J.P. Morgan Securities PLC. Proposed secondary placing in Airtel Africa plc (9631F)

25 March 2022 - 3:44AM

UK Regulatory

TIDMAAF

RNS Number : 9631F

J.P. Morgan Securities PLC.

24 March 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, INTO OR IN THE UNITED STATES,

CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH

OFFERS OR SALES WOULD BE PROHIBITED BY APPLICABLE LAW. THIS

ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM AN OFFER OF SECURITIES IN

THE UNITED STATES, CANADA, AUSTRALIA, SOUTH AFRICA, JAPAN OR ANY

OTHER JURISDICTION.

PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THIS

ANNOUNCEMENT

Press Release, 24 March 2022

Proposed secondary placing of shares in Airtel Africa plc

J.P. Morgan Securities plc, which conducts its UK investment

banking activities as J.P. Morgan Cazenove ("J.P. Morgan

Cazenove"), has been appointed by Singapore Telecom International

Pte Ltd (the "Selling Shareholder") to sell approximately 55

million ordinary shares in Airtel Africa plc ("Airtel Africa" or

the "Company") (the "Placing Shares"), representing approximately

1.5 per cent. of the Company's issued ordinary share capital.

The price per Placing Share will be determined through an

accelerated bookbuild process. The bookbuild process will commence

with immediate effect following this announcement and may close at

any time at short notice. A further announcement will be made

following the completion of the bookbuild and pricing of the

Placing. The Placing is subject to demand, price and market

conditions.

The Selling Shareholder will be locked up in respect of its

residual holding for a period of 90 days post settlement of the

Placing, subject to waiver by J.P. Morgan Cazenove.

J.P. Morgan Cazenove is acting as sole bookrunner in relation to

the Placing.

Airtel Africa will not receive any proceeds from the

Placing.

Enquiries:

J.P. Morgan Cazenove

Achintya Mangla

Aloke Gupte +44 207 742 4000

IMPORTANT NOTICE

This announcement is not for publication, distribution or

release, directly or indirectly, in or into the United States of

America (including its territories and possessions), Australia,

Canada, Japan or the Republic of South Africa or any other

jurisdiction where such an announcement would be unlawful. The

distribution of this announcement may be restricted by law in

certain jurisdictions and persons into whose possession this

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

This announcement is not an offer of securities or investments

for sale nor a solicitation of an offer to buy securities or

investments in any jurisdiction where such offer or solicitation

would be unlawful. No action has been taken that would permit an

offering of the securities or possession or distribution of this

announcement in any jurisdiction where action for that purpose is

required. Persons into whose possession this announcement comes are

required to inform themselves about and to observe any such

restrictions.

The Placing Shares may not be offered to the public in any

jurisdiction in circumstances which would require the preparation

or registration of any prospectus or offering document relating to

the Placing Shares in such jurisdiction. No action has been taken

by the Selling Shareholder or J.P. Morgan Cazenove that would

permit an offering of the Placing Shares or possession or

distribution of this announcement or any other offering or

publicity material relating to such securities in any jurisdiction

where action for that purpose is required.

The securities referred to herein have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

"Securities Act"), and, subject to certain exemptions, may not be

offered or sold in the United States (as defined in Regulation S

under the Securities Act). Neither this document nor the

information contained herein constitutes or forms part of an offer

to sell or the solicitation of an offer to buy securities in the

United States. There will be no public offer of any securities in

the United States or in any other jurisdiction.

In member states of the European Economic Area ("EEA") (each, a

"Relevant Member State"), this announcement and any offer if made

subsequently is directed exclusively at persons who are 'qualified

investors' within the meaning of the Prospectus Regulation

("Qualified Investors"). For these purposes, the expression

'Prospectus Regulation' means Regulation (EU) 2017/1129.

In the United Kingdom, this announcement is directed exclusively

at persons who are 'qualified investors' within the meaning of the

UK Prospectus Regulation and (i) who have professional experience

in matters relating to investments falling within Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005, as amended (the "Order") or (ii) who fall within

Article 49(2)(A) to (D) of the Order, or (iii) to whom it may

otherwise lawfully be communicated (all such persons being referred

to as "Relevant Persons"). For these purposes, the expression 'UK

Prospectus Regulation' means Regulation (EU) 2017/1129 as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018. In the United Kingdom, this announcement is

directed only at Relevant Persons and must not be acted on or

relied on by persons who are not Relevant Persons. Any investment

or investment activity to which this document relates is available

in the United Kingdom only to Relevant Persons and will be engaged

in only with Relevant Persons.

In connection with any offering of the Placing Shares, J.P.

Morgan Cazenove and any of its affiliates acting as an investor for

their own account may take up as a proprietary position any Placing

Shares and in that capacity may retain, purchase or sell for their

own account such Placing Shares. In addition, they may enter into

financing arrangements and swaps with investors in connection with

which they may from time to time acquire, hold or dispose of

Placing Shares. They do not intend to disclose the extent of any

such investment or transactions otherwise than in accordance with

any legal or regulatory obligation to do so.

J.P. Morgan Cazenove is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting on behalf of the Selling

Shareholder and no one else in connection with any offering of the

Placing Shares and will not be responsible to any other person for

providing the protections afforded to any of its clients or for

providing advice in relation to any offering of the Placing Shares.

J.P. Morgan Cazenove will not regard any other person as its client

in relation to the offering of the Placing Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFZGZFVDFGZZM

(END) Dow Jones Newswires

March 24, 2022 12:44 ET (16:44 GMT)

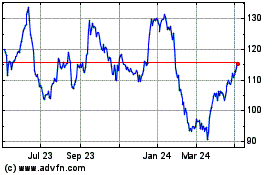

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

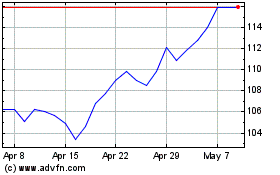

Airtel Africa (LSE:AAF)

Historical Stock Chart

From Apr 2023 to Apr 2024