TIDMAAZ

RNS Number : 8545O

Anglo Asian Mining PLC

13 October 2021

Anglo Asian Mining plc / Ticker: AAZ / Index: AIM / Sector:

Mining

13 October 2021

Anglo Asian Mining plc

Q3 and 9M 2021 Production and Operations review

Production of 16,316 gold equivalent ounces in Q3 2021

Cash of $30.9 million at 30 September 2021

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer operating in Azerbaijan, is

pleased to provide a production, sales and operations review for

its Gedabek gold, copper and silver production contract area

("Gedabek") in western Azerbaijan for the three and nine months to

30 September 2021 ("Q3 2021" and "9M 2021" respectively).

Note that all references to "$" are to United States

dollars.

Overview

-- Q3 2021 production of 16,316 gold equivalent ounces ("GEOs") (Q3 2020: 18,190 GEOs)

-- 9M 2021 total production of 48,487 GEOs (9M 2020: 50,702 GEOs)

-- Cash of $30.9 million at 30 September 2021 (30 June 2021: $36.6 million)

o Final dividend for 2020 of $5.2 million and profits tax of

$1.4 million paid in Q3 2021

-- Full Year 2021 ("FY 2021") production guidance of 64,000 to 72,000 GEOs maintained

-- Transformational acquisition of rights to three new

concessions in Azerbaijan with significant copper reserves, a

milestone in the Company's history, announced on 29 September 2021.

These new concessions, subject to parliamentary ratification,

underpin Anglo Asian's strategy to become a mid-tier copper and

gold miner

-- An interim dividend of $0.045 per share will be paid gross to

shareholders at the record date of 8 October on 4 November 2021 for

the year ending 31 December 2021

Anglo Asian CEO Reza Vaziri commented:

"I am pleased to report a steady rate of production year-to-date

as we continue to mine our existing sites, and we reiterate

production guidance for the full year 2021.

"We made considerable progress in increasing our resources

during the period and are now presented with several compelling

growth opportunities. The high-quality Zafar deposit, and three

exciting new contract areas, significantly strengthen our copper

inventories. These will underpin our future long-term production

and transition to a mid-tier producer."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information please contact:

Reza Vaziri Anglo Asian Mining plc Tel: +994 12 596 3350

Bill Morgan Anglo Asian Mining plc Tel: +994 502 910 400

------------------------------ ----------------------

Stephen Westhead Anglo Asian Mining plc Tel: +994 502 916 894

------------------------------ ----------------------

Ewan Leggat SP Angel Corporate Finance Tel: +44 (0) 20 3470

Adam Cowl LLP 0470

Nominated Adviser and Broker

------------------------------ ----------------------

Charlie Jack Hudson Sandler Tel: +44(0) 20 7796

Elfie Kent 4133

------------------------------ ----------------------

Notes to editors

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in Central Asia with a broad portfolio of production and

exploration assets in Azerbaijan. The Company produced 67,249 gold

equivalent ounces ("GEOs") for the year ended 31 December 2020. The

Company has a production target for the year to 31 December 2021 of

48,000 ounces to 54,000 ounces of gold and 2,500 tonnes to 2,800

tonnes of copper. This total production target expressed as gold

equivalent ounces ("GEOs") at budgeted prices is between 64,000

GEOs and 72,000 GEOs.

