Ad hoc announcement - GAM Holding AG releases interim statement for

the three-month period to 31 March 2022

20 April 2022

PRESS RELEASE

Ad hoc announcement pursuant to Art. 53 listing rules:

GAM Holding AG releases

interim statement for the three-month period to

31 March

2022

Financial highlights

- Investment

Management AuM at

CHF

30.0

billion, with

net client outflows of

CHF 270

million and net

negative market and

foreign exchange (FX)

movements of CHF

1.6

billion

- Fund Management

Services AuM at

CHF

64.8

billion, with

net client

inflows of CHF

290

million, offset

by net negative

market and FX movements

of CHF

3.5

billion

- Investment

performance:

73%

of assets under

management outperforming

their benchmark

over 3 years

as at 31 March

2022, compared to 68% as at 31

December 2021

Strategic highlights during first

quarter 2022

- Continued progress of GAM’s

growth strategy reflected by overall net positive client inflows in

the quarter

- Launched strategic

partnership with Liberty Street Advisors to provide clients with

access to late-stage privately owned technology and

innovation-driven companies and a low carbon infrastructure

strategy

- New Head of

Investments, David

Dowsett joined GAM

- GAM achieved a ‘best in

class’ rank in 4 out of 15 factors in Citywire European Fund

Selector survey and top rated for accessibility of fund managers

amongst 50 asset managers

- GAM funds

won several Refinitiv Lipper

awards in Austria, France,

Germany, Switzerland, the

UK and for Europe overall

-

Financial

Conduct Authority

publication of final

notice relating to the

settlement previously announced in

December, bringing these

matters to a close

- Returned

over 100% of the value of the GAM

Greensill Supply Chain Finance Fund to

clients marking the end of our

legacy business relationship with

Greensill

Peter Sanderson, Group CEO, said: “This has

been an encouraging first quarter for GAM with net positive inflows

for the firm overall. I am pleased that, despite pressure on the

level of assets under management in the current market environment,

our Investment Management business continues to improve with net

inflows across a range of strategies and reduced outflows from our

larger fixed income strategies.”

Assets under Management

As at 31 March 2022, Group AuM totalled CHF 94.8 billion

down from CHF 100.0 billion as at the end of December

2021.

Investment Management

AuM totalled CHF 30.0 billion, down from CHF 31.9 billion as at

31 December 2021, with net client outflows of CHF 270 million,

and net negative market and foreign exchange movements of

CHF 1.6 billion.

Net flows by capability

In fixed income, we recorded net outflows of CHF 396 million,

primarily driven by outflows in the GAM Star Credit Opportunities

and Local Emerging Bond funds, offset by inflows into GAM Star Cat

Bonds and GAM Star MBS funds.

In equities, we saw another positive quarter with net inflows of

CHF 28 million. While inflows were driven by a variety of funds,

the main contributors were our GAM Star Continental European Equity

and GAM Emerging Markets funds.

In multi asset, systematic and alternatives, we saw net inflows

CHF 44 million, CHF16 million and CHF 67 million respectively.

Assets under management movements (CHF bn)

|

Capability |

Opening AuM31 Dec 2021 |

Net clientflows |

Market/FXmovements |

Closing AuM31 Mar 2022 |

|

Fixed Income |

14.1 |

(0.40) |

(0.46) |

13.2 |

|

Equity |

8.0 |

0.03 |

(1.08) |

7.0 |

|

Multi asset |

7.7 |

0.04 |

(0.20) |

7.5 |

|

Systematic |

1.2 |

0.02 |

0.08 |

1.3 |

|

Alternatives |

0.4 |

0.07 |

0.03 |

0.5 |

|

Absolute Return |

0.5 |

(0.03) |

0.00 |

0.5 |

|

Total |

31.9 |

(0.27) |

(1.63) |

30.0 |

Investment performance

Over the three-year period to 31 March 2022, 73% of AuM in

investment management outperformed their benchmarks compared to 68%

as at the end of December 2021. Over the five-year period to 31

March 2022, 51% of funds outperformed their benchmarks, down from

60% as at 31 December 2021. With respect to GAM’s AuM tracked by

Morningstar 56% and 71% outperformed their peer groups over the

three- and five-year periods as at 31 March 2022, respectively,

compared to 70% and 62%, respectively, as at 31 December 2021.

