TIDMABDX

RNS Number : 3637G

Abingdon Health PLC

29 March 2022

Abingdon Health plc

("Abingdon" or "the Company")

Interim Results for the six months ended 31 December 2021

York, U.K - 29 March 2022: Abingdon Health plc (AIM: ABDX), a

leading international developer and manufacturer of high quality

and effective rapid tests, announces its unaudited interim results

for the six months ended 31 December 2021.

Operational Highlights (including post-period):

-- CE-marking for professional use of AbC-19(TM) Semi-Q Rapid

Test, which produces semi-quantitative results via a line intensity

scorecard;

-- AppDx(R) smartphone app solution for lateral flow tests

reached critical technical performance milestone, an additional UK

patent has been granted for the AppDx(R) technology and is now

ready for commercial launch;

-- Two contract service opportunities secured to date in 2022 -

in fertility testing and environmental monitoring;

-- The transfer of the Vatic Health Ltd ("Vatic") antigen test

into manufacturing is progressing as planned. Three technical

transfer batches have been completed which adhere to specification

with the final batch to be shipped to Vatic at the end of March

according to plan. Initial production orders have been received and

manufacturing will commence following technical transfer. Vatic

submitted its FDA Emergency Use Authorisation ("EUA") in March

2022;

-- As announced in an RNS Reach today , DeepVerge plc

("DeepVerge") and Abingdon have signed a Memorandum of

Understanding ("MoU") for a commercial agreement for the

development, manufacture and commercialisation of lateral flow

tests for DeepVerge's Modern Water and Life Science divisions;

-- As announced in an RNS Reach today , Vatic and Abingdon have

signed an MoU for a commercial agreement for the development,

manufacturing and commercialisation of lateral flow self-tests in

the area of infectious diseases with an initial focus on influenza;

and

-- Strong pipeline of other technical transfer opportunities,

highlighting benefits of integrating our lateral flow contract

development and manufacturing proposition.

Financial Highlights:

-- Revenue decreased to GBP1.7m (2020: GBP7.7m), predominantly

due to no DHSC being recognised in the period, as well as other

COVID-19 non-recurring revenues falling;

-- Like-for-like Contract Manufacturing revenue (excluding

COVID-19 related contracts) decreased by 15.2% to GBP1.0m (2020:

GBP1.2m);

-- Like-for-like Contract Development revenue increased by 27.6% to GBP0.9m (2020: GBP0.7m);

-- Gross profit margin adjusted for stock provisions was 25.4%

(2020 40.1%), main impact on margin being labour under-recoveries

with the changing cost base of the business on lower turnover;

and

-- Adjusted(1) Operating loss of GBP4.8m (2020: Adjusted(2) Operating loss of GBP0.1m);

-- Non-binding terms of a settlement with DHSC were agreed on 9

November 2021. The Company awaits conclusion of this matter and

payment of money owed, totalling GBP8.45m of unpaid invoices;

and

-- Fundraise of GBP6.5m gross and GBP6.1m net of fees in

December 2021 to support working capital and new product

developments in the market segments of infectious disease for flu

testing, Lyme disease and hepatitis C.

(1) adjusted for amortization, depreciation, share based payment

expense and non-recurring legal fees

(2) adjusted for amortization, depreciation, share based payment

expense and listing costs

Chris Yates, CEO at Abingdon Health plc, commented:

"Our focus remains on providing our customers with a first-class

lateral flow contract development and manufacturing service. We

have invested significantly in our operational infrastructure over

the past 18 months and more importantly we have advanced our

technical capability in developing, transferring and manufacturing

lateral flow tests across an increasingly diverse range of use

cases. I believe this is evidenced by the positive progress, and

customer feedback we have received, in the scale-up to manufacture

of recent tests, including Vatic, and I am proud of our people for

the commitment and team effort they have shown in achieving

these.

"We believe we are uniquely positioned in Europe to provide

prospective customers with an efficient and expert technical

transfer service to transition their lateral flow products into

manufacture. With supply chain challenges remaining a major issue

for many of our prospective customers, we are seeing significant

interest in on-shoring and outsourcing lateral flow test

manufacture as the international landscape for sourcing of these

tests becomes more uncertain in these changing times. In addition,

the diverse market and applications for lateral flow testing

continues to grow and we are increasingly focused on a broader

range of opportunities across clinical (including COVID-19), animal

health, environmental and plant pathogen testing, giving us

confidence that our strategy will drive future revenue growth."

