IQST - iQSTEL Announces 44% Year Over Year Revenue Growth To $64.7 Million With 59% Gross Profit Increase

20 April 2022 - 1:07AM

InvestorsHub NewsWire

New York, NY -- April 19, 2022 -- InvestorsHub NewsWire --

iQSTEL, Inc. (OTCQX:

IQST) today announced the company has published its 2021 annual

report with an audited financial statement on SEC Form 10K. In

2021, iQSTEL realized a 44% increase in revenue over 2020 reaching

$64.7 million compared $44.9 million the year prior. The company

also realized a year over year 59% increase in gross profit.

CEO Leandro Iglesias has published a shareholder letter,

included in its entirety below to address the higlights of the 2021

annual report. Mr. Iglesias plans to publish a second letter on

Thursday, April 21, 2022 to provide shareholders with the latest

updates on iQSTEL’s continuing progress toward its 2022 objectives

in light of the momentum the company achieved in 2021.

Dear Shareholders:

On behalf of everyone working at iQSTEL to dilligently advance

the company, I’m proud to highlight here the exceptional results of

their dedicated efforts. I believe the 2021 audited financial

results are a meaningful indication of the company’s potential to

achieve our stated 2022 objectives. Today, will focus on the 2021

results and in a follow-up letter later this week, I will address

how I feel these results substantiate our potential to achieve our

2022 objectives.

iQSTEL’s 2021 revenue increased 44% year over year to $64.7

million, and the gross profit increased 59%. Increasing revenues

and improving gross margins contributed to a substantial bottom

line improvement with the company’s consolidated net loss

decreasing 42% year over year. The company’s balance sheet also

improved dramatically resulting in an overall 368% increase in

shareholder equity.

Below I have included a chart summarizing the year over year

operating performance and balance sheet improvements.

|

Summary Financials 2021 vs 2022

|

|

Statements of Operation

|

2021

|

2020

|

%

|

Direction

|

|

Revenues

|

$64.70 Million

|

$44.91 Million

|

44%

|

Increase

|

|

Gross Profit

|

$1.53 Million

|

$0.96 Million

|

59%

|

Increase

|

|

Operating Loss

|

-$2.98 Million

|

-$3.21 Million

|

-7%

|

Reduction

|

|

Consolidated Net Loss

|

-$3.86 Million

|

-$6.69 Million

|

-42%

|

Reduction

|

|

Balance Sheet

|

2021

|

2020

|

%

|

Direction

|

|

Cash

|

$3.33 Million

|

$0.75 Million

|

343%

|

Increase

|

|

Assets

|

$9.06 Million

|

$5.95 Million

|

52%

|

Increase

|

|

Liabilities

|

$2.64 Million

|

$8.35 Million

|

-68%

|

Reduction

|

|

Stockholders´ Equity

|

$6.42 Million

|

-$2.40 Million

|

368%

|

Increase

|

At the following link, you can see more visual analysis of the

company’s year over year performance in graphs and charts

constructed from the published annual report.

https://bit.ly/IQSTELFINANCIALEVOLUTION

On behalf of the Independent Board of Directors, I want to

extend a gracious thanks to all the employees of iQSTEL that have

contributed to the delivery of these outstanding results. I also

want to thank the iQSTEL shareholders for their continued

confidence and support. Look for more from me later this week in a

second letter discussing our future in light of these results.

Sincerely,

Leandro Iglesias

CEO

iQSTEL Inc. (OTCQX:

IQST) (www.iQSTEL.com) is a US-based publicly-listed

company holding an Independent Board of Directors and Independent

Audit Committee offering leading-edge services through its two

business divisions and each of them with independent brands. The

B2B division, Brand IQSTelecom offering Telecommunications,

Internet of Things, Technology and Blockchain platforms services,

the target market for the B2B division is Global Markets. The B2C

division, Brand EVOSS offering EV Electric Motorcycles, Fintech

Ecosystem, the target market for this business division is Latin

America, and the Spanish speakers in the USA. The company has

presence in 15 countries, and its products and services are used in

several industries as Telecommunications, Electric Vehicle (EV),

Financial Services, Chemical and Liquid Fuel Distribution

Industries. IQSTEL announced on February 17th 2021 that it became a

Debt Free Company and is now completely debt free with no

Convertible Notes, Warrants, Promissory Notes or Settlement

Agreements from its Balance Sheet.

Safe Harbor Statement: Statements in this news release may be

"forward-looking statements". Forward-looking statements include,

but are not limited to, statements that express our intentions,

beliefs, expectations, strategies, predictions or any other

statements relating to our future activities or other future events

or conditions. These statements are based on current expectations,

estimates and projections about our business based, in part, on

assumptions made by management. These statements are not guarantees

of future performance and involve risks, uncertainties and

assumptions that are difficult to predict. Therefore, actual

outcomes and results may, and are likely to, differ materially from

what is expressed or forecasted in forward-looking statements due

to numerous factors. Any forward-looking statements speak only as

of the date of this news release and iQSTEL Inc. undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This

press release does not constitute a public offer of any securities

for sale. Any securities offered privately will not be or have not

been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from

registration requirements.

iQSTEL Inc.

IR US Phone: 646-740-0907, IR Email: investors@iqstel.com

Source: iQSTEL Inc. and its subsidiaries: www.iqstel.com

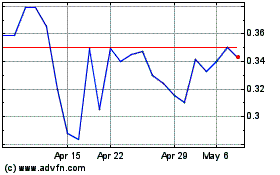

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024