Fund Management Services

Our Fund Management Services business reported AuM of CHF 64.8

billion, as at 31 March 2022, compared to CHF 68.0 billion as at 31

December 2021.

Assets under management movements (CHF bn)

|

Fund domicile |

Opening AuM 31 Dec 2021 |

Net flows |

Market/FX movements |

Closing AuM 31 Mar 2022 |

|

Switzerland |

14.4 |

0.16 |

(0.31) |

14.3 |

|

Rest of Europe |

53.6 |

0.13 |

(3.21) |

50.5 |

|

Total |

68.0 |

0.29 |

(3.52) |

64.8 |

On 30 March 2022, a Fund Management Services client announced

their intention to insource their funds to their own management

company from April 2023. As at 31 December 2021, the relevant

assets under management were CHF 11.5 billion with associated

revenues of approximately CHF 6 million per annum. The client will

be moving approximately CHF 10.5 billion of funds and approximately

CHF 1.0 billion will remain with GAM.

Outlook

We expect the market environment to remain challenging, with

continuing geopolitical uncertainty, further increases in interest

rates and a medium-term low growth outlook. However, we are

encouraged by our improved momentum so far in 2022 and believe that

clients will continue to be attracted by our distinctive range of

investment products and fund solutions, which can help them address

their investment needs in this challenging environment.

Upcoming events:

28 April

2022

Annual General Meeting3 August

2022 Half-year

results 202220 October

2022 Q3 2022

Interim management statement

For further information please contact:

Charles Naylor

Head of

Communications and Investor RelationsT +44 7890 386 699

Investor

Relations Media

Relations Stephen

Gardner Ute Dehn

Christen T +44 7790

778544 T +41 58 426 31

36

Visit us: www.gam.comFollow us: Twitter and LinkedIn

About GAM

GAM is a leading independent, pure-play asset manager. The

company provides active investment solutions and products for

institutions, financial intermediaries, and private investors

through three businesses: Investment Management, Fund Management

Services and Wealth Management. GAM employed 605 FTEs in 14

countries with investment centres in London, Cambridge, Zurich,

Hong Kong, New York, Milan, and Lugano as at 31 December 2021. The

investment managers are supported by an extensive global

distribution network. Headquartered in Zurich, GAM is listed on the

SIX Swiss Exchange with the symbol ‘GAM’. The Group has AuM of CHF

94.8 billion (USD 103 billion) as at 31 March 2022.

Disclaimer regarding forward-looking

statements

This press release by GAM Holding AG (‘the Company’) includes

forward-looking statements that reflect the Company’s intentions,

beliefs or current expectations and projections about the Company’s

future results of operations, financial condition, liquidity,

performance, prospects, strategies, opportunities, and the industry

in which it operates. Forward-looking statements involve all

matters that are not historical facts. The Company has tried to

identify those forward-looking statements by using words such as

‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’,

‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’,

‘continue’ and similar expressions. Such statements are made on the

basis of assumptions and expectations which, although the Company

believes them to be reasonable at this time, may prove to be

erroneous.

These forward-looking statements are subject to risks,

uncertainties, assumptions and other factors that could cause the

Company’s actual results of operations, financial condition,

liquidity, performance, prospects or opportunities, as well as

those of the markets it serves or intends to serve, to differ

materially from those expressed in, or suggested by, these

forward-looking statements. Important factors that could cause

those differences include but are not limited to changing business

or other market conditions, legislative, fiscal, and regulatory

developments, general economic conditions, and the Company’s

ability to respond to trends in the financial services industry.

Additional factors could cause actual results, performance, or

achievements to differ materially. The Company expressly disclaims

any obligation or undertaking to release any update of, or

revisions to, any forward-looking statements in this press release

and any change in the Company’s expectations or any change in

events, conditions, or circumstances on which these forward-looking

statements are based, except as required by applicable law or

regulation.

- 2022 04 20 Ad hoc IMS Q1_Media Release_EN

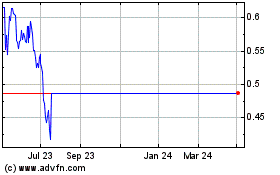

Gam (LSE:0QN3)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gam (LSE:0QN3)

Historical Stock Chart

From Apr 2023 to Apr 2024