For further information, please contact:

Abingdon Health plc www.abingdonhealth.com/investors/

Chris Yates, Chief Executive Officer Via Walbrook PR

Melanie Ross , Chief Financial Officer

Chris Hand, Non-Executive Chairman

Singer Capital Markets (Sole Broker and Tel: +44 (0)20 7496 3000

Nominated Adviser)

Shaun Dobson, Peter Steel, Alex Bond

(Corporate Finance)

Tom Salvesen (Corporate Broking)

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or abingdon@walbrookpr.com

Paul McManus / Lianne Applegarth Mob: +44 (0)7980 541 893 / +44

Phil Marriage (0)7584 391 303 +44 (0)7867

984 082

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement

via the Regulatory Information Service, this inside information is

now considered to be in the public domain.

About Abingdon Health plc

Abingdon Health is a world leading developer and manufacturer of

high-quality rapid tests across all industry sectors, including

healthcare and COVID-19. Abingdon Health is the partner of choice

for a growing global customer base and takes projects from initial

concept through to routine and large-scale manufacturing and has

also developed and marketed its own labelled tests.

The Company offers product development, regulatory support,

technology transfer and manufacturing services for customers

looking to develop new assays or transfer existing laboratory-based

assays to a lateral flow format. Abingdon Health aims to support

the increase in need for rapid results across many industries and

locations and produces lateral flow tests in areas such as

infectious disease, clinical testing including companion

diagnostics, animal health and environmental testing. Faster access

to results allows for rapid decision making, targeted intervention

and can support better outcomes. This ability has a significant

role to play in improving life across the world. To support this

aim Abingdon Health has also developed AppDx(R) , a patented

customisable image capturing technology that transforms a

smartphone into a self-sufficient, standalone lateral-flow

reader.

Founded in 2008, Abingdon Health is headquartered in York,

England.

www.abingdonhealth.com

BUSINESS REVIEW

Strategy

Abingdon Health's goal is to make rapid testing accessible to

all, by providing our customers with a comprehensive lateral flow

contract development and automated manufacturing service and

through the development and launch of our own lateral flow

products.

As outlined in the trading update earlier this month, the

Company is focused on three strategic growth areas:

1) Contract Development and Manufacturing Service

Our focus is to provide our customers with a rst-class

development, technical transfer and manufacturing contract service,

supported by additional expertise such as its in-house regulatory

and commercial support. Many of our people have been involved in

bringing lateral flow tests "from idea to market" across a range of

different sectors and we can bring this experience to bear in

servicing the needs of our growing customer base.

Non-COVID-19

As previously disclosed, the Company has successfully secured

two contract service opportunities to date in 2022, one with an

existing customer and one with a new European customer. One of

these customers is in the eld of fertility testing, the other is in

the eld of environmental monitoring, with both having commenced the

process of scale-up to automated manufacturing.

We also have a number of other non-COVID-19 opportunities in the

pipeline in a range of different clinical areas and we are

confident of converting a number of these opportunities into signed

contracts over the coming months.

We have seen, over recent months, a couple of key themes emerge

in our markets. Firstly, supply chains remain challenging with

issues for those buying product from abroad around surety of supply

from Far Eastern manufacturers with delivery delays, logistics

challenges (and increased logistics costs) and product quality

issues. This is leading us to experience an increase in enquiries

from prospective customers looking for a manufacturing partner

"closer to home".

Secondly, a number of prospective customers that have

successfully launched products are looking for a manufacturing

partner to allow them to transition to high volume manufacture.

Abingdon is an ideal partner given our ability to manufacture at

scale and significant investment in automation in the primary

scientific areas of production, including biochemical processes,

spraying of membranes, lamination of finished lateral flow test

strips, and the assembly and foiling of devices.

Today we announced the signing of an MoU with DeepVerge, an AIM

listed environmental and life sciences group, leading to a

commercial agreement for the development and manufacture of a range

of Lateral Flow Tests ("LFTs") for Deepverge's Modern Water and

Life Science divisions.

The MoU has been signed to enable the potential integration of

the respective technologies of both Abingdon and DeepVerge. Both

parties intend to enter into a longer-term commercial agreement,

with Abingdon manufacturing and DeepVerge commercialising these new

products.

