0001141240

LIQUIDMETAL TECHNOLOGIES INC

true

--12-31

FY

2023

false

false

false

false

0.001

0.001

1,100,000,000

1,100,000,000

917,285,149

917,285,149

917,285,149

917,285,149

0

0

1

5

10

17

0

0

5

62

10

5

3

0

902

859

43

0.00

0.11

0.00

0.11

http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpense

http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpense

0

2016 2017 2018 2019 2020 2021 2022 2023

10,066,809

0.07

00011412402023-01-012023-12-31

iso4217:USD

00011412402023-06-30

xbrli:shares

00011412402024-11-21

thunderdome:item

00011412402023-12-31

00011412402022-12-31

iso4217:USDxbrli:shares

0001141240us-gaap:ProductMember2023-01-012023-12-31

0001141240us-gaap:ProductMember2022-01-012022-12-31

0001141240us-gaap:LicenseMember2023-01-012023-12-31

0001141240us-gaap:LicenseMember2022-01-012022-12-31

00011412402022-01-012022-12-31

0001141240us-gaap:PreferredStockMember2021-12-31

0001141240us-gaap:CommonStockMember2021-12-31

0001141240lqmt:AdditionalPaidInCapitalAttributableToWarrantsMember2021-12-31

0001141240us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001141240us-gaap:RetainedEarningsMember2021-12-31

0001141240us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0001141240us-gaap:NoncontrollingInterestMember2021-12-31

00011412402021-12-31

0001141240us-gaap:PreferredStockMember2022-01-012022-12-31

0001141240us-gaap:CommonStockMember2022-01-012022-12-31

0001141240lqmt:AdditionalPaidInCapitalAttributableToWarrantsMember2022-01-012022-12-31

0001141240us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-31

0001141240us-gaap:RetainedEarningsMember2022-01-012022-12-31

0001141240us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-31

0001141240us-gaap:NoncontrollingInterestMember2022-01-012022-12-31

0001141240us-gaap:PreferredStockMember2022-12-31

0001141240us-gaap:CommonStockMember2022-12-31

0001141240lqmt:AdditionalPaidInCapitalAttributableToWarrantsMember2022-12-31

0001141240us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001141240us-gaap:RetainedEarningsMember2022-12-31

0001141240us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001141240us-gaap:NoncontrollingInterestMember2022-12-31

0001141240us-gaap:CommonStockMember2023-01-012023-12-31

0001141240lqmt:AdditionalPaidInCapitalAttributableToWarrantsMember2023-01-012023-12-31

0001141240us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-31

0001141240us-gaap:RetainedEarningsMember2023-01-012023-12-31

0001141240us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-31

0001141240us-gaap:NoncontrollingInterestMember2023-01-012023-12-31

0001141240us-gaap:PreferredStockMember2023-12-31

0001141240us-gaap:CommonStockMember2023-12-31

0001141240lqmt:AdditionalPaidInCapitalAttributableToWarrantsMember2023-12-31

0001141240us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001141240us-gaap:RetainedEarningsMember2023-12-31

0001141240us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0001141240us-gaap:NoncontrollingInterestMember2023-12-31

xbrli:pure

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-31

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlqmt:TwoMajorCustomersMember2023-01-012023-12-31

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlqmt:TwoMajorCustomersMember2023-12-31

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-31

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlqmt:TwoMajorCustomersMember2022-01-012022-12-31

0001141240us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberlqmt:TwoMajorCustomersMember2022-12-31

0001141240us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-31

0001141240us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqmt:ThreeMajorCustomersMember2023-01-012023-12-31

0001141240us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-31

0001141240us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMemberlqmt:ThreeMajorCustomersMember2022-01-012022-12-31

utr:Y

0001141240srt:MinimumMember2023-12-31

0001141240srt:MaximumMember2023-12-31

0001141240us-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001141240us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001141240us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001141240us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001141240us-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001141240us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001141240us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001141240us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001141240lqmt:YihaoMember2022-01-122022-01-12

00011412402017-02-16

0001141240lqmt:ValenciaCircleLLCMember2017-02-162017-02-16

0001141240lqmt:LightIndustrialAndOfficeBuildingMember2020-01-23

utr:M

0001141240lqmt:The2016PurchaseAgreementMember2016-03-10

0001141240lqmt:The2016PurchaseAgreementMember2016-03-102016-03-10

0001141240lqmt:CommonStockPurchasePricePerShareOf015Memberlqmt:The2016PurchaseAgreementMember2016-10-26

0001141240lqmt:The2016PurchaseAgreementMember2016-10-26

0001141240lqmt:CommonStockPurchasePricePerShareOf025Memberlqmt:The2016PurchaseAgreementMember2016-10-26

0001141240lqmt:WarrantsInConnectionWithThe2016PurchaseAgreementMember2016-03-10

0001141240lqmt:WarrantsInConnectionWithThe2016PurchaseAgreementMemberlqmt:VestOnMarch102016Member2016-03-10

0001141240lqmt:WarrantsInConnectionWithThe2016PurchaseAgreementMemberlqmt:VestOnOctober262016Member2016-10-26

0001141240lqmt:WarrantsInConnectionWithThe2016PurchaseAgreementMember2016-10-26

0001141240lqmt:EutectixMember2020-01-31

0001141240lqmt:EutectixMember2020-01-312020-01-31

0001141240lqmt:LiquidmetalGolfMember2022-12-31

0001141240lqmt:AtjMember2022-01-132022-01-13

00011412402022-01-132022-01-13

0001141240us-gaap:USTreasuryAndGovernmentMember2023-12-31

0001141240us-gaap:USTreasuryAndGovernmentMember2022-12-31

0001141240us-gaap:CorporateDebtSecuritiesMember2023-12-31

0001141240us-gaap:CorporateDebtSecuritiesMember2022-12-31

0001141240lqmt:InterestAndInvestmentIncomeMember2023-01-012023-12-31

0001141240lqmt:InterestAndInvestmentIncomeMember2022-01-012022-12-31

0001141240us-gaap:LandBuildingsAndImprovementsMember2023-12-31

0001141240us-gaap:LandBuildingsAndImprovementsMember2022-12-31

0001141240us-gaap:MachineryAndEquipmentMember2023-12-31

0001141240us-gaap:MachineryAndEquipmentMember2022-12-31

0001141240us-gaap:ComputerEquipmentMember2023-12-31

0001141240us-gaap:ComputerEquipmentMember2022-12-31

0001141240lqmt:OfficeEquipmentFurnishingsAndImprovementsMember2023-12-31

0001141240lqmt:OfficeEquipmentFurnishingsAndImprovementsMember2022-12-31

0001141240lqmt:PurchasedAndLicensedPatentRightsMember2023-12-31

0001141240lqmt:PurchasedAndLicensedPatentRightsMember2022-12-31

0001141240lqmt:InternallyDevelopedPatentsMember2023-12-31

0001141240lqmt:InternallyDevelopedPatentsMember2022-12-31

0001141240us-gaap:TrademarksMember2023-12-31

0001141240us-gaap:TrademarksMember2022-12-31

0001141240lqmt:UtilityDepositsMember2023-12-31

0001141240lqmt:UtilityDepositsMember2022-12-31

0001141240lqmt:PrepaidLeaseCostsAndLongtermReceivablesMember2023-12-31

0001141240lqmt:PrepaidLeaseCostsAndLongtermReceivablesMember2022-12-31

0001141240lqmt:EquityIncentivePlan2012Member2023-12-31

0001141240us-gaap:ShareBasedPaymentArrangementEmployeeMemberlqmt:EquityIncentivePlan2012Member2023-01-012023-12-31

