Current Report Filing (8-k)

27 April 2022 - 1:16AM

Edgar (US Regulatory)

0001527702

false

0001527702

2022-04-21

2022-04-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 21, 2022

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As previously reported, on November 18, 2021, we entered into a Memorandum

of Understanding (“MOU”) with Jose Ramon Olivar and Eduardo Borrero (together, “Seller”) concerning the contemplated

sale by Seller and the purchase by us of 51% of the membership interests Seller holds in Smartbiz Telecom LLC (the “Company”).

On April 21, 2021, in furtherance of the MOU, we entered into a Purchase

Agreement with Seller concerning the sale by Seller and the purchase by us of 51% of the membership interests Seller holds in the Company.

The Company is a Florida Corporation which provides telecommunication services,

dedicated to VoIP business for wholesale and retail markets.

Pursuant to the Purchase Agreement, the closing of the purchase of the

51% membership interests shall be no later than May 1, 2022. The purchase price for the acquisition shall be $1,800,000 and shall consist

of $800,000 in cash and $1,000,000 in our common stock to Seller, which amounts to 2,378,059 shares of common stock.

Seller shall have an additional right to request that we buy additional

membership interests of the Company up to 8% membership interests at a total cost to us of $400,000 if certain net income goals are met

by September 30 and December 31 as stated under the Purchase Agreement.

The Purchase Agreement contains customary representations and warranties

of the parties, including, among others, with respect to corporate organization, capitalization, corporate authority, financial statements

and compliance with applicable laws. The representations and warranties of each party set forth in the Purchase Agreement were made solely

for the benefit of the other parties to the Purchase Agreement, and investors are not third-party beneficiaries of the Purchase Agreement.

In addition, such representations and warranties (a) are subject to materiality and other qualifications contained in the Purchase Agreement,

which may differ from what may be viewed as material by investors, (b) were made only as of the date of the Purchase Agreement or such

other date as is specified in the Purchase Agreement and (c) may have been included in the Purchase Agreement for the purpose of allocating

risk between the parties rather than establishing matters as facts. Accordingly, the Purchase Agreement is included with this filing only

to provide investors with information regarding the terms of the Purchase Agreement, and not to provide investors with any other factual

information regarding any of the parties or their respective businesses.

The foregoing description of the Purchase Agreement is not complete and

is qualified in its entirety by reference to the text of such document, which is filed as Exhibit 2.1 hereto and which is incorporated

herein by reference.

SECTION 9 – Financial

Statements and Exhibits

Item 9.01 Financial Statements

and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date April 26, 2022

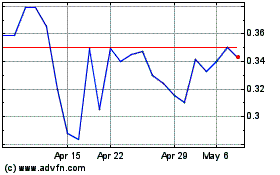

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Apr 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Apr 2023 to Apr 2024