TIDMABDP

RNS Number : 7863W

AB Dynamics PLC

28 April 2021

28 April 2021

AB Dynamics plc

Unaudited interim Results for the six months ended 28 February

2021

"Stable performance with positive trading momentum"

AB Dynamics plc (AIM: ABDP, "ABD", "the Group"), the designer,

manufacturer and supplier of advanced testing systems and

measurement products to the global automotive market, is pleased to

announce its interim results for the six-month period to 28

February 2021 (the "period").

H1 2021 H2 2020 H1 2020

GBPm GBPm GBPm

Revenue 27.3 26.8 34.7

Gross margin 57.7% 58.3% 58.5%

Adjusted operating profit(1) 3.5 3.3 8.0

Adjusted operating margin(1) 12.8% 12.2% 23.2%

Statutory operating profit 1.4 1.8 3.6

Cash flow from operations 7.8 3.7 3.3

Net cash 33.1 30.0 34.2

------------------------------ -------- -------- --------

Pence Pence Pence

Adjusted diluted earnings

per share(1) 13.1 10.7 29.2

Statutory diluted earnings

per share 5.6 7.2 12.9(2)

Interim dividend per share 1.6 - -

Final dividend per share - 4.4 -

------------------------------ -------- -------- --------

(1) Before amortisation on acquired intangibles, acquisition

related charges, and exceptional items. A reconciliation to

statutory measures is given in the Financial Review. Comparatives

for H1 2020 have been restated to reflect the inclusion of

share-based payments which were previously reported as an

adjustment.

(2) The prior year comparative has been restated to reflect a

change in the statutory tax charge following the finalisation of

provisional fair value adjustments on the acquisition of Dynamic

Research Inc ('DRI') included in the Annual Report for the year

ended 31 August 2020.

Financial performance

-- Improved order intake against H2 2020 across both divisions

with a positive book to bill ratio providing confidence in delivery

of H2 revenue expectations, a significant proportion of which is

covered by the current order book

-- As anticipated, revenue was broadly comparable to H2 2020

with COVID-19 impact continuing into H1 2021

-- Track testing revenue was 29% lower than H1 2020 and 6% lower

than H2 2020, due to ongoing COVID-19 disruption to customer

testing activity, although driving robot sales started to recover

during the period

-- Laboratory testing and simulation delivered revenue growth of

23% on H1 2020 and 38% on H2 2020 driven by strong order intake

following the deferments last year

-- Operating margins of 12.8% were consistent with H2 2020,

reflecting reduced levels of activity and continued strategic

investment in capability to support long-term growth drivers (H1

2020: 23.2%, H2 2020: 12.2%)

-- Strong cash flow from operations of GBP7.8m. Significant net

cash balance of GBP33.1m at the period end (29 February 2020:

GBP34.2m, 31 August 2020: GBP30.0m) after investing GBP4.6m in

capital expenditure in the period, providing scope to support the

Group's strategic growth objectives. During H2 2021, EUR20m of this

cash was used to fund the acquisition of Vadotech Group

-- Interim dividend of 1.6p per share (H1 2020: nil)

Operational and strategic performance

-- Customer activity slowly returning as testing operations

remain restricted with COVID-19 impact continuing into H1 2021

-- Continued progress in growing the proportion of recurring and

service-based sales, which will be further enhanced by the

strengthening of our APAC regional footprint

-- New product development continues as planned with successful

launches including high speed ADAS platforms and a next generation

simulator

-- Continued investment for growth with the completion of the

new Engineering Design Centre and the ongoing build of the senior

management team

-- Since the period end, Vadotech Group has been acquired,

demonstrating further progress against the Group's strategic

priorities. The acquisition expanded our capability into on-road

testing services and established a regional hub in the

strategically important APAC region

Current trading and outlook

-- As anticipated, performance in the first half of the year was

broadly comparable to the second half of FY20, with continued

impacts of the COVID-19 pandemic

-- The order intake trend provides confidence for continued positive momentum into H2

-- The Board's expectations for the financial year are unchanged

-- Future growth prospects remain supported by long term

structural and regulatory growth drivers in active safety and

autonomous systems

There will be a presentation for analysts this morning at 9.30am

via conference call. Please contact abdynamics@tulchangroup.com if

you would like to attend.

Commenting on the results, Dr James Routh, Chief Executive

Officer said:

"The Group has delivered another resilient performance in the

first half of the year against a backdrop of market conditions that

continue to be challenging.

We have seen an encouraging rebuild of demand in our key markets

from the severe disruption experienced in the second half of FY20.

The Board's expectations for the financial year are unchanged,

despite the continued disruption associated with further waves of

infection which means that visibility remains limited and there

remains short-term uncertainty as to the shape and rate of the

recovery. This, together with the risk of currency headwinds and

Brexit-related logistics disruption, means that we remain cautious

in the near term. However, our improved order intake provides

positive trading momentum into H2. Looking further ahead, we remain

confident that demand will recover over the longer term and that

the actions we have taken in the last 12 months position the Group

very strongly to capitalise on this.

Despite the uncertain backdrop, we see significant scope for

continued progress against the Group's strategy, as demonstrated by

the acquisition of the Vadotech Group in March 2021 and the related

growth opportunities. The market drivers are compelling and the

medium-term outlook for AB Dynamics continues to be positive. The

Board remains confident the Group can continue to deliver on its

strategic priorities."

