[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

[ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ ] No

[ ]

Indicate by check if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a not-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [

] No [X]

The aggregate market value of the voting and non-voting common

equity held by non-affiliates as of April 11, 2014 was $3,929,529 based upon the

closing sales price of the Registrant’s Common Stock as reported on the

Over-the-Counter Bulletin Board of $0.04

At April 11, 2014 the Company had outstanding 102,238,238

shares of Common Stock, of $0.001 par value per share.

PART I

This Annual Report on Form

10-K contains forward-looking statements that have been made pursuant to the

provisions of Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934, and the Private Securities Litigation Reform

Act of 1995 and concern matters that involve risks and uncertainties that could

cause actual results to differ materially from historical results or from those

projected in the forward-looking statements. Discussions containing

forward-looking statements may be found in the material set forth under

“Business,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and in other sections of this Form 10-K. Words such as

“may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “continue” or similar words are intended to

identify forward-looking statements, although not all forward-looking statements

contain these words. Although we believe that our opinions and expectations

reflected in the forward-looking statements are reasonable as of the date of

this Report, we cannot guarantee future results, levels of activity, performance

or achievements, and our actual results may differ substantially from the views

and expectations set forth in this Annual Report on Form 10-K. We expressly

disclaim any intent or obligation to update any forward-looking statements after

the date hereof to conform such statements to actual results or to changes in

our opinions or expectations.

Readers should carefully

review and consider the various disclosures made by us in this Report, set forth

in detail in Part I, under the heading “Risk Factors,” as well as those

additional risks described in other documents we file from time to time with the

Securities and Exchange Commission, which attempt to advise interested parties

of the risks, uncertainties, and other factors that affect our business. We

undertake no obligation to publicly release the results of any revisions to any

forward-looking statements to reflect anticipated or unanticipated events or

circumstances occurring after the date of such statements.

Item 1. Business

General

These financial statements have been prepared in accordance

with generally accepted accounting principles applicable to a going concern,

which assumes that the Company will be able to meet its obligations and continue

its operations for its next fiscal year. Realization values may be substantially

different from carrying values as shown and these financial statements do not

give effect to adjustments that would be necessary to the carrying values and

classification of assets and liabilities should the Company be unable to

continue as a going concern. At December 31, 2013, the Company had not yet

achieved profitable operations, has accumulated losses of $14,355,874 since

inception and expects to incur further losses in the development of its

business, of which cast substantial doubt about the Company’s ability to

continue as a going concern.

The Company’s ability to continue as a going concern is

dependent upon future profitable operations and/or the necessary financing to

meet its obligations and repay its liabilities arising from normal business

operations when they come due.

Management has obtained additional funds by related party’s

advances and loans from third parties; however there is no assurance that this

additional funding is adequate and further funding may be necessary.

1

On March 16, 2011, the Company signed a Farm-Out Agreement for

oil and gas exploration in the Peco Area of Alberta. The Farm-Out Agreement

between FormCap Corp. and a private Alberta Corporation is comprised of a

Seismic Option, a Farm-Out and a Participation clause. The Agreement stipulated

a commencement date for the shooting of a 3D seismic program on the Farm-Out

Lands not later than June 1, 2011 and a Commencement Date of November 1, 2011

for spudding and continuous drilling of a Test Well. Due to conditions in the

oil and gas industry these dates were amended to October 1, 2011 for

commencement of seismic program and February 1, 2012 for the spudding of a Test

Well. The Agreement provides FormCap 60 days following completion of the seismic

program to elect to drill the Test Well. Upon completion of the Test Well

FormCap shall have earned a 40% working interest in the well subject to a 10%

Gross Overriding Royalty payable to the Farmor. The Farmor may elect to convert

the Gross Overiding Royalty to a 50% interest in FormCap’s working interest

(i.e.: a 20% working interest). During the second quarter of 2012 The Company

decided to discontinue activities on this project.

On November 19, 2013 the Company executed a Definitive

Agreement with: Kerr Energy Group and Keta Oil & Gas LLC (Kerr and Keta)

both incorporated in Wichita, Kansas. Pursuant to the terms of the Agreement the

Company paid Kerr and Keta a non-refundable deposit in the amount of $25,000

(the “Deposit”) to be applied to the purchase price of oil leases to be

purchased by Formcap, in Cowley County Kansas. The Company also agreed to issue

Kerr and Keta a total of 200,000 Rule 144 shares of common stock of FormCap.

In addition, the Company will pay Kerr and Keta two hundred dollars ($200.00) per acre for up to 2,400 acres of Leases, at total cost not to exceed $480,000 within 30 days of execution of the Agreement, subject to final due diligence by the

Company. The Company will own 100% of the Leases (80% net revenue to FormCap; 20% freehold royalty), and will be the operator. The Company will have the option to purchase additional leases in Cowley County from Kerr and Keta under an Area of Mutual

Interest, the terms of which are set forth in the Agreement. FormCap is required to drill one well in each of the first two years of the lease term to maintain its interest in the Leases.

The Company will also have the option to participate in the drilling of up to six exploration or development wells on lands currently owned by Keta and Kerr under terms set out in the agreement.

On November 7, 2013 the Board of Directors approved the issuance of 200,000 Rule 144 shares

of common stock to Kerr and Keta.