0001141240lqmt:EquityIncentivePlan2012Member2022-12-31

0001141240lqmt:EquityIncentivePlan2015Member2015-01-27

0001141240lqmt:EquityIncentivePlan2015Membersrt:ChiefExecutiveOfficerMember2023-01-012023-12-31

0001141240lqmt:EquityIncentivePlan2015Membersrt:DirectorMember2023-01-012023-12-31

0001141240lqmt:EquityIncentivePlan2015Member2023-12-31

0001141240lqmt:EquityIncentivePlan2015Member2022-12-31

0001141240lqmt:RestrictedStockAndUnvestedStockOptionsMember2023-01-012023-12-31

0001141240lqmt:RestrictedStockAndUnvestedStockOptionsMember2022-01-012022-12-31

0001141240lqmt:ExercisePriceRange1Member2023-01-012023-12-31

0001141240lqmt:ExercisePriceRange1Member2023-12-31

0001141240lqmt:ExercisePriceRange2Member2023-01-012023-12-31

0001141240lqmt:ExercisePriceRange2Member2023-12-31

0001141240lqmt:ExercisePriceRange1Member2022-01-012022-12-31

0001141240lqmt:ExercisePriceRange1Member2022-12-31

0001141240lqmt:ExercisePriceRange2Member2022-01-012022-12-31

0001141240lqmt:ExercisePriceRange2Member2022-12-31

0001141240us-gaap:DomesticCountryMember2023-12-31

0001141240us-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMember2023-12-31

0001141240us-gaap:DomesticCountryMemberlqmt:LiquidmetalGolfIncMember2023-12-31

0001141240us-gaap:EmployeeStockOptionMember2023-12-31

0001141240us-gaap:DomesticCountryMemberus-gaap:ResearchMember2023-12-31

0001141240us-gaap:StateAndLocalJurisdictionMemberus-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:ResearchMember2023-12-31

0001141240us-gaap:DomesticCountryMemberus-gaap:InternalRevenueServiceIRSMember2023-01-012023-12-31

0001141240us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-12-31

0001141240us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-31

0001141240us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-12-31

0001141240us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-31

0001141240us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-12-31

0001141240us-gaap:EmployeeStockOptionMember2023-01-012023-12-31

0001141240us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-12-31

0001141240us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-12-31

0001141240us-gaap:EmployeeStockOptionMember2022-01-012022-12-31

0001141240us-gaap:EmployeeStockOptionMembersrt:MinimumMember2022-12-31

0001141240us-gaap:EmployeeStockOptionMembersrt:MaximumMember2022-12-31

0001141240us-gaap:WarrantMember2023-01-012023-12-31

0001141240us-gaap:WarrantMember2022-01-012022-12-31

0001141240us-gaap:WarrantMember2022-12-31

0001141240us-gaap:WarrantMember2023-12-31

0001141240srt:MinimumMemberlqmt:ChairmanOfEontecMember2023-12-31

0001141240lqmt:LicenseAgreementMemberlqmt:EontecMember2023-01-012023-12-31

0001141240lqmt:LicenseAgreementMemberlqmt:EontecMember2022-01-012022-12-31

0001141240lqmt:LicenseAgreementMemberlqmt:EontecMember2023-12-31

0001141240lqmt:LicenseAgreementMemberlqmt:EontecMember2022-12-31

0001141240lqmt:FormerDirectorMember2022-05-10

0001141240srt:MaximumMemberlqmt:FormerDirectorMember2022-05-102022-05-10

0001141240lqmt:FormerDirectorMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-05-102022-05-10

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2023 |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ___________

Commission File No. 001-31332

LIQUIDMETAL TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | | 33-0264467 |

| (State or other jurisdiction of incorporation or

organization) | | (I.R.S. Employer

Identification No.) |

20321 Valencia Circle

Lake Forest, CA 92630

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (949) 635-2100

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | LQMT | OTCQB |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ Emerging growth company ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

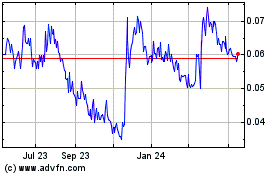

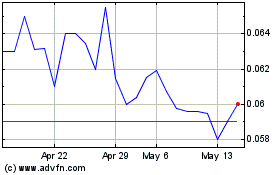

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, was approximately $30,650,385. For purposes of this calculation only, (i) shares of common stock are deemed to have a market value of $0.06 per share, the closing price of the common stock as reported on the “OTCQB Venture Marketplace” on June 30, 2023, and (ii) each of the executive officers, directors and persons holding more than 10% of the outstanding common stock as of June 30, 2023, is deemed to be an affiliate.

The number of shares of common stock outstanding as of November 21, 2024 was 917,285,149.

EXPLANATORY NOTE

This amendment (the “Amendment”) is being filed to provide amendments to the financial statements of Liquidmetal Technologies, Inc. and Subsidiaries (the “Company”), including the notes to the financial statements, for the years ended December 31, 2023 and 2022, contained in the Annual Report on Form 10-K for the years ended December 31, 2023 and 2022, filed with the Securities and Exchange Commission on November 21, 2024 (“Form 10-K), and in order to replace the Report of Independent Registered Public Accounting Firm of BF Borgers CPA PC (“Borgers”), included in the Form 10-K, with the Report of Independent Registered Public Accounting Firm from BCRG Group (“BCRG”), included in this Amendment, and to make certain other changes as described herein.

The following items have also been amended to reflect the immaterial amendments:

| | ● | Part I, Item 1. Business |

| | ● | Part I, Item 1A. Risk Factors |

| | ● | Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| | ● | Part III, Item 14. Principal Accountant Fees and Services |

| | ● | Exhibit 21.1. Subsidiaries of Registrant |

The Company’s Principal Executive Officer and Principal Financial Officer has provided new certifications dated as of the date of this filing in connection with this Amendment (Exhibits 31.1, 31.2, 32.1 and 32.2).

Except as described above, no other portion of the Form 10-K is being amended and this Amendment does not reflect any events occurring after the filing of the Form 10-K.

