Intesa Sanpaolo Sees Fully Loaded CET1 Ratio Above 12% Through 2025

23 January 2023 - 6:16PM

Dow Jones News

By Pierre Bertrand

Intesa Sanpaolo SpA said late Friday that it expects to achieve

a fully loaded common equity Tier 1 ratio well above 12% during the

course of its business plan to 2025.

The Italian bank, responding to a media report, said it expects

the ratio at around 13% as of Dec. 31, 2022.

Bloomberg on Friday, citing unnamed sources, reported the bank

was cutting risk-weighted assets by as much as 20 billion euros

($21.71 billion) through the sale of loans and other assets, after

the European Central Bank critiqued its risk assessment

methodology.

Intesa Sanpaolo said its actions to reduce its risk-weighted

assets during the fourth quarter of 2022 relate to regulatory

changes by European Banking Authority guidelines applicable as of

Jan. 1 and "contribute to the significant value creation and

distribution to shareholders."

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

January 23, 2023 02:01 ET (07:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

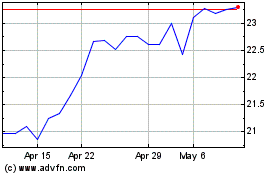

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

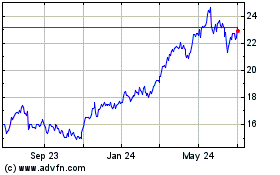

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From Apr 2023 to Apr 2024