Item 1A. Risk Factors

AN INVESTMENT IN THE COMPANY IS HIGHLY SPECULATIVE IN NATURE AND INVOLVES AN EXTREMELY HIGH DEGREE OF RISK.

There may be conflicts of interest between our management and our non-management stockholders.

Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of other investors. A conflict of interest may arise between our management’s own pecuniary interests and may at some point

compromise its fiduciary duty to our stockholders. In addition, our officers and directors are currently involved with other blank check companies and conflicts in the pursuit of business combinations with such other blank check companies with which

they and other members of our management are, and may in the future be affiliated with, may arise. If we and the other blank check companies that our officers and directors are affiliated with desire to take advantage of the same opportunity, then

those officers and directors that are affiliated with both companies would abstain from voting upon the opportunity. In the event of identical officers and directors, the officers and directors will arbitrarily determine the company that will be

entitled to proceed with the proposed transaction.

As the Company has no recent operating history or revenue and there is a risk that we will be unable to continue as a going concern and consummate a business combination. We will, in all likelihood, sustain operating expenses without corresponding

revenues, at least until the consummation of a business combination. This may result in our incurring a net operating loss that will increase continuously until we can consummate a business combination with a profitable business opportunity. We

cannot assure you that we can identify a suitable business opportunity and consummate a business combination.

THERE IS COMPETITION FOR THOSE PRIVATE COMPANIES SUITABLE FOR A MERGER TRANSACTION OF THE TYPE CONTEMPLATED BY MANAGEMENT.

The Company is in a highly competitive market for a small number of business opportunities which could reduce the likelihood of consummating a successful business combination. We are and will continue to be an insignificant participant in the

business of seeking mergers with, joint ventures and acquisitions of small private and public entities. A large number of established and well-financed entities, including small public companies and venture capital firms, are active in mergers and

acquisitions of companies that may be desirable target candidates for us. Nearly all these entities have significantly greater financial resources, technical expertise and managerial capabilities than we do, consequently, we will be at a competitive

disadvantage in identifying possible business opportunities and successfully completing a business combination. These competitive factors may reduce the likelihood of our identifying and consummating a successful business combination.

FUTURE SUCCESS IS HIGHLY DEPENDENT ON THE ABILITY OF MANAGEMENT TO LOCATE AND ATTRACT A SUITABLE ACQUISITION.

The nature of our operations is highly speculative and there is a consequent risk of loss of your investment. The success of our plan of operation will depend to a great extent on the operations, financial condition and management of the identified

business opportunity. While management intends to seek business combination(s) with entities having established operating histories, we cannot assure you that we will be successful in locating candidates meeting that criterion. In the event we

complete a

business combination, the success of our operations may be dependent upon management of the successor firm or venture partner firm and numerous other factors beyond our control.

OUR BUSINESS WILL HAVE NO REVENUES UNLESS AND UNTIL WE MERGE WITH OR ACQUIRE AN OPERATING BUSINESS.

We are a development stage company and have had no revenues from operations. We may not realized any revenues unless and until we successfully merge with or acquire an operating business.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

None

Item 3. Legal Proceedings

None

See Subsequent Events

Item 4. Submission of Matters to a Vote of Security Holders

On October 1, 2012 the Company effected a reverse stock split in the ratio of 50 old shares for one new share. The consent resolution approving the Reverse Split was signed by 5 shareholders representing more than 50% of the issued and outstanding

Common Stock of the Company. As the consent resolution satisfied the requirements of the Nevada Revised Statutes the Company did not solicit the proxies or consent of the remaining shareholders.

PART II

Item 5. Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities The Company’s

Common Stock is presently quoted on the National Association of Securities

Dealers’ Over-the-Counter Bulletin Board and on the “Pink Sheets” under the

symbol “FRMC”.

The table below reflects the high and low “bid” and “ask”

quotations for the Company’s Common Stock for each of the calendar years covered

by this report, as reported by the National Association of Securities Dealers

Over the Counter Bulletin Board National Quotation System. The prices reflect

inter-dealer prices, without retail mark-up, markdown or commission and do not

necessarily represent actual transactions.

|

2013

|

High

|

Low

|

|

1

st

Quarter

|

0.510

|

0.008

|

|

2

nd

Quarter

|

0.105

|

0.012

|

|

3

rd

Quarter

|

0.200

|

0.085

|

|

4

th

Quarter

|

1.920

|

0.200

|

|

|

|

|

|

2012

|

High

|

Low

|

|

1

st

Quarter

|

0.119

|

0.003

|

|

2

nd

Quarter

|

0.180

|

0.003

|

|

3

rd

Quarter

|

0.050

|

0.003

|

|

4

th

Quarter

|

0.499

|

0.004

|

As of December 31, 2013, there were 92,238,238 common shares

issued and approximately 98 shareholders on record. The Company believes that an

undefined number of shares of its common stock are held in either nominee name

or street name brokerage accounts. Consequently, the Company is unable to

determine the exact number of beneficial owners of its common stock.

The Company has not paid cash dividends on its common stock.

The Company anticipates that for the foreseeable future any earnings will be

retained for use in its business, and no cash dividends will be paid on the

common stock. Declaration of common stock dividends will remain within the

discretion of the Company’s Board of Directors and will depend upon the

Company’s growth, profitability, financial condition and other relevant factors.

