TIDMAAF

RNS Number : 0499H

Airtel Africa PLC

30 July 2021

30 July 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Airtel Africa plc

("Airtel Africa", or the "Group")

QIA to invest $200 million in Airtel Africa's mobile money

business,

at $2.65 billion valuation.

London and Lagos: 30 July 2021: Airtel Africa, a leading

provider of telecommunications and mobile money services, with a

presence in 14 countries across Africa, today announces the signing

of an agreement under which Qatar Holding LLC, an affiliate of the

Qatar Investment Authority ("QIA"), will invest $200 million in

Airtel Mobile Commerce BV ("AMC BV"), a subsidiary of Airtel Africa

plc (the "Transaction") . AMC BV is the holding company for several

of Airtel Africa's mobile money operations; and ultimately is

intended to own and operate the mobile money businesses across all

of Airtel Africa's fourteen operating countries.

The Transaction values Airtel Africa's mobile money business at

$2.65 billion on a cash and debt free basis. QIA will hold a

minority stake in AMC BV upon completion of the Transaction

(alongside other minority investors), with Airtel Africa continuing

to hold the majority stake. The Transaction is subject to customary

closing conditions.

Following the announcement on 18 March 2021 of a $200m

investment in AMC BV by TPG's The Rise Fund, on 1 April 2021 of a

$100m investment in AMC BV by MasterCard and the sale of the

Group's telecommunication towers companies in Madagascar and Malawi

on 23 March 2021, the Transaction is a continuation of the Group's

pursuit of strategic asset monetization and investment

opportunities, and i t is the aim of Airtel Africa to explore the

potential listing of the mobile money business within four

years.

The proceeds from the Transaction will be used to reduce Group

debt and invest in network and sales infrastructure in the

respective operating countries.

Airtel Africa mobile money services

Operating under the Airtel Money brand, Airtel Africa's mobile

money services is a leading digital mobile financial services

platform catering to a large addressable market in Africa

(characterised by limited access to formal financial institutions

with limited banking infrastructure) and includes mobile wallet

deposit and withdrawals, merchant and commercial payments, benefits

transfers, loans and savings, virtual card and international money

transfers.

Mobile money services are available across the Group's 14

countries of operation, however in Nigeria the Group offers Airtel

Money services through a partnership with a local bank and has

applied for its own mobile banking licence. It is the intention

that all mobile money operations will be owned and operated by AMC

BV.

In our most recent reported results for Q1'22, the mobile money

services (corresponding to all the businesses that are intended to

be transferred to AMC BV) delivered a strong operational

performance:

-- Generated revenue of $124m ($496m annualised), and underlying EBITDA of

$60m ($240m annualised) at a margin of 48.8%.

-- Year on year revenue growth for the quarter was 53.7% in

constant currency, largely driven by 24.6% growth in the customer

base to 23.1 million, and 25.4% ARPU growth.

-- Growth in transaction value was 64.4% (constant currency) to $14.7bn ($59bn annualised).

Our mobile money business benefits from strong network presence

with our core telecom business through the extensive distribution

platform of kiosks and mini shops as well as dedicated Airtel Money

branches supplementing our extensive agent network, to facilitate

customers' access to assured wallet and cash.

We have a clear strategy to continue to drive sustainable

long-term growth in Airtel Money with a focus on assured float

availability, distribution expansion and increased usage cases for

our customers.

Last year we added partnerships with Mastercard, Samsung,

Asante, Standard Chartered Bank, MoneyGram, Mukuru and WorldRemit

to expand both the range and depth of the Airtel Money offerings

and to further drive customer growth and penetration.

The profits before tax in the full year ending 31 March 2021 and

the value of gross assets as of that date, attributable to the

mobile money businesses were $185m and $668m, respectively.

Key elements of the Transaction

-- Agreement values Airtel Africa's mobile money business at

$2.65bn on a cash and debt free basis.

-- AMC BV, a subsidiary of Airtel Africa, is the holding company

for several of Airtel Africa's mobile money operations; and it is

intended that ultimately it shall own and operate the mobile money

businesses across all of Airtel Africa's fourteen operating

countries once the inclusion of the remaining mobile money

operations under AMC BV perimeter is completed.

-- QIA will invest $200m through a secondary purchase of shares

in AMC BV from Airtel Africa. The transaction will close in two

stages. $150m will be invested at first close, subject to customary

closing conditions including necessary regulatory filings, with

$50m to be invested at second close once further transfers of

certain mobile money operations and contracts into the AMC BV

perimeter have been completed.

The Transaction first close is expected in August. From first

close, QIA will be entitled to appoint a director to the board of

AMC BV and to certain customary information and minority protection

rights.

Raghunath Mandava, CEO of Airtel Africa, commented:

" With today's announcement we are pleased to welcome QIA as a

prospective investor in our mobile money business, joining both

Mastercard and TPG's The Rise Fund as a further partner to help us

realise the full potential from the substantial opportunity to bank

the unbanked across Africa ."

Mansoor bin Ebrahim Al-Mahmoud, CEO of QIA, commented:

"We are delighted to build on our support of Airtel Africa in

promoting financial inclusion to the large and growing population

of Sub-Saharan Africa. Airtel Money plays a critical role in

facilitating economic activity, including for customers without

access to traditional financial services. We firmly believe in its

mission to expand these efforts over the coming years."

-ENDS-

Enquiries

Airtel Africa - Investor Relations

Pier Falcione

Morten Singleton

Investor.relations@africa.airtel.com +44 207 493 9315

Hudson Sandler

Nick Lyon

Bertie Berger

airtelafrica@hudsonsandler.com +44 207 796 4133

The person responsible for making this announcement is Simon

O'Hara, Group Company Secretary.

About Airtel Africa

Airtel Africa is a leading provider of telecommunications and

mobile money services, with a presence in 14 countries in Africa,

primarily in East Africa and Central and West Africa.

Airtel Africa offers an integrated suite of telecommunications

solutions to its subscribers, including mobile voice and data

services as well as mobile money services, both nationally and

internationally.

The Group aims to continue providing a simple and intuitive

customer experience through streamlined customer journeys.

For more information visit https://www.airtel.africa/

About QIA

Qatar Investment Authority ("QIA") is the sovereign wealth fund

of the State of Qatar. QIA was founded in 2005 to invest and manage

the state reserve funds. QIA is among the largest and most active

sovereign wealth funds globally. QIA invests across a wide range of

asset classes and regions as well as in partnership with leading

institutions around the world to build a global and diversified

investment portfolio with a long-term perspective that can deliver

sustainable returns and contribute to the prosperity of the State

of Qatar.

For more information visit www.qia.qa

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGLGDRUSXDGBG

(END) Dow Jones Newswires

July 30, 2021 02:58 ET (06:58 GMT)

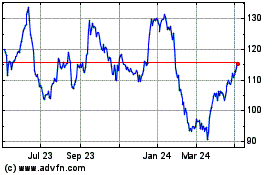

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

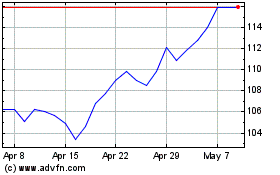

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Apr 2023 to Apr 2024