Amended Statement of Beneficial Ownership (sc 13d/a)

26 January 2017 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

ULTRAPETROL (BAHAMAS) LIMITED

(Name of Issuer)

Common Stock, Par Value $0.01 Per Share

(Title of Class of Securities)

P94398107

(CUSIP Number)

|

Sparrow Capital Investments Ltd.

c/o Southern Cross Group

Dr. Luis Bonavita 1294

Innovation Center, Suite 102

Montevideo CP 11,300 Uruguay

Attention: Gonzalo Alende Serra

Tel: (598) 2626-2310

Copy to:

Chadbourne & Parke LLP

1301 Avenue of the Americas

New York, NY 10019

Attention: Morton E. Grosz

Tel.: (212) 408-5592

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

January 17, 2017

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [ ]

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Sparrow Capital Investments Ltd.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

The Bahamas

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

2

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Sparrow CI Sub Ltd.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

The Bahamas

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

3

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Triton Shipping Ltd.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

The Bahamas

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

4

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Quattro Shipping Holdings Ltd.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

AF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

The Bahamas

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

5

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Southern Cross Latin America Private Equity Fund III, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Ontario, Canada

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

PN

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

6

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Southern Cross Capital Partners III, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Ontario, Canada

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

PN

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

7

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

SC GP Company III

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

8

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Southern Cross Latin America Private Equity Fund IV, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Ontario, Canada

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

PN

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

9

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

Southern Cross Capital Partners IV, L.P.

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Ontario, Canada

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

PN

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

10

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

SC GP Company IV Limited

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Ireland

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

119,266,821*

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

84.7%

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

* Represents (i) 103,206,821 shares of common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow Capital Investments Ltd., and (ii) 16,060,000 shares of

common stock of Ultrapetrol (Bahamas) Limited held for the account of

Sparrow CI Sub Ltd. See Item 5 of this Schedule 13D.

11

This Amendment No. 7 to Schedule 13D ("

Amendment No. 7

") relates to the Common Stock, par value $0.01 per share, of Ultrapetrol (Bahamas) Limited, a Bahamas corporation (the "

Issuer

"), which has its principal executive office at Ocean Centre, Montagu Foreshore, East Bay St., Nassau, Bahamas, P.O. Box SS-19084. This Amendment No. 7 amends and supplements, as set forth below, the Schedule 13D filed by the Reporting Persons with respect to the Issuer on December 20, 2012, Amendment No. 1 thereto filed on June 14, 2013, Amendment No. 2 thereto filed on February 24, 2014, Amendment No. 3 thereto filed on July 15, 2014, Amendment No. 4 thereto filed on September 8, 2014, Amendment No. 5 thereto filed on November 18, 2016 and Amendment No. 6 thereto filed on November 29, 2016 (together, the "

Schedule 13D

"). All capitalized terms not otherwise defined herein have the meanings ascribed to them in the Schedule 13D. Only those items amended are reported herein.

ITEM 4. PURPOSE OF TRANSACTION

On January 17, 2017, the Issuer and certain of its subsidiaries entered into a Restructuring Support Agreement (the "Offshore Support Agreement") with certain lenders to the Issuer's offshore business (the "

Supporting Lenders

"), the agents, facility agents or security agents under certain

loans made to the Issuer's offshore subsidiaries by the Supporting Lenders

, Southern Cross Latin America Private Equity Fund III, L.P. and Southern Cross Latin America Private Equity Fund IV, L.P., Sparrow Capital Investments Ltd. and Sparrow CI Sub Ltd., Sparrow Offshore Investments Ltd. and UABL Limited.