The Transfer Agent for the Company's Common Stock is Presidents

Stock Transfer, located at 215 - 515 West Hastings Street, Vancouver, B.C.

V6B-6H5 Canada.

Section 15(g) of the Securities Exchange Act of 1934:

The Company’s shares are covered by Section 15(g) of the

Securities Exchange Act of 1934, as amended that imposes additional sales

practice requirements on broker/dealers who sell such securities to persons

other than established customers and accredited investors (generally

institutions with assets in excess of $5,000,000 or individuals with net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouses). For transactions covered by this Section 15(g), the

broker/dealer must make a special suitability determination for the purchase and

have received the purchaser's written agreement to the transaction prior to the

sale. Consequently, Section 15(g) may affect the ability of broker/dealers to

sell the Company’s securities and also may affect your ability to sell your

shares in the secondary market.

Section 15(g) also imposes additional sales practice

requirements on broker/dealers who sell penny securities. These rules require a

one page summary of certain essential items. The items include the risk of

investing in penny stocks in both public offerings and secondary marketing; terms important to an

understanding of the function of the penny stock market, such as "bid" and

"offer" quotes, a dealers "spread" and broker/dealer compensation; the

broker/dealer compensation, the broker/dealers duties to its customers,

including the disclosures required by any other penny stock disclosure rules;

the customers rights and remedies in causes of fraud in penny stock

transactions; and, the NASD's toll free telephone number and the central number

of the North American Administrators Association, for information on the

disciplinary history of broker/dealers and their associated persons.

RECENT SALES OF RESTRICTED SECURITIES

The Company did not issue any additional shares during the year

ended December 31, 2012.

On May 16, 2013, 50,000,000 common shares were issued under a

debt settlement agreement with a related Party.

On May 20, 2013, 39,999,998 common shares were issued under a

debt settlement agreement with a related Party.

On November 7, 2013, 200,000 common shares were issued in

connection with the acquisition of exploration property leases.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

The following discussion of our financial condition and results

of operations should be read in conjunction with the financial statements and

notes thereto and the other financial information included elsewhere in this

report. Certain statements contained in this report, including, without

limitation, statements containing the words “believes,” “anticipates,” “expects”

and words of similar import, constitute “forward looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks and uncertainties.

Our actual results may differ materially from those anticipated in these

forward-looking statements as a result of certain factors, including our ability

to create, sustain, manage or forecast our growth; our ability to attract and

retain key personnel; changes in our business strategy or development plans;

competition; business disruptions; adverse publicity; and international,

national and local general economic and market conditions. Our audited financial

statements are stated in United States Dollars and are prepared in accordance

with United States Generally Accepted Accounting Principles.

Overview

The Company does not currently engage in any business

activities that provide cash flow. The Company is currently in the development

stage.

On November 19, 2013 the Company executed a Definitive Agreement with: Kerr Energy Group and Keta Oil & Gas LLC (Kerr and Keta) both incorporated in Wichita, Kansas. Pursuant to the terms of the Agreement the Company paid Kerr and Keta a

non-refundable deposit in the amount of $25,000 (the “Deposit”) to be applied to the purchase price of oil leases to be purchased by Formcap, in Cowley County, Kansas. The Company also agreed to issue Kerr and Keta a total of 200,000

Rule 144 shares of FormCap.

Going Concern

We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and

classification of liabilities that might be necessary should we be unable to continue in operation.

We expect we will require additional capital to meet our long term operating requirements. We expect to raise additional capital through, among other things, the sale of equity or debt securities.

Results of Operations for the Fiscal Years Ended December 31, 2013 and 2012

The audited operating results and cash flows are presented for the years ended December 31, 2013 and 2012 and for the period since inception to December 31, 2013.

We did not earn any revenues for the years ended December 31, 2013 and 2012.

Net Loss: For the year ended December 31, 2013 we had a net loss of $2,386,213 as compared with a net loss of $109,440 for the year ended December 31, 2012.

Operating Expenses. For the year ended December 31, 2013, we had total operating expenses of $112,203 as compared to $109,397 for the year ended December 31, 2012. The reduction is due to a decrease of $50,145 in consulting services and

an increase in General and administrative expenses of $52,951.

Consulting Fees. For the year ended December 31, 2012, we had consulting fees of $14,022 as compared to $64,167 for the previous year. The decrease was attributable to the reduced use of consulting services as compared with the previous

year.

General and administrative expenses: For the year ended December 31, 2013 we had general and administrative expenses of $98,181, an increase of $52,951 as compared with $45,230 for the year ended December 31, 2012.

Filing, Transfer agents’ expenses increased by $2,694 from $6,037 during the year ended December 31, 2012 to $8,731 during the year ended December 31, 2013 as a result of corporate activity.

Investor and public relations expenses increased by $56,328 from $2,413 for the year ended December 31, 2012 to $58,741 for the year ended December 31, 2013 as the Company engaged a specialist to develop a corporate branding strategy and

a new website.

Audit and accounting expenses for the year ended December 31, 2013 amounted to

$26,167, a decrease of $415 as compared with $26,582 incurred during the year

ended December 31, 2012. The increase in expenditure in this category resulted

from a correction to the accruals for this category of professional services.

The Company did not incur legal expenses for the year ended December 31, 2013.

