After a glitzy roadshow, Ferrari's long-awaited initial public

offering is finally at the starting line, with the stock likely to

be priced Tuesday and the first day of trading on the New York

Stock Exchange expected Wednesday.

Investors will be carefully watching the stock's initial

performance, given the rich price range set for the new shares and

a difficult IPO market.

Fiat Chrysler Automobiles NV is selling about 10% of Ferrari in

the IPO. At the top of its projected range of $48 to $52 a share,

the sports-car maker would have a stock-market value of $9.8

billion.

That range is much higher than most initial forecasts when plans

for the IPO were first announced a year ago, but below what Fiat

Chrysler had targeted.

Sergio Marchionne, chairman of Ferrari and chief executive of

Fiat Chrysler, has been talking up Ferrari for the past week at a

roadshow that featured Ferraris parked in prominent places in

Manhattan and that kicked off with a luncheon at New York's St.

Regis hotel, where more than 200 people filled the rooftop ballroom

and mingled in two overflow rooms.

The roadshow also stopped in Boston before crossing the Atlantic

to London. At one event in London, it drew 200 people, double the

expected number.

Mr. Marchionne and Ferrari Chief Financial Officer Alessandro

Gili also wooed potential investors at Ferrari's historic

headquarters in Maranello, in northern Italy, and were scheduled to

make final stops in San Francisco and Los Angeles before the share

pricing.

Ferrari's fair value has been a point of intense debate among

analysts and investors since the beginning. Right after the

announcement, many analysts put Ferrari's value at between $5

billion and $7 billion. Though a valuation approaching $10 billion

is regarded as a victory for Mr. Marchionne, he initially had been

pushing for as much as $13.5 billion.

At the top end of the price range Ferrari is reasonably priced

and "may be a very appealing opportunity," said Brian Hamilton,

chairman of Sageworks, which does financial analysis of privately

held companies.

Though major stock markets have rebounded lately, Ferrari will

be facing a skittish IPO market. In recent weeks, Digicel Group

Ltd., Neiman Marcus Group and Albertsons Cos. have canceled or

postponed public offerings.

Mr. Marchionne has argued that Ferrari is recession-proof, as

evidenced by its strong financial results throughout the downturn

that began in 2007, which battered other car makers and

luxury-goods companies. Ferrari revenue and profit fell in 2009 at

the depth of the downturn, but then quickly rebounded to precrisis

levels and have continued to grow.

Such a strong performance has been typical of Ferrari, which,

according to some analysts, accounts for more than a third of Fiat

Chrysler's overall market value. Ferrari's operating profit margin

is triple that of its parent's; it makes up 12% of Fiat Chrysler's

operating profit, even though it brings in just 3% of its

revenue.

"While Ferrari serves as a luxury brand and a prestige builder

for Fiat Chrysler, it also provides a significant amount of revenue

and earnings for its parent company," said Mr. Hamilton.

Intentionally capping production at about 7,000 vehicles a year

has been a pillar of Ferrari's strategy, adding scarcity value. On

average, new customers spend a year on its waiting list before they

take possession of their Ferrari.

Now, Mr. Marchionne, who has personally handled the bulk of the

presentations during the roadshow while sporting his trademark

sweater-shirt combo, is getting ready to change course.

In its IPO prospectus, Ferrari said it would boost production in

2019 to 9,000 vehicles, close to the 10,000 that Mr. Marchionne

says the company could sell annually without damaging its prestige.

He has proposed increasing sales in markets such as China—where

demand is still hot despite a slowdown in the luxury market—while

keeping them largely steady in mature markets like the U.S. and

Europe.

"We now believe [production of 9,000 cars] is conservative,"

said Adam Wyden, managing member with ADW Capital Management LLC,

who attended Ferrari's presentation in New York. "Mr. Marchionne,

during the roadshow, said Ferrari will produce 7,700 vehicles in

2015. That would put Ferrari's growth rate on track to be above

10,000 units by 2019."

After selling about 10% of Ferrari in the IPO, Fiat Chrysler

plans to distribute the other 80% it owns to its shareholders early

next year. The remaining 10% of Ferrari is owned by Piero Ferrari,

son of the company's founder, Enzo Ferrari.

Following the spinoff, Italy's Agnelli family, the largest

shareholder in Fiat Chrysler, will own about a quarter of Ferrari.

The family's stake, coupled with that of Mr. Ferrari, who has said

he has no plans to sell, as well as a loyalty share program, which

gives longer-term shareholders extra voting rights, will protect

Ferrari from unwanted suitors.

UBS Group AG is the IPO's lead underwriter and is being helped

by Bank of America Corp., Allen & Co., Banco Santander SA, BNP

Paribas SA, J.P. Morgan Chase & Co. and Mediobanca.

Write to Eric Sylvers at eric.sylvers@wsj.com and Jeff Bennett

at jeff.bennett@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 18, 2015 20:55 ET (00:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

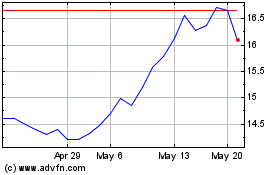

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

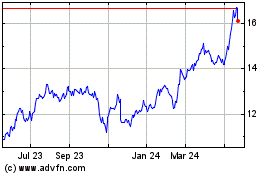

Mediobanca Banca Di Cred... (PK) (USOTC:MDIBY)

Historical Stock Chart

From Feb 2024 to Feb 2025