UCASU Confirmed $0.10/share Dividend

Plan and Strongly Optimistic for 2022 on Annual Meeting

Atlanta, GA -- November 19, 2021 -- InvestorsHub NewsWire --

During its annal shareholder meeting on yesterday, UC Asset LP

(OTCQX:

UCASU), confirmed its dividend plan of $0.10 or more per share,

and made a strongly optimistic projection for the year of 2022.

The meeting was chaired by the company's Executive Director

Christal Jordan, who announced at 9:00 am Eastern time that the

meeting started without any motions from either the manager or any

shareholders to request a shareholder voting on any business

matters. Jordan also cautioned that the discussion might

contain forward-looking statements which investors should no place

due reliance on.

Greg Bankston, managing general partner of UC Asset, reported to

shareholders on the operation of the company during the fiscal year

of 2021. He outlined the continuous transition of UC Asset from

"house-flip" investor into a more innovative investor on a variety

of properties, namely, cannabis properties, Airbnb-based SHOC

properties and historic landmarks. He then explained each of the

three investment strategies in greater detail.

"We acquired our first SHOC Airbnb property in June. It is a

triplex, located within a block of Martin Luther King Jr.

Center, a few blocks from the Jimmy Carter Center, and right

across the expressways is downtown Atlanta where you have companies

such as Georgia Pacific, Coca Cola world headquarters. We are

partnering with a local management company that will manage the

operations. Based upon the numbers from our management partner, the

internal rate of return (IRR) for us as the property owner could be

as high as 33%."

Later, UC Asset founder Larry Wu corrected that the 33% number

is based on the previous floor plan. After adjustment of floor plan

due to city regulation, the IRR has been adjusted down to 26%-31%.

Still, Wu pointed out that the projection was based on average

Airbnb performance. The result might be higher if we consider the

possible competitive advantage of SHOC.

Bankston moved on to the second investment strategy, historic

landmarks of which the intangible value may sold as NFTs

(non-fungible tokens) by UC Asset's franchised technology

partners.

Bankston said that NFT and Metaverse is one of the hottest

topics, particularly among young generation. But even without NFT,

the first landmark building UC Asset acquired, the Rufus Rose

House, is a valuable commercial property. "It sits right in the

heart of downtown Atlanta, only one block from this city's tallest

skyscraper. And there are two new buildings going up on each side

of the Rufus Rose house. So we are truly excited about its value as

an income-producing commercial property. Still, we believe that our

NFT partnership, if successful, may generate an additional 50 to

100% return over next few years," explained Bankston.

In the third section of his speech, Bankston talked about

cannabis property, claiming that it was an idea the management had

kicked around for five years, but it was only most recently the

political climate had become more favorable, and success cases of

other public companies, such as Innovative Industrial Properties

(NYSE: IIPR) and Power REIT (NYSE: PW), had become more

convincing.

Bankston then disclosed more details about the pipeline the

company is building in relation to cannabis properties. "We are not

just looking within the State of Georgia. We are looking at places

in Oklahoma, Michigan, and California,"said Bankston.

After Bankston's presentation, UC Asset founder Larry Wu

reaffirmed the company's plan to distribute a dividend of $0.10 per

share for the year 2021, and he added that, subject to audited

financials, the management may decide on a higher amount of

dividend. "There are still more than 40 days of 2020 so anything

may still happen, but we are pretty optimistic that we will be able

to fulfill this dividend plan, " said Wu.

Wu made a strongly optimistic projection on the coming year. "We

are doing good this year; implementing three new investment

strategies. Looking into 2022, I believe that at least one of them,

maybe all three of them, will explode into fast growth. And we will

likely see great numbers come back in 2022, perhaps much better

than this year. "

A minutes of the meeting, after transcribed and edited, will be

published on the company's website in the coming weeks.

About UC Asset LP

UC Asset LP is a limited partnership

formed for the purpose of investing in real estate with innovative

strategies, concentrating in metropolitan areas of Atlanta,

GA. For more

information about UC Asset, please visit: www.ucasset.com

Disclaimer:

This News Release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause our

actual results, performance or achievements, or industry results,

to differ materially from any these statements. You are cautioned

not to place undue reliance on any those forward-looking

statements. Except as otherwise required by the federal securities

laws, we undertake no obligation to publicly update or revise any

forward-looking statements after the date of this news release.

None of such forward-looking statements should be regarded as a

representation by us or any other person that the objectives and

plans set forth in this News Release will be achieved or be

executed.

For More Information Contact:

Christal Jordan | Executive Director, UC Asset LP

cjordan@ucasset.com |

678-499-0297

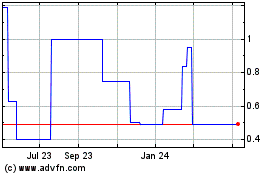

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Mar 2024 to Apr 2024

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Apr 2023 to Apr 2024