Stock Market News for February 23, 2012 - Market News

23 February 2012 - 8:00PM

Zacks

US markets closed in red the

following renewed fears of a recession in the Eurozone after an

economic report stated that manufacturing activity had contracted

across Europe and China. Separately, weak earnings figures from

Dell and a lack of domestic economic reports further dampened

investor sentiment.

The Dow Jones Industrial Average

(DJIA) declined 0.2% to settle at 12,938.67. The major decliner for

the blue chip index was Wal-Mart Stores which fell 2.45% after the

retailer reported uninspiring quarterly earnings results. However,

the 30 stock index is up 6% for the year. The Standard & Poor

500 (S&P 500) declined 0.3% or 4.55 points and closed

yesterday’s trading session at 1,357.66. Energy sector stocks

gained the most while financials took a heavy beating during the

day’s trade. The tech laden Nasdaq Composite Index closed at

2,933.17, losing15.40 points. Total volumes on the New York Stock

Exchange were 729 million shares. On the NYSE, for every two stocks

that rose three fell. Total composite volume was around 3.6 billion

shares traded, lower than last year’s average of 4.3 billion.

Coming to earnings results, world’s

number three PC maker Dell Inc.’s (NASDAQ:DELL) share prices fell

5.8% to close at $17.15 after the company’s fourth quarter earnings

figures came in lower than the Street’s expectations. Separately,

the company also projected first quarter revenue below the Street’s

estimates. Net income stood at $764 million or $0.43 a share,

registering a drop of 18% on a yearly basis. Chief financial

officer of Dell, Mr. Brian T. Gladden said “Profit margins for the

quarter were hurt by a combination of weakness in public spending

in the United States, discounting of the leftover inventory of its

previous generation phones and the lingering impact of the Thailand

flood on its product mix”. Separately, analysts at Citigroup

downgraded the shares of the company from buy to neutral

rating.

On the domestic economic front,

there were no major releases yesterday that could give a boost to

the markets. The lone report was from the National Association of

Realtors, which stated that existing home sales rose 4.3% for the

month of January to a seasonally adjusted annual rate of 4.57

million from a downwardly revised 4.38 million-unit pace in

December. Lawrence Yun, NAR chief economist, said strong gains in

contract activity in recent months show buyers are responding to

very favorable market conditions. “The uptrend in home sales is in

line with all of the underlying fundamentals – pent-up household

formation, record-low mortgage interest rates, bargain home prices,

sustained job creation and rising rents,” he said. However, another

report showed that mortgage applications fell during the prior

week, raising questions about the U.S. housing market's recovery.

Major economic reports scheduled for release today include weekly

Initial Claims and Crude Inventories. On Wednesday, the Obama

administration said it proposes to cut the US corporate tax rate

from 35% to 28% and also plans to eliminate various tax breaks.

Meanwhile, lackluster data from the

Chinese Government showed that the country’s export orders had

declined. The fall is said to be the worst in the past eight

months. European stock markets fell after a survey showed that

business activity in the Euro zone contracted during the month of

February. Fresh recessionary fears in Europe were felt following

data showing weakness in the manufacturing and services sectors.

Jack DeGan, chief investment officer at Harbor Advisory Corp in

Portsmouth said, "We had some modestly weak data from Europe and

China, but today is mostly just another day of churning as we sit

close to that key level of 1,360 on the S&P."

Coming to sectoral stocks, gains

made by oil stocks nearly offset the losses felt by the banking

sector. Share prices of Nabor Industries Ltd (NYSE:NBR) gained 7%

to close at $21.78 after the company’s results topped the Street’s

expectations. Shares of other oil and gas companies including

Pioneer Drilling Co (AMEX:PDC), Patterson-UTI Energy, Inc

(NASDAQ:PTEN), Parker Drilling Company (NYSE:PKD), Unit Corporation

(NYSE:UNT) and Rowan Companies (NYSE:RDC) all increased by 2.3%,

1.9%, 2.3%, 1.7% and 1.8% to close at $9.59, $19.97, $7.13 and

38.37 respectively. Major banking stocks to shed their gains during

the day were Bank of America (NYSE:BAC), Citigroup (NYSE:C), JP

Morgan (NYSE:JPM), Goldman Sachs (NYSE:GS) and Canandaigua National

Corporation (OTC:CNND), all of which decreased by 1.9%, 3%, 1%,

1.9% and 6.8% respectively.

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

DELL INC (DELL): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

NABORS IND (NBR): Free Stock Analysis Report

PIONEER DRILLNG (PDC): Free Stock Analysis Report

PARKER DRILLING (PKD): Free Stock Analysis Report

PATTERSON-UTI (PTEN): Free Stock Analysis Report

ROWAN COS INC (RDC): Free Stock Analysis Report

UNIT CORP (UNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

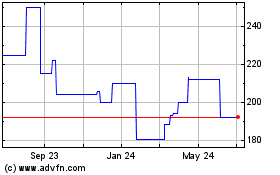

Canandaigua National (CE) (USOTC:CNND)

Historical Stock Chart

From Oct 2024 to Nov 2024

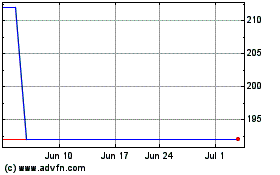

Canandaigua National (CE) (USOTC:CNND)

Historical Stock Chart

From Nov 2023 to Nov 2024