TABLE OF CONTENTS

Forward-Looking Statements

This Annual Report on Form 10-K of Liquidmetal Technologies, Inc. contains “forward-looking statements” that may state our management’s plans, future events, objectives, current expectations, estimates, forecasts, assumptions or projections about the company and its business. Any statement in this report that is not a statement of historical fact is a forward-looking statement, and in some cases, words such as “believes,” “estimates,” “projects,” “expects,” “intends,” “may,” “anticipate,” “plans,” “seeks,” and similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual outcomes and results to differ materially from the anticipated outcomes or results. These statements are not guarantees of future performance, and undue reliance should not be placed on these statements. It is important to note that our actual results could differ materially from what is expressed in our forward-looking statements due to the risk factors described in the section of this report entitled “Risk Factors” (Item 1A of this report) as well as the following risks and uncertainties:

| |

● |

Our ability to fund our operations in the long-term through financing transactions on terms acceptable to us, or at all; |

| |

● |

Our history of operating losses and the uncertainty surrounding our ability to achieve or sustain profitability; |

| |

● |

Our limited history of developing and selling products made from our bulk amorphous alloys; |

| |

● |

Challenges associated with having products manufactured from our alloys and the use of third parties for manufacturing; |

| |

● |

Our limited history of licensing our technology to third parties; |

| |

● |

Lengthy customer adoption cycles and unpredictable customer adoption practices; |

| |

● |

Our ability to identify, develop, and commercialize new product applications for our technology; |

| |

● |

Competition from current suppliers of incumbent materials or producers of competing products; |

| |

● |

Our ability to identify, consummate, and/or integrate strategic partnerships; |

| |

● |

The potential for manufacturing problems or delays; and |

| |

● |

Potential difficulties associated with protecting or expanding our intellectual property position. |

We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 1. Business

In this Annual Report on Form 10-K, unless the context indicates otherwise, references to “the Company”, “Liquidmetal Technologies”, “our Company”, “we”, “us”, and similar references refer to Liquidmetal Technologies, Inc. and its subsidiaries.

Overview

We are a materials technology company that works with manufacturing and commercial partners to develop and commercialize products made from our proprietary amorphous alloys. Our Liquidmetal® family of alloys consists of a variety of proprietary bulk alloys and composites that utilize the advantages offered by amorphous alloy technology. We work with partners to design, develop, and sell custom products and parts from bulk amorphous alloys for sale in various industries. We also partner with third-party manufacturers and licensees to develop and commercialize Liquidmetal alloy products.

Amorphous alloys are, in general, unique materials that are distinguished by their ability to retain a random atomic structure when they solidify, in contrast to the crystalline atomic structure that forms in other metals and alloys when they solidify. Liquidmetal alloys are proprietary amorphous alloys that possess a combination of performance, processing, and potential cost advantages that we believe will make them preferable to other materials in a variety of applications. The amorphous atomic structure of bulk alloys enables them to overcome certain performance limitations caused by inherent weaknesses in crystalline atomic structures, thus facilitating performance and processing characteristics superior in many ways to those of their crystalline counterparts. We believe the alloys and the molding technologies we employ can result in components for many applications that exhibit exceptional dimensional control and repeatability that rivals precision machining, excellent corrosion resistance, brilliant surface finish, high strength, high hardness, high elastic limit, alloys that are non-magnetic, and the ability to form complex shapes common to the injection molding of plastics. All of these characteristics are achievable from the molding process, so design engineers often do not have to select specific alloys to achieve one or more of the characteristics as is the case with crystalline materials. We believe these advantages could result in Liquidmetal alloys supplanting high-performance alloys, such as titanium and stainless steel, and other incumbent materials in a wide variety of applications. Moreover, we believe these advantages could enable the introduction of entirely new products and applications that are not possible or commercially viable with other materials.

Our bulk amorphous alloy technology is a relatively new technology as compared to many other material technologies, such as plastics and widely-used high-performance crystalline alloys. Historically, the successful commercialization of a new material technology has required the persistent improvement and refining of the technology over a sometimes lengthy period of time. Accordingly, we believe that our Company’s future success will be dependent on our ability to continue expanding and improving our technology platform by, among other things, constantly refining and improving our processes, optimizing our existing amorphous alloy compositions for various applications, and developing and improving new bulk amorphous alloy compositions.

General Corporate Information

We were originally incorporated in California in 1987, and we reincorporated in Delaware in May 2003. Our principal executive office is located at 20321 Valencia Circle, Lake Forest, California 92630. Our telephone number at that address is (949) 635-2100. Our Internet website address is www.liquidmetal.com and all of our filings with the Securities and Exchange Commission (“SEC”) are available free of charge on our website.

Our Technology

The performance, processing, and potential cost advantages of Liquidmetal alloys are a function of their unique atomic structure and their proprietary material composition.

Unique Atomic Structure

The atomic structure of Liquidmetal alloys is the fundamental feature that differentiates them from other alloys and metals. In the molten state, the atomic particles of all alloys and metals have an amorphous atomic structure, which means that the atomic particles appear in a completely random structure with no discernible patterns. However, when non-amorphous alloys and metals are cooled to a solid state, their atoms bond together in a repeating pattern of regular and predictable shapes or crystalline grains. This process is analogous to the way ice forms when water freezes and crystallizes. In non-amorphous metals and alloys, the individual crystalline grains contain naturally occurring structural defects that limit the potential strength and performance characteristics of the material. These defects, known as dislocations, consist of discontinuities or inconsistencies in the patterned atomic structure of each grain. Unlike other alloys and metals, bulk Liquidmetal alloys can retain their amorphous atomic structure throughout the solidification process and therefore do not develop crystalline grains and the associated dislocations. Consequently, bulk Liquidmetal alloys exhibit superior strength and other superior performance characteristics compared to their crystalline counterparts.

Prior to 1993, commercially viable amorphous alloys could be created only in thin forms, such as coatings, films, or ribbons. However, in 1993, researchers at the California Institute of Technology (“Caltech”) developed the first commercially viable amorphous alloy in a bulk form. We obtained the exclusive right to commercialize the bulk amorphous alloy through a license agreement with Caltech and have developed the technology to enable the commercialization of bulk amorphous alloys.

Proprietary Material Composition

The constituent elements and percentage composition of Liquidmetal alloys are critical to their ability to solidify into an amorphous atomic structure. We have several different alloy compositions that have different constituent elements in varying percentages. The raw materials that we use in Liquidmetal alloys are readily available and can be purchased from multiple suppliers.

Advantages of Liquidmetal Alloys

Liquidmetal alloys possess a unique combination of performance, processing, and potential cost advantages that we believe makes them superior in many ways to other commercially available materials for a variety of existing and potential future product applications. The unique combined performance and processing features result in precise dimensional control and repeatability, surface finish, strength, hardness, elasticity, and corrosion resistance are uncommon in crystalline material alternatives. Additionally, the ability to leverage various molding processes and related tooling technologies provides the ability to deliver a broad range of material characteristics in a complex shaped component.

Performance Advantages

Our bulk Liquidmetal alloys provide several distinct performance advantages over other materials, and we believe that these advantages make the alloys desirable in applications that require high precision and repeatability, high yield strength, strength-to-weight ratio, elasticity, corrosion resistance and hardness.

Processing Advantages

The processing of a material generally refers to how a material is shaped, formed, or combined with other materials to create a finished product. Bulk Liquidmetal alloys possess processing characteristics that we believe make them preferable to other materials in a wide variety of applications. In particular, our alloys are amenable to processing options that are similar in many respects to those associated with plastics. Additionally, unlike most metals and alloys, our bulk Liquidmetal alloys are capable of being thermoplastically molded in bulk form. Thermoplastic molding consists of heating a solid piece of material until it is transformed into a moldable state, although at temperatures much lower than the melting temperature, and then introducing it into a mold to form near-to-net shaped products. Accordingly, thermoplastic molding can be beneficial and economical for net-shape fabrication of high-strength products. Liquidmetal alloys also have superior net-shape casting capabilities as compared to high-strength crystalline metals and alloys. “Net-shape casting” is a type of casting that permits the creation of near-to-net shaped products that reduce costly post-cast processing or machining.

