TIDMAAEV

Albion Enterprise VCT PLC

LEI Code 213800OVSRDHRJBMO720

As required by the UK Listing Authority's Disclosure Guidance

and Transparency Rule 4.2, Albion Enterprise VCT PLC today makes

public its information relating to the Half-yearly Financial Report

(which is unaudited) for the six months to 30 September 2022. This

announcement was approved by the Board of Directors on 7 December

2022.

The full Half-yearly Financial Report (which is unaudited) for

the period to 30 September 2022, will shortly be sent to

shareholders. Copies of the full Half-yearly Financial Report will

be shown via the Albion Capital Group LLP website by clicking

www.albion.capital/funds/AAEV/30Sep22.pdf.

Investment policy

Albion Enterprise VCT PLC (the "Company") is a Venture Capital

Trust and the investment objective of the Company is to provide

investors with a regular source of income, combined with the

prospect of longer term capital growth.

The Company will invest in a broad portfolio of higher growth

businesses across a variety of sectors of the UK economy including

higher risk technology companies. Allocation of assets will be

determined by the investment opportunities which become available

but efforts will be made to ensure that the portfolio is

diversified both in terms of sector and stage of maturity of

company.

VCT qualifying and non-VCT qualifying investments

Application of the investment policy is designed to ensure that

the Company continues to qualify and is approved as a VCT by HM

Revenue and Customs ("VCT regulations"). The maximum amount

invested in any one company is limited to relevant HMRC annual

investment limits. It is intended that normally at least 80 per

cent. of the Company's funds will be invested in VCT qualifying

investments. The VCT regulations also have an impact on the type of

investments and qualifying sectors in which the Company can make

investment.

Funds held prior to investing in VCT qualifying assets or for

liquidity purposes will be held as cash on deposit, invested in

floating rate notes or similar instruments with banks or other

financial institutions with high credit ratings or invested in

liquid open-ended equity funds providing income and capital equity

exposure (where it is considered economic to do so). Investment in

such open-ended equity funds will not exceed 10 per cent. of the

Company's assets at the time of investment.

Risk diversification and maximum exposures

Risk is spread by investing in a number of different businesses

within Venture Capital Trust qualifying industry sectors using a

mixture of securities. The maximum amount which the Company will

invest in a single company is 15 per cent. of the Company's assets

at cost, thus ensuring a spread of investment risk. The value of an

individual investment may increase over time as a result of trading

progress and it is possible that it may grow in value to a point

where it represents a significantly higher proportion of total

assets prior to a realisation opportunity being available.

Gearing

The Company's maximum exposure in relation to gearing is

restricted to 10 per cent. of its adjusted share capital and

reserves.

Financial calendar

Record date for second dividend 3 February 2023

Payment date for second dividend 28 February 2023

Financial year end 31 March

Financial summary

Audited

Unaudited six months ended Unaudited six months ended year ended

30 September 2022 30 September 2021 31 March 2022

(pence per share) (pence per share) (pence per share)

-------------- -------------------------- -------------------------- -----------------

Opening net

asset value 132.28 114.60 114.60

Capital

(loss)/return (2.13) 18.04 23.78

Revenue

return/(loss) 0.15 (0.94) 0.19

-------------------------- -------------------------- -----------------

Total

(loss)/return (1.98) 17.10 23.97

Dividends paid (3.31) (2.87) (6.09)

Impact from

share capital

movements 0.01 0.02 (0.20)

-------------------------- -------------------------- -----------------

Net asset

value 127.00 128.85 132.28

-------------------------- -------------------------- -----------------

Pence per share

Total dividends paid to 30 September 2022 65.69

Net asset value on 30 September 2022 127.00

---------------

Total shareholder value to 30 September 2022 192.69

--------------------------------------------- ---------------

A more detailed breakdown of the dividends paid per year can be

found at www.albion.capital/funds/AAEV under the 'Dividend History'

section.

In addition to the dividends summarised above, the Board has

declared a second dividend for the year ending 31 March 2023, of

3.18 pence per share to be paid on 28 February 2023 to shareholders

on the register on 3 February 2023.

Interim management report

Introduction

In the six months to 30 September 2022, the Company generated a

total loss of 1.98 pence per share, representing a 1.5% decrease on

the opening net asset value. After 12 months of growth last

financial year (20.7% shareholder return for the year ended 31

March 2022), this relatively small decrease reflects the multiple

headwinds which all enterprises currently face. Following the

payment of the first interim dividend of 3.31 pence per share paid

to shareholders on 31 August 2022, the net asset value ("NAV") at

30 September 2022 was 127.00 pence per share (31 March 2022: 132.28

pence per share). Despite the ongoing uncertainty resulting from

rising interest rates, high levels of inflation and the war in

Ukraine, our portfolio companies continue to show resilience

through the underlying quality of their business offering.

Valuations and results

The total loss on investments for the six months to 30 September

2022 was GBP0.9 million (30 September 2021: gain of GBP15.8

million). The key upward movements in the period resulting from

strong trading include: a GBP1.2 million increase in the valuation

of Threadneedle Software Holdings (T/A Solidatus) and a GBP0.9

million increase in the valuation of Convertr Media.

The challenging economic environment has resulted in falling

valuations in some technology and healthcare companies which has

consequently led to some write-downs in our portfolio. The largest

of these has been Black Swan Data (loss of GBP0.9 million), and

Egress Software Technologies (loss of GBP0.7 million). Although

Egress has been written down in line with falls in market

multiples, we are encouraged that it continues to grow and has the

potential to recover value in time.

