China's Big Banks Eked Out Higher Profits in Turbulent 2020

30 March 2021 - 11:59PM

Dow Jones News

By Xie Yu

China's biggest commercial banks managed to eke out small

increases in profit for 2020, with a sharp turnaround in their

fortunes during the year mirroring the country's rapid economic

rebound from the coronavirus pandemic.

For all of 2020, China's four largest banks reported that annual

net profit rose between 1.2% to 2.9%, according to filings released

Tuesday and late last week. China was the only major world economy

to grow last year, expanding by 2.3%.

The quartet -- Industrial and Commercial Bank of China Ltd.,

China Construction Bank Corp., Agricultural Bank of China Ltd. and

Bank of China Ltd. -- together account for more than one-third of

the industry's total assets.

At Industrial and Commercial Bank of China, net profit grew 1.2%

year-over-year to 315.9 billion yuan, the equivalent of $48.1

billion. The giant lender is the world's biggest bank by assets,

according to an April 2020 ranking by S&P Global Market

Intelligence.

The modest increase in annual earnings masked a turbulent year,

with earnings jumping 44% year-over-year in the last three months

of 2020. It was a similar story at the other big banks.

To combat the economic effects of the pandemic, Beijing slashed

benchmark lending rates, stepped up government spending and ordered

banks to offer cheap loans to support businesses and households.

First-half profits fell by more than 10% at all of the big four

banks, as they took large provisions against potential bad

loans.

In the last sixth months of the year, as an economic recovery

gathered steam, businesses recovered. Meanwhile the central bank

tolerated rising money-market rates. These help determine the

levels at which banks lend to their customers.

"Covid was under control for the second half of the year," said

Harry Hu, senior director at S&P Global Ratings in Hong Kong.

That meant corporate cash flows improved as people and businesses

grew less pessimistic, he said, leading to a slowdown in loans

turning sour.

Likewise, Shujin Chen, a banking analyst at Jefferies, said new

bad loans declined after peaking in the second quarter, allowing

banks to set aside fewer provisions. At the same time, she said

banks were able to increase their net-interest margins, a key

measure of bank profitability, after previously having to "forgo

profit to bolster the real economy." Ms. Chen said these two

tailwinds meant the banks had a good chance of growing earnings by

double-digit percentages in 2021.

Interest margins rose in the second half, but still lag

pre-pandemic levels. At China Construction Bank, for instance, the

net-interest margin rose to 2.19% for the whole year, up from 2.14%

at the half-year point. In 2019 the margin stood at 2.32%.

For the whole year, the ratio of nonperforming loans to total

assets at the big four banks edged up versus 2019.

Across the banking sector, net profit declined by 2.7% in 2020,

official figures show. That indicates smaller lenders face tougher

conditions than the big four, but shows the entire sector is

recovering, after registering a 9.4% drop in the first half of the

year.

(END) Dow Jones Newswires

March 30, 2021 08:44 ET (12:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

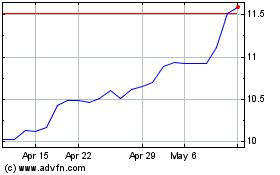

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

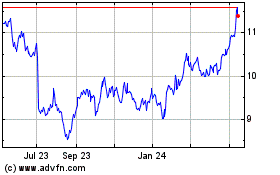

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Nov 2023 to Nov 2024