Enquiries:

AB Dynamics plc 01225 860 200

Dr James Routh, Chief Executive Officer

Sarah Matthews-DeMers, Chief Financial

Officer

Peel Hunt LLP 0207 894 7000

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Laura Marshall

The person responsible for arranging the release of this

information is Felicity Jackson, Company Secretary.

Half Year Review

Group overview

Against a backdrop of macroeconomic conditions that remain

challenging, the Group has delivered another resilient performance,

whilst also continuing to invest to ensure AB Dynamics can

capitalise on the significant long-term structural and regulatory

growth drivers within its markets.

The Group has seen gradual recovery in order intake through the

first half of the year, with customer activity returning slowly, as

testing operations are still impacted by COVID-19 restrictions, and

likely to remain so in the short term. Pleasingly, several capital

equipment orders which were deferred in the prior year have now

been received, including an order for an advanced variant of our

simulator for a major automotive OEM.

Our continued investments have strengthened our market position

to enable the business to emerge strongly as markets recover. New

product development has continued as planned with new launches

including high speed ADAS (Advanced Driver Assistance Systems)

platforms and the next generation simulator. The completion of the

new Engineering Design Centre and continued build of the senior

management team strengthen our capability and capacity.

Financial performance

Against a very strong prior year comparative period (delivered

prior to the COVID-19 pandemic) in which revenues increased by 34%,

the results for the first half of FY21 are significantly lower.

Revenue of GBP27.3m was down 21% (H1 2020: GBP34.7m).

However, as the COVID-19 pandemic did not impact the first half

of last year, a more relevant comparative is against the second

half of the last financial year. Against H2 2020, current period

revenue was up 2% (H2 2020: GBP26.8m).

Gross margins reduced by 80 bps to 57.7% (H1 2020: 58.5%, H2

2020 58.3%), impacted by a higher proportion of large capital

equipment revenues in laboratory testing and simulation, which are

lower margin than the Group's other products and services.

Group adjusted operating profit of GBP3.5m decreased 57% against

H1 2020, but increased 6% against H2 2020. The adjusted operating

margin decreased against H1 2020 to 12.8% (H1 2020: 23.2%), being

significantly impacted by the decrease in sales volumes, by our

continued investment in our strategy for growth and building out

the senior management team, partly offset by mitigating actions to

reduce discretionary spending. It was up 60 bps against the second

half of last year (H2 2020: 12.2%) with similar levels of

activity.

Net finance costs were GBPnil (H1 2020: net income GBP0.1m).

Adjusted profit before tax was GBP3.5m (H1 2020: GBP8.1m). The

Group adjusted tax charge totalled GBP0.5m (H1 2020: GBP1.5m), an

adjusted effective tax rate of 15% (H1 2020: 19%).

Adjusted diluted earnings per share was 13.1p (H1 2020: 29.2p),

a decrease of 55%, reflecting the decrease in operating profit.

Statutory operating profit reduced by 62% to GBP1.4m and after

net finance costs of GBPnil (H1 2020: net finance income GBP0.1m),

statutory profit before tax was down 63% from GBP3.7m to GBP1.4m,

giving statutory basic diluted earnings per share of 5.6p (H1 2020:

12.9p). The statutory tax charge was GBP0.1m (H1 2020: GBP0.7m). A

reconciliation of statutory to underlying non-GAAP financial

measures is provided below. The adjustments of GBP2.1m comprise

GBP1.7m of amortisation of acquired intangibles and GBP0.4m of

acquisition costs (H1 2020: GBP4.4m comprising GBP1.8m of

amortisation of acquired intangibles, GBP0.6m acquisition costs,

GBP0.1m restructuring costs and GBP1.9m inventory impairment).

The Group delivered strong operating cash flow of GBP7.8m with

the net cash position at the period end of GBP33.1m underpinning a

robust balance sheet and providing the resources to acquire the

Vadotech Group after the period end for EUR20.0m initial

consideration and first performance payment from existing cash

balances.

COVID-19

The emergence of the COVID-19 pandemic in early 2020 saw

unprecedented impacts on global economies, with the automotive

sector impacted particularly significantly. The Group took rapid

steps to limit discretionary spend and conserve cash whilst we

gained clarity on the overall short-term impact on the

business.

The Group has not seen any significant adverse impacts on its

supply chain or manufacturing facilities, but many larger, capital

equipment orders were initially deferred by our customers. More

significant however was the widespread curtailment of and

significant disruption to both motor sport and the vehicle track

testing activities of our customers during the second half of the

previous financial year. This directly and severely impacted demand

for our testing services and products. Whilst activity in these

areas remains below pre-COVID 19 levels in many instances, we are

seeing evidence of a gradual and sustained recovery. Order intake

has started to improve during the last three quarters and several

of the anticipated larger capital equipment orders have now been

received, giving improved order coverage for the second half of the

year.

Throughout the periods of lockdown, the Group has been able to

maintain key manufacturing and track testing operations, whilst

approximately 70% of our global workforce worked remotely. This

balance has proved to be effective, and we have been able to

continue delivering for our customers whilst maintaining our

investment activities, particularly in product development. The

restrictions on travel are curtailing certain installation,

commissioning and training activities from taking place, however

our recently added international sales and support offices have

been able to continue to support customers where required.