Our top 3 portfolio companies now account for 29.3% of the

Company's NAV (30 September 2021: 34.0%; 31 March 2022: 28.8%).

Further details of the portfolio of investments and investment

realisations can be found below.

Dividends

In line with our dividend policy targeting a dividend around 5%

of NAV per annum the Company paid a first interim dividend of 3.31

pence per share during the period to 30 September 2022 (30

September 2021: 2.87 pence per share). The Company will pay a

second interim dividend for the financial year ending 31 March 2023

of 3.18 pence per share on 28 February 2023 to shareholders on the

register on 3 February 2023, being 2.5% of the 30 September 2022

NAV.

This will bring the total dividends paid for the year ending 31

March 2023 to 6.49 pence per share, which equates to a 4.9% yield

on the opening NAV of 132.28 pence per share.

Dividend Reinvestment Scheme ("DRIS")

The Company continues to offer a DRIS whereby shareholders can

elect to receive dividends in the form of new shares. Shareholders

not currently in the DRIS have the option to elect to have their

dividends reinvested into new shares through the DRIS by logging

into their account at www.investorcentre.co.uk. Please note that

shareholders who hold their shares in CREST will need to contact

their CREST service provider.

The terms and conditions for the DRIS can be found on the

Company's webpage on the Manager's website at

www.albion.capital/funds/AAE

https://www.globenewswire.com/Tracker?data=kzdVQO4mM7EKoccqXHXdmZZJ6ztKE9boCwkkOCvdujPnWV0nctQC8IUZ_hQCwCS7pBVVAgq1LM4eLTw2dzbTwA==

V

https://www.globenewswire.com/Tracker?data=bIlau3tcnezGGdJBSaPKFbvq5pcbagWE9_uODxnwpjzCMVlxBV08fcDsdM-ufsMBV6ReNflqqqFyLIYBmshogg==

under the 'Fund reports' section.

Investment activity

During the period the Company has invested GBP4.7 million into

new portfolio companies, comprising:

-- GBP1.3 million into Toqio FinTech Holdings, a provider of embedded

FinTech solutions;

-- GBP0.9 million into PeakData, a provider of insights and analytics to

pharmaceutical companies about therapeutic areas;

-- GBP0.8 million into GX Molecular (T/A CS Genetics), a developer of

single-cell sequencing solutions;

-- GBP0.6 million into OutThink, a SaaS platform to measure and manage human

risk for enterprises;

-- GBP0.6 million into Neurofenix, a neurorehabilitation platform; and

-- GBP0.5 million into Ophelos, an autonomous and ethical debt resolution

platform.

A further GBP2.1 million was invested in supporting our existing

portfolio companies to help them as they continue to grow,

including GBP0.8 million into The Voucher Market (T/A WeGift), and

GBP0.7 million into Gravitee TopCo (T/A Gravitee.io).

Investment portfolio by sector

The pie chart at the end of this announcement shows the

different sectors in which the Company's assets, at carrying value,

were invested on 30 September 2022.

Share buy-backs

It remains the Board's policy to buy-back shares in the market,

subject to the overall constraint that such purchases are in the

Company's interest. This includes the maintenance of sufficient

cash resources for investment in new and existing portfolio

companies and the continued payment of dividends to

shareholders.

It is the Board's intention that such buy-backs should be at

around a 5% discount to net asset value, in so far as market

conditions and liquidity permit.

Transactions with the Manager

Details of transactions with the Manager for the reporting

period can be found in note 5. Details of related party

transactions can be found in note 11.

Risks and uncertainties

The UK is experiencing its highest level of inflation in

decades, rising interest rates, and uncertainty over the future

course, and global impact, of Russia's invasion of Ukraine, in

addition to the risks around Covid-19. Our investment portfolio,

while concentrated principally in the technology and healthcare

sectors, remains diversified in terms of both sub-sector and stage

of maturity.

In accordance with DTR 4.2.7, the Board confirms that the

principal risks and uncertainties facing the Company have not

materially changed from those identified in the Annual Report and

Financial Statements for the year ended 31 March 2022. The current

high levels of inflation and the war in Ukraine have created

heightened uncertainty but have not changed the nature of the

principal risks. The Board considers that the present processes for

mitigating those risks remain appropriate.

The principal risks faced by the Company are:

-- Investment, performance and valuation risk;

-- VCT approval and regulatory change risk;

-- Regulatory and compliance risk;

-- Operational and internal control risk (including cyber and data security);

-- Economic and political risk;

-- Liquidity risk; and

-- Environmental, social and governance ("ESG") risk.

A detailed explanation of the principal risks facing the Company

can be found in the Annual Report and Financial Statements for the

year ended 31 March 2022 on pages 16 to 18, copies of which are

available on the Company's webpage on the Manager's website at

www.albion.capital/funds/AAEV under the 'Financial Reports and

Circulars' section.

Albion VCTs Top Up Offers

Your Board, in conjunction with the boards of the other five

VCTs managed by Albion Capital Group LLP, launched a prospectus top

up offer of new Ordinary shares for subscription in the 2022/23 and

2023/24 tax years on 10 October 2022. The prospectus is available

online at www.albion.capital/vct-hub/current-offers.