The Company has recently announced a transaction with the

Government of Azerbaijan which grants it three additional

concessions with a combined area of 882 square kilometers which

include the Garadagh porphyry copper deposit with a Soviet

classified resource of over 300,000 tonnes of copper. The

transaction is subject to ratification by the parliament of

Azerbaijan.

https://www.angloasianmining.com/

Production overview

Q3 2021

-- Total production of 16,316 GEOs (Q3 2020: 18,190 GEOs)

-- Gold production of 12,847 ounces (Q3 2020: 15,461 ounces):

o 12,317 ounces contained within gold doré

o 13 ounces from sulfidisation, acidification, recycling and

thickening ("SART") processing

o 517 ounces from flotation processing

-- Copper production totalled 573 tonnes (Q3 2020: 688 tonnes):

o 265 tonnes from SART processing

o 308 tonnes from flotation processing

-- Silver production totalled 36,912 ounces (Q3 2020: 31,036 ounces):

o 5,473 ounces contained within gold doré

o 19,526 ounces from SART processing

o 11,913 ounces from flotation processing

9M 2021

-- Total production of 48,487 GEOs (9M 2020: 50,702 GEOs)

-- Gold production of 37,096 ounces (9M 2020: 43,384 ounces)

-- Copper production totalled 1,906 tonnes (9M 2020: 1,895 tonnes)

-- Silver production totalled 115,843 ounces (9M 2020: 89,564 ounces)

Sales

-- Q3 2021 gold bullion sales of 6,828 ounces at an average of

$1,815 per ounce (Q3 2020: 6,599 ounces sold at an average of

$1,947 per ounce)

-- Q3 2021 copper concentrate shipments totalled 3,549 dry

metric tonnes ("dmt") with a sales value of $5.7 million (excluding

Government of Azerbaijan profit share) (Q3 2020: 2,084 dmt with a

sales value of $3.4 million)

Company financials

-- Cash and cash equivalents totaling $30.9 million at 30

September 2021 (Cash and cash equivalents of $36.6 million at 30

June 2021)

o Final dividend in respect of 2020 of $5.2 million and profits

tax of $1.4 million paid in Q3 2021

Gedabek - mining, detailed production and sales

Anglo Asian continued to mine existing sites during the period,

following the exhaustion of the Ugur open pit in late 2020, in line

with previously announced guidance for the year and maintaining

steady production.

The Company mined the following amounts and grades of ore in the

nine months to 30 September 2021:

6 months to 3 months to 9 months to

30 June 2021 30 September 2021 30 September 2021

Average Average Average

Mine Ore mined gold grade Ore mined gold grade Ore mined gold grade

(tonnes) (g/t) (tonnes) (g/t) (tonnes) (g/t)

---------- ------------ ---------- ------------ ---------- ------------

Open pit 902,151 0.81 388,519 0.71 1,290,670 0.78

Ugur - o/pit - - - - - -

Gadir - u/g 54,145 2.05 31,188 1.81 85,333 1.96

Gosha - u/g - - - - - -

Gedabek -

u/g 99,847 1.60 54,179 1.36 154,026 1.52

---------- ------------ ---------- ------------ ---------- ------------

Total 1,056,142 0.95 473,886 0.86 1,530,028 0.65

-------------- ---------- ------------ ---------- ------------ ---------- ------------

* There have been some minor changes to the previously reported

figures following the reconciliation of ore stockpiles.

The Company processed the following amounts and grades of ore by

leaching for FY 2020 and Q1 to Q3 2021:

Quarter ended Ore processed Gold grade of ore processed

-------------------------------------- --------------------------------------

Heap leach Heap leach Agitation Heap leach Heap leach Agitation

pad crushed pad ROM leaching pad crushed pad ROM leaching

ore ore plant* ore ore plant*

(tonnes) (tonnes) (tonnes) (g/t) (g/t) (g/t)

------------- ------------- ----------- ----------

31 March 2020 132,731 258,121 163,379 0.84 0.49 2.53

30 June 2020 139,752 134,675 161,079 0.79 0.44 1.95

30 September

2020 168,945 149,031 181,200 0.87 0.50 2.09

31 December 2020 107,852 172,206 177,487 0.89 0.59 1.81

------------- ----------- ---------- ------------- ----------- ----------

FY 2020 549,280 714,033 683,145 0.85 0.51 2.17

------------------ ------------- ----------- ---------- ------------- ----------- ----------

31 March 2021 110,612 258,097 154,373 0.90 0.61 1.84

------------- ----------- ---------- ------------- ----------- ----------

30 June 2021 154,619 177,369 164,288 0.81 0.59 1.64

------------- ----------- ---------- ------------- ----------- ----------

H1 2021 265,231 435,466 318,661 0.84 0.60 1.78

------------------ ------------- ----------- ---------- ------------- ----------- ----------

30 September

2021 154,112 194,816 170,829 0.79 0.51 1.65

------------- ----------- ---------- ------------- ----------- ----------

* includes previously heap leached ore.