Looking forward there remains uncertainty around the ongoing

impact of COVID-19 and the Board continues to be cautious and alert

to conditions in the wider automotive market. Timing of order

intake is likely to remain variable and we expect this uncertainty

to continue through at least the remainder of the financial year,

particularly in relation to larger, capital equipment orders.

However, we are confident that the long-term structural and

regulatory drivers that underpin our markets remain firmly intact.

The Group is therefore continuing to invest, demonstrated by the

recent acquisition of Vadotech Group, as well as further investment

in new product development and business infrastructure, all of

which the Board believes are critical to delivering its long-term

growth and strategic development objectives.

Sector review

Track testing

Track testing revenue of GBP20.9m was down 29% against H1 2020

(GBP29.5m) and down 6% against H2 2020 (GBP22.2m).

Driving robot sales started to recover in the first half of the

year to GBP9.1m (H1 2020: GBP13.7m, H2 2020 GBP7.3m), having fallen

significantly in the second half of last year. Compared with

pre-pandemic levels, the Group expects sales revenues in this

sector to remain constrained in the short term, before growing

again once new regulatory requirements for new ADAS technologies

are released and customer track testing operations can resume at

full capacity.

Demand for ADAS platforms was resilient during the second half

of last year but reduced to GBP9.6m in H1 2021 (H1 2020: GBP12.7m,

H2 2020: GBP11.4m). Demand for these products, particularly the

Launchpad, is expected to continue to build as new test protocols

are released from regulatory and consumer bodies such as Euro-NCAP.

The trend towards multi-object test scenarios will further drive

demand for a range of platforms that meet these test requirements,

including platforms to carry a range of objects (e.g. pedestrian

dummies, cyclists, scooters, motorcycles, etc.) that can operate at

a range of speeds and can interact with a variety of test vehicles

from passenger cars to commercial vehicles. We have recently

launched higher speed versions of the GST and Launchpad, which can

operate at speeds of up to 120kph and 60kph respectively, enabling

customers to perform a greater range of tests, particularly the

assessment of automated lane keeping technology.

The track testing services provided to the US market by DRI

enable customers to evaluate the performance of ADAS systems,

autonomous vehicles and vehicle dynamics through its extensive test

facility. DRI's track testing revenue of GBP2.2m fell by GBP0.9m in

the first half of the year, which is usually their quieter period,

as government related contracts were delayed due to the change of

administration and customers' ability to attend the track was

curtailed (H1 2020: GBP3.1m, H2 2020: GBP3.5m).

Order intake for track testing products has continued to

improve, giving confidence for the continued recovery into the

second half of the year.

The Group continues to invest in new product development in this

sector with further new product launches planned for H2.

Laboratory testing and simulation

The laboratory testing and simulation sector delivered strong

revenue growth against both comparator periods; at GBP6.3m it

increased 23% on H1 2020 and 38% on H2 2020 (H1 2020: GBP5.2m, H2

2020: GBP4.6m).

Simulation sales grew significantly, with the receipt of one of

the deferred simulator orders early in the first half and growth

from the return of motorsport series. Simulation revenue of GBP4.3m

grew 39% compared with GBP3.1m in H1 2020 (H2 2020: GBP1.6m).

Following the receipt of another deferred order, SPMM revenue of

GBP2.0m was broadly similar to H1 2020 (H1 2020: GBP2.1m, H2 2020:

GBP3.0m) with further opportunities in the pipeline.

The Group has made solid progress during the period in

laboratory testing and simulation, with a number of orders received

for large systems and further opportunities in the pipeline,

although timing still remains uncertain. The current order coverage

for SPMM and simulators provides good confidence for delivery of

expectations for the remainder of the financial year.

The Group's new Engineering Design Centre now houses a

simulation research and development facility to accelerate the

development of new simulator technologies, including the next

generation full motion simulator.

Progress on our strategy

We are pleased with the ongoing progress made against the

five-point strategy announced in April 2019.

Investment in product development has been ongoing, with the

market launch of the GST 120 and Launchpad 60 and the continued

development of the wider ADAS platform family, completion of the

aNVH 250 and further expansion of our simulator product family and

simulation capability. These new products address future regulatory

requirements for testing of ADAS systems and the market need to

rapidly accelerate autonomous system verification. Significant

investment in product development continues which supports our

model of sustainable revenue growth.

To deliver the required capability and capacity to drive our

future growth, the Group has further invested in strengthening and

developing the senior management team and completed the build of

our new Engineering Design Centre. Investment in building our

business infrastructure continues with the ERP implementation

project due to go live during 2021. This is a significant change

project that will transform the business processes across the Group

and provide strong foundations to support current and future

growth.

Since the period end, the acquisition of Vadotech Group has been

completed, expanding our capability into on-road testing services

and establishing our regional hub in the strategically important

APAC region and the acquisition pipeline remains promising.

Acquisitions

Vadotech Group was acquired after the period end, on 3 March

2021, for total potential cash consideration of up to EUR26.0m.

Vadotech is a leading supplier of testing services in the Asia

Pacific region, headquartered in Singapore with key operations in

China, Germany and Japan. It provides comprehensive automotive

testing services including evaluations of ADAS systems,

infotainment, connectivity, electric vehicle performance and

charging and other associated functions. The business has

long-standing relationships with German automotive OEMs, providing

vehicle testing services to local operations, underpinned by

long-term customer framework agreements.