The proceeds will be used to provide support to our existing

portfolio companies and to enable us to take advantage of new

investment opportunities, six of which are detailed above.

To ensure efficient Shareholder communication the Board is

actively encouraging Shareholders who are currently receiving hard

copy information to change their preferences to electronic

communications. There are many reasons why we think this is the

right thing to do including being more environmentally friendly,

and the immediacy of getting information to you regarding the

Company and new Offers.

Shareholders can sign up for e-Comms by going to:

www.investorcentre.co.uk/ecomms.

Prospects

Whilst disappointed with the small loss for the period, the

Board remains encouraged by the prospects for our portfolio

companies against a backdrop of multiple macroeconomic and

geopolitical uncertainties and challenges. Our focus on technology

and healthcare, thus minimising exposure to discretionary consumer

expenditure, is designed to help the Company weather uncertain

times. Importantly the Company has the cash resources to capitalise

on exciting new investment opportunities being seen by the Manager

and to support the existing portfolio.

Maxwell Packe

Chairman

7 December 2022

Responsibility statement

The Directors, Maxwell Packe, Christopher Burrows, Rhodri

Whitlock, Pippa Latham and Patrick Reeve, are responsible for

preparing the Half-yearly Financial Report. In preparing these

condensed Financial Statements for the period to 30 September 2022

we, the Directors of the Company, confirm that to the best of our

knowledge:

(a) the condensed set of Financial Statements, which has been prepared in accordance with Financial Reporting Standard 104 "Interim Financial Reporting", give a true and fair view of the assets, liabilities, financial position and profit and loss of the Company as required by DTR 4.2.4R;

(b) the Interim management report includes a fair review of the information required by DTR 4.2.7R (indication of important events during the first six months and description of principal risks and uncertainties for the remaining six months of the year); and

(c) the Interim management report includes a fair review of the information required by DTR 4.2.8R (disclosure of related parties' transactions and changes therein).

This Half-yearly Financial Report has not been audited or

reviewed by the Auditor.

For and on behalf of the Board

Maxwell Packe

Chairman

7 December 2022

Portfolio of investments

On 30 September 2022

Cumulative movement Change in

Fixed asset % voting Cost in value Value value for the period(*)

investments rights GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- -------- ------------------- -------- ------------------------

Quantexa 2.5 2,108 12,422 14,530 -

Egress Software

Technologies 9.9 3,365 9,197 12,562 (745)

Proveca 9.6 1,512 4,799 6,311 79

Oviva 2.8 2,601 2,716 5,317 (40)

Radnor House School

(TopCo) 9.4 1,729 1,640 3,369 (47)

The Evewell Group 6.1 1,477 1,405 2,882 15

Threadneedle

Software Holdings

(T/A Solidatus) 2.2 1,360 1,158 2,518 1,158

Cantab Research

(T/A

Speechmatics) 1.6 1,359 806 2,165 182

Regenerco Renewable

Energy 12.5 1,261 807 2,068 22

Convertr Media 6.2 992 911 1,903 869

Gravitee TopCo (T/A

Gravitee.io) 3.5 1,431 366 1,797 157

The Voucher Market

(T/A WeGift) 2.2 1,396 327 1,723 327

Healios 4.0 1,134 522 1,656 -

The Street by

Street Solar

Programme 8.6 891 699 1,590 (30)

Aridhia Informatics 6.4 1,244 240 1,484 (41)

Panaseer 2.3 816 592 1,408 204

Elliptic

Enterprises 0.9 1,219 175 1,394 (279)

NuvoAir Holdings 2.0 826 501 1,327 201

Toqio FinTech

Holdings 1.8 1,279 45 1,324 45

Alto Prodotto Wind 11.1 753 457 1,210 (53)

Black Swan Data 4.2 1,967 (785) 1,182 (925)

TransFICC 2.6 938 223 1,161 -

Greenenerco 28.6 675 445 1,120 (45)

Locum's Nest 5.1 602 348 950 (71)

PeakData 1.9 862 78 940 78

Seldon Technologies 1.9 911 - 911 -

Beddlestead 8.1 966 (87) 879 (189)

uMotif 3.6 1,109 (268) 841 (135)

InCrowd Sports 3.8 588 247 835 73

GX Molecular (T/A

CS Genetics) 2.7 786 - 786 -

Cisiv 8.7 799 (86) 713 (460)

Arecor Therapeutics 0.9 329 331 660 (340)

Koru Kids 2.5 674 (25) 649 (327)

OutThink 2.6 644 - 644 -

DySIS Medical 3.8 2,742 (2,150) 592 -

Neurofenix 2.7 552 - 552 -

Ophelos 2.0 526 - 526 -

Accelex Technology 2.9 517 - 517 -

Perchpeek 1.5 511 - 511 -

Oxsensis 5.1 1,151 (768) 383 (427)

Zift Channel

Solutions 2.0 1,053 (698) 355 3

Brytlyt 1.8 341 - 341 -

Imandra 1.3 173 110 283 (163)

AVESI 5.5 179 59 238 1

Limitless

Technology 1.8 471 (236) 235 (120)

Mirada Medical 5.0 1,487 (1,279) 208 21

uMedeor (T/A uMed) 1.3 201 1 202 1

Memsstar 8.9 192 (10) 182 (34)

Regulatory Genome

Development 0.7 114 - 114 -

MHS 1 1.2 83 4 87 18

Symetrica 0.2 55 (11) 44 -

Forward Clinical

(T/A Pando) 1.8 218 (215) 3 -

Concirrus 1.6 830 (830) - (247)

Total fixed asset

investments 51,999 34,183 86,182 (1,264)

------------------- -------- -------- ------------------- -------- ------------------------

* as adjusted for additions and disposals during the period;

including realised gains/(losses).