The Company processed the following amounts of ore and contained

metal by flotation for FY 2020 and Q1 to Q3 2021:

Quarter ended Ore processed Gold content Silver content Copper content

(tonnes) (ounces) (ounces) (tonnes)

-------------- ------------- --------------- ---------------

31 March 2020 126,354 1,860 28,831 622

30 June 2020 132,848 1,459 18,354 762

30 September

2020 123,440 1,565 15,530 741

31 December 2020 110,772 859 8,660 693

-------------- ------------- --------------- ---------------

FY 2020 493,414 5,743 71,375 2,818

------------------ -------------- ------------- --------------- ---------------

31 March 2021 111,060 920 15,782 652

30 June 2021 116,910 1,251 23,870 596

-------------- ------------- --------------- ---------------

H1 2021 227,970 2,171 39,652 1,248

------------------ -------------- ------------- --------------- ---------------

30 September

2021 126,161 1,231 19,939 519

-------------- ------------- --------------- ---------------

The following table summarises gold doré production and sales at

Gedabek for FY 2020 and Q1 to Q3 2021:

Gold produced* Silver Gold sales** Gold Sales price

(ounces) produced* (ounces) ($/ounce)

(ounces)

Quarter ended

31 March 2020 15,034 3,852 11,236 1,577

30 June 2020 11,455 3,562 12,743 1,713

-------------- ------------------ ------------- ------------- ----------------

H1 2020 26,489 7,414 23,979 1,649

-------------- ------------------ ------------- ------------- ----------------

30 Sept 2020 14,945 5,487 6,599 1,947

31 Dec 2020 13,276 4,614 18,072 1,884

-------------- ------------------ ------------- ------------- ----------------

H2 2020 28,221 10,101 24,671 1,901

-------------- ------------------ ------------- ------------- ----------------

FY 2020 54,710 17,515 48,650 1,777

-------------- ------------------ ------------- ------------- ----------------

31 March 2021 11,541 4,916 5,635 1,697

30 June 2021 11,791 5,922 13,947 1,808

-------------- ------------------ ------------- ------------- ----------------

H1 2021 23,332 10,838 19,582 1,776

-------------- ------------------ ------------- ------------- ----------------

30 Sept 2021 12,317 5,473 6,828 1,815

-------------- ------------------ ------------- ------------- ----------------

Note

* including Government of Azerbaijan's share

** excluding Government of Azerbaijan's share

The following table summarises copper concentrate production

from both the Company's SART and flotation plants at Gedabek for FY

2020 and Q1 to Q3 2021:

Concentrate Copper Gold Silver

production* content* content* content*

2020 (dmt) (tonnes) (ounces) (ounces)