Legal expenses for the year ended December 31, 2012 was $3,273. The decrease

resulted from reduced corporate activity during the year ended December 31, 2013

as compared with the year ended December 31, 2012.

Losses on foreign exchange transactions amounted to $1,580 in the year ended

December 31, 2013, as compared with a loss of $146 in the year ended December

31, 2012. These losses arose as a result of fluctuations in the exchange rates

between the US Dollar and foreign currencies.

Loss on impairment of assets: We did not incur a Loss on impairment of assets

during the years ended December 31, 2013 and 2012, respectively

Financing expenses: We did not incur Financing expenses during the years ended

December 31, 2013 and 2012, respectively

Interest Expense. The Company incurred insignificant interest expense charges

during the years ended December 31, 2013 and 2012, respectively.

Loss on settlement of debt: During the year ended December 31, 2013 we incurred

a loss of $2,274,000 on the settlement of debts owed to related parties.

Liquidity and Capital Resources: During the year ended December 31, 2013 our

operating activities consumed cash in the amount of $78,126, an increase of

$66,253 as compared to cash consumed by operations of $11,873 during the year

ended December 31, 2012. During the year ended December 31, 2013 we invested

$6,802 in the purchase of oil and gas leases and advanced $9,266 to an unrelated

Canadian company (year ended December 31, 2012 - $Nil). During the year ended

December 31, 2013, we obtained financing in the amount of $85,790 in the form of

convertible notes as compared with $6,417 and $5,000 in proceeds from related

party payables and proceeds from notes payable, respectively, during the year

ended December 31, 2012.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

The Company does not hold any derivatives or investments that are subject to market risk. The carrying values of any financial instruments, approximate fair value as of those dates because of relatively short-term maturity of these instruments which

eliminates any potential market risk associated with such instruments.

Item 8. Financial Statements and Supplementary Data

See Item 15

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Not applicable

Item 9A (T). Controls and Procedures.

As supervised by our board of directors and our principal executive and principal financial officers, management has established a system of disclosure controls and procedures and has evaluated the effectiveness of that system. The system and its

evaluation are reported on in the below Management's Annual Report on Internal Control over Financial Reporting. Our principal executive and financial officer has concluded that our disclosure controls and procedures (as defined in the 1934

Securities Exchange Act Rule 13a-15(e)) as of December 31, 2013, are not effective, based on the evaluation of these controls and procedures required by paragraph (b) of Rule 13a-15.

Management's Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rule 13a-15(f) of the Securities Exchange Act of 1934 (the "Exchange Act"). Internal control over financial

reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

Management assessed the effectiveness of internal control over financial reporting as of December 31, 2013. We carried out this assessment using the criteria of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal

Control—Integrated Framework. This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by our

registered public accounting firm, pursuant to temporary rules of the Securities and Exchange Commission that permits us to provide only management's report in this annual report. Management concluded in this assessment that as of December 31, 2013,

our internal control over financial reporting is not effective.

There have been no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fourth quarter of our 2013 fiscal year that have materially affected, or are reasonably

likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

None.

The accompanying notes are an integral part of these financial

statements.

The accompanying notes are an integral part of these financial

statements.

FORMCAP CORP.

(A Development Stage Company)

Statements of Cash Flows for the years ended December 31, 2013

and 2012 and for the period since April 10, 1991 (Inception) to December 31,

2012 (CONTINUED)

|

|

|

|

|

|

|

|

|

From Inception on

|

|

|

|

|

For the Year Ended

|

|

|

April 10, 1991 to

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2013

|

|

|

2012

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase

of capital assets

|

|

-

|

|

|

-

|

|

|

(104,880

|

)

|

|

Acquisition deposits

|

|

-

|

|

|

-

|

|

|

(431,000

|

)

|

|

Extinguishment of oil and gas leases

|

|

-

|

|

|

-

|

|

|

-

|

|

|

Purchase of oil and gas

lease

|

|

(6,802

|

)

|

|

-

|

|

|

(256,802

|

)

|

|

Capitalized software expenditures

|

|

-

|

|

|

-

|

|

|

(135,181

|

)

|

|

Principal payments on

notes receivable

|

|

-

|

|

|

-

|

|

|

44,117

|

|

|

Notes

receivable advances

|

|

-

|

|

|

-

|

|

|

(701,152

|

)

|

|

Convertible promissory

note receivable

|

|

(9,266

|

)

|

|

|

|

|

(9,266

|

)

|

|

Proceeds

from sale of notes receivable

|

|

-

|

|

|

-

|

|

|

350,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Investing Activities

|

|

(16,068

|

)

|

|

-

|

|

|

(1,244,164

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

Proceeds from related

party payables

|

|

15,000

|

|

|

6,417

|

|

|

2,065,177

|

|

|

Repayments of related party payables

|

|

-

|

|

|

-

|

|

|

(637,012

|

)

|

|

Proceeds from notes

payable

|

|

|

|

|

5,000

|

|

|

931,919

|

|

|

Repayment

of notes payable

|

|

|

|

|

-

|

|

|

-

|

|

|

Proceeds from the sale of

preferred stock

|

|

-

|

|

|

-

|

|

|

3,000

|

|

|

Proceeds

from the sale of common stock and stock options

|

|

-

|

|

|

-

|

|

|

3,608,242

|

|

|

Process from Convertible notes payable

|

|

70,790

|

|

|

-

|

|

|

70,790

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Cash Provided by Financing Activities