Opening Total Gain/(loss) on

carrying Disposal realised opening

Investment realisations in the period to 30 September Cost value proceeds gain/(loss) value

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------ -------- --------- --------- ------------ --------------

Disposals:

------------------------------------------------------

Arecor Therapeutics 72 218 170 98 (48)

Abcodia 987 4 5 (982) 1

Avora 430 10 - (430) (10)

Sandcroft Avenue (T/A Hussle) 1,370 - - (1,370) -

Loan stock repayments and other:

------------------------------------------------------

Greenenerco 32 46 46 14 -

Alto Prodotto Wind 30 45 45 15 -

Escrow adjustments* - - 386 386 386

Total fixed asset realisations 2,921 323 652 (2,269) 329

------------------------------------------------------ -------- --------- --------- ------------ --------------

* These comprise fair value movements on deferred consideration

on previously disposed investments and expenses which are

incidental to the purchase or disposal of an investment.

Total change in value of investments for the period (1,264)

Movement in loan stock accrued interest (87)

-------

Unrealised losses on fixed asset investments sub-total (1,351)

Realised gains in the current period 329

Finance income from the unwinding of discount on deferred

consideration 150

Total losses on investments as per Income statement (872)

----------------------------------------------------------- -------

Condensed income statement

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

---------------------------------------------------------- ---- ------------------------------- ------------------------------- -------------------------------

Revenue Capital Revenue Capital Revenue Capital

Note GBP'000 GBP'000 Total GBP'000 GBP'000 GBP'000 Total GBP'000 GBP'000 GBP'000 Total GBP'000

---- ------- ------- ------------- ------- ------- ------------- ------- ------- -------------

(Losses)/gains on

investments 3 - (872) (872) - 15,752 15,752 - 21,636 21,636

Investment income 4 553 - 553 297 - 297 886 - 886

Investment

Manager's fees 5 (116) (1,044) (1,160) (755) (2,266) (3,021) (196) (3,696) (3,892)

Other expenses (301) - (301) (250) - (250) (549) - (549)

------- ------- ------------- ------- ------- ------------- ------- ------- -------------

Return/(loss) on

ordinary activities before taxation 136 (1,916) (1,780) (708) 13,486 12,778 141 17,940 18,081

Tax on ordinary activities - - - - - - - - -

------- ------- ------------- ------- ------- ------------- ------- ------- -------------

Return/(loss) and total comprehensive income attributable

to shareholders 136 (1,916) (1,780) (708) 13,486 12,778 141 17,940 18,081

------- ------- ------------- ------- ------- ------------- ------- ------- -------------

Basic and diluted return/(loss) per share (pence)* 7 0.15 (2.13) (1.98) (0.94) 18.04 17.10 0.19 23.78 23.97

---- ------- ------- ------------- ------- ------- ------------- ------- ------- -------------

* adjusted for treasury shares

The accompanying notes below form an integral part of this

Half-yearly Financial Report.

Comparative figures have been extracted from the unaudited

Half-yearly Financial Report for the six months ended 30 September

2021 and the audited statutory accounts for the year ended 31 March

2022.

The total column of this Condensed income statement represents

the profit and loss account of the Company. The supplementary

revenue and capital columns have been prepared in accordance with

The Association of Investment Companies' Statement of Recommended

Practice.

Condensed balance sheet

Audited

Unaudited Unaudited 31 March

30 September 2022 30 September 2021 2022

Note GBP'000 GBP'000 GBP'000

-------------------- ----- ------------------ ------------------ ---------

Fixed asset

investments 86,182 80,897 80,842

Current assets

Trade and other

receivables 2,679 2,304 10,725

Cash and cash

equivalents 26,008 15,758 29,552

------------------ ------------------ ---------

28,687 18,062 40,277

Total assets 114,869 98,959 121,119

Payables

Trade and other

payables less than

one year (828) (2,911) (2,704)

------------------ ------------------ ---------

Total assets less

current

liabilities 114,041 96,048 118,415

------------------ ------------------ ---------

Equity attributable

to equity holders

Called-up share

capital 8 1,028 859 1,017

Share premium 9,606 54,009 8,278

Capital redemption

reserve - 104 -

Unrealised capital

reserve 34,037 33,133 32,790

Realised capital

reserve 14,253 12,619 17,416

Other distributable

reserve 55,117 (4,676) 58,914

------------------ ------------------ ---------

Total equity

shareholders'

funds 114,041 96,048 118,415

------------------ ------------------ ---------

Basic and diluted

net asset value per

share (pence)* 127.00 128.85 132.28

* excluding treasury shares

The accompanying notes below form an integral part of this

Half-yearly Financial Report.

Comparative figures have been extracted from the unaudited

Half-yearly Financial Report for the six months ended 30 September

2021 and the audited statutory accounts for the year ended 31 March

2022.