Cost Advantages

Liquidmetal alloys have the potential to provide cost advantages over other high-strength metals and alloys in certain applications. Because bulk Liquidmetal alloys have processing characteristics similar in some respects to plastics, which lend themselves to near-to-net shape molding, Liquidmetal alloys can in many cases be shaped efficiently into intricate, engineered products. This capability can eliminate or reduce certain post-molding steps, such as machining and re-forming, and therefore has the potential to significantly reduce processing costs associated with making parts in high volume.

Our Strategy

The key elements of our strategy include:

| • |

Focusing Our Marketing Activities on Select Products with Optimized Gross-Margins. We have focused and continue to focus our marketing activities on select products with optimized gross margins for the long term. This strategy is designed to align our product development initiatives with our processes and cost structure, and to reduce our exposure to more commodity-type product applications that are prone to unpredictable demand and fluctuating pricing. Our focus is primarily on products that possess design features that take advantage of our physical properties and manufacturing advantages of our technology and that command a price commensurate with the performance advantages of our alloys. In addition, we will continue to engage in prototype manufacturing for products that will ultimately be licensed to or manufactured by third-parties. |

| |

|

| • |

Pursuing Strategic Partnerships in Order to More Rapidly Develop and Commercialize Products. We have and continue to actively pursue and support strategic partnerships that will enable us to leverage the resources, strength, and technologies of other companies in order to more rapidly develop and commercialize products. These partnerships may include licensing transactions in which we license full commercial rights to our technology in a specific application area, or they may include transactions of a more limited scope in which, for example, we outsource manufacturing activities or grant limited licensing rights. We believe that utilizing such a partnering strategy will enable us to reduce our working capital burden, better fund product development efforts, better understand customer adoption practices, leverage the technical and financial resources of our partners, and more effectively handle product design and process challenges. |

| |

|

| • |

Advancing the Liquidmetal® Brand. We believe that building our corporate brand will foster continued adoption of our technology. Our goal is to position Liquidmetal alloys as a superior substitute for materials currently used in a variety of products across a range of industries. Furthermore, we seek to establish Liquidmetal alloys as an enabling technology that will facilitate the creation of a broad range of commercially viable new products. To enhance industry awareness of our company and increase demand for Liquidmetal alloys, we are engaged in various brand development strategies that could include collaborative advertising and promotional campaigns with select customers, industry conference and trade show appearances, public relations, and other means. |

Applications for Liquidmetal Alloys

There is a very broad number of markets where Liquidmetal alloys have application opportunities. Some of the more prominent markets include: medical/ dental, automotive, non-consumer electronics, and sporting equipment. We believe that these areas are consistent with our strategy in terms of market size, building brand recognition, and providing an opportunity to develop and refine our processing capabilities. Although we believe that strategic partnership transactions could also create valuable opportunities beyond the parameters of these target markets, we anticipate continuing to pursue these markets both internally and in conjunction with partners.

Medical Devices

We are engaged in product development efforts relating to various medical devices that could be made from bulk Liquidmetal alloys. We believe that the unique properties of bulk Liquidmetal alloys provide a combination of performance and cost benefits that could make them a desirable replacement for incumbent materials, such as machined stainless steel and titanium, or components made from other more traditional metalworking technologies currently used in various medical device applications. Our ongoing emphasis has been on minimally invasive surgical instrument applications for Liquidmetal alloys. These include, but are not limited to, specialized blades, clamps, tissue suturing components, tissue manipulation devices and orthopedic instruments utilized for implant surgery procedures, dental devices, and general surgery devices. The potential value offered by our alloys is higher performance in some cases and cost reduction in others, the latter stemming from the ability of Liquidmetal alloys to be net shape molded into components, thus reducing costs of secondary processing common with other metalworking processes. The status of most components in the prototyping phase is subject to non-disclosure agreements with our customers.

Automotive Components

We are engaged in product development efforts relating to various automotive components that could be made from bulk Liquidmetal alloys. We believe that the unique properties of bulk Liquidmetal alloys provide the combination of long-lasting surface finish, corrosion resistance, strength, and precision required by most automotive applications, especially for the EV space. The potential value offered by our alloys is higher performance in some cases and cost reduction in others, the latter stemming from the ability of Liquidmetal alloys to be net shape molded into components, thus reducing costs of secondary processing common with existing processes.

Components for Non-Consumer Electronic Products

We work with partners to design, develop and supply components for non-consumer electronic devices utilizing our bulk Liquidmetal alloys and believe that our alloys offer enhanced performance and design benefits for these components in certain applications. Our strategic focus is primarily on parts that command a price commensurate with the performance advantages of our alloys. These product categories in the non-consumer electronics field include, but are not limited to, aerospace components, leisure products, and industrial machines. We believe that there are multiple applications and opportunities in the non-consumer electronics product category for us to produce parts that command the higher margin and premium prices consistent with our core business strategy.

We believe that the continued miniaturization of, and the introduction of advanced features to non-consumer electronic devices is a primary driver of growth, market share, and profits in our industry. The high strength-to-weight ratio and elastic limit, along with the processing advantages of bulk Liquidmetal alloys enable the production of smaller, thinner, but stronger electronic parts. We also believe that the strength characteristics of our alloys could facilitate the creation of a new generation of non-consumer electronic devices which currently may not be viable because of strength limitations of conventional metal parts in the marketplace today. Lastly, we believe that our alloys offer style and design flexibility, such as shiny metallic finishes, to accommodate the changing tastes of our customers.

On August 5, 2010, we entered into a license transaction with Apple Inc. (“Apple”) pursuant to which, for a one-time, upfront license fee, we granted to Apple a perpetual, worldwide, fully-paid, exclusive license to commercialize our intellectual property in the field of “consumer electronic” products, as defined in the license agreement. We continue to work with Apple to develop and advance research and development in the amorphous alloy space to benefit both consumer and non-consumer electronics fields. For more information regarding our transaction with Apple, see “ – Licensing Transactions” below.

Sporting Goods and Leisure Products

We are developing a variety of applications for Liquidmetal alloys in the sporting goods and leisure products area.

In the sporting goods industry, we believe that the high strength, hardness, corrosion resistance, and elasticity of our bulk alloys have the potential to enhance performance in a variety of products including, but not limited to, golf clubs, tennis rackets, archery, sporting arms and scuba equipment. We further believe that many sporting goods products are conducive to our strategy of focusing on high-margin products that meet our design criteria.

In the leisure products category, we believe that bulk Liquidmetal alloys can be used to efficiently produce intricately engineered designs with high-quality finishes, such as premium watchcases and knives. We further believe that Liquidmetal technology can be used to make high-quality, high-strength jewelry from precious metals.