The acquisition supports a number of the Group's stated

strategic priorities including:

-- Expanding the Company's international footprint by providing

a sales and technical facility in the strategically important

Chinese market;

-- Establishing a new Asia Pacific divisional operating hub in

Singapore to manage the territory, drive additional cross selling

of Group products in the region and identify and deliver further

strategically important growth initiatives;

-- Further increasing the Group's visibility of future revenue

as Vadotech Group sales are supported by long-term customer

framework agreements;

-- Increasing the range of services provided by the Group to

include full vehicle assessments including quality assurance

testing and support to new vehicle R&D programmes;

-- Establishing an electric vehicle and e-mobility technology training centre in Germany; and

-- Opportunity to replicate the Vadotech Group business model in

other territories such as Europe and the USA

The acquisition was completed on a cash free, debt free basis

for an initial cash consideration of EUR17.0m, funded from the

Company's existing cash resources. A further cash payment of

EUR3.0m has become payable based on performance for the year ended

31 December 2020, with a further conditional cash payment of

EUR6.0m being subject to certain performance criteria being

achieved for the year ending 31 December 2021.

The acquisition provides a significantly larger physical

presence for AB Dynamics in Asia Pacific and the Group will invest

approximately GBP1.0m in ongoing operational costs to establish a

strong regional hub for the wider business.

Alternative performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax and adjusted earnings per

share.

The interim report includes both statutory and adjusted non-GAAP

financial measures, the latter of which the Directors believe

better reflect the underlying performance of the business and

provides a more meaningful comparison of how the business is

managed and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this interim report relate to

underlying business performance (as defined above) unless otherwise

stated.

A reconciliation of adjusted measures to statutory measures is

provided below:

H1 2021 H1 2020

Adjusted Adjustments Statutory Adjusted Adjustments Statutory

Operating profit (GBPm) 3.5 (2.1) 1.4 8.0 (4.4) 3.6

Operating margin (%) 12.8 (7.8) 5.0 23.2 (12.9) 10.3

Profit before tax (GBPm) 3.5 (2.1) 1.4 8.1 (4.4) 3.7

Tax expense (GBPm) (0.5) 0.4 (0.1) (1.5) 0.7 (0.8)

Profit after tax (GBPm) 3.0 (1.7) 1.3 6.6 (3.7) 2.9

Diluted earnings per share (pence) 13.1 (7.5) 5.6 29.2 (16.3) 12.9

The adjustments to operating profit comprise:

H1 2021 H1 2020

GBPm GBPm

Amortisation of acquired intangibles 1.7 1.8

Acquisition related costs 0.4 0.6

Inventory impairment - 1.9

Restructuring - 0.1

-------------------------------------- -------- --------

Adjustments 2.1 4.4

-------------------------------------- -------- --------

See note 3 for further details.

Research and development

While research and development forms a significant part of the

Group's activities, a significant proportion relates to specific

customer programmes which are included in the cost of the product.

Development costs of GBP0.6m (H1 2020: GBP0.2m) have been

capitalised in relation to projects for which there are a number of

near-term sales opportunities. Other research and development

costs, all of which have been written off to the profit and loss

account as incurred, total GBP0.2m (H1 2020: GBP0.4m).

Foreign currency exposure

The Group faces currency exposure on its foreign currency

transactions and with significant overseas operations, also has

exposure to foreign currency translation risk.

The Group maintains a natural hedge whenever possible to

transactional exposure by matching the cash inflows and outflows in

the respective currencies.

There was no material difference between the reported profit for

the year and that calculated on a constant currency basis as the

impact of the weakening US dollar was offset by the strengthening

Euro.

Dividends

The Board has declared an interim dividend of 1.6p per ordinary

share which will be paid on 14 May 2021 to shareholders on the

register on 30 April 2021. In 2020, against a background of

significant macroeconomic uncertainty, the Board suspended the

interim dividend pending the conclusion of the financial year. A

final dividend of 4.4p per share was paid in respect of the year

ended 31 August 2020. It is the Board's intention to pursue a

sustainable and growing dividend policy in the future having regard

to the development of the Group.

Summary and Outlook

The Group has delivered another resilient performance in the

first half of the year against a backdrop of market conditions that

continue to be challenging. We have seen an encouraging rebuild of

demand in our key markets from the severe disruption experienced in

the second half of FY20. The Board's expectations for the financial

year are unchanged, despite the continued disruption associated

with further waves of infection which means that visibility remains

limited and there remains short-term uncertainty as to the shape

and rate of the recovery. This, together with the risk of currency

headwinds and Brexit-related logistics disruption, means that we

remain cautious in the near term. However, our improved order

intake provides positive trading momentum into H2. Looking further

ahead, we remain confident that demand will recover over the longer

term and that the actions we have taken in the last 12 months

position the Group very strongly to capitalise on this.

Despite the uncertain backdrop, we see significant scope for

continued progress against the Group's strategy, as demonstrated by

the acquisition of the Vadotech Group in March 2021 and the related

growth opportunities. The market drivers are compelling and the

medium-term outlook for AB Dynamics remains positive. The Board is

confident the Group can continue to deliver on its strategic

priorities.