These Financial Statements were approved by the Board of

Directors, and authorised for issue on 7 December 2022 and were

signed on its behalf by

Maxwell Packe

Chairman

Company number: 05990732

Condensed statement of changes in equity

Called-up Unrealised Realised

share Share capital capital Other distributable

capital premium Capital redemption reserve reserve reserve* reserve* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- --------- -------- --------------------------- ---------- --------- ------------------- --------

As at 1 April 2022 1,017 8,278 - 32,790 17,416 58,914 118,415

Return/(loss) and total comprehensive income for the

period - - - (1,351) (565) 136 (1,780)

Transfer of previously unrealised losses on disposal

of investments - - - 2,598 (2,598) - -

Issue of equity 11 1,366 - - - - 1,377

Cost of issue of equity - (38) - - - - (38)

Purchase of own shares for treasury - - - - - (964) (964)

Dividends paid - - - - - (2,969) (2,969)

As at 30 September 2022 1,028 9,606 - 34,037 14,253 55,117 114,041

----------------------------------------------------- --------- -------- --------------------------- ---------- --------- ------------------- --------

As at 1 April 2021 852 53,258 104 17,538 14,728 (1,082) 85,398

Return/(loss) and total comprehensive income for the

period - - - 15,621 (2,135) (708) 12,778

Transfer of previously unrealised gains on disposal

of investments - - - (26) 26 - -

Issue of equity 7 778 - - - - 785

Cost of issue of equity - (27) - - - - (27)

Purchase of own shares for treasury - - - - - (747) (747)

Dividends paid - - - - - (2,139) (2,139)

As at 30 September 2021 859 54,009 104 33,133 12,619 (4,676) 96,048

----------------------------------------------------- --------- -------- --------------------------- ---------- --------- ------------------- --------

As at 1 April 2021 852 53,258 104 17,538 14,728 (1,082) 85,398

Return and total comprehensive income for the year - - - 17,239 701 141 18,081

-----------------------------------------------------

Transfer of previously unrealised gains on disposal

of investments - - - (1,987) 1,987 - -

Issue of equity 165 21,638 - - - - 21,803

Cost of issue of equity - (544) - - - - (544)

Reduction of share premium and capital redemption

reserve - (66,074) (104) - - 66,178 -

Purchase of own shares for treasury - - - - - (1,795) (1,795)

Dividends paid - - - - - (4,528) (4,528)

As at 31 March 2022 1,017 8,278 - 32,790 17,416 58,914 118,415

----------------------------------------------------- --------- -------- --------------------------- ---------- --------- ------------------- --------

* Included within these reserves is an amount of GBP30,514,000

(30 September 2021: GBP7,943,000; 31 March 2022: GBP37,334,000)

which is considered distributable. Over the next three years an

additional GBP35,819,000 will become distributable. This is due to

the HMRC requirement that the Company cannot use capital raised in

the past three years to make a payment or distribution to

shareholders.

Condensed statement of cash flows

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

----------------------------- ------------------ ------------------ --------------

Cash flow from operating

activities

Investment income received 304 298 826

Dividend income received 117 - -

Deposit interest received 45 1 3

Investment Manager's fees

paid (3,095) (1,224) (2,084)

Other cash payments (362) (271) (503)

Net cash flow from operating

activities (2,991) (1,196) (1,758)

Cash flow from investing

activities

Purchase of fixed asset

investments (7,377) (5,173) (8,519)

Disposal of fixed asset

investments 964 112 9,379

Net cash flow from investing

activities (6,413) (5,061) 860

Cash flow from financing

activities

Issue of share capital 9,178 430 12,230

Cost of issue of equity (18) (16) (19)

Dividends paid* (2,446) (1,792) (3,806)

Purchase of own shares

(including costs) (854) (1,036) (2,384)

Net cash flow from financing

activities 5,860 (2,414) 6,021

(Decrease)/increase in cash

and cash equivalents (3,544) (8,671) 5,123

Cash and cash equivalents at

start of the period 29,552 24,429 24,429

------------------ ------------------ --------------

Cash and cash equivalents at

end of the period 26,008 15,758 29,552

------------------ ------------------ --------------

*The dividends paid shown in the cash flow are different to the

dividends disclosed in note 6 as a result of the non-cash effect of

the Dividend Reinvestment Scheme.

Notes to the condensed Financial Statements

1. Basis of accounting

The Financial Statements have been prepared in accordance with

applicable United Kingdom law and accounting standards, including

Financial Reporting Standard 102 ("FRS 102"), and with the

Statement of Recommended Practice "Financial Statements of

Investment Trust Companies and Venture Capital Trusts" ("SORP")

issued by The Association of Investment Companies ("AIC"). The

Financial Statements have been prepared on a going concern

basis.

The preparation of the Financial Statements requires management

to make judgements and estimates that affect the application of

policies and reported amounts of assets, liabilities, income and

expenses. The most critical estimates and judgements relate to the

determination of carrying value of investments at Fair Value

Through Profit and Loss ("FVTPL") in accordance with FRS 102

sections 11 and 12. The Company values investments by following the

International Private Equity and Venture Capital Valuation ("IPEV")

Guidelines as updated in 2018 and further detail on the valuation

techniques used are outlined in note 2 below.

Company information can be found on page 2 of the full

Half-yearly Financial Report.

2. Accounting policies

Fixed asset investments

The Company's business is investing in financial assets with a

view to profiting from their total return in the form of income and

capital growth. This portfolio of financial assets is managed and

its performance evaluated on a fair value basis, in accordance with

a documented investment policy, and information about the portfolio

is provided internally on that basis to the Board.