Licensing Transactions

Eontec License Agreement

On March 10, 2016, in connection with the 2016 Purchase Agreement (defined below), we entered into a Parallel License Agreement (the “License Agreement”) with DongGuan Eontec Co., Ltd., a Hong Kong corporation (“Eontec”) pursuant to which we each entered into a cross-license of our respective technologies.

The License Agreement provides for the cross-license of certain patents, technical information, and trademarks between us and Eontec. In particular, we granted to Eontec a paid-up, royalty-free, perpetual license to our patents and related technical information to make, have made, use, offer to sell, sell, export, and import products in certain geographic areas outside of North America and Europe, and Eontec granted to us a paid-up, royalty-free, perpetual license to Eontec’s patents and related technical information to make, have made, use, offer to sell, sell, export, and import products in certain geographic areas outside of specified countries in Asia. The license granted by us to Eontec is exclusive (including to the exclusion of us) in the countries of Brunei, Cambodia, China (P.R.C and R.O.C.), East Timor, Indonesia, Japan, Laos, Malaysia, Myanmar, Philippines, Singapore, South Korea, Thailand, and Vietnam. The license granted by Eontec to us is exclusive (including to the exclusion of Eontec) in North America and Europe. The cross-licenses are non-exclusive in geographic areas outside of the foregoing exclusive territories.

Eutectix Business Development Agreement

On January 31, 2020, we entered into a Business Development Agreement (the “Agreement”) with Eutectix, LLC, a Delaware limited liability company (“Eutectix”), which provides for collaboration, joint development efforts, and the manufacturing of products based on our proprietary amorphous metal alloys. Under the Agreement, we have agreed to license to Eutectix specified equipment owned by us, including two injection molding machines, the Machines, and other machines and equipment, all of which will be used to make products for our customers and Eutectix customers. The licensed machines and equipment represent substantially all of the machinery and equipment currently held by us. We have also licensed to Eutectix various patents and technical information related to our proprietary technology. Under the Agreement, Eutectix will pay us a royalty of six percent (6%) of the net sales price of licensed products sold by Eutectix, and Eutectix will also manufacture products for us. The Agreement has a term of five years, subject to renewal provisions and the ability of either party to terminate earlier upon specified circumstances.

Apple License Transaction

On August 5, 2010, we entered into a license transaction with Apple pursuant to which (i) we contributed substantially all of our intellectual property assets to a newly organized special-purpose, wholly-owned subsidiary, Crucible Intellectual Property, LLC (“CIP”), (ii) CIP granted to Apple a perpetual, worldwide, exclusive license to commercialize such intellectual property in the field of consumer electronic products, as defined in the license agreement, in exchange for a one-time, upfront license fee, and (iii) CIP granted back to us a perpetual, worldwide, fully-paid, exclusive license to commercialize such intellectual property in all other fields of use.

Under the agreements relating to the license transaction with Apple, we were obligated to contribute to CIP all intellectual property developed by us through February 2016. We are also obligated to maintain certain limited liability company formalities with respect to CIP at all times after the closing of the license transaction.

Swatch Group License

In March 2009, we entered into a license agreement with Swatch Group, Ltd. (“Swatch”) under which Swatch was granted a non-exclusive license to our technology to produce and market watches and certain other luxury products. In March 2011, this license agreement was amended to grant Swatch exclusive rights as to watches as against all third parties (including us), but non-exclusive as to Apple. We will receive royalty payments over the life of the contract on all Liquidmetal products produced and sold by Swatch. The license agreement with Swatch will expire on the expiration date of the last licensed patent.

Liquidmetal Golf License

On January 13, 2022, our Liquidmetal Golf subsidiary (see below) entered into a sublicense agreement (“LMG Sublicense Agreement”) with Amorphous Technologies Japan, Inc. (“ATJ”), a newly formed Japanese entity that was established by Twins Corporation, a sporting goods company operating in Japan. Under the agreement, LMG granted to ATJ a nonexclusive worldwide sublicense to the Company’s amorphous alloy technology and related trademarks to manufacture and sell golf clubs and golf related products. The LMG Sublicense Agreement has a term of three years and provides for the payment of a running royalty to LMG of 3% of the net sales price of licensed products.

Our Intellectual Property

Our intellectual property consists of patents, trade secrets, know-how, and trademarks. Protection of our intellectual property is a strategic priority for our business, and we intend to vigorously protect our patents and other intellectual property. Our intellectual property portfolio includes more than 34 owned or licensed U.S. patents relating to the composition, processing, and application of our alloys, as well as more than 39 foreign counterpart patents and patent applications.

Our initial bulk amorphous alloy technology was developed by researchers at Caltech. We have acquired patent rights that provide us with the exclusive right to commercialize amorphous alloys and other amorphous alloy technology developed at Caltech through a license agreement (“Caltech License Agreement”) with Caltech. In addition to the patents and patent applications that we license from Caltech, we are building a portfolio of our own patents to expand and enhance our technology position. These patents and patent applications primarily relate to various applications of our bulk amorphous alloys and the processing of our alloys. The patents expire on various dates between 2024 and 2039. Our policy is to seek patent protection for all technology, inventions, and improvements that are of commercial importance to the development of our business, except to the extent that we believe it is advisable to maintain such technology or invention as a trade secret.

In order to protect the confidentiality of our technology, including trade secrets, know-how, and other proprietary technical and business information, we require that all of our employees, consultants, advisors and collaborators enter into confidentiality agreements that prohibit the use or disclosure of information that is deemed confidential. The agreements also obligate our employees, consultants, advisors and collaborators to assign to us developments, discoveries and inventions made by such persons in connection with their work with us.

Research and Development

We have engaged in limited research and development programs that were driven by the following key objectives:

| • |

Enhance Material Processing and Manufacturing Efficiencies. We are working with our strategic partners to enhance material processing and manufacturing efficiencies. We plan to continue research and development of processes and compositions that will decrease our cost of making products from Liquidmetal alloys. |

| • |

Develop New Applications. We will continue the research and development of new applications for Liquidmetal alloys. We believe the range of potential applications will broaden as we expand the forms, compositions, and methods of processing of our alloys. |

In addition to our internal research and development efforts, we enter into cooperative research and development relationships with leading academic institutions. We have entered into development relationships with other companies for the purpose of identifying new applications for our alloys and establishing customer relationships with such companies. Some of our product development programs are partially funded by our customers. We are also engaged in negotiations with other potential customers regarding possible product development relationships. Our research and development expenses for the years ended December 31, 2023 and 2022 were $20 and $55, respectively.

Raw Materials

Liquidmetal alloy compositions are comprised of many elements, many of which are generally available commodity products. While we believe that each of these raw materials is readily available in sufficient quantities from multiple sources on commercially acceptable terms, we continue to seek opportunities to secure stocks of essential elements in advance to manage lead-times and cost. Due to our inherent dependency on these alloy compositions for the manufacture of Liquidmetal products, any substantial increase in the price or interruption in the supply of these materials could have an adverse effect on our business.