Modern Water is the environmental division of DeepVerge that has

developed and commercialised cutting-edge technology focused on

monitoring of contaminated water and decontamination of

wastewater.

Abingdon and DeepVerge will work on the development of LFT

devices to detect dangerous pathogens and chemicals in household

drinking and wastewater. This will add an extra layer of detection

to the Modern Water range of equipment and services by

incorporating a LFT into a hand-held mobile unit. The results can

be digitally scanned using a mobile app with the potential to

incorporate Abingdon's proprietary AppDx(R) technology.

In addition, Abingdon and DeepVerge will collaborate on the

development of new LFTs to be added to DeepVerge's life science

home-test portfolio , including hormone analysis related to

menopause and associated skin changes, stress levels (cortisol),

vitamin D, and other health markers related to conditions including

diabetes, heart and liver function.

COVID-19

Abingdon's approach to COVID-19 is to target large contract

manufacturing opportunities. It is the Board's opinion that, whilst

individual governments may change their testing approach, the need

from the public or private sector for COVID-19 antigen testing is

likely to remain for an extended period. In all likelihood we will

see an increase in testing requirements during the autumn and

winter periods on a seasonal basis in the same way we do with the

flu virus.

It is also interesting to note that the Chinese Government has

recently made antigen tests available to the general public for the

first time as it transitions away from a "zero-tolerance" approach

to COVID-19. This may create challenges for the supply to Europe of

Chinese-made lateral flow tests as these manufacturers divert their

products to their domestic market. This further underlines the need

for lateral flow development and manufacturing in local markets.

Abingdon is well placed to service these needs.

Abingdon continues to work with Vatic on the technical transfer

to large-scale manufacture of its Know-Now(TM) COVID-19 rapid

antigen test into Abingdon's facilities. We are confident the Vatic

Know-Now(TM) test will complete technical transfer to manufacture

during March 2022. We also note Vatic's recent announcement of its

submission to FDA EUA of its Know-Now(TM) COVID-19 rapid antigen

test, which would open up the largest global diagnostics market to

this test.

Vatic has placed firm purchase orders for the manufacture of

Know-Now(TM) Tests and Abingdon will commence production as soon as

practicable following completion of technical transfer, scheduled

for 31 March 2022.

We were disappointed with the pause in the transfer of Avacta

Group plc's ("Avacta") A DX(R) SARS-CoV-2 antigen lateral ow tests,

following the successful preparation of three batches of its

product which adhered to the agreed speci cations and passed all

quality control procedures.

Abingdon is in active discussions on additional contract

services opportunities in the area of COVID-19 antigen testing

speci cally where the products are already in manufacture and a

second manufacturer is required or there is a need to support a

particular stage of the manufacturing process, for example in

primary production where there may be a need to spray reagents on

nitrocellulose and laminate to card format. A number of these

discussions are advancing and we are optimistic of commercial

traction in due course.

With regards to the AbC-19(TM) Rapid Test, the Directors

strongly believe that the test has significant utility. However, to

date, national testing strategies have not focused on antibody

testing. Therefore, the Company has, for now, decided to rotate its

focus away from block sales to health authorities toward end users

of the AbC-19(TM) test and the BioSure COVID-19 antibody test, for

which Abingdon is the manufacturer. The AbC-19(TM) product will

therefore remain available for sale, including via the Abingdon

website, and the Company will be ready to scale-up its supply as

and when national testing strategies focus on an individual's

antibody levels as a proxy for immunity.

2) E-commerce and distribution

The Company is in the process of developing and launching an

enhanced B2C e-commerce website, due for completion in Q2 2022. The

Directors believe that the direct-to-consumer lateral ow test

market will grow signi cantly and in its recent report, Future

Market Insights forecasts the global market for self-testing kits

will be worth US $11bn by 2030.

The Company expects its e-commerce site to become a 'one-stop

shop' for consumers to purchase lateral ow tests across a range of

indications, with Abingdon selling its own tests as well as

complementary third-party tests directly to consumer via the site.

These third-party tests will be independently validated by the

Company to provide the customer with the assurance that the tests

have been checked by lateral flow experts and are "fit for purpose"

and user-friendly.

As part of this process of improving our digital offering we

relaunched in March 2022 our B2B Pocket Diagnostics e-commerce

site. This will initially focus on plant, food and environmental

testing products and we will look to augment our existing Pocket

Diagnostic product range with third party products going

forward.