Directors' Responsibility Statement

The Directors confirm that this condensed consolidated half year

financial information has been prepared in accordance with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the European Union, and that the half year management

report herein includes a fair review of the information required by

DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

half year financial information, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

By order of the Board

Dr James Routh

Chief Executive

28 April 2021

AB Dynamics plc

Unaudited consolidated statement of comprehensive income

for the six months ended 28 February 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended 28 ended 29 ended

February February 31 August

2021 2020 2020

(Restated)*

GBP'000 GBP'000 GBP'000

Notes

Revenue 2 27,280 34,672 61,514

Cost of sales (11,552) (14,401) (25,592)

---------- ------------- -----------

Gross profit 15,728 20,271 35,922

General and administrative

expenses (14,372) (16,708) (30,511)

---------- ------------- -----------

Operating profit 1,356 3,563 5,411

Finance income 21 114 218

Finance expense (18) (15) (30)

Other finance expense - - (564)

---------- ------------- -----------

Profit before tax 1,359 3,662 5,035

Tax expense (87) (749) (483)

---------- ------------- -----------

Profit for the period 1,272 2,913 4,552

---------- ------------- -----------

Other comprehensive expense:

Items that may be reclassified to consolidated income

statement:

Exchange losses on foreign

currency net investments (948) (755) (1,978)

---------- ------------- -----------

Total comprehensive income

for the period 324 2,158 2,574

---------- ------------- -----------

Earnings per share - basic

(pence) 5 5.6p 13.0p 20.2p

Earnings per share - diluted

(pence) 5 5.6p 12.9p 20.1p

---------- ------------- -----------

Alternative performance measures

Operating profit 1,356 3,563 5,411

Amortisation of acquired

intangibles 1,678 1,844 3,549

Inventory impairment - 1,865 3,267

Acquisition related charge/(credit) 463 588 (1,865)

Restructuring - 186 969

---------- ------------- -----------

Adjusted operating profit 3,497 8,046 11,331

Net finance income/(expense) 3 99 (376)

---------- ------------- -----------

Adjusted profit before tax 3,500 8,145 10,955

Adjusted tax (515) (1,520) (1,939)

---------- ------------- -----------

Adjusted profit after tax 2,985 6,625 9,016

---------- ------------- -----------

Adjusted earnings per share

- basic (pence) 5 13.2p 29.6p 40.1p

Adjusted earnings per share

- diluted (pence) 5 13.1p 29.2p 39.9p

---------- ------------- -----------

*Restated following finalisation of provisional fair value

adjustments to deferred tax and goodwill on the acquisition of DRI

detailed in the Annual Report for the year ended 31 August

2020.

AB Dynamics plc

Unaudited consolidated statement of financial position

as at 28 February 2021

Unaudited Unaudited Audited

28 February 29 February 31 August

2021 2020 2020

(Restated)*

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 15,821 16,542 16,170

Acquired intangible assets 15,719 19,574 17,623

Other intangible assets 2,389 423 1,114

Investment 12 13 12

Property, plant and equipment 26,845 20,637 24,309

Right-of-use assets 466 917 701

Deferred tax assets - 390 -

------------- ------------- -----------

61,252 58,496 59,929

------------- ------------- -----------

Current assets

Inventories 9,090 10,560 9,180

Trade and other receivables 14,466 16,289 12,844

Contract assets 1,613 2,002 2,926

Taxation 868 2,428 2,838

Fixed term deposits - 15,000 5,000

Cash and cash equivalents 34,084 20,139 26,183

------------- ------------- -----------

60,121 66,418 58,971

------------- ------------- -----------

LIABILITIES

Current liabilities

Borrowings 485 - 505

Trade and other payables 14,857 17,530 12,370

Short-term lease liabilities 246 426 473

------------- ------------- -----------

15,588 17,956 13,348

------------- ------------- -----------

Non-current liabilities

Deferred tax liabilities 2,927 3,189 2,549

Long-term lease liabilities 237 496 249

Deferred consideration - 3,239 -

------------- ------------- -----------

3,164 6,924 2,798

------------- ------------- -----------

Net assets 102,621 100,034 102,754

------------- ------------- -----------

Shareholders' equity

Share capital 230 225 226

Share premium 61,785 60,857 61,736

Reconstruction reserve (11,284) (11,284) (11,284)

Merger relief reserve 11,390 11,390 11,390

Translation reserve (2,748) (577) (1,800)

Retained earnings 43,248 39,423 42,486

------------- ------------- -----------

Total equity 102,621 100,034 102,754

------------- ------------- -----------

*Restated following finalisation of provisional fair value

adjustments to deferred tax and goodwill on the acquisition of DRI

detailed in the Annual Report for the year ended 31 August

2020.