Quarter ended 31 March

SART processing 221 114 8 12,895

Flotation 2,773 445 825 17,895

--------------------------- ------------ --------- --------- ---------

Total 2,994 559 833 30,790

--------------------------- ------------ --------- --------- ---------

Quarter ended 30 June

SART processing 267 151 7 10,857

Flotation 2,904 497 573 9,542

--------------------------- ------------ --------- --------- ---------

Total 3,171 648 580 20,399

--------------------------- ------------ --------- --------- ---------

Quarter ended 30 Sept

SART processing 301 165 7 17,148

Flotation 2,965 523 476 8,416

--------------------------- ------------ --------- --------- ---------

Total 3,266 688 483 25,564

--------------------------- ------------ --------- --------- ---------

Quarter ended 31 December

SART processing 421 196 15 21,279

Flotation 2,929 500 243 7,086

--------------------------- ------------ --------- --------- ---------

Total 3,350 696 258 28,365

--------------------------- ------------ --------- --------- ---------

2021

Quarter ended 31 March

SART processing 473 276 13 19,850

Flotation 2,375 362 353 10,599

--------------------------- ------------ --------- --------- ---------

Total 2,848 638 366 30,449

--------------------------- ------------ --------- --------- ---------

Quarter ended 30 June

SART processing 512 301 12 22,428

Flotation 2,652 394 539 15,216

--------------------------- ------------ --------- --------- ---------

Total 3,164 695 551 37,644

--------------------------- ------------ --------- --------- ---------

Quarter ended 30 Sept

SART processing 503 265 13 19,526

Flotation 2,600 308 517 11,913

--------------------------- ------------ --------- --------- ---------

Total 3,103 573 530 31,439

--------------------------- ------------ --------- --------- ---------

Note

* including Government of Azerbaijan's share.

Certain amounts for SART and flotation production may differ to

those previously disclosed due to final reconciliation of

production.

The following table summarises total copper concentrate

production and sales for FY 2020 and Q1 to Q3 2021. Note that sales

of concentrates are initially recorded at provisional amounts until

agreement of final assay:

Concentrate Copper Gold Silver Concentrate Concentrate

production* content* content* content* sales** sales**

(dmt) (tonnes) (ounces) (ounces) (dmt) ($000)

Quarter ended

31 March 2020 2,994 559 833 30,790 2,018 2,863

30 June 2020 3,171 648 580 20,399 3,526 4,707

--------------- ------------ --------- --------- --------- ------------ --------------

H1 2020 6,165 1,207 1,413 51,189 5,544 7,570

--------------- ------------ --------- --------- --------- ------------ --------------

30 Sept 2020 3,266 688 483 25,564 2,084 3,377

31 Dec 2020 3,350 696 258 28,365 4,211 6,763

--------------- ------------ --------- --------- --------- ------------ --------------

H2 2020 6,616 1,384 741 53,929 6,295 10,140

--------------- ------------ --------- --------- --------- ------------ --------------

FY 2020 12,781 2,591 2,154 105,118 11,839 17,710

--------------- ------------ --------- --------- --------- ------------ --------------

31 March 2021 2,848 638 366 30,499 - -

30 June 2021 3,164 695 551 37,644 3,467 9,066

--------------- ------------ --------- --------- --------- ------------ --------------

H1 2021 6,012 1,333 917 68,143 3,467 9,066

--------------- ------------ --------- --------- --------- ------------ --------------

30 Sept 2021 3,103 573 530 31,439 3,549 5,712

--------------- ------------ --------- --------- --------- ------------ --------------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

Cash

The Company had cash of $30.9 million at 30 September 2021

($36.6 million at 30 June 2021) and no debt.

Gadir underground mine - JORC Mineral Resources and Ore reserves

Published on 23 September 2021 - Correction

On 23 September 2021, the Company published its interim results

for the six months

ended 30 June 2021. These included the JORC Mineral Resources

and Ore Reserves of the Gadir underground mine, as disclosed in

tables three and four respectively of the Strategic Report. The two

tables incorrectly gave the units of the contained zinc and copper

as thousands of tonnes ("kt"). The correct units for the amounts

shown in the two tables for contained zinc and copper are

tonnes.

**S**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTQLLFFFBLLFBB

(END) Dow Jones Newswires

October 13, 2021 02:00 ET (06:00 GMT)

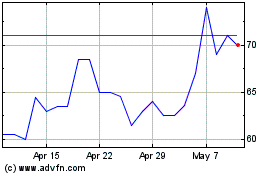

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024