China's Big Banks Report Profit Drops

31 August 2020 - 6:45PM

Dow Jones News

By Xie Yu

China's major banks reported their biggest profit drops in more

than a decade, as the economic impact of the pandemic led them to

take large provisions against potential bad loans.

China's top four banks, which account for more than one-third of

the industry's total assets, all said net profit fell more than 10%

year-over-year in the first half, according to stock-exchange

filings on Sunday.

The declines were in line with market expectations. Beijing has

told state banks to sacrifice earnings for the benefit of the wider

economy and to beef up rainy-day funds, since the emergence of bad

debt normally lags behind an economic slump.

Chen Shujin, an analyst at Jefferies, said higher provisions

were the biggest reason for slimmer profits, which could suppress

earnings as other parts of the economy suffered.

"A key message the regulator wants to deliver is that banks are

supporting the real economy and banks' performance should be in

line with or slower than economic growth," said Ms. Chen.

Provisions, or funds set aside from profits to cover potential

losses from soured loans, rose even as the share of actual bad

loans to total credit edged up slightly.

The increases in provisions ranged from 27% at Industrial &

Commercial Bank of China Ltd., the biggest lender by assets, to 97%

at Bank of China Ltd., the fourth-largest lender.

The second and third-largest banks, China Construction Bank

Corp. and Agricultural Bank of China Ltd., reported 49% and 35%

increases. Before provisions, all big four banks' operating profits

rose by single-digit percentages from a year earlier.

At ICBC, first half net profit fell 11.4% to 148.8 billion yuan

($21.67 billion). Nonperforming loans accounted for 1.5% of ICBC's

total credit, compared with 1.48% a year earlier. Across the whole

industry, first half-net profit declined 9.4% from a year earlier,

according to the China Banking and Insurance Regulatory

Commission.

China's economy shrank 6.8% in the first quarter, the most

severe contraction in decades, after the government locked down

cities to control the coronavirus. But gross domestic product

jumped 3.2% in the second quarter, after Beijing slashed benchmark

lending rates, stepped up government spending and ordered banks to

offer generous loans.

In June, the State Council, China's cabinet, called on banks to

forgo 1.5 trillion yuan ($218.5 billion) in profit this year to

support companies, especially smaller and more vulnerable firms.

Lenders have been told to offer cheap loans, cut service fees,

defer loan repayments and extend more unsecured loans to risky

smaller borrowers to help them stay afloat.

It isn't the first time China's largely state-controlled banks

have helped revive the economy. During the global financial crisis

in 2009, they lent heavily as part of a massive national stimulus

package.

The net interest margin narrowed at the top four banks, Sunday's

results showed. This is a key gauge of bank profitability,

reflecting the difference between the interest charged and what is

paid for funds. That narrower margin is due to the government

requiring banks to cut the rates they charge on loans, to stimulate

credit demand and economic activity.

Both total nonperforming loans and the bad-loan ratio at the big

four banks rose in the first half. Analysts and officials expect

soured debt to keep rising for several more quarters as more loans

go bad and because the Chinese economy still faces headwinds from

weak domestic consumption and rising geopolitical tensions.

"As it takes time for the economic downturn to show its effects

while the government's macro policy was rolled out to offset them,

we expect there is a delay for the nonperforming loans to emerge.

Thus, Agricultural Bank of China still faces a pressure of

rebounding bad loans," President Zhang Qingsong said Monday.

China's banking regulator has urged lenders to dispose of more

bad debts, urging them to offload 3.4 trillion yuan of bad loans

this year, nearly 50% higher than what was tallied in 2019.

Chinese banks typically do this at the end of the year, but this

year two of the top four undertook more of a cleanup of their

balance sheets in the first half. Nonperforming loan disposals and

transfer-outs at ICBC, the No. 1 lender, rose nearly 50% from a

year earlier in the first half.

Grace Zhu contributed to this article.

Write to Xie Yu at Yu.Xie@wsj.com

(END) Dow Jones Newswires

August 31, 2020 04:30 ET (08:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

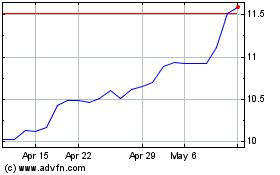

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

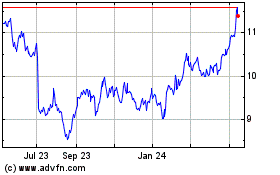

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Nov 2023 to Nov 2024