Manufacturing

Our current manufacturing strategy is to partner with global companies that are contract manufacturers and alloy producers. We seek third party companies with proven track records of success who can gain specialized skills and knowledge of our alloys through close collaborations with our team of engineers. We believe that partnering with these global companies will allow us to forgo the capital intensive requirements of maintaining our own large scale manufacturing facilities and allow us to grow the number of applications for the technology much faster than could be accomplished on our own.

On January 12, 2022, Liquidmetal Technologies entered into a manufacturing agreement (“Manufacturing Agreement”) with Dongguan Yihao Metal Materials Technology Co. Ltd. (“Yihao”) to become the primary outsourced manufacturer of the Company’s products. Under the Manufacturing Agreement, which has a term of five years, Yihao has agreed to serve as a non-exclusive contract manufacturer for amorphous alloy parts offered and sold by the Company at prices determined on a “cost-plus” basis. Yihao is an affiliate of Dongguan Eontec Co. Ltd. and Professor Lugee Li, our Chairman and largest beneficial owner of the Company’s capital stock.

Customers

During 2023, there were three major customers, who together accounted for 86% of our revenue. During 2022, there were three major customers, who together accounted for 74% of our revenue. As of December 31, 2023, two customers represented 96%, or $178, of the total outstanding trade accounts receivable. As of December 31, 2022, one customer represented 100%, or $24, of the total outstanding trade accounts receivable. In the future, we expect that a significant portion of our revenue may continue to be concentrated in a limited number of customers, even if our bulk alloys business grows.

Competition

Our bulk Liquidmetal alloys face competition from other materials, including metals, alloys, plastics and composites, which are currently used in the commercial applications that we pursue. For example, we face significant competition from plastics, zinc and stainless steel in our non-consumer electronics components business, and titanium and composites will continue to be used widely in medical devices and sporting goods. Many of these competitive materials are produced by domestic and international companies that have substantially greater financial and other resources than we do. Based on our experience developing products for a variety of customers, we believe that the selection of materials by potential customers will continue to be product-specific in nature, with the decision for each product being driven primarily by the performance needs of the application and, secondarily, by cost considerations and design flexibility. Because of the relatively high strength of our alloys, dimensional precision, and the design flexibility of our process, we are most competitive when the customer is seeking a higher strength, as well as greater design flexibility, than currently available with other materials. However, if currently available materials, such as plastics, are strong enough for the application, our alloys are often not competitive in those applications with respect to price. We also believe that our alloys are generally not competitive with the cost of some of the basic metals, such as steel, aluminum or copper, when such basic metals can be processed by simple traditional metalworking processes into shapes and components that are satisfactory for their intended applications. Our alloys are generally more competitive with respect to price compared to components machined from various metals, such as titanium, stainless steel and other higher performance crystalline metals. Our alloys could also face competition from new materials that may be developed in the future, including new materials that could render our alloys obsolete.

We experience and will continue to experience indirect competition from the competitors of our customers. Because we rely on our customers to market and sell finished goods that incorporate our components or products, our success will depend in part on the ability of our customers to effectively market and sell their own products and compete in their respective markets.

Backlog

Because of the minimal lead-time associated with orders of bulk alloy parts, we generally do not carry a significant backlog. The backlog as of any particular date gives no indication of actual sales for any succeeding period.

Sales and Marketing

We direct our marketing efforts towards customers that will incorporate our components and products into their finished goods. Our goal is to educate customers on the benefits of our technology and help them gain adequate knowledge to apply the technology to their upcoming product application designs. To that end, we have business development personnel who, in conjunction with engineers and scientists, will actively identify potential customers that may be able to benefit from the introduction of Liquidmetal alloys to their products. We currently have 4 full-time individuals engaged in our internal sales, business development and marketing activities. In addition, we work closely with a team of more than 15 external sales representatives covering the territories of North America and Europe.

Human Capital

As of December 31, 2023, we had 7 full-time employees and 1 full-time consultant. As of that date, none of our employees or consultants were represented by a labor union. We have not experienced any work stoppages, and we consider our employee and consultant relations to be favorable. We endeavor to maintain a workplace that is free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. The basis for recruitment, hiring, development, training, compensation and advancement is a person’s qualifications, performance, skills and experience. We believe that our employees are fairly compensated, without regard to gender, race and ethnicity, and routinely recognized for outstanding performance.

Governmental Regulation

Government regulation of our products will depend on the nature and type of product and the jurisdictions in which the products are sold. For example, medical instruments incorporating our Liquidmetal alloys will be subject to regulation in the United States by the Food and Drug Administration (“FDA”) and corresponding state and foreign regulatory agencies. Medical device manufacturers to whom we intend to sell our products may need to obtain FDA approval before marketing their medical devices that incorporate our products and may need to obtain similar approvals before marketing these medical device products in foreign countries.

Environmental Law Compliance

Our operations are subject to national, state, and local environmental laws in the United States. We believe that we are in material compliance with all applicable environmental regulations. While we continue to incur costs to comply with environmental regulations, we do not believe that such costs will have a material effect on our capital expenditures, earnings, or competitive position.

Liquidmetal Golf

Liquidmetal Golf Inc. (“Liquidmetal Golf” or “LMG”) is a majority-owned subsidiary which has the exclusive right and license to utilize our Liquidmetal alloy technology for purposes of golf equipment applications. This right and license is set forth in an intercompany license agreement dated January 1, 2002 between Liquidmetal Technologies and Liquidmetal Golf. This license agreement provides that Liquidmetal Golf has a perpetual and exclusive license to use Liquidmetal alloy technology for the purpose of manufacturing, marketing, and selling golf club components and other products used in the sport of golf. We own 79% of the outstanding common stock in Liquidmetal Golf.

On January 13, 2022, Liquidmetal Golf entered into a sublicense agreement (“LMG Sublicense Agreement”) with Amorphous Technologies Japan, Inc. (“ATJ”), a newly formed Japanese entity that was established by Twins Corporation, a sporting goods company operating in Japan. Under the agreement, LMG granted to ATJ a nonexclusive worldwide sublicense to the Company’s amorphous alloy technology and related trademarks to manufacture and sell golf clubs and golf related products. The LMG Sublicense Agreement has a term of three years and provides for the payment of a running royalty to LMG of 3% of the net sales price of licensed products.

Item 1A. Risk Factors

Investing in our securities involves a high degree of risk. The risks described below are not the only ones facing us. Additional risks not currently known to us or that we currently believe are immaterial also may impair our business, operations, liquidity and stock price materially and adversely. You should carefully consider the risks and uncertainties described below in addition to the other information included or incorporated by reference in this Annual Report on Form 10-K. If any of the following risks actually occur, our business, financial condition or results of operations would likely suffer. In that case, the trading price of our common stock could fall and you could lose all or part of your investment.

Risk Related to Our Company and Business

We have incurred significant operating losses in the past and may not be able to achieve or sustain profitability in the future.

We have experienced significant cumulative operating losses since our inception. Our operating loss for the years ended December 31, 2023 and 2022 were $2.0 million and $2.4 million, respectively. We had an accumulated deficit of approximately $276.7 million at December 31, 2023, and approximately $274.7 million at December 31, 2022. We anticipate that we may continue to incur operating losses for the foreseeable future. Consequently, it is possible that we may never achieve positive earnings and, if we do achieve positive earnings, we may not be able to achieve them on a sustainable basis.

