possess, shall be entitled to seek injunctive and other equitable relief

to prevent or remedy a breach of this Agreement by Employee.

Indemnification for Negligence

or Misconduct

Section

2.6. Employee shall indemnify and hold Employer harmless from all liability for loss, damage,

or injury to persons or property resulting from Employee's negligence or misconduct.

Trade Secrets

Section 2.7.

| (a) | The

Parties acknowledge and agree that during the term of this Agreement and in the course of

the discharge of his duties hereunder, Employee shall have access to and become acquainted

with financial, personnel, sales, scientific, technical and other information regarding formulas,

patterns, compilations, programs, devices, methods, techniques, operations, plans and processes

that are owned by Employer, actually or potentially used in the operation of Employer's business,

or obtained from third parties under an agreement of confidentiality, and that such information

constitutes "Employer's Trade Secrets." |

| (b) | Employee

specifically agrees that he shall not misuse, misappropriate, or disclose in writing, orally

or by electronic means, any Trade Secrets, directly or indirectly, to any other person or

use them in any way, either during the term of this Agreement or at any other time thereafter,

except as is required in the course of his employment for Employer. |

| (c) | Employee

acknowledges and agrees that the sale or unauthorized use or disclosure in writing, orally

or by electronic means, of any of Employer's Trade Secrets obtained by Employee during the

course of his employment under this Agreement, including information concerning Employer's

actual or potential work, services, or products, the facts that any such work, services,

or products are planned, under consideration, or in production, as well as any descriptions

thereof, constitute unfair competition. Employee promises and agrees not to engage in any

unfair competition with Employer, either during the term of this Agreement or at any other

time thereafter. |

| (d) | Employee

further agrees that all files, records, documents, drawings, specifications, equipment, software,

and similar items, whether maintained in hard copy or online relating to Employer's business,

whether prepared by Employee or others, are and shall remain exclusively the property of

Employer and that they shall be removed from the premises or, if kept on-line, from the computer

systems of Employer only with the express prior written consent of Employer's Board of Directors. |

Article

III.

Obligations of Employer.

General Description

Section 3.1.

Employer shall provide Employee with the compensation, incentives, benefits, and business expense reimbursement as specified in this

Agreement.

Office and Staff

Section 3.2.

The Employer shall provide the Employee with business equipment, office space, and administrative support suitable to the Employee's

position and adequate for performing his duties.

Article

IV. Compensation of Employee.

Annual Salary

Section

4.1. Employee waives payment of compensation for the term of this Agreement.

Article

V. Employee Benefits.

Health Insurance

Section

5.1. The Employer agrees to reimburse the Employee for the premiums of the Employee’s current

health insurance plan upon the Employee’s submission of premium statements to the Employer.

Life Insurance

Section

5.2. The Employer agrees to reimburse the Employee for the premiums of the Employee’s current

life insurance policy upon the Employee’s submission of premium statements to the Employer.

Article

VI. Business Expenses.

Business Expenses

Section

6.1.

| (a) | Employer

shall promptly reimburse Employee for all reasonable business expenses incurred by Employee

in promoting the business of Employer, including expenditures for entertainment, gifts, and

travel. |

| (b) | Each

such expenditure shall be reimbursable only if it is of a nature qualifying it as a proper

deduction on the federal and state income tax return of Employer. |

| (c) | Each

such expenditure shall be reimbursable only if Employee furnishes to Employer adequate records

and other documentary evidence required by federal and state statutes and regulations issued

by the appropriate taxing authorities for the substantiation of that expenditure as an income

tax deduction or as may be required by Employer. |

Article

VII. Termination of Employment.

Termination for Cause

Section 7.1.

| (a) | Employer

reserves the right to terminate this Agreement if Employee (1) willfully breaches or habitually

neglects the duties which he is required to perform under the terms of this Agreement, or

(2) commits acts of dishonesty, fraud, misrepresentation, or other acts of moral turpitude,

that would prevent the effective performance of his duties. |

| (b) | Employer

may, at its option, terminate this Agreement for the reasons stated in this section by giving

written notice of termination to Employee without prejudice to any other remedy to which

Employer may be entitled either at law, in equity, or under this agreement. |

| (c) | Termination

under this section shall be considered "for cause" for the purposes of this Agreement. |