In accordance with the requirements of FRS 102, those

undertakings in which the Company holds more than 20 per cent. of

the equity as part of an investment portfolio are not accounted for

using the equity method. In these circumstances the investment is

measured at FVTPL.

Upon initial recognition (using trade date accounting)

investments, including loan stock, are classified by the Company as

FVTPL and are included at their initial fair value, which is cost

(excluding expenses incidental to the acquisition which are written

off to the Income statement).

Subsequently, the investments are valued at 'fair value', which

is measured as follows:

-- Investments listed on recognised exchanges are valued at their bid prices

at the end of the accounting period or otherwise at fair value based on

published price quotations.

-- Unquoted investments, where there is not an active market, are valued

using an appropriate valuation technique in accordance with the IPEV

Guidelines. Indicators of fair value are derived using established

methodologies including earnings multiples, revenue multiples, the level

of third party offers received, cost or price of recent investment rounds,

net assets and industry valuation benchmarks. Where price of recent

investment is used as a starting point for estimating fair value at

subsequent measurement dates, this has been benchmarked using an

appropriate valuation technique permitted by the IPEV guidelines.

-- In situations where cost or price of recent investment is used,

consideration is given to the circumstances of the portfolio company

since that date in determining fair value. This includes consideration of

whether there is any evidence of deterioration or strong definable

evidence of an increase in value. In the absence of these indicators, the

investment in question is valued at the amount reported at the previous

reporting date. Examples of events or changes that could indicate a

diminution include:

-- the performance and/or prospects of the underlying business are

significantly below the expectations on which the investment was

based;

-- a significant adverse change either in the portfolio company's

business or in the technological, market, economic, legal or

regulatory environment in which the business operates; or

-- market conditions have deteriorated, which may be indicated by a

fall in the share prices of quoted businesses operating in the

same or related sectors.

Investments are recognised as financial assets on legal

completion of the investment contract and are de-recognised on

legal completion of the sale of an investment.

Dividend income is not recognised as part of the fair value

movement of an investment but is recognised separately as

investment income through the other distributable reserve when a

share becomes ex-dividend.

Current assets and payables

Receivables (including debtors due after more than one year),

payables and cash are carried at amortised cost, in accordance with

FRS 102. Debtors due after more than one year meet the definition

of a financing transaction held at amortised cost, and interest

will be recognised through capital over the credit period using the

effective interest method. There are no financial liabilities other

than payables.

Investment income

Equity income

Dividend income is included in revenue when the investment is

quoted ex-dividend.

Unquoted loan stock income

Fixed returns on non-equity shares and debt securities are

recognised when the Company's right to receive payment and expect

settlement is established. Where interest is rolled up and/or

payable at redemption then it is recognised as income unless there

is reasonable doubt as to its receipt.

Bank interest income

Interest income is recognised on an accruals basis using the

rate of interest agreed with the bank.

Investment management fee, performance incentive fee and

expenses

All expenses have been accounted for on an accruals basis.

Expenses are charged through the other distributable reserve except

the following which are charged through the realised capital

reserve:

-- 90% of management fees and 100% of performance incentive fees, if any,

are allocated to the realised capital reserve. This has changed from 75%

for both management fees and performance incentive fees in the period

ended 30 September 2021, to better align with the Board's expectation

that over the long term the majority of the Company's investment returns

will be in the form of capital gains; and

-- expenses which are incidental to the purchase or disposal of an

investment are charged through the realised capital reserve.

Taxation

Taxation is applied on a current basis in accordance with FRS

102. Current tax is tax payable/(refundable) in respect of the

taxable profit/(tax loss) for the current period or past reporting

periods using the tax rates and laws that have been enacted or

substantively enacted at the financial reporting date. Taxation

associated with capital expenses is applied in accordance with the

SORP.

Deferred tax is provided in full on all timing differences at

the reporting date. Timing differences are differences between

taxable profits and total comprehensive income as stated in the

Financial Statements that arise from the inclusion of income and

expenses in tax assessments in periods different from those in

which they are recognised in the Financial Statements. As a VCT the

Company has an exemption from tax on capital gains. The Company

intends to continue meeting the conditions required to obtain

approval as a VCT in the foreseeable future. The Company therefore,

should have no material deferred tax timing differences arising in

respect of the revaluation or disposal of investments and the

Company has not provided for any deferred tax.

Share capital and reserves

Called-up share capital

Called-up share capital accounts for the nominal value of the

Company's shares.

Share premium

This reserve accounts for the difference between the price paid

for the Company's shares and the nominal value of those shares,

less issue costs and transfers to the other distributable

reserve.

Capital redemption reserve

This reserve accounts for amounts by which the issued share

capital is diminished through the repurchase and cancellation of

the Company's own shares.

Unrealised capital reserve

Increases and decreases in the valuation of investments held at

the year end against cost are included in this reserve.

Realised capital reserve

The following are disclosed in this reserve:

-- gains and losses compared to cost on the realisation of investments, or

permanent diminutions in value;

-- expenses, together with the related taxation effect, charged in

accordance with the above policies; and

-- dividends paid to equity holders where paid out by capital.

Other distributable reserve

The special reserve, treasury share reserve and the revenue

reserve were combined in 2013 to form a single reserve named other

distributable reserve.

This reserve accounts for movements from the revenue column of

the Income statement, the payment of dividends, the buy-back of

shares and other non-capital realised movements.