|

|

235,663

|

|

|

11,417

|

|

|

6,042,116

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH

|

|

862

|

|

|

(456

|

)

|

|

910

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

48

|

|

|

504

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH AT END OF PERIOD

|

$

|

910

|

|

$

|

48

|

|

$

|

910

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OFCASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR:

|

|

|

|

|

|

|

|

|

|

|

Interest

|

$

|

10

|

|

$

|

43

|

|

$

|

12,660

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON CASH FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for

rounding shares

|

$

|

|

|

$

|

22

|

|

$

|

22

|

|

|

Common

stock issued for prepaid expenses

|

$

|

-

|

|

$

|

-

|

|

$

|

280,000

|

|

|

Common

stock issued for purchase of oil and gas leases

|

$

|

20,000

|

|

$

|

-

|

|

$

|

20,000

|

|

|

Conversion

of related party payables to common stock

|

$

|

425,000

|

|

$

|

-

|

|

$

|

3,984,999

|

|

|

Extinguishment of related party notes payable and

Accounts Payable

|

$

|

2,699,000

|

|

$

|

|

|

$

|

2,699,000

|

|

|

Notes Payable Issued for Oil and Gas

Lease

|

$

|

75,000

|

|

$

|

|

|

$

|

75,000

|

|

The accompanying notes are an integral part of these financial

statements

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 1: ORGANIZATION AND DESCRIPTION OF BUSINESS

FormCap Corp. (the “Company” or “FormCap”) was incorporated in

the State of Florida on April 10, 1991, under the name of Aarden-Bryn

Enterprises, Inc. The Company became a foreign registrant in the State of Nevada

on December 24, 1998, and became qualified to transact business in the State of

Nevada.

Since its incorporation, the Company has changed its name

several times. On August 27, 1998 the Company changed its name to Corbett’s Cool

Clear WTAA, Inc., on September 24, 1999 to WTAA International, Inc., on December

6, 2001 to Gravitas International, Inc., and finally to its current name,

FormCap Corp. on October 12, 2007.

On September 18, 2007, the Company merged the Florida

jurisdiction and the Nevada jurisdiction into one Nevada jurisdiction.

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

These financial statements

have been prepared in accordance with generally accepted accounting principles

in the United States of America and are stated in US dollars. Because a precise

determination of many assets and liabilities is dependent upon future events,

the preparation of financial statements for a period necessarily involves the

use of estimates which have been made using careful judgment. Actual results may

differ from these estimates.

Reclassification of Financial Statement Accounts

Certain amounts in the December 31, 2012 as well as the inception column of

the financial statements have been reclassified to conform to the presentation

in the December 31, 2013 financial statements.

Use of Estimates

The preparation of financial

statements in accordance with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reportable amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates.

Development Stage Company

The Company is considered

to be in the development stage as defined in Accounting Standards Codification

(ASC) 915 “Development Stage Entities.” The Company is devoting substantially

all of its efforts to development of business plans.

Basic Earnings (Loss) Per Share

Basic earnings

(loss) per share is calculated by dividing the Company’s net loss applicable to

common shareholders by the weighted average number of common shares during the

period. Diluted earnings per share is calculated by dividing the Company’s net

income available to common shareholders by the diluted weighted average number

of shares outstanding during the year. The diluted weighted average number of

shares outstanding is the basic weighted number of shares adjusted for any

potentially dilutive debt or equity. There were no dilutive or potentially

dilutive instruments outstanding as of December 31, 2013 and 2012.

Stock Issued in Exchange for Services

The valuation

of common stock issued in exchange for services is valued at an estimated fair

market value as determined by the most readily determinable value of either the

stock or services exchanged. Values of the stock are based upon other sales and

issuances of the Company’s common stock within the same general time period.

Cash and Cash Equivalents

Cash equivalents are

comprised of certain highly liquid investments with original maturities of three

months or less when purchased. The Company maintains its cash in bank deposit

accounts which at times may exceed federally insured limits of $250,000. The

Company has not experienced any losses related to this concentration of risk.

Deposits did not exceed insured limits during the years ended December 31, 2013

and 2012.

1

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Financial Instruments

For accounts receivable,

accounts payable, accrued liabilities, current portion of long-term debt and

long-term debt, the carrying amounts of these financial instruments approximates

their fair value. Unless otherwise noted, it is management’s opinion that the

Company is not exposed to significant interest, currency or credit risks arising

from these financial instruments.

Foreign Currency Translation

The Company translates

foreign currency transactions and balances to its reporting currency, United

States Dollars, in accordance with ASC 830 “Foreign Currency Matters”. Monetary

assets and liabilities are translated into the functional currency at the

exchange rate in effect at the end of the year. Non-monetary assets and

liabilities are translated at the exchange rate prevailing when the assets were

acquired or the liabilities assumed. Revenue and expenses are translated at the

rate approximating the rate of exchange on the transaction date. All exchange

gains and losses are included in the determination of net income (loss) for the

year.

Income Taxes

The Company applies ASC 740, which

requires the asset and liability method of accounting for income taxes. The

asset and liability method requires that the current or deferred tax

consequences of all events recognized in the financial statements are measured

by applying the provisions of enacted tax laws to determine the amount of taxes

payable or refundable currently or in future years. Deferred tax assets are

reviewed for recoverability and the Company records a valuation allowance to

reduce its deferred tax assets when it is more likely than not that all or some

portion of the deferred tax assets will not be recovered.