We are also actively building our own distribution network. Our

expertise is in the development and manufacture of lateral flow

tests and we are not looking to own the route to market. Therefore,

we will work with partners to distribute our lateral flow tests in

certain channels and internationally. We recently appointed a new

distribution channel manager tasked with building this distribution

channel to provide routes to market for both our own products and

third-party products which we have validated.

3) New product development

There is strong public sentiment that people are increasingly

willing to manage their own healthcare but also wish to prevent

spreading infection further by, for example, isolating from elderly

and immune compromised family and friends in the event of a

positive test result.

The Company therefore intends to develop lateral ow self-tests

in areas of large and unmet need. The Company has commenced its

product development process to develop lateral ow self-tests for in

uenza A/B and Lyme disease with hepatitis C work at an earlier

stage.

Global Market Insights estimates that the rapid in uenza

diagnostic tests market will be worth US $689m globally by the year

2025. The majority of u testing is currently performed by

professionals using 'for professional use only' tests, and the

Directors believe there is a clear rationale for an influenza

self-test, with encouraging early market feedback having been

undertaken with consumers and clinicians. The flu test programme

has commenced and we are undertaking reagent selection at this

time.

We were pleased to announce today the signing of an MoU with

Vatic, leading to a commercial agreement for the development and

manufacture of a range of LFTs in the area of infectious disease.

Initially Abingdon and Vatic will focus on the development of an

innovative influenza LFT, utilising Vatic's proprietary technology

platform which identifies proteins via their surface biological

mechanisms. The technology has been proven in the development of

Vatic's KnowNow test, and means the test only identifies

"infectious" or "active" copies of the virus which are capable of

cell entry and thereby infect a human cell. The application of this

technology within the influenza LFT could have the same potential

benefits in terms of accuracy and sensitivity in picking up only

those that are infectious, differentiating it from other

commercially available tests.

We are working with a European partner, which is an expert in

this field, on the development of our Lyme disease self-test that

is providing validated samples and expertise in this area. Work to

date has shown that the test is functional and going forward

practical work will focus on final confirmation of reagents and

test strip material configuration.

The consumer market feedback we have received from independent

surveys on both flu and Lyme disease is very positive and we are

confident there is a market for these tests. With regard to flu

testing, our results indicate that the public understand the

benefits of testing themselves, are prepared to pay for tests, and

that they will change their behaviour if they receive a positive

test result.

In terms of Lyme disease there is a strong recognition from our

consumer survey that people want a test to rule in/out Lyme disease

to enable early diagnosis and treatment. There have been a number

of high-profile cases of Lyme disease where late detection caused

significant medical complications and these may have been prevented

by early diagnosis and treatment.

Operational capacity

The Company has a large capacity to develop and manufacture

lateral flow tests at its disposal due to the investment made

following the IPO. This capacity is capable of delivering c.150m

test strips per annum, and c.85m fully completed foiled wrapped

devices. We believe this makes us one of the largest automated

lateral flow test manufacturers in Europe with the ability to

provide a full contract service to our customers, including reagent

selection, test development, technical transfer into manufacturing,

regulatory consultancy and commercial support. Our investment in

automation means that we can compete not only on scale and quantity

of tests, but also on price whilst delivering a quality product to

our customers, without the concerns of significant freight costs or

timing delays associated with bringing product in from other areas

of the world.

AppDx(R) smartphone app solution for lateral flow tests

AppDx(R) uses proprietary digital processing and machine

learning algorithms to allow the objective reading of lateral flow

results via a smartphone. Abingdon has developed this algorithm as

a Software Development Kit (SDK) which can then be incorporated

into a smartphone app solution in any potential application, for

example in the development of self-test solutions in the clinical

market.

The AppDx(R) SDK is protected by a portfolio of intellectual

property. In addition to being a knowledge leader for source code

for SDK in this field, and holding historical patents, the Company

has a newly granted UK patent on the use of neural networks to read

lateral flow tests (GB2583149) with other international

applications pending. The Company has additional patent

applications filed and in process.

Using deep learning for the qualitative readout of rapid tests,

Abingdon's model achieved 98.15% sensitivity and 98.28% specificity

on a blood-based lateral flow test. Following achievement of this

critical technical performance milestone the AppDx(R) SDK is ready

for commercial launch. As previously advised, the Company is

seeking to work with a small number of strategic partners to bring

this important digital solution to market later this year.