Dividends

Dividends by the Company are accounted for when the liability to

make the payment (record date) has been established.

Segmental reporting

The Directors are of the opinion that the Company is engaged in

a single operating segment of business, being investment in smaller

companies principally based in the UK.

3. (Losses)/gains on investments

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

---------------------- ------------------ ------------------ --------------

Unrealised

(losses)/gains on

fixed asset

investments (1,351) 15,621 17,239

Realised gains on

fixed asset

investments 329 2 4,129

Finance income from

deferred

consideration 150 129 268

(872) 15,752 21,636

------------------ ------------------ --------------

4. Investment income

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

---------------------- ------------------ ------------------ --------------

Loan stock interest 391 296 883

Dividend income 117 - -

Bank deposit interest 45 1 3

553 297 886

------------------ ------------------ --------------

5. Investment Manager's fees

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

-------------------- ------------------ ------------------ --------------

Investment

management fee

charged to revenue 116 227 196

Investment

management fee

charged to capital 1,044 680 1,762

Performance

incentive fee

charged to revenue - 528 -

Performance

incentive fee

charged to capital - 1,586 1,934

------------------ ------------------ --------------

1,160 3,021 3,892

------------------ ------------------ --------------

Further details of the Management agreement under which the

investment management fee and performance incentive fee are paid is

given in the Strategic report on page 13 of the Annual Report and

Financial Statements for the year ended 31 March 2022.

During the period, services of a total value of GBP1,276,000 (30

September 2021: GBP998,000; 31 March 2022: GBP2,156,000) were

purchased by the Company from Albion Capital Group LLP; this

includes GBP1,160,000 (30 September 2021: GBP907,000; 31 March

2022: GBP1,958,000) of management fee and GBP116,000 (30 September

2021: GBP91,000; 31 March 2022: GBP198,000) of administration fee.

At the financial period end, the amount due to Albion Capital Group

LLP in respect of these services disclosed within payables was

GBP625,000 (30 September 2021: GBP428,000; 31 March 2022:

GBP628,000). For the period to 30 September 2022, no performance

incentive fee has been accrued, in line with the Management

agreement (30 September 2021: GBP2,114,000; 31 March 2022:

GBP1,934,000).

During the period, the Company was not charged by Albion Capital

Group LLP in respect of Patrick Reeve's services as a Director (30

September 2021: GBPnil; 31 March 2022: GBPnil).

Albion Capital Group LLP, its partners and staff (including

Patrick Reeve) held a total of 696,257 shares in the Company on 30

September 2022.

Albion Capital Group LLP is, from time to time, eligible to

receive arrangement fees and monitoring fees from portfolio

companies. During the period to 30 September 2022, fees of

GBP139,000 attributable to the investments of the Company were

received pursuant to these arrangements (30 September 2021:

GBP108,000; 31 March 2022: GBP177,000).

6. Dividends

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------------------ ------------------ --------------

First dividend of 3.31p per share paid on 31 August

2022 (31 August 2021: 2.87p per share) 2,969 2,139 2,139

Second dividend of 3.22p per share paid on 28 February

2022 - - 2,391

Unclaimed dividends - - (2)

2,969 2,139 4,528

------------------ ------------------ --------------

In addition to the dividends summarised above, the Board has

declared a second dividend for the year ending 31 March 2023 of

3.18 pence per share which will be paid on 28 February 2023 to

shareholders on the register on 3 February 2023. This is expected

to amount to approximately GBP3,004,000.

7. Basic and diluted return/(loss) per share

Unaudited Unaudited Audited

six months ended six months ended year ended

30 September 2022 30 September 2021 31 March 2022

Revenue Capital Revenue Capital Revenue Capital

-------------- --------- --------- --------- --------- ------- -------

Return/(loss)

attributable

to equity

shares

(GBP'000) 136 (1,916) (708) 13,486 141 17,940

Weighted

average

shares in

issue 89,944,537 74,745,677 75,440,864

Return/(loss)

per Ordinary

share

(pence) 0.15 (2.13) (0.94) 18.04 0.19 23.78

The weighted average number of shares is calculated after

adjusting for treasury shares of 12,967,934 (30 September 2021:

11,346,766; 31 March 2022: 12,195,568).

There are no convertible instruments, derivatives or contingent

share agreements in issue for the Company, therefore no dilution

affecting the return per share. The basic return per share is

therefore the same as the diluted return per share.

8. Called-up share capital

Allotted, called-up and fully paid shares of 1 penny Unaudited Unaudited 30 Audited

each 30 September 2022 September 2021 31 March 2022

----------------------------------------------------- ------------------ ------------------ --------------

Number of shares 102,766,464 85,891,086 101,711,805

Nominal value of allotted shares (GBP'000) 1,028 859 1,017

Voting rights (number of shares net of treasury

shares) 89,798,530 74,544,320 89,516,237

During the period to 30 September 2022, the Company purchased

772,366 shares (30 September 2021: 633,346; 31 March 2022:

1,482,148) to be held in treasury at a nominal value of GBP7,724

and at a cost of GBP964,000. The total number of shares held in

treasury on 30 September 2022 was 12,967,934 (30 September 2021:

11,346,766; 31 March 2022: 12,195,568) representing 12.6% of the

shares in issue on 30 September 2022.

