Talon International Announces New $8.5 Million Credit Facility With Union Bank

08 January 2014 - 12:00AM

Marketwired

Talon International Announces New $8.5 Million Credit Facility With

Union Bank

Debt Refinancing Sets Stage for Growth

LOS ANGELES, CA--(Marketwired - Jan 7, 2014) - Talon

International, Inc. (OTCQB: TALN), a leading global supplier of

custom zippers and apparel accessories, today announced that it

finalized a new $8.5 million credit facility agreement with Union

Bank, N.A. on December 31, 2013, consisting of a $5.0 million term

loan and a $3.5 million revolving credit facility.

Talon immediately used proceeds from the term loan and $1.0

million of the revolving credit facility to repay in full the

company's $5.8 million of indebtedness to CVC California, LLC that

was scheduled to mature on January 12, 2014. Amounts outstanding

under the revolving credit facility mature in two years and the

term loan is a fully amortized loan payable monthly over three

years. Outstanding amounts bear interest at favorable market

rates and the credit facility is secured by substantially all of

Talon assets.

"We are delighted to obtain this new credit facility from Union

Bank, and particularly on attractive terms," said Lonnie Schnell,

Talon's Chief Executive Officer. "Refinancing the promissory

note from our former preferred stockholder is the final step in our

July 2013 redemption of all of our preferred shares and is an

important milestone in our multi-year effort to strengthen Talon's

capital structure." In addition to refinancing the promissory note,

the credit agreement provides Talon access to additional working

capital to fund strategic growth initiatives.

"Our presence in the U.S., Europe and Southeast Asia is a

significant competitive advantage that positions Talon to serve

leading retailers and apparel manufacturers worldwide. Improved

access to working capital will enable us to leverage this advantage

by continuing to invest in sales, marketing and new product

development initiatives to expand and strengthen our market

position. With our improved financial strength and flexibility, we

are positioned better than ever to deliver sustained profitable

growth and value to our stockholders," concluded Schnell.

"Over the past several years, Talon has demonstrated a highly

successful turnaround," said Rudy Cedillos, Vice President of Union

Bank. "The company is now poised for new growth and this financing

will provide Talon the flexibility and resources it needs to

execute on its growth strategy. Union Bank is proud to support

Talon and looks forward to a long and mutually beneficial

relationship."

About Talon International, Inc. Talon International, Inc. is a

major supplier of custom zippers, complete trim solutions and

stretch technology products to manufacturers of fashion apparel,

specialty retailers, mass merchandisers, brand licensees and major

retailers worldwide. Talon develops, manufactures and distributes

custom zippers exclusively under its Talon® brand ("The World's

Original Zipper Since 1893"); designs, develops, manufactures, and

distributes complete apparel trim solutions and products; and

provides stretch technology for specialty waistbands all under its

trademark and world renowned brands, Talon®, and TekFit® to major

apparel brands and retailers. Leading retailers worldwide recognize

and use Talon products including Abercrombie and Fitch, Polo Ralph

Lauren, Kohl's, J.C. Penney, FatFace, Victoria's Secret, Wal-Mart,

Tom Tailor, Phillips-Van Heusen, Juicy Couture, and many others.

The company is headquartered in the greater Los Angeles area, and

has offices and facilities throughout the United States, United

Kingdom, Hong Kong, China, Taiwan, India, Indonesia and

Bangladesh.

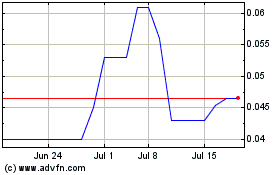

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Nov 2024 to Dec 2024

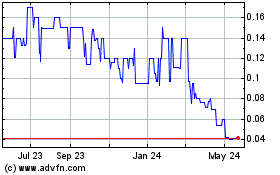

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Dec 2023 to Dec 2024