IQST - $0.60 Sleeper Stock Set To Explode In Fintech Parade Of Decacorn IPO's

24 December 2021 - 3:51AM

InvestorsHub NewsWire

December 23, 2021 -- InvestorsHub NewsWire -- via Prime

Time Profiles --

By Primetime

Editorial / Feature

- IQST Could Reach The $3 Nasdaq Minimum Listing

Price

iQSTEL, Inc. (OTCQX:

IQST) is a telecommunications company leveraging a $60 million

annual revenue foundation to expand into fintech and more.

From the IQST CEO Leandro Iglesias:

- We believe iQSTEL’s combined operations are uniquely

positioned to serve an increasingly mobile and connected

world.

- iQSTEL provides connectivity through its B2B iQSTelecom

Division which includes our Telecommunications, Internet of Things,

and Blockchain products and services.

- iQSTEL provides mobility through its B2C EVOSS Division

which includes our EV Motorcycles and Fintech Mastercard Ecosystem

products and services.

- IQST has announced reaching an anticipated $63 million in

revenue for 2021 beating their $60 million forecast.

- The company has also announced a $90 million forecast for

next year.

- IQST now expects to imminently close a strategic $50

million investment and subsequently up-list to Nasdaq.

Add $50 million to the IQST balance sheet and the current market

cap should go from a $90 million plus range to $150 million taking

the share price over one dollar.

IQST Could Reach The $3 Nasdaq Minimum Listing

Price

The $150 million market cap valuation could be low if you think

the current share price is under valued at $0.60 now. There is a

strong argument that the company is currently undervalued. Telecom

companies have an average price to sales ratio over 2, and

financial services have an average price to sales ratio over 3, and

software companies have an average price to sales ratio over 11.

IQST can be consider in all those categories and it has a price to

sales ration of just over 1 at this time. IQST has the potential to

reach the $3 Nasdaq minimum listing price without a reverse split.

(see NYU/Stern

Study)

With the overall stock market going sideways in the second half

of 2021, a number of anticipated IPO’s have been delayed. 2022

could bring pent-up IPO demand. Fintech is shaping up to

potentially be one of the hottest IPO sectors in 2022.

MarketWatch characterized the coming year as “a

fintech parade:”:

“The year ahead could bring “five or six massive ‘decacorn’”

IPOs in the fintech space, said [Rainmaker Securities managing

director Greg Martin], acknowledging that Stripe’s would actually

be a “centicorn” deal given that the company is hovering around a

$100 billion valuation.”

Consider IQST’s expansion into the fintech space and the

corresponding potential to catch a decacorn IPO wave, and a PPS

increase from $0.60 to $3.00 may be conservative.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is

responsible for the production and distribution of this content.

STM, Llc. is not operated by a licensed broker, a dealer, or a

registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the business of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The information made

available by STM, Llc. is not intended to be, nor does it

constitute, investment advice or recommendations. The contributors

may buy and sell securities before and after any particular

article, report and publication. In no event shall STM, Llc. be

liable to any member, guest or third party for any damages of any

kind arising out of the use of any content or other material

published or made available by STM, Llc., including, without

limitation, any investment losses, lost profits, lost opportunity,

special, incidental, indirect, consequential or punitive damages.

Past performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. STM, Llc. strongly urges you conduct a complete

and independent investigation of the respective companies and

consideration of all pertinent risks. Readers are advised to review

SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports,

Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its

authors, contributors, or its agents, may be compensated for

preparing research, video graphics, and editorial content. STM, LLC

has not been compensated to produce and syndicate content for

iQSTEL, Inc. Readers, subscribers, and website viewers, are

expected to read the full disclaimers and financial disclosures

statement that can be found on our website by visiting

primetimeprofiles.com/disclaimer.

Source - https://primetimeprofiles.com/iqst-0-60-sleeper-stock-set-to-explode-in-fintech-parade-of-decacorn-ipos/

Other stocks on the move include

ILUS,

AABB, and

CYDY

SOURCE: Prime Time Profiles

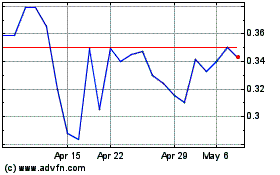

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024