People

During the six months to 31 December 2021, the Company

stabilised its employee numbers with a small downward shift from

134 people at the start of the financial year to 123 as at the end

of December 2021. The Company will continue to review its

operational infrastructure to ensure it is appropriately sized to

satisfy its near term pipeline and revenue growth expectations.

As a business, Abingdon Health has undergone significant change

in the past 18 months with a large scale up project for AbC-19(TM)

and the regrettable redundancy programme that followed as a direct

impact of the DHSC dispute. The Board would like to thank all of

the Company's staff for their flexibility and support during this

challenging period; their commitment and endeavour continues to be

greatly appreciated. Throughout the COVID-19 pandemic, more than

ever, the safety and well-being of the Company's staff has been the

priority.

To support the Company's strategic refocus, Olly Gardner was

appointed as Chief Commercial Officer in February 2022 and Mark

Jones was appointed Chief Operating Officer to drive forward both

the commercial strategy and the operational roll-out of new

manufacturing programmes.

Financial Performance

As previously disclosed, revenues during the period were GBP1.7m

(2020: GBP7.7m), representing a decrease of 78%. The Company's

contract with the DHSC for the supply of AbC-19(TM) forms a

substantial portion of this reduction in revenue for the period.

GBP4.4m in the prior period related to AbC-19(TM) sales to DHSC and

GBP1.7m related to other COVID-19 related non-recurring

revenues.

The gross profit margin (adjusted for stock obsolescence) for

the period decreased to 25.4% (2020: 40.1%). This reflects the

labour under-recovery of the infrastructure built and

under-utilised.

Stock obsolescence was a further GBP1.6m, which reflects the

stocks of AbC-19(TM) built for deployment in territories that have

not materialised in the timeframe expected. The Directors continue

to believe that it has a role to play in COVID-19 vaccine roll

outs. As such, we continue to offer the product, however, the

volumes of stocks held will now be much lower until traction

increases.

Adjusted operating loss has increased significantly from the

prior period to GBP4.8m (2020: loss of GBP0.1m) due to lack of

volume. Adjustments made to the operating loss include share-based

payment expenses (GBP0.1m) and one-off costs relating to the

judicial review scheduled for May 2022 where the Group is named as

an interested party (GBP0.2m).

The Company's cash balance at 31 December 2021 was GBP5.9m.

DHSC

At this time, the DHSC owes Abingdon Health GBP8.4m in relation

to the supply of AbC-19(TM) and the procurement of materials on

behalf of the DHSC. As described in Note 3 to these interim

statements the Board are confident that the Company can

substantially recover monies related to this debt, however, this is

taking longer than previously anticipated and the timing of

recovery is uncertain following the signing of a non-binding heads

of terms agreement in November 2021. Due to the uncertain timing

and completion of this agreement, the Company has at this time

elected to treat a portion of these amounts owing as a bad debt,

which will enable the reclaiming of c. GBP0.8m in VAT previously

paid over to HMRC by Abingdon in relation to the provision of tests

(but not paid to Abingdon by DHSC). At the point the monies are

paid over by the DHSC in final settlement, the necessary further

amendments to VAT will be made and paid over to HMRC.

Current Trading and Outlook

The Board is confident that the Company is well placed to take

advantage of the expected growth in the lateral flow test market

across the clinical, animal health, plant and environmental

markets. Lateral flow tests are now much more widely understood and

adopted by the general public and COVID-19 has highlighted the

significant utility of these cost-effective rapid tests. The Board

is encouraged by the pipeline of opportunities the Company is

actively engaging with.

That said, the Company continues to work in a complex and

uncertain environment and is mindful that the capacity within the

business is under-utilised at this time.. As evidenced above, the

Company has a strong pipeline of opportunities in the near to

medium term which should lead to revenue growth. However, if these

opportunities do not convert then the Company remains able to take

action to conserve cash.