AB Dynamics plc

Unaudited consolidated statement of changes in equity

for the six months ended 28 February 2021

Share Share Merger Recon-struction Translation Retained Total

capital premium relief reserve reserve earnings equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2020 226 61,736 11,390 (11,284) (1,800) 42,486 102,754

Share based

payments - - - - - 570 570

Total comprehensive

income - - - - (948) 1,272 324

Deferred tax

on share based

payments - - - - - (86) (86)

Dividend paid - - - - - (994) (994)

Issue of shares 4 49 - - - - 53

--------- --------- --------- ---------------- ------------ ---------- ---------

At 28 February

2021 230 61,785 11,390 (11,284) (2,748) 43,248 102,621

--------- --------- --------- ---------------- ------------ ---------- ---------

At 1 September

2019 222 60,049 11,390 (11,284) 178 38,252 98,807

Share based

payments - - - - - 540 540

Total comprehensive

income* - - - - (755) 2,913 2,158

Deferred tax

on share based

payments - - - - - (1,656) (1,656)

Dividend paid - - - - - (626) (626)

Issue of shares 3 808 - - - - 811

--------- --------- --------- ---------------- ------------ ---------- ---------

At 29 February

2020* 225 60,857 11,390 (11,284) (577) 39,423 100,034

--------- --------- --------- ---------------- ------------ ---------- ---------

At 1 September

2019 222 60,049 11,390 (11,284) 178 38,252 98,807

Share based

payments - - - - - 1,282 1,282

Total comprehensive

income - - - - (1,978) 4,552 2,574

Deferred tax

on share based

payments - - - - - (974) (974)

Dividend paid - - - - - (626) (626)

Issue of shares 4 1,687 - - - - 1,691

--------- --------- --------- ---------------- ------------ ---------- ---------

At 31 August

2020 226 61,736 11,390 (11,284) (1,800) 42,486 102,754

--------- --------- --------- ---------------- ------------ ---------- ---------

*Restated following finalisation of provisional fair value

adjustments to deferred tax and goodwill on the acquisition of DRI

detailed in the Annual Report for the year ended 31 August

2020.

.

AB Dynamics plc

Unaudited consolidated cash flow statement

for the six months ended 28 February 2021

Unaudited Unaudited Audited

Year

6 months 6 months ended

ended ended 31 August

28 February 29 February 2020

2021 2020 (Restated)*

(Restated)*

GBP'000 GBP'000 GBP'000

Profit before tax 1,359 3,662 5,035

Depreciation and amortisation 2,779 2,824 5,639

Net finance income (3) (99) (188)

Acquisition costs/(credit) - 39 (2,548)

Share based payments 570 540 1,282

-------------- ------------- -------------

Operating cash flows before changes

in working capital 4,705 6,966 9,220

Decrease in inventories 90 602 1,992

Increase in trade and other receivables (298) (3,264) (565)

Increase/(decrease) in trade and

other payables 3,285 (1,049) (3,737)

-------------- ------------- -------------

Cash flows from operations 7,782 3,255 6,910

Interest received 21 114 218

Finance costs paid (113) - -

Income tax received/(paid) 1,570 (2,114) (2,229)

-------------- ------------- -------------

Net cash flows from operating

activities 9,260 1,255 4,899

Cash flows used in investing activities

Acquisition of businesses (560) - (2,823)

Purchase of property, plant and

equipment (3,363) (1,977) (7,276)

Capitalised development costs (1,258) (168) (886)

-------------- ------------- -------------

Net cash used in investing activities (5,181) (2,145) (10,985)

Cash flows from financing activities

Movements in loans (20) - 477

Purchase of fixed term deposits - (15,000) (20,000)

Maturity of fixed term deposits 5,000 - 15,000

Dividends paid (994) (626) (626)

Proceeds from issue of share capital 53 811 1,691

Repayment of lease liabilities (249) (276) (592)

-------------- ------------- -------------

Net cash flow generated from/(used

in) financing activities 3,790 (15,091) (4,050)

-------------- ------------- -------------

Net increase/(decrease) in cash

and cash equivalents 7,869 (15,981) (10,136)

Cash and cash equivalents at beginning

of period 26,183 36,225 36,225

Effect of exchange rates on cash

and cash equivalents 32 (105) 94

-------------- ------------- -------------

Cash and cash equivalents at end

of period 34,084 20,139 26,183

-------------- ------------- -------------

*Restated following reclassification of fixed term deposits with

a maturity date of greater than three months at inception.

AB Dynamics plc

Notes to the unaudited interim report

for the six months ended 28 February 2021

1. Basis of preparation

The Company is a public limited company limited by shares and

incorporated under the UK Companies Act. The Company is domiciled

in the United Kingdom and the registered office and principal place

of business is Middleton Drive, Bradford on Avon, Wiltshire, BA15

1GB.

The principal activity is the specialised area of design and

manufacture of test equipment for vehicle suspension, steering,

noise and vibration. The company also offers a range of services

which include analysis, design, prototype manufacture, testing and

development.

The interim financial information has been prepared in

accordance with IAS 34, 'Interim Financial Reporting' as adopted by

the EU.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards as

adopted for use by the European Union. A copy of the statutory

accounts for the year ended 31 August 2020 has been delivered to

the Registrar of Companies. The auditor's report on those accounts

was unqualified and did not contain any statements under section

498(2) or (3) of the Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed in this unaudited interim financial

information as those which were applied in the preparation of the

Group's annual financial statements for the year ended 31 August

2020.

Certain new standards, amendments to standards and

interpretations are not yet effective for the year ended 31 August

2021 and have therefore not been applied in preparing this interim

financial information.