Under the terms of the Dividend Reinvestment Scheme Circular

(dated 26 November 2009), the following new shares of nominal value

1 penny each were allotted during the period to 30 September

2022:

Number

of Net

Date of shares Aggregate nominal value of shares invested Opening market price on allotment date (pence per

allotment allotted GBP'000 Issue price (pence per share) GBP'000 share)

31 August

2022 410,130 4 126.89 503 120.50

Under the terms of the Albion VCTs Prospectus Top Up Offers

2021/22, the following new shares of nominal value 1 penny each

were allotted during the period to 30 September 2022:

Number

of

Date of shares Aggregate nominal value of shares Net consideration received Opening market price on allotment date (pence per

allotment allotted GBP'000 Issue price (pence per share) GBP'000 share)

---------- -------- --------------------------------- ------------------------------ -------------------------- -------------------------------------------------

11 April

2022 133,797 1 131.70 174 122.50

11 April

2022 17,745 - 132.40 23 122.50

11 April

2022 492,987 5 133.00 639 122.50

644,529 836

-------- --------------------------

9. Commitments and contingencies

On 30 September 2022, the Company had no financial commitments

in respect of investments (30 September 2021: GBPnil; 31 March

2022: GBPnil).

There were no contingencies or guarantees of the Company on 30

September 2022 (30 September 2021: GBPnil; 31 March 2022:

GBPnil).

10. Post balance sheet events

The following are the material post balance sheet events since

30 September 2022:

-- Investment of GBP1,372,000 in a new portfolio company, an employee

digital healthcare platform;

-- Investment of GBP1,366,000 in an existing company, a provider of an

online platform delivering family centric psychological care primarily to

children and adolescents;

-- Investment of GBP541,000 in a new portfolio company, an AI for code

testing/writing platform;

-- Investment of GBP450,000 in a new portfolio company, a veterinary

engagement and communications platform;

-- Investment of GBP360,000 in a new portfolio company, a bite-sized

workplace learning platform; and

-- Investment of GBP257,000 in a new portfolio company, a software platform

automating revenue and customer forecasting.

The following new Ordinary shares of nominal value 1 penny each

were allotted under the Albion VCTs Prospectus Top Up Offers

2022/23 after 30 September 2022:

Number of

Date of shares Aggregate nominal value of shares Net consideration received Opening market price on allotment date (pence per

allotment allotted GBP'000 Issue price (pence per share) GBP'000 share)

---------- --------- --------------------------------- ------------------------------ -------------------------- -------------------------------------------------

2 December

2022 1,144,527 11 129.00 1,454 120.50

2 December

2022 245,176 2 129.60 311 120.50

2 December

2022 3,289,782 33 130.30 4,180 120.50

4,679,485 5,945

--------- --------------------------

11. Related party transactions

Other than transactions with the Manager as disclosed in note 5,

there are no other related party transactions or balances requiring

disclosure.

12. Going concern

The Board has conducted a detailed assessment of the Company's

ability to meet its liabilities as they fall due. Cash flow

forecasts are updated and discussed quarterly at Board level and

have been stress tested to allow for the forecasted impact of the

current economic climate and increasingly volatile geopolitical

backdrop. The Board have revisited and updated their assessment of

liquidity risk and concluded that it remains unchanged since the

last Annual Report and Financial Statements. Further details can be

found on page 70 of those accounts.

The portfolio of investments is diversified in terms of sector

and the major cash outflows of the Company (namely investments,

dividends and share buy-backs) are within the Company's control.

Accordingly, after making diligent enquiries, the Directors have a

reasonable expectation that the Company has adequate cash and

liquid resources to continue in operational existence for the

foreseeable future. For this reason, the Directors have adopted the

going concern basis in preparing this Half-yearly Financial Report

and this is in accordance with the Guidance on Risk Management,

Internal Control and Related Financial and Business Reporting

issued by the Financial Reporting Council in September 2014, and

the subsequent updated Going concern, risk and viability guidance

issued by the FRC due to Covid-19 in 2020.

13. Other information

The information set out in this Half-yearly Financial Report

does not constitute the Company's statutory accounts within the

terms of section 434 of the Companies Act 2006 for the periods

ended 30 September 2022 and 30 September 2021, and is unaudited.

The information for the year ended 31 March 2022 does not

constitute statutory accounts within the terms of section 434 of

the Companies Act 2006 but is derived from the statutory accounts

for the financial year, which have been delivered to the Registrar

of Companies. The Auditor reported on those accounts; their report

was unqualified and did not contain statements under s498 (2) or

(3) of the Companies Act 2006.

14. Publication

This Half-yearly Financial Report is being sent to shareholders

and copies will be made available to the public at the registered

office of the Company, Companies House, the National Storage

Mechanism and also electronically at www.albion.capital/funds/AAEV,

where the Report can be accessed from the 'Financial Reports and

Circulars' section.

Attachment

-- AAEV pie chart for announcement 30 Sep 2022

https://ml-eu.globenewswire.com/Resource/Download/511ea921-813f-484f-9e85-3a3dc45d423d

(END) Dow Jones Newswires

December 07, 2022 07:28 ET (12:28 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

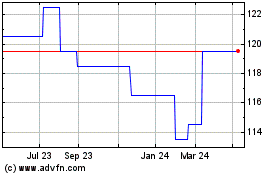

Albion Enterprise Vct (LSE:AAEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albion Enterprise Vct (LSE:AAEV)

Historical Stock Chart

From Apr 2023 to Apr 2024