As a UK developer and manufacturer of lateral flow tests, the

Company is uniquely placed to support its growing customer base as

they focus on surety of supply and quality and the Board is

confident that its redefined strategic plan will ultimately deliver

value for shareholders.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 31 December 2021

As restated*

Notes Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 December 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

Revenue 1 1,704 7,687 11,618

Cost of sales (2,844) (4,606) (7,475)

-------------

Gross (loss)/profit (1,140) 3,081 4,143

Administrative expenses (3,664) (3,229) (7,547)

Other income 50 134 148

------------------------------ -------- ------------- ------------- ---------

Operating loss (before

adjusting items) (4,754) (14) (3,256)

Amortisation (58) (7) (42)

Depreciation (581) (34) (707)

Share-based payment expenses (100) (1,243) (1,367)

Non-recurring legal fees (198) - (257)

Listing costs - (570) (903)

Non-recurring redundancy

costs - - (188)

Operating loss (5,691) (1,868) (6,720)

Finance income - - -

Finance costs (34) (205) (234)

Loss before taxation (5,725) (2,073) (6,954)

Taxation (charge)/credit (9) 1,713 (19)

Loss for the period (5,734) (360) (6,973)

------------- ------------- ---------

Other comprehensive loss - (16) -

Total comprehensive loss

for the period (5,734) (376) (6,973)

------------- ------------- ---------

Basic earnings per share

(pence) 2 (2.05) (0.05) (2.65)

------------- ------------- ---------

Diluted earnings per

share (pence) 2 (2.05) (0.05) (2.65)

------------- ------------- ---------

*The restatement is detailed in note 6.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the period ended 31 December 2021

Notes As restated*

Unaudited Unaudited Audited

31 December 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 763 763 763

Other intangible assets 445 174 465

Property, plant and equipment 8,764 5,315 9,041

Deferred tax assets - 1,204 -

-------------- -------------

9,972 7,456 10,269

-------------- ------------- ----------

Current assets

Deferred tax assets - 1,000 -

Inventories 7,736 5,833 7,888

Trade and other receivables 3 9,592 6,801 9,978

Income tax debtor 155 275 115

Cash and cash equivalents 5,961 16,516 4,977

-------------- ------------- ----------

23,444 30,425 22,958

-------------- ------------- ----------

Total assets 33,416 37,881 33,227

-------------- ------------- ----------

LIABILITIES

Current liabilities

Trade and other payables 10,263 8,540 10,405

Borrowings 125 73 125

Lease liabilities 220 228 227

10,608 8,841 10,757

-------------- ------------- ----------

Non-current liabilities

Borrowings 311 177 367

Lease liabilities 668 888 776

-------------

979 1,065 1,143

-------------- ------------- ----------

Provisions

Deferred tax liabilities - 509 -

-------------- ------------- ----------

- 509 -

-------------- ------------- ----------

Total liabilities 11,587 10,415 11,900

-------------- ------------- ----------

Net assets 21,829 27,466 21,327

-------------- ------------- ----------

EQUITY

Share capital 4 76 69 69

Share premium 30,309 23,846 24,180

Share based payment reserve 5 121 329 44

Retained earnings (8,677) 3,222 (2,966)

Total equity 21,829 27,466 21,327

-------------- ------------- ----------

*The restatement is detailed in note 6

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 31 December 2021

Share Share Share based Retained Total equity

capital premium payment earnings attributable

reserve to owners

of the parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 15 13,195 70 (10,531) 2,749

Loss (as restated, note 6) - - - (360) (360)

Deferred tax OCI movement - - - (16) (16)

Total comprehensive loss for the period - - - (376) (376)

Capital reduction - (13,145) - 13,145 -

Bonus share allotment 46 (46) - - -

Share option expense (as restated, note

6) - - 1,243 - 1,243

Share options exercised (as restated,

note 6) 1 - (973) 973 1

Share options cancelled - - (11) 11 -

Conversion of loan notes 1 3,481 - - 3,482

Shares issued on listing 6 21,994 - - 22,000

Cost of issue of shares - (1,633) - - (1,633)

At 31 December 2020 (as restated) 69 23,846 329 3,222 27,466

--------- --------- ------------ ---------- ---------------

Loss - - - (6,613) (6,613)

Deferred tax OCI movement - - - 16 16

--------- --------- ------------ ---------- ---------------

Total comprehensive loss for the period - - - (6,597) (6,597)

Share option expense - - 124 - 124

Share options cancelled - - (409) 409 -

Cost of issue of shares adjustment - 334 - - 334

At 30 June 2021 69 24,180 44 (2,966) 21,327

--------- --------- ------------ ---------- ---------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