The interim accounts are unaudited and do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

Going concern basis of accounting

The Directors have assessed the principal risks discussed in

note 8, including by modelling a severe but plausible downside

scenario for COVID-19, whereby the Group experiences:

-- A reduction in demand of 25%

-- 10% increase in operating costs from supply chain disruption

-- Increase in cash collection cycle

With GBP33.1m of net cash at 28 February 2021 and availability

of a revolving credit facility of GBP15.0m, in this severe downside

scenario, the Group has sufficient headroom to be able to continue

to operate for the foreseeable future. The Directors believe that

the Group is well placed to manage its financing and other business

risks satisfactorily, and have a reasonable expectation that the

Group will have adequate resources to continue in operation for at

least 12 months from the signing date of this interim financial

information. They therefore consider it appropriate to adopt the

going concern basis of accounting in preparing the interim

financial information.

The interim financial information for the six months ended 28

February 2021 was approved by the Board on 28 April 2021.

2. Segment information

Revenues attributable to individual foreign countries are as

follows:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 29 February 31 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

United Kingdom 3,191 1,145 2,146

European Union 4,763 9,097 14,775

North America 8,963 7,432 15,606

Rest of the World 10,363 16,998 28,987

-------------- -------------- --------------

27,280 34,672 61,514

-------------- -------------- --------------

Revenues are disaggregated as

follows:

Track testing 20,937 29,517 51,760

Laboratory testing and simulation 6,343 5,155 9,754

-------------- -------------- --------------

27,280 34,672 61,514

-------------- -------------- --------------

3. Alternative Performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax and adjusted earnings per

share.

The interim financial information includes both statutory and

adjusted non-GAAP financial measures, the latter of which the

Directors believe better reflect the underlying performance of the

business and provide a more meaningful comparison of how the

business is managed and measured on a day-to-day basis. The Group's

alternative performance measures and KPIs are aligned to the

Group's strategy and together are used to measure the performance

of the business and form the basis of the performance measures for

remuneration. Adjusted results exclude certain items because if

included, these items could distort the understanding of the

performance for the year and the comparability between the

periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this interim report relate to

underlying business performance (as defined above) unless otherwise

stated.

A summary of the items which reconcile statutory to adjusted

measures is included below:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 29 February 31 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

Amortisation of acquired intangibles 1,678 1,844 3,549

Acquisition related charge/(credit) 463 588 (1,865)

Inventory impairment - 1,865 3,267

Restructuring - 186 969

-------------- -------------- --------------

2,141 4,483 5,920

-------------- -------------- --------------

Amortisation of acquired intangibles

The amortisation relates to the businesses acquired in 2019, DRI

and rFpro.

Acquisition related costs

The costs relate to the acquisition of the Vadotech Group after

the period end as well as staff retention payments to the employees

of rFpro. The cash to pay this was contributed by the previous

owner of rFpro prior to acquisition, but as the employees had to

remain within the business for a period prior to receiving payment,

a charge had to be recognised in the income statement in both the

current and the prior year. The credit in the second half of the

prior year relates to the release of deferred consideration on the

rFpro acquisition which, due to COVID-19 disruption was not

payable.

Inventory impairment

In the prior year, following a detailed review of inventory

levels and usage, a number of items previously included in the

carrying value were written off and the system of accounting for

inventory updated to better reflect the Group's current

operations.

Restructuring

The restructuring costs in 2020 relate to rebalancing the skill

base of the business and termination of agents.

4. Tax

The effective tax rate for the period is a charge of 6.4% (H1

2020: 20.5%, 2020: 9.6%) reflecting availability of additional

R&D credits and an increased patent box deduction.

The adjusted effective tax rate, adjusting both the tax charge

and the profit before taxation is 14.7% (H1 2020: 18.7%, 2020:

17.7%).

A number of changes to the UK corporation tax system were

announced in the March 2021 Budget Statement which will increase

the main rate of corporation tax to 25% by 1 April 2023. These

changes have not been substantively enacted at the balance sheet

date therefore the increased rate has not been reflected in

calculating the Group's deferred tax liabilities at 28 February

2021. Once enacted, this is expected to increase the deferred tax

liabilities and hence the Group's tax charge for the current year

by approximately GBP0.5m.

5. Earnings per share

The calculation of earnings per share is based on the following

earnings and number of shares:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

28 February 29 February 31 August

2021 2020 2020

Profit after tax attributable

to owners of the Company (GBP'000) 1,272 2,913 4,552

Weighted average number of shares

('000)

Basic 22,583 22,416 22,482

Diluted 22,781 22,661 22,622

Earnings per share (pence)

Basic 5.6 13.0 20.2

Diluted 5.6 12.9 20.1

Adjusted basic 13.2 29.6 40.1

Adjusted diluted 13.1 29.2 39.9

6. Dividends

A final dividend was paid in respect of the year ended 31 August

2019 of 2.8p per share totalling GBP626,000.

No interim dividend was paid in respect of the year ended 31

August 2020 as, given the significant macroeconomic uncertainty in

April 2020, the Board took the decision to suspend the interim

dividend pending the conclusion of the financial year.

At the Annual General Meeting the shareholders approved a final

dividend in respect of the year ended 31 August 2020 of 4.4p per

ordinary share totalling GBP994,000. This was paid on 22 January

2021 to shareholders on the register on 8 January 2021.