We have a limited history of developing and selling products made from our bulk amorphous alloys.

We have a relatively limited history of producing bulk amorphous alloy components and products on a mass-production scale. Furthermore, our suppliers’ ability to produce our products in desired quantities and at commercially reasonable prices is uncertain and is dependent on a variety of factors that are outside of its control, including the nature and design of the component, the customer’s specifications, and required delivery timelines.

We rely on assumptions about the markets for our products and components that, if incorrect, may adversely affect our profitability.

We have made assumptions regarding the market size for, and the manufacturing requirements of, our products and components based in part on information we received from third parties and also from our limited history. If these assumptions prove to be incorrect, we may not achieve anticipated market penetration, revenue targets or profitability.

Our historical results of operations may not be indicative of our future results.

As a result of our limited history of developing and marketing bulk amorphous alloy components and products, as well as our new manufacturing strategy of partnering with contract manufacturers and alloy producers, our historical results of operations may not be indicative of our future results.

We primarily rely on limited suppliers for mold making, manufacturing and alloying of our bulk amorphous alloys and parts.

We currently have one supplier located in China who fulfills the alloying, mold making and manufacturing of our bulk amorphous alloy parts. Our supplier may allocate its limited capacity to fulfill the production requirements of its other customers. In the event of a disruption of the operations of our supplier related to limited capacity, as well as other geo-political issues, we may not have other manufacturing sources immediately available. Such events could cause significant delays in shipments and may adversely affect our revenue, cost of goods sold and results of operations.

Risk Related to Customer Relationships

If we cannot establish and maintain relationships with customers that incorporate our components and products into their finished goods, we will not be able to increase our revenue and commercialize our products.

Our business is based upon the commercialization of new and unique materials technology. Our ability to increase our revenues will depend on our ability to successfully maintain and establish relationships with customers who are willing to incorporate our proprietary alloys and technology into their finished products. However, we believe that the size of our company and the novel nature of our technology and manufacturing process may continue to make it challenging to maintain and establish such relationships. In addition, we rely and will continue to rely to a large extent on the manufacturing, research, and development capabilities, as well as the marketing and distribution capabilities, of our customers in order to commercialize our products. Our future growth and success will depend in large part on our ability to enter into these relationships and the subsequent success of these relationships. Even if our products are selected for use in a customer’s products, we still may not realize significant revenue from that customer if that customer’s products are not commercially successful.

It may take significant time and cost for us to develop new customer relationships, which may delay our ability to generate additional revenue or achieve profitability.

Our ability to generate revenue from new customers is generally affected by the amount of time it takes for us to, among other things:

| |

● |

identify a potential customer and introduce the customer to Liquidmetal alloys; |

| |

|

|

| |

● |

work with the customer to select and design the parts to be fabricated from Liquidmetal alloys; |

| |

|

|

| |

● |

make the molds and tooling to be used to produce the selected part; |

| |

|

|

| |

● |

make prototypes and samples for customer testing; |

| |

|

|

| |

● |

work with our customers to test and analyze prototypes and samples; and |

| |

|

|

| |

● |

with respect to some types of products, such as medical devices, obtain regulatory approvals. |

We believe that our average sales cycle (the time we deliver a proposal to a customer until the time our customer fully integrates our Liquidmetal alloys into its product) could be a significant period of time. Our history to date has demonstrated that the sales cycle could extend beyond one year. The time it takes to transition a customer from limited production to full-scale production runs will depend upon the nature of the processes and products into which our Liquidmetal alloys are integrated. Moreover, we have found that customers often proceed very cautiously and slowly before incorporating a fundamentally new and unique type of material into their products.

After we develop a customer relationship, it may take a significant amount of time for that customer to develop, manufacture, and sell finished goods that incorporate our components and products.

Our experience has shown that our customers will perform numerous tests and extensively evaluate our components and products before incorporating them into their finished products. The time required for testing, evaluating, and designing our components and products into a customer’s products, and in some cases, obtaining regulatory approval, can be significant, with an additional period of time before a customer commences volume production of products incorporating our components and products, if ever. Moreover, because of this lengthy development cycle, we may experience a delay between the time we accrue expenses for research and development and sales and marketing efforts and the time when we generate revenue, if any. We may incur substantial costs in an attempt to transition a customer from initial testing to prototype and from prototype to final product. If we are unable to minimize these transition costs, or to recover the costs of these transitions from our customers, our operating results will be adversely affected.

A limited number of our customers generate a significant portion of our revenue.

For the near future, we expect that a significant portion of our revenue may be concentrated in a limited number of customers. A reduction, delay, or cancellation of orders from one or more of these customers or the loss of one or more customer relationships could significantly reduce our revenue and harm our business. Unless we establish long-term sales arrangements with these customers, they will have the ability to reduce or discontinue their purchases of our products on short notice.

We expect to rely on our customers and licensees to market and sell finished goods that incorporate our products and components, a process over which we will have little control.

Our future revenue growth and ultimate profitability will depend in part on the ability of our customers and licensees to successfully market and sell their finished goods that incorporate our products. We may have little control over our customers’ and licensees’ marketing and sales efforts. These marketing and sales efforts may be unsuccessful for various reasons, any of which could hinder our ability to increase revenue or achieve profitability. For example, our customers may not have or devote sufficient resources to develop, market, and sell their finished goods that incorporate our products. Because we typically will not have exclusive sales arrangements with our customers, they will not be precluded from exploring and adopting competing technologies. Also, products incorporating competing technologies may be more successful for reasons unrelated to the performance of Liquidmetal products or the marketing efforts of our customers and licensees.

Risk Related to Technological and Intellectual Property

Our growth depends on our ability to identify, develop, and commercialize new applications for our technology.

Our future growth and success will depend in part on our ability to identify, develop, and commercialize, either alone or in conjunction with our customers and partners, new applications and uses for Liquidmetal alloys. If we are unable to identify and develop new applications, we may be unable to develop new products or generate additional revenue. Successful development of new applications for our products may require additional investment, including costs associated with research and development and the identification of new customers. In addition, difficulties in developing and achieving market acceptance of new products would harm our business.

We may not be able to effectively compete with current suppliers of incumbent materials or producers of competing products.

The future growth and success of our Liquidmetal alloy business will depend in part on our ability to establish and retain a technological advantage over other materials for our targeted applications. For many of our targeted applications, we will compete with manufacturers of similar products that use different materials many of which have substantially greater financial and other resources than we do. These different materials may include plastics, zinc, titanium alloys, metal injection molding, or stainless steel, among others, and we will compete directly with suppliers of the incumbent material. In addition, in each of our targeted markets, our success will depend in part on the ability of our customers to compete successfully in their respective markets. Thus, even if we are successful in replacing an incumbent material in a finished product, we will remain subject to the risk that our customer will not compete successfully in its own market.

Our bulk amorphous alloy technology is still at an early stage of commercialization relative to many other materials.