For the period ended 31 December 2021

Share Share Share based Retained Total equity

capital premium payment earnings attributable

reserve to owners

of the parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Loss - - - (5,734) (5,734)

---------- --------- ------------ ---------- ---------------

Total comprehensive loss for the period - - - (5,734) (5,734)

Share option expense - - 100 - 100

Share options cancelled - - (23) 23 -

Issue of shares 7 6,493 - - 6,500

Cost of issue of shares - (364) - - (364)

At 31 December 2021 76 30,309 121 (8,677) 21,829

---------- --------- ------------ ---------- ---------------

CONSOLIDATED STATEMENT OF CASHFLOWS

For the period ended 31 December 2021

As restated

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 30 June

31 December 31 December 2021

2021 2020

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Loss for the period (5,734) (360) (6,973)

Adjustment for:

Other income (50) (134) (148)

Net finance costs 34 205 234

Tax charge/(credit) 9 (1,713) 19

Amortisation and impairment of intangible

assets 58 7 42

Share based payments 100 1,243 1,367

Depreciation of property, plant

and equipment 581 337 707

Disposal of property, plant and 39 - -

equipment

Changes in working capital:

Decrease/(Increase) in inventories 152 (5,054) (7,109)

Decrease/(increase) in trade and

other receivables 385 (5,124) (8,103)

(Decrease)/increase in trade and

other payables (134) 5,326 7,033

-------------- -------------- -------------------

Cash used in operations (4,560) (5,267) (12,931)

Interest paid (34) (27) (51)

Income taxes received 1 - 106

-------------- -------------- -------------------

Net cash used in operating activities (4,593) (5,294) (12,876)

-------------- -------------- -------------------

Cash flow from investing activities

Purchase of intangible assets (39) (166) (71)

Internally capitalised development

costs - - (419)

Purchase of property, plant and

equipment (342) (2,654) (6,761)

Proceeds on disposal of property,

plant and equipment - 8 8

Payment of deferred consideration - (32) (32)

-------------- -------------- -------------------

Net cash used in investing activities (381) (2,844) (7,275)

-------------- -------------- -------------------

Cash flow from financing activities

Net proceeds from issue of own shares 6,135 20,368 20,702

Cash withheld for SAYE scheme (3) - 9

Proceeds from new bank loans and

borrowings - - 250

Repayment of bank loans and borrowings (58) (13) (19)

Payment of lease obligations (116) (109) (222)

Proceeds from issue of loan notes - 20 20

Net cash generated from investing

activities 5,958 20,266 20,740

-------------- -------------- -------------------

Increase in cash and cash equivalents 984 12,128 589

Net cash and cash equivalents at

beginning of the period 4,977 4,388 4,388

-------------- -------------- -------------------

Net cash and cash equivalents at

end of period 5,961 16,516 4,977

-------------- -------------- -------------------

Notes to the Interim Financial Statements

For the period ended 31 December 2021

Company information

Abingdon Health PLC ("the Company") is a public limited company

domiciled and incorporated in England and Wales. The Company is

quoted on the London Stock Exchange's Alternative Investment Market

("AIM"). The registered office is York Biotech Campus, Sand Hutton,

York, YO41 1LZ. The consolidated financial information (or

"financial statements") incorporate the financial information of

the Company and entities (its subsidiaries) controlled by the

Company (collectively comprising the "Group").

The principal activity of the Group is to develop, manufacture

and distribute diagnostic devices and provide consultancy services

to businesses in the diagnostics sector.

Significant accounting policies

The Group has presented below key extracts of its accounting

policies. All policies are consistent with the previous statutory

financial statements for the year ended 30 June 2021 and are

expected to be consistently applied for the current year ended 30

June 2022 inclusive of these changes. However, there has been a

restatement to the period ended 31 December 2020 as detailed in

note 6.

Basis of preparation

These financial statements have been prepared in accordance with

international accounting standards ("IFRS") as adopted by the

United Kingdom ("UK") insofar as these apply to interim financial

statements.

The financial information set out in these interim consolidated

financial statements for the six months ended 31 December 2021 is

unaudited. The financial information presented are not statutory

accounts prepared in accordance with the Companies Act 2006, and

are prepared only to comply with AIM requirements for interim

reporting.

The Group's financial statements for the year ended 30 June 2021

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain a statement under Section 498 (2) of the Companies Act

2006, except for a material uncertainty in relation to going

concern.

