Cannabis Sector Dark Horse Amassing War Chest

02 December 2021 - 2:09AM

InvestorsHub NewsWire

December 1, 2021 -- InvestorsHub NewsWire -- via pennymillions

--

Puration, Inc.

(PURA)

built a promising foothold in the sports nutrition marketplace with

a CBD infused beverage called EVERx, then handed it off to its

sister company, North American Cannabis Holdings, Inc.

(USMJ). Both USMJ and PURA are controlled by the same

majority shareholder, ACI

Conglomerated.

PURA gave up a

promising foothold to otherwise pursue what initially appeared to

be a vague and nebulous branding strategy ostensibly on behalf of

the entire hemp industry. It sounded a bit pie-in-the-sky

without a clear revenue

model.

A year or so

later, PURA’s Farmersville Hemp Brand vision is starting to come

into focus and PURA appears to be very creatively amassing what

could be a substantial war chest to back a campaign that just might

actually advance the brand recognition of industrial hemp

worldwide.

PURA recently

put out shareholder letter from its CEO Brian Shibley in which he

described three sources of revenue – education, branding, and

partnership. Yesterday, PURA published a follow up to the

shareholder letter specifically addressing the partnership revenue

potential:

PURA

Highlights Dark Horse Potential To Substantially Exceed $1M Revenue

Forecast

The

partnership revenue potential is pretty intriguing and looks to be

a very compelling resource that has the potential to give PURA a

substantial war chest to fund its Farmersville Hemp Brand

vision.

PURA’s

Subtle War Chest Construction That Could Make It A Cannabis Sector

Standout

From PURA’s

financial reports published on OTC Markets, you can find that PURA

has made a $1 million investment into an entity called QP Agritech

Partners LLC. A quick google search later, you find that QP

Agritech Partners LLC is controlled by Stern Aegis, the venture arm

of Aegis Capital Corp. QP Agritech has raised tens of

millions in total. We can only speculate, but given that PURA

is in the hemp/cannabis business and Stern Aegis is in the venture

investment business, it’s a fair bet that QP Agritech with tens of

millions in the bank, is backing a rather substantial cannabis

venture.

Stern Aegis

has made pre-ipo investments in companies that include Airbnb,

SpaceX, Impossible Foods and Hydrofarms among many

others.

PURA’s

“partnership” strategy, as the CEO emphasized in his press release

yesterday, could indeed be a dark horse revenue contributor to PURA

in 2021.

PURA’s

partnership strategy also includes a deal with a publicly traded

real estate company that has recently entered the cannabis space

funding cannabis real estate. PURA and UC Asset (UCASU)

have entered into a deal where UCASU is financing the construction

or PURA’s facilities in Farmersville, Texas. UCASU is also

backing PURA real estate investments in Farmersville Hemp Brand

partners.

In yet a third

partnership, PURA has acquired a 5% interest in Alkame Holdings,

Inc. (ALKM),

a co-packer with a specialty in cannabis

products.

PURA, in

connection with its relationship with ACI Conglomerated, seems to

have years of experience and relationships in the cannabis

sector. The move away from EVERx’s promising foothold may

seem baffling at first, but after looking under PURA’s covers,

particularly at its partnership strategy, PURA may indeed be a

hemp/cannabis sector dark horse.

Source - https://www.pennymillions.com/blog/0w5lr20xmylawrtxk5vakwjffo9fjn

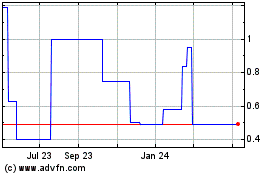

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Mar 2024 to Apr 2024

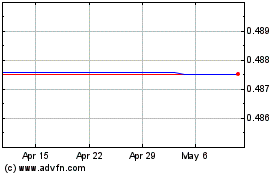

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Apr 2023 to Apr 2024