Termination Without Cause

Section

7.2.

| (a) | This

Agreement shall be terminated upon the death of Employee. |

| (b) | Employer

reserves the right to terminate this Agreement not less than 3 months after Employee suffers

any physical or mental disability that would prevent the performance of his essential job

duties under this Agreement, unless reasonable accommodation can be made to allow Employee

to continue working. Such a termination shall be effected by giving 10 days'] written notice

of termination to Employee. |

| (c) | Termination

under this section shall not be considered "for cause" for the purposes of this

Agreement. |

Effect of Merger, Transfer of Assets,

or Dissolution

Section

7.3.

| (a) | This

Agreement shall not be terminated by any voluntary or involuntary dissolution of Employer

resulting from either a merger or consolidation in which Employer is not the consolidated

or surviving corporation, or a transfer of all or substantially all of the assets of Employer. |

| (b) | In

the event of any such merger or consolidation or transfer of assets, Employer's rights, benefits,

and obligations hereunder shall be assigned to the surviving or resulting corporation or

the transferee of Employer's assets. |

Termination

by Employee

Section

7.4. Employee may terminate his obligations under this Agreement by giving Employer at least

30 days’ notice.

Effect on

Compensation

Section

7.5. If this Agreement is terminated before the completion of the term of employment specified

herein, Employee shall be entitled to the compensation earned by and vested in him prior to the termination date as provided for in this

Agreement, computed pro rata up to and including that date. Employee shall be entitled to no further compensation as of the termination

date.

Article

VIII. Non-Competition and Non-Solicitation.

Section

8.1. Employee agrees that during his employment by the Employer and the one (1) year period commencing

upon termination of his employment (the “Restriction Period”) Employee will not, directly or indirectly: (i) own, manage,

operate, control or participate in the ownership, management, operation of, or be connected as an officer, partner, director or otherwise,

or have any financial interest in any other business that is (a) significant to the Employer and its subsidiaries as a whole and (b)

during Employee’s employment hereunder is in competition with the business conducted by the Employer and any of its subsidiaries

in any geographic region where such business is being conducted during such Restriction Period; provided that ownership, for personal

investment purposes only, of no more than five (5) percent of the voting stock of any publicly held corporation shall not constitute

a violation of this section; or (ii) solicit the customers of the Employer and its subsidiaries for business on behalf of any entity or person other than the Employer and its subsidiaries.

Section

8.2. During the Restriction Period, Employee will not, directly or indirectly, solicit for employment

by any person or entity other than the Employer and its subsidiaries, any person then employed by the Employer and its subsidiaries.

Section

8.3. Employee agrees that during the term of this Agreement, he will not take any action which

might divert from the Employer or any of its subsidiaries any opportunity which would be within the scope of any of the present businesses

of Employer or any business proposed or contemplated to be engaged in by Employer during the term of this Agreement.

Article

IX. Representation of Employee.

Section 9.1.

Employee represents and warrants that Employee’s employment with Employer and performance under this Agreement will not violate

or breach any duty or obligation owed by Employee to any other person or company under contract, agreement or by operation of law.

Article

X. General Provisions.

Notices

Section 10.1.

Any notices required to be given under this Agreement by either party to the other shall be in writing and shall be transmitted either

by (i) registered mail, (ii) certified mail, return receipt requested, or (iii) overnight mail, addressed to the party to be notified

at the following address or to such other address (or person) as such party shall specify by like notice hereunder:

| American

Cannabis Company, Inc. |

Joseph

Cleghorn |

| 1004

S. Tejon Street, Colorado Springs, CO 80903 |

701

Waddell Avenue, Key West, FL 33040 |

| Attention:

Ellis Smith, Director |

Attention:

Joseph Cleghorn |

Arbitration

Section

10.2. Any dispute, controversy, or claim between the Parties arising out of or related in any way to this Agreement which

cannot be amicably resolved by the Parties shall be solely and finally settled by arbitration administered by JAMS following its commercial

arbitration rules. Judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof. The arbitration

shall occur before a panel of three arbitrators in Denver, Colorado. The arbitration shall be in English. The arbitrators will be bound

to adjudicate all disputes following the laws of the State of Colorado. The arbitrators' decision shall be in writing with written findings

of fact and shall be final and binding on the Parties. Each party shall bear its own costs for the arbitration proceedings irrespective

of its outcome. This section provides the sole recourse for the settlement of any disputes arising out of, in connection with, or related

to this Agreement.