The Offshore Support Agreement provides for an out-of-court restructuring of all loans provided to the Issuer's offshore subsidiaries by the Supporting Lenders and the Supporting Lenders' agreement with respect to the transactions contemplated by a joint prepackaged plan of reorganization under Chapter 11 of the Bankruptcy Code (the "

Plan

"), which provides for an implementation of a restructuring of the Issuer's river business through a voluntary bankruptcy case under chapter 11 of title 11 of the United States Code as previously disclosed. In connection with entering into the Offshore Restructuring Agreement, Supporting Lenders and the creditors to the Issuer's river business agreed to a timetable that includes consummation of the Plan on or before March 31, 2017.

The terms and conditions of the Offshore Support Agreement are described in further detail in Exhibit 1 of the Form 6-K of the Issuer filed on January 19, 2017 and Exhibit 99.1 of the Form 6-K of the Issuer filed on January 20, 2017 with the Securities and Exchange Commission and which are hereby incorporated by reference herein.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

The information set forth in Item 4 of this Amendment No. 4 is hereby incorporated by reference in this Item 6.

As discussed in Item 4 above, the parties thereto have executed the Offshore Support Agreement. The description of the Offshore Support Agreement contained in this Item 6 is not intended to be complete and is qualified in its entirety by reference to such agreement, which is filed as an exhibit hereto and incorporated by reference herein.

ITEM 7. MATERIALS TO BE FILED AS EXHIBITS

|

Exhibit I:

|

Restructuring Support Agreement dated as of January 17, 2017

by and among

Ultrapetrol (Bahamas) Limited,

certain lenders to the Issuer's offshore business party thereto, the agents, facility agents or security agents under certain

loans made to the Issuer's offshore subsidiaries party thereto

, Southern Cross Latin America Private Equity Fund III, L.P. and Southern Cross Latin America Private Equity Fund IV, L.P., Sparrow Capital Investments Ltd. and Sparrow CI Sub Ltd., Sparrow Offshore Investments Ltd. and UABL Limited

(incorporated by reference to Exhibit 99.1 of the Form 6-K of Ultrapetrol (Bahamas) Limited filed on January 20, 2017 with the Securities and Exchange Commission)

|

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: January 25, 2017

|

|

SPARROW CAPITAL INVESTMENTS LTD.

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SPARROW CI SUB LTD.

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

TRITON SHIPPING LTD.

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

QUATTRO SHIPPING HOLDINGS LTD.

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SOUTHERN CROSS LATIN AMERICA PRIVATE EQUITY FUND III, L.P.

|

|

|

By: Southern Cross Capital Partners III, L.P., its general partner

|

|

|

By: SC GP Company III, its general partner

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SOUTHERN CROSS CAPITAL PARTNERS III, L.P.

|

|

|

By: SC GP Company III, its general partner

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SC GP COMPANY III

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

13

|

|

SOUTHERN CROSS LATIN AMERICA PRIVATE EQUITY FUND IV, L.P.

|

|

|

By: Southern Cross Capital Partners IV, L.P., its general partner

|

|

|

By: SC GP Company IV Limited, its general partner

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SOUTHERN CROSS CAPITAL PARTNERS IV, L.P.

|

|

|

By: SC GP Company IV Limited, its general partner

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

|

|

|

|

|

SC GP COMPANY IV LIMITED

|

|

|

|

|

|

By:

|

/s/ Ricardo Rodriguez

|

|

|

|

Name: Ricardo Rodriguez

|

|

|

|

Title: Director

|

14

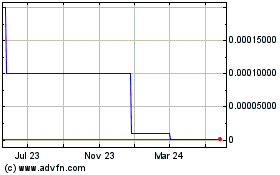

Ultrapetrol Bahamas (CE) (USOTC:ULTRF)

Historical Stock Chart

From Nov 2024 to Dec 2024

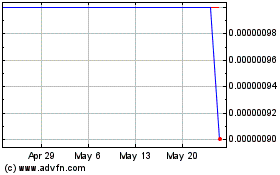

Ultrapetrol Bahamas (CE) (USOTC:ULTRF)

Historical Stock Chart

From Dec 2023 to Dec 2024