Basis of measurement

The financial statements have been prepared on the historical

cost basis, modified to include the revaluation of certain

financial instruments at fair value.

Use of estimates and judgements

The preparation of the financial statements in conformity with

IFRS requires management to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of assets and liabilities, income, and expenses. The

estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised and in any future periods

affected.

Going concern

As at 31 December 2021, the Group has net current assets. The

Group has a number of contracts in place which generate revenues,

and are expected to continue doing so. The Group also has unused

cash reserves available.

The Group continues to focus on securing sales of existing and

new products, but the delay in recovery of monies owed by the

Department of Health and Social Care ("DHSC"), which are described

more fully in note 3, meant that there was a need to obtain further

funding as well as continue to monitor costs in the near term to

ensure that the Group has adequate financial resources to meet its

obligations as they fall due for the next twelve month period with

reasonable certainty. The above factors represented a material

uncertainty that may cast significant doubt on the Group's ability

to continue as a going concern.

The Group received additional funding support of GBP6.5m through

an issue of shares during the period to 31 December 2021. In case

the DHSC receivable remains unpaid for an extended period, the

Directors are of the opinion that the funds raised and the

significant unused cash reserves plus to continued monitoring of

costs and commercial traction will permit it to remain a going

concern, and as such the Directors continue to adopt a going

concern basis for the preparation of these interim financial

statements.

Basis of consolidation

The Group financial information consolidates those of the

Company and the subsidiaries that the Company has control of.

Control is established when the Company is exposed, or has rights,

to variable returns from its involvement with the subsidiary and

has the ability to affect those returns through its power over the

subsidiary.

Electronic communications

The Company is not proposing to bulk print and distribute hard

copies of this Interim Report for the six months ended 31 December

2021 unless specifically requested by individual shareholders. The

Board believes that by utilising electronic communication it

delivers savings to the Company in terms of administration,

printing and postage, and environmental benefits through reduced

consumption of paper and inks, as well as speeding up the provision

of information to shareholders.

News updates, Regulatory News and Financial statements can be

viewed and downloaded from the Group's website,

www.abingdonhealth.com/investors. Copies can also be requested

from: Company Secretary, Abingdon Health PLC, York Biotech Campus,

Sand Hutton, York YO41 1LZ.

Share-based payment

The fair value of equity-settled share-based payments to

employees is determined at the date of grant and is expensed on a

straight-line basis over the vesting period based on the Group's

estimate of shares or options that will eventually vest.

1. Revenue

The Group applies IFRS 15 'Revenue from contracts with

customers'. Under IFRS 15, the Group applies the 5-step method to

identify contracts with its customers, determine performance

obligations arising under those contracts, set an expected

transaction price, allocate that price to the performance

obligations, and then recognises revenues as and when those

obligations are satisfied.

Segmental analysis of revenue

Unaudited Unaudited

6 months 6 months Audited

to to 12 months

31 December 31 December to 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

Contract development 887 695 1,568

Contract manufacturing 614 610 1,690

Product sales 203 382 8,360

------------- ------------- ------------

Total revenue from contracts

with customers 1,704 7,687 11,618

------------- ------------- ------------

Revenue analysed by geographical market

Unaudited Unaudited Audited

6 months 6 months 12 months

to 31 December to 31 December to 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

United Kingdom 1,013 5,022 6,596

United States of America 67 1,823 3,405

Europe 523 557 1,560

Rest of World 101 285 57

---------------- ---------------- ------------

1,704 7,687 11,618

---------------- ---------------- ------------

2. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

31 December As restated 30 June 2021

2021 31 December

2020

Earnings used in calculation

(GBP'000s) (5,734) (360) (6,973)

Number of shares 279,428,969 248,082,324 262,926,110

Basic EPS (p) (2.05) (0.15) (2.65)

Number of dilutable shares 279,428,969 248,179,612 262,926,110

Diluted EPS (p) (2.05) (0.15) (2.65)

The directors have presented adjusted earnings before the

introduction of deferred taxes which were previously unrecognised

as a measure of ongoing profitability and performance, and before

deduction of share based payment costs and listing costs. This is

to permit better ongoing comparison of underlying trends, as

explained more fully in note 12 to the 30 June 2021 annual

financial statements. The calculated adjusted earnings for the