An interim dividend of 1.6p per ordinary share has been declared

in respect of the year ending 31 August 2021 which will be paid on

14 May 2021 to shareholders on the register on 30 April 2021.

7. Net cash

Net cash comprises cash and cash equivalents, bank overdrafts,

fixed term deposits with a maturity on acquisition of more than

three months and lease liabilities.

Unaudited Unaudited Audited

28 February 29 February 31 August

2021 2020 2020

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 34,084 20,139 26,183

Fixed term deposits - 15,000 5,000

Borrowings (485) - (505)

Lease liabilities (483) (922) (722)

------------- ------------- -----------

33,116 34,217 29,956

------------- ------------- -----------

During the period, the Group put in place a GBP15.0m revolving

credit facility with National Westminster Bank plc. The facility

remained undrawn at 28 February 2021.

8. Principal risks

The principal risks and uncertainties impacting the Group are

described on pages 43-47 of our Annual Report 2020 and remain

unchanged at 28 February 2021.

They include: COVID-19 disruption, downturn or instability in

major geographic markets or market sectors, loss of major customers

and changes in customer procurement processes, failure to deliver

new products, dependence on external routes to market, acquisitions

integration and performance, cybersecurity and business

interruption, competitor actions, loss of key personnel, threat of

disruptive technology, product liability, failure to manage growth,

foreign currency, credit risk and intellectual

property/patents.

9. Related party transactions

Mr A Best, Chairman of the Company, is a trustee and beneficiary

of the Best Middleton Trust. Rental payments of GBP24,000 (H1 2020:

GBP24,000, 2020: GBP48,000) were made in the period to the Trust.

No amounts were due to or from the Trust at any period end.

10. Acquisition of businesses

On 30 August 2019 the Group acquired 100% of Dynamic Research

Incorporated ('DRI') based in California, US, for initial

consideration of GBP17.3m (US$21.0m), before acquisition expenses

of GBP0.4m. Maximum deferred contingent consideration of GBP2.9m

(US$3.5m) was payable based on the performance of DRI for the

twelve months ended 31 May 2020. DRI exceeded its performance

targets and the deferred contingent consideration was paid in full

in July 2020. An accrual for the deferred contingent consideration

was included in the balance sheet on the date of acquisition at net

present value and the discount of GBP564,000 unwound and included

in other finance costs during the year ended 31 August 2020.

At 31 August 2019, the provisional fair value of goodwill was

recorded as GBP11.7m in relation to this acquisition. At 31 August

2020, following finalisation of the deferred tax position, both

goodwill and deferred tax liabilities were reduced by GBP2.2m and

goodwill was recorded at GBP9.5m. Due to the availability of an

election under US tax laws, the assets acquired have benefited from

a step-up in the asset base cost, resulting in increased

amortisation that is tax deductible in future periods. As the tax

base of the assets is equal to the acquisition date fair value of

those assets, no deferred tax has been recognised at the date of

acquisition. The impact of the adjustment on the comparatives for

the period ended 29 February 2020 was to reduce goodwill by

GBP2.1m, reduce deferred tax liabilities by GBP2.0m and increase

the tax charge by GBP0.1m.

During 2019 the Group acquired 100% of rFpro Limited for initial

consideration of GBP18.1m, before acquisition expenses of GBP0.3m.

Maximim deferred consideration of GBP3.5m was payable based on the

performance of rFpro for the 12 months ended 31 January 2021.

However due to COVID-19 disruption, the performance targets were

not met and no further consideration was payable. The accrual for

the deferred contingent consideration was released during the year

ended 31 August 2020.

Post balance sheet event

On 3 March 2021, the Group acquired 100% of Vadotech Pte Ltd and

Zynit Pte Ltd (collectively 'Vadotech Group') for total cash

consideration of up to EUR26.0m. The acquisition supports a number

of the Group's strategic priorities, including providing a sales

and technical facility in the strategically important Chinese

market, establishing a new Asia Pacific divisional operating hub

and further increasing the Group's visibility of future revenue as

Vadotech Group sales are supported by long term customer framework

agreements.

The acquisition has been completed on a cash free, debt free

basis for an initial cash consideration of EUR17.0m (GBP14.8m),

funded from the Group's existing cash resources. Two further

conditional cash payments of up to EUR3.0m (GBP2.6m) and EUR6.0m

(GBP5.2m) are subject to certain performance criteria being

achieved for the year ended 31 December 2020 and the year ending 31

December 2021, respectively. The criteria in relation to the

payment for the year ended 31 December 2020 have been met therefore

an additional EUR3.0m has become payable.

The book value of the acquired assets and liabilities at the

date of acquisition was GBP3.8m. The Group is currently in the

process of determining the fair values of the assets and

liabilities acquired.

Acquisition expenses totalled GBP0.4m, of which GBP0.2m was

incurred in the year ended 31 August 2020 and GBP0.2m is included

in administrative expenses in the consolidated statement of

comprehensive income for the period ended 28 February 2021.

Had the acquisition been completed at the beginning of the

period, Group revenue would have been GBP33.9m and adjusted

operating profit would have been GBP4.7m.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBVBRARUSUAR

(END) Dow Jones Newswires

April 28, 2021 02:00 ET (06:00 GMT)

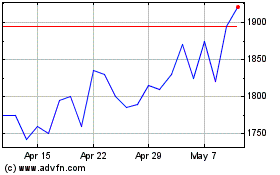

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Apr 2023 to Apr 2024