Attorneys' Fees and Costs

Section 10.3.

If either party incurs any legal fees associated with the enforcement of this Agreement or any rights under this Agreement, the prevailing

party shall be entitled to recover its reasonable attorney’s fees and

any court, arbitration, mediation, or other litigation expenses from the other party.

Entire Agreement

Section

10.4. This Agreement supersedes any and all other agreements, either oral or in writing, between the Parties hereto with

respect to the employment of Employee by Employer and contains all of the covenants and agreements between the Parties with respect to

that employment in any manner whatsoever. Each party to this Agreement acknowledges that no representations, inducements, promises, or

agreements, orally or otherwise, have been made by any party, or anyone acting on behalf of any party, which are not embodied herein,

and that no other agreement, statement, or promise not contained in this Agreement shall be valid or binding.

Modifications

Section

10.5. Any modification of this agreement will be effective only if it is in writing signed by Employee and an authorized

representative of the Employer.

Waiver

Section

10.6. The failure of either party to insist on strict compliance with any of the terms, covenants, or conditions of this

Agreement by the other party shall not be deemed a waiver of that term, covenant, or condition, nor shall any waiver or relinquishment

of any right or power at any one time or times be deemed a waiver or relinquishment of that right or power for all or any other times.

Enforceability

Section

10.7. Employer and Employee recognize that the laws and public policies of the various states of the United States may

differ regarding the validity and enforceability of certain provisions in this Agreement. The Parties intend that all provisions of this

Agreement shall be enforced to the fullest extent permissible under the laws and public policies of each state and jurisdiction in which

such enforcement is sought, and that the unenforceability of any provision hereof shall not render unenforceable or impair the remainder

of the Agreement. Accordingly, if any provision of this Agreement shall be determined to be invalid or unenforceable, then the offending

provision or part thereof shall be deleted as narrowly as possible to render the remaining balance of the Agreement enforceable and to

protect to the fullest extent the Employer’s legitimate interests as expressed and intended herein.

Law Governing Agreement

Section 10.8.

This Agreement shall be governed by and construed following the laws of the State of Colorado, without regard to its conflicts of

laws principles.

Employee Review

Section

10.9. Employee understands that this Agreement creates legally binding obligations and that Employee will be subject

to liability if the Employee violates any of the provisions of this Agreement. The Employee acknowledges having read this Agreement,

having understood the meaning and consequences of every term and enters it voluntarily and freely and after adequate opportunity to review

and consider it and to consult with his legal and financial advisors. Employee acknowledges receiving a copy of this Agreement and that

the consideration received by Employee for entering into this Agreement is fair and equitable.

Survival

Section

10.10. The provisions of this Agreement which by their nature extend beyond the termination of the Agreement will survive termination

or expiration of the Agreement.

Sums Due Deceased

Employee

Section

10.11.

If Employee dies

prior to the expiration of the term of his employment, any sums that may be due him from Employer under this agreement as of the date

of death shall be paid to Employee's executors, administrators, heirs, personal representatives, successors, and assigns.

IT WITNESS WHEREOF, the Parties

have signed this Agreement on November 19, 2024.

EMPLOYER

AMERICAN CANNABIS COMPANY, INC.

| By: |

/s/

Ellis Smith |

|

| |

ELLIS

SMITH, DIRECTOR |

|

EMPLOYEE

JOSEPH CLEGHORN

| By: |

/s/

Joseph Cleghorn |

|

| |

JOSEPH

CLEGHORN |

|

v3.24.3

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

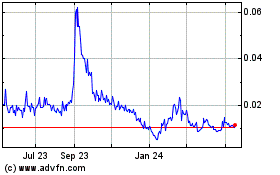

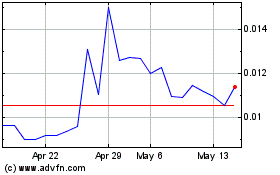

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

American Cannabis (CE) (USOTC:AMMJ)

Historical Stock Chart

From Nov 2023 to Nov 2024