Our bulk amorphous alloy technology is a relatively new technology as compared to many other material technologies, such as plastics and widely-used high-performance crystalline alloys. Historically, the successful commercialization of a new material technology has required the persistent improvement and refining of the technology over a sometimes lengthy period of time. Accordingly, we believe that our company’s future success will be dependent on our ability to continue expanding and improving our technology platform by, among other things, constantly refining and improving our processes, optimizing our existing amorphous alloy compositions for various applications, and developing and improving new bulk amorphous alloy compositions. Our failure to further expand our technology base could limit our growth opportunities and hamper our commercialization efforts.

Future advances in materials science could render Liquidmetal alloys obsolete.

Academic institutions and business enterprises frequently engage in the research and testing of new materials, including alloys and plastics. Advances in materials science could lead to new materials that have a more favorable combination of performance, processing, and cost characteristics than our alloys. The future development of any such new materials could render our alloys obsolete and unmarketable or may impair our ability to compete effectively.

Risks Related to Human Resources

Our growth depends upon our ability to retain and attract a sufficient number of qualified employees.

Our business is based upon the commercialization of a new and unique materials technology. Our future growth and success will depend in part on our ability to retain key members of our management and engineering staff, who are familiar with this technology and the potential applications and markets for it. We do not have “key man” or similar insurance on any of the key members of our management and engineering staff. If we lose their services or the services of other key personnel, our financial results or business prospects may be harmed. Additionally, our future growth and success will depend in part on our ability to attract, train, and retain scientific engineering, manufacturing, sales, marketing, and management personnel. We cannot be certain that we will be able to attract and retain the personnel necessary to manage our operations effectively. Competition for experienced executives and engineers from numerous companies and academic and other research institutions may limit our ability to hire or retain personnel on acceptable terms. In addition, many of the companies with which we compete for experienced personnel have greater financial and other resources than we do. Moreover, the employment of otherwise highly qualified non-U.S. citizens may be restricted by applicable immigration laws.

We may not be able to successfully identify, consummate, integrate, or derive benefit from strategic partnerships.

As part of our business strategy, we intend to pursue strategic partnering transactions that provide access to new technologies, products, markets, and manufacturing capabilities. These transactions could include licensing agreements, joint ventures, or business combinations. We believe that these transactions will be particularly important to our future growth and success due to the size and resources of our company and the novel nature of our technology. For example, we may determine that we may need to license our technology to a larger manufacturer in order to penetrate a particular market. In addition, we may pursue transactions that will give us access to new technologies that are useful in connection with the composition, processing, or application of Liquidmetal alloys. We may not be able to successfully identify any potential strategic partnerships. Even if we do identify one or more potentially beneficial strategic partners, we may not be able to consummate transactions with these strategic partners on favorable terms or obtain the benefits we anticipate from such a transaction.

Risks Related to Our Global Business, Litigation, Laws and Regulation

We may derive some portion of our revenue from sales outside the United States, which may expose the Company to foreign commerce risks.

We may sell a portion of our products to customers outside of the United States, and our operations and revenue may be subject to risks associated with foreign commerce, including transportation delays and foreign tax and legal compliance. Moreover, customers may sell finished goods that incorporate our components and products outside of the United States, which indirectly expose us to additional foreign commerce risks.

A substantial increase in the price or interruption in the supply of raw materials for our alloys could have an adverse effect on our profitability.

Our proprietary alloy compositions are comprised of many elements, all of which are generally available commodity products. Although we believe that each of these raw materials is currently readily available in sufficient quantities from multiple sources on commercially acceptable terms, if the prices of these materials substantially increase or there is an interruption in the supply of these materials, such increase or interruption could adversely affect our profitability. For example, if the price of one of the elements included in our alloys substantially increases, we may not be able to pass the price increase on to our customers.

Our business could be subject to the potentially adverse consequences of exchange rate fluctuations.

We expect to conduct business in various foreign currencies and will be exposed to market risk from changes in foreign currency exchange rates and interest rates. Fluctuations in exchange rates between the U.S. dollar and such foreign currencies may have a material adverse effect on our business, results of operations, and financial condition and could specifically result in foreign exchange gains and losses. The impact of future exchange rate fluctuations on our operations cannot be accurately predicted. To the extent that the percentage of our non-U.S. dollar revenue derived from international sales increases in the future, our exposure to risks associated with fluctuations in foreign exchange rates will increase further.

Our inability to protect our licenses, patents, trademarks, and proprietary rights in the United States and foreign countries could harm our business.

We own several patents relating to amorphous alloy technology, and we have other rights to amorphous alloy patents through an exclusive license from Caltech. Our success depends in part on our ability to obtain and maintain patent and other proprietary right protection for our technologies and products in the United States and other countries. If we are unable to obtain or maintain these protections, we may not be able to prevent third parties from using our proprietary rights. Specifically, we must:

| |

● |

protect and enforce our owned and licensed patents and intellectual property; |

| |

● |

exploit our owned and licensed patented technology; and |

| |

● |

operate our business without infringing on the intellectual property rights of third parties. |

Our licensed technology is comprised of several issued United States patents covering the composition, method of manufacturing, and application and use of the family of Liquidmetal alloys. We also hold several United States and corresponding foreign patents covering the manufacturing processes of Liquidmetal alloys and their use. Those patents have expiration dates between 2022 and 2039. The laws of some foreign countries do not protect proprietary rights to the same extent as the laws of the United States, and we may encounter significant problems and costs in protecting our proprietary rights in these foreign countries.

In August 2010, we entered into a license transaction with Apple pursuant to which (i) we contributed substantially all of our intellectual property assets to a special-purpose, wholly-owned subsidiary, Crucible Intellectual Property (“CIP”), (ii) CIP granted to Apple a perpetual, worldwide, fully-paid, exclusive license to commercialize such intellectual property in the field of consumer electronic products, as defined in the license agreement, and (iii) CIP granted back to us a perpetual, worldwide, fully-paid, exclusive license to commercialize such intellectual property in all other fields of use.

Patent law is still evolving relative to the scope and enforceability of claims in the fields in which we operate. Our patent protection involves complex legal and technical questions. Our patents and those patents for which we have license rights may be challenged, narrowed, invalidated, or circumvented. We may be able to protect our proprietary rights from infringement by third parties only to the extent that our proprietary technologies are covered by valid and enforceable patents or are effectively maintained as trade secrets. Furthermore, others may independently develop similar or alternative technologies or design around our patented technologies. Litigation or other proceedings to defend or enforce our intellectual property rights could require us to spend significant time and money and could otherwise adversely affect our business.

Other companies or individuals may claim that we infringe their intellectual property rights, which could cause us to incur significant expenses or prevent us from selling our products.

Our success depends, in part, on our ability to operate without infringing on valid, enforceable patents or proprietary rights of third parties and without breaching any licenses that may relate to our technologies and products. Future patents issued to third parties may contain claims that conflict with our patents and that compete with our products and technologies, and third parties could assert infringement claims against us. Any litigation or interference proceedings, regardless of their outcome, may be costly and may require significant time and attention from our management and technical personnel. Litigation or interference proceedings could also force us to:

| |

● |

stop or delay using our technology; |

| |

● |

stop or delay our customers from selling, manufacturing or using products that incorporate the challenged intellectual property; |

| |

● |

enter into licensing or royalty agreements that may be unavailable on acceptable terms. |