MARKET MOVEMENTS:

-- Brent crude oil is 0.3% lower at $81.91 a barrel.

-- European benchmark gas rises 2.1% to EUR58.13 a megawatt

hour.

-- Gold futures are down 0.4% at $1,924 a troy ounce.

-- Three-month copper is 0.6% higher at $9,091.50 a metric

ton.

-- Wheat futures are down 0.7% at $7.56 a bushel.

TOP STORY:

Europe Cuts Addiction to Russian Energy, Yet Fuel Scramble

Continues

Europe's dependence on Russian energy is drawing to a close,

ending a decadeslong power imbalance and leaving the continent

racing to squirrel away fuels and find alternative supplies.

The final act of separation: On Sunday, the European Union and

the U.K. will bar imports of Russian fuels such as diesel and

gasoline. The move follows a ban on Russian crude imports in

December. Coal imports stopped last summer. Natural-gas flows from

Siberia, once the lifeblood of European industry, have

dwindled.

Taken together, the moves have allowed Europe to wean itself

from Russian energy almost entirely in less than a year since the

invasion of Ukraine. The flow of Russian gas through pipelines to

the EU and U.K. last month was almost 90% lower than in January

2021, according to commodities data firm ICIS.

OTHER STORIES:

Food Prices Declined for Tenth Month in a Row in January, says

UN

Food prices have fallen for the tenth month in a row, as higher

exports of wheat from Russia and Australia ease inflationary

pressures, a report published Friday by the Food and Agriculture

Organization of the United Nations said.

The FAO's food-price index, a closely watched barometer of

global food prices, averaged 131.2 points in January 2023, down 1.1

points or 0.8% from December's reading. Prices are now down 17.9%

from the peak in March 2022, when the index hit an all-time high of

159.7 points following Russia's invasion of Ukraine.

The U.N. body said that much of the easing had been led by lower

wheat prices but that grain prices overall were more or less

unchanged from December with a FAO cereal price index reading of

147.4 points in January, a rise of just 0.1%. Wheat prices had

fallen 2.5% during the month on higher Russian and Australian wheat

exports, but strong demand for corn had meant flat grain prices

overall.

MARKET TALKS:

Palm Oil Firms Amid Strong Soybean Oil Prices

1002 GMT - Malaysian palm-oil prices closed higher, tracking

soybean oil's gains on the Dalian Commodity Exchange, a Kuala

Lumpur-based trader says. The oils often trade in tandem as they

are used in similar products. However, palm-oil gains were likely

capped due to declining demand, he adds. The Bursa Malaysia

Derivatives Exchange contract for April delivery closed MYR97

higher at MYR3,848 a metric ton. (yiwei.wong@wsj.com)

--

Anglo American's Investment Case Is Compelling Despite 2022

Operational Issues

0952 GMT - Anglo American delivered a strong 4Q result as it met

its full-year production targets and backed its 2023 production and

cost guidance, analysts at Jefferies say in a note. Diamond,

copper, coal and manganese production for the year rose, but

platinum group metals production fell due to lower grades and

planned infrastructure closures, as did iron ore, and nickel, which

was hurt by a maintenance shutdown and high rainfall, the analysts

say. "Despite operational issues in 2022, which are arguably

already priced in as these shares are down nearly 20% over the last

9 months, the longer-term investment case for Anglo is compelling,"

the analysts say. Jefferies rates the stock buy and has a 3,387

pence target price. (anthony.orunagoriainoff@dowjones.com)

--

Oil Edges Down Ahead of Ban on Russia Oil Products

0846 GMT - Oil prices tick lower despite an impending European

Union ban on Russian oil product exports which is expected to

tighten crude markets further. Brent crude oil edges down 0.2% to

$82.00 a barrel while WTI weakens 0.3% to $75.70 a barrel. The EU's

ban is set to come into force Sunday. Ample time to prepare and

strong Russian exports of crude and oil products ahead of the ban

are keeping prices in check, ING says in a note. "Despite this

imminent disruption to flows, the market appears relatively

calm...the market has had a significant amount of time to prepare

for the ban. We have seen strong inflows of middle distillates into

Europe ahead of Feb. 5," ING says. (william.horner@wsj.com)

--

Metals Mixed Ahead of Jobs Report

0832 GMT - Metals prices are mixed, with nonfarm payroll data

due later. Three-month copper is up 0.4% to $9,070.50 a metric ton,

while aluminum is 0.5% lower at $2,591 a ton. Meanwhile, gold is

down 0.2% to $1,927.20 a troy ounce. This week has been a bumper

data week, with more positive data out of China meeting Western

central banks indicating more monetary tightening may be needed in

March as they seek to taper inflation. "Despite Chinese growth

outperforming, slowing economic growth elsewhere globally will

result in muted global demand growth for metals," Fitch Solutions

says in a note. It sees metal prices climbing this year on Chinese

demand but elsewhere the picture looks less clear.

(yusuf.khan@wsj.com)

--

Iron Ore Futures Decline as Steel Demand Weakens

0120 GMT - Chinese iron ore futures decline as demand for the

steel ingredient weakens. "The demand for steel is still weak, with

the inventory replenishment of steel mills slow," say CFC Financial

analysts in a note to clients, adding that iron ore prices are

likely capped. Prices for commodities such as iron ore, steel and

coal have fallen in the last few days and CFC Financial believes

that is due to faded market expectations. Iron ore contracts on the

Dalian Commodity Exchange are lower across the board, with the

most-traded May contract down 1.6% at CNY843.0 a ton.

(bingyan.wang@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 03, 2023 07:33 ET (12:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

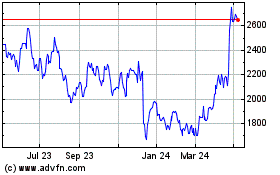

Anglo American (LSE:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

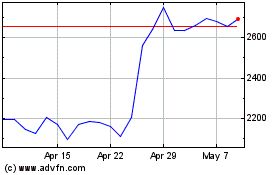

Anglo American (LSE:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024