Anglo American 4Q Production Mainly Rose -- Commodity Comment

02 February 2023 - 7:44PM

Dow Jones News

Anglo American PLC on Thursday reported a rise in fourth-quarter

production of most of its commodities compared with the same period

a year earlier, with the exception of iron ore and platinum group

metals. Here's what the FTSE 100-listed mining company had to

say:

On copper production:

"Copper production increased by 52% to 244,300 tonnes, due to

the ramp-up of production from Quellaveco in Peru, while Chile's

production was broadly flat."

On rough diamond production:

"Rough diamond production increased by 6%, reflecting strong

operational performance, particularly at Jwaneng, which was

partially offset by the planned completion of the final cut at

Venetia's open pit."

On steelmaking coal production:

"Steelmaking coal production increased by 6% to 4.6 million

tonnes, primarily due to the ramp-up of the Grosvenor longwall

operation following its restart in February 2022."

On iron-ore production:

"Iron ore production increased by 4% to 15.7 million tonnes,

reflecting a 7% increase at Minas-Rio and a 3% increase at

Kumba."

On metal in concentrate production:

"Metal in concentrate production from our Platinum Group Metals

(PGMs) operations decreased by 10%, due to the impact of lower

grades at Mogalakwena and planned infrastructure closures at

Amandelbult."

On nickel production:

"Nickel production decreased by 4% to 10,200 tonnes, primarily

due to planned annual maintenance at Barro Alto as well as the

impact of high rainfall in December."

On prices:

"The full year average realized price for nickel of $10.26/lb

was 12% lower than the market price, primarily reflecting the

ferronickel discount to LME grade nickel."

"The full year average realized basket price was $2,551/PGM

ounce, reflecting lower market prices."

"The full year average realized price for hard coking coal was

$310/tonne, which was lower than the benchmark price of

$364/tonne."

"The price realization was lower at 85% (2021: 93%) driven by a

higher volume of premium hard coking coal being produced and sold

in the second half of 2022 when the benchmark price was lower."

On 2023 guidance:

"Production guidance is for 2023 is 30-33 million carats (100%

basis), subject to trading conditions."

"Unit cost guidance for 2023 is c.$80/ct."

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 02, 2023 03:29 ET (08:29 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

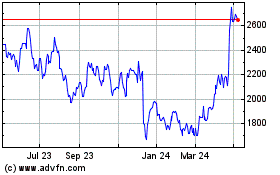

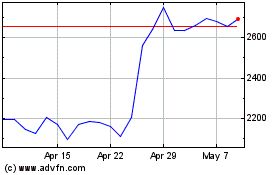

Anglo American (LSE:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo American (LSE:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024