The Company adopted ASC 740, at the beginning of fiscal year

2008. This interpretation requires recognition and measurement of uncertain tax

positions using a “more-likely-than-not” approach, requiring the recognition and

measurement of uncertain tax positions. The adoption of ASC 740 had no material

impact on the Company’s financial statements.

Recent Accounting Pronouncements

Except for rules

and interpretive releases of the SEC under authority of federal securities laws

and a limited number of grandfathered standards, the FASB Accounting Standards

Codification™ (“ASC”) is the sole source of authoritative GAAP literature

recognized by the FASB and applicable to the Company. Management has reviewed

the aforementioned rules and releases and believes any effect will not have a

material impact on the Company's present or future consolidated financial

statements.

NOTE 3 - GOING CONCERN

The Company's financial statements are prepared using generally

accepted accounting principles in the United States of America applicable to a

going concern which contemplates the realization of assets and liquidation of

liabilities in the normal course of business. The Company has not yet

established an ongoing source of revenues sufficient to cover its operating

costs and allow it to continue as a going concern. The ability of the Company to

continue as a going concern is dependent on the Company obtaining adequate

capital to fund operating losses until it becomes profitable. If the Company is

unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need,

among other things, additional capital resources. Management's plan is to obtain

such resources for the Company by obtaining capital from management and

significant shareholders sufficient to meet its minimal operating expenses and

seeking equity and/or debt financing. However management cannot provide any

assurances that the Company will be successful in accomplishing any of its

plans.

The ability of the Company to continue as a going concern is

dependent upon its ability to successfully accomplish the plans described in the

preceding paragraph and eventually secure other sources of financing and attain

profitable operations. The accompanying financial statements do not include any

adjustments that might be necessary if the Company is unable to continue as a

going concern.

2

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 4 – PROMISSORY NOTE RECEIVABLE

On June 3, 2013 the Company advanced the sum of $11,194

($11,500 Canadian Dollars) to an unrelated Canadian company. The loan is secured

by a promissory note and is due on December 31, 2014. On November 30, 2013 the

Borrower repaid $1,928, leaving a balance owing of $9,266 as of December 31,

2013.

The promissory note is non-interest bearing until maturity and

bears interest at 3% per annum thereafter. The Promissory note will become due

and payable if the company receives financing totalling $5,000,000 in aggregate

prior to the maturity date. The promissory note is convertible into common

shares of the company either in whole or in part at the option of the Company.

NOTE 5 – EXPLORATION PROPERTY LEASE

On November 19, 2013 the Company executed a Definitive

Agreement with Kerr Energy Group and Keta Oil & Gas LLC (Kerr and Keta) both

incorporated in Wichita, Kansas.

Pursuant to the terms of the Agreement the Company paid Kerr

and Keta a non-refundable deposit in the amount of $75,000 (the “Deposit”) to be

applied to the purchase price of oil leases to be purchased by the Company, in

Cowley County Kansas and agreed to issue Kerr and Keta a total of 200,000 Rule

144 shares of common stock of FormCap.

In addition, the Company will pay Kerr and Keta two hundred

dollars ($200.00) per acre for up to 2,400 acres of Leases, at total cost not to

exceed $480,000 within 30 days of execution of the Agreement, subject to final

due diligence by the Company. The Company will own 100% of the Leases (80% net

revenue to FormCap; 20% freehold royalty), and will be the operator. The Company

will have the option to purchase additional leases in Cowley County from Kerr

and Keta under an Area of Mutual Interest, the terms of which are set forth in

the Agreement. FormCap is required to drill one well in each of the first two

years of the lease term to maintain its interest in the Leases. As at December

31, 2013 the Company has capitalized $101,802 toward the acquisition of the

Leases.

NOTE 6 – CONVERTIBLE PROMISSORY NOTES PAYABLE

During April and May, 2013 the Company issued convertible

promissory notes in the amounts of $15,000 to two unrelated third parties. The

notes mature on December 31, 2014

On June 3, 2013, the Company issued promissory notes in the

amounts of $20,000 Canadian Dollars in favour an unrelated third

party. The notes mature on December 31, 2015

On July 30, 2013 the Company issued a promissory

note in the amount $5,000 Dollars in favour an unrelated third party. The note

matures on December 31, 2015

On August 9, 2013 the Company issued a promissory

note in the amount of $3,000 in favour an unrelated third

party. The note matures on December 31, 2015

On September 30, 2013 the Company issued a promissory note in

the amount of $25,000 to an unrelated third party. The note matures on December

31, 2015

On November 8, 2013 the Company issued a promissory note in the

amount of $7,500 to a related third party. The note matures on December 31,

2015

On November 6, 2013 the Company issued a promissory note in the

amount of $3,000 to a unrelated third party. The note matures on December 31,

2015

On November 19, 2013 the Company issued a promissory note in

the amount of $7,500 to a unrelated third party. The note matures on December 31,

2015

3

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

On December 16, 2013, an unrelated third party paid $50,000 to

Kerr and Keta in connection with the acquisition of the Cowley leases. On that

date the Company issued a promissory note in the amount of $50,000 to the

unrelated third party. The note matures on December 31, 2015

On December 24, 2013 the Company issued a promissory note in

the amount of $24,800 to an unrelated third party. The note matures on December

31, 2015

The promissory notes are non-interest bearing until maturity

and bear interest at 3% per annum thereafter. The Promissory notes will become

due and payable if the Company receives financing totalling $5,000,000 in

aggregate prior to the maturity date. The promissory notes are convertible into

common shares of the Company on terms to be determined by the Company, either in

whole or in part at the option of the Holders.

NOTE 7 – RELATED PARTY PAYABLES

The Company from time to time has borrowed funds from or has

received services from several related parties for operating purposes.

During 2012 the Company borrowed cash in the amount of $6,417

and had expenses paid on behalf of the Company by related parties in the amount

of $32,339.

As of December 31, 2013 the Company owed related parties

$126,500. These amounts bear no interest, are not

collateralized, and are due on demand.

4

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 8 – NOTES PAYABLE

During 2012 the Company borrowed cash from various third

parties in the amount of $5,000. These parties also paid expenses on behalf of

the Company in the amount of $3,569.

The balance owed to these parties as of December 31, 2013 was

$78,653 (December 31, 2012 - $78,653). These amounts bear no interest, are not

collateralized, and are due on demand.

NOTE 9 – COMMON STOCK

The Company had 50,000,000 shares of preferred stock authorized

with no shares outstanding as of December 31, 2013 and 2012. The Company also

had 200,000,000 shares of Common Stock authorized with 98,238,236 and 2,038,240

shares issued and outstanding as of December 31, 2013 and 2012 respectively.

On November 23, 2011 500,000 common shares were issued under a

debt settlement agreement with a related Party.

On December 1, 2011, 200,000 common shares were issued under

the terms of an Oil & Gas Farm-In, Operating and Consulting Agreement with a

consultant.

On December 1, 2011, 200,000 common shares were issued to the

same consultant under a debt settlement agreement as payment in full for

previous debt incurred under a Consulting Agreement.

On December 1, 2011, 200,000 common shares were issued to the

President of the Company as payment for services rendered in the performance of

his duties.

On October 1, 2012, the Company effected a 1 for 50 reverse

stock split. All references in these financial statements to number of common

shares issued and outstanding, price per share and weighted average number of

common shares have been adjusted to reflect the stock split on a retroactive

basis, unless otherwise noted. The Company’s authorized preferred stock and

authorized common stock remain unchanged.

Prior to the reverse stock split, the Company had 100,788,607

common shares issued and outstanding. Immediately after the reverse split the

Company had 2,038,240 common shares issued and outstanding, including 22,467

common shares issued to various shareholders as a result of rounding. The

rounding shares were not issued for compensation and have no net effect on

owner’s equity.

During the year ended December 31, 2013, the Company issued

89,999,998 Common shares in settlement of debts owed by the Company (see Note

10).

On November 7, 2013 the Company issued 200,000 shares to Kerr

and Keta in connection with the acquisition of the Cowley Leases (see Note 5)

NOTE 10 – DEBT SETTLEMENT

On May 16, 2013 the Company settled debts owed to related

parties in the amount of $50,000 by the issuance of 50,000,000 Common Shares.

The Company recorded a loss of $1,362,587 on this transaction.

On May 20, 2013 the Company settled debts owed to related

parties in the amount of $375,000 by the issuance of 39,999,998 Common Shares.

The Company recorded a loss of $911,413 on this transaction.

5

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 11 – INCOME TAXES

Income Taxes

The Company accounts for income taxes in accordance with

Accounting Standards Codification Topic 740, Income Taxes ("Topic 740"), which

requires the recognition of deferred tax liabilities and assets at currently

enacted tax rates for the expected future tax consequences of events that have

been included in the financial statements or tax returns. A valuation allowance

is recognized to reduce the net deferred tax asset to an amount that is more

likely than not to be realized.

Topic 740 provides guidance on the accounting for uncertainty

in income taxes recognized in a company's financial statements. Topic 740

requires a company to determine whether it is more likely than not that a tax

position will be sustained upon examination based upon the technical merits of

the position. If the more likely-than-not threshold is met, a company must

measure the tax position to determine the amount to recognize in the financial

statements.

Net deferred tax assets consist of the following components as

of December 31, 2013 and 2012:

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

Deferred tax assets:

|

|

2013

|

|

|

2012

|

|

|

|

Net operating loss carryover

|

$

|

(7,856,769

|

)

|

$

|

(7,744,556

|

)

|

|

|

Common stock and warrants

issued for services

|

|

563,712

|

|

|

563,712

|

)

|

|

|

Common stock issued for settlement of debt

|

|

45,900

|

|

|

45,900

|

|

|

|

Loss on extinguishment of

debt

|

|

2,621,982

|

|

|

1,848,822

|

|

|

|

Impairment of assets

|

|

423,710

|

|

|

423,710

|

|

|

|

Amortization of beneficial

conversion feature

|

|

258,373

|

|

|

258,373

|

|

|

|

Valuation allowance

|

|

2,671,301

|

|

|

2,633,149

|

|

|

|

Income tax expense per books

|

$

|

-

|

|

$

|

-

|

|

The income tax provision differs from the amount of income tax

determined by applying the estimated U.S. federal and state income tax rates of

39% to pretax income from continuing operations for the year ended December 31,

2012 and 2011 due to the following:

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

|

2013

|

|

|

2012

|

|

|

|

Income tax expense at

statutory rate

|

$

|

(38,152

|

)

|

$

|

(37,210

|

)

|

|

|

Common stock and warrants issued for services

|

|

|

|

|

-

|

|

|

|

Loss on extinguishment of

debt

|

|

|

|

|

-

|

|

|

|

Impairment of assets

|

|

|

|

|

-

|

|

|

|

Amortization of beneficial

conversion feature

|

|

|

|

|

-

|

|

|

|

(Gain) Loss on extinguishment of debt

|

|

|

|

|

-

|

|

|

|

Valuation allowance

|

|

38,152

|

|

|

37,210

|

|

|

|

Income tax expense per books

|

$

|

-

|

|

$

|

-

|

|

As at December 31, 2013, the Company had net operating loss

carry forwards of approximately $6,622,735 through 2032. No tax benefit has been

reported in the December 31, 2013 financial statements as the potential tax

benefit is offset by a valuation allowance of the same amount.

Due to the change in ownership provisions of the Tax Reform Act

of 1986, net operating loss carry forwards for Federal income tax reporting

purposes are subject to annual limitations. Should a change in ownership occur,

net operating loss carry forwards may be limited as to use in future years.

6

FORMCAP CORP.

(A Development Stage Company)

Notes

to the Financial Statements December 31, 2013 and 2012

NOTE 12 – SUBSEQUENT EVENTS

In accordance with ASC 855-10 Company management reviewed all

material events through the date of this report

Payments in connection with the acquisition of oil and gas leases

On January 2, 2014, an unrelated third party paid Kerr and Keta a further

$25,000 in connection with the acquisition of the Cowley leases. On that date

the Company issued a promissory note in the amount of $25,000 to the unrelated

third party.

On January 23, 2014, an unrelated third party paid Kerr and Keta a further

$50,000 in connection with the acquisition of the Cowley leases. On that date

the Company issued a promissory note in the amount of $50,000 to the unrelated

third party. The promissory notes are non-interest bearing until maturity on

December 31, 2015 and bear interest at 3% per annum thereafter. The Promissory

notes will become due and payable if the Company receives financing totalling

$5,000,000 in aggregate prior to the maturity date. The promissory notes are

convertible into common shares of the Company on terms to be determined by the

Company, either in whole or in part at the option of the Holder.

On March 11, 2014 an unrelated third party paid Kerr and Keta a further $305,000

in connection with the acquisition of the Cowley leases. This payment was made

pursuant to a material definitive agreement entered into between the Company and

the unrelated third party (see below)

Entry into a Material Definitive Agreement.

Ironridge Global IV, Ltd. ("Ironridge") purchased from various creditors of the

Company, bona fide claims held by those creditors against the Company in the

aggregate amount of $671,938.90 (the "Claim Amount"). Subsequently, the Company

offered to settle those claims in exchange for the issuance of unrestricted and

fully tradable shares of the Company's common stock. Ironridge accepted the

Company's settlement offer, subject to a hearing on the fairness of the

settlement terms. On February 21, 2014, the Company, Ironridge and the CEO of

the Company entered into a Stipulation Order for the settlement on the terms

agreed on by Ironridge and the Company. On February 21, 2014, a California

Superior Court for the County of Los Angeles (the "State Court") held a hearing

on the fairness of the Company's settlement offer to Ironridge. Pursuant to the

court order issued by the State Court on February 21, 2014, the shares of the

Company's common stock will be deemed issued in settlement of the claims

(subject to certain adjustments based on the future trading value of the stock)

when delivered to Ironridge. On February 24, 2014 the Company's transfer agent

delivered to Ironridge 10,000,000 shares of the Company's common stock. The

shares issued to Ironridge are freely tradable and exempt from registration

under the Securities Act of 1933 and the California Corporations Code. The

number of shares to be issued to Ironridge is subject to adjustment based

trading price of the Company's stock such that the value of the shares is

sufficient to cover the Claim Amount, a 10% agent fee amount and Ironridge's

reasonable legal fees and expenses ( the "Final Amount"). Under the Stipulation

Order, Ironridge may not be the beneficial owner of more than 9.99% of the

Company's outstanding shares of common stock until the Final Amount is paid.

Further Ironridge has agreed not to exercise any voting rights of the shares

issued to it nor influence or cause any change in control of the Company.

7

(b)

Exhibits

SIGNATURES

In accordance with the Securities Exchange Act of 1934, this

report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

Dated: April 15, 2014

FORMCAP CORP.

By:

/s/ Graham

Douglas

Graham

Douglas

President,

Secretary, Treasurer & Director.

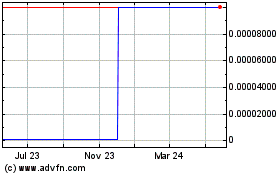

Formcap (CE) (USOTC:FRMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

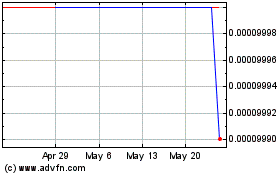

Formcap (CE) (USOTC:FRMC)

Historical Stock Chart

From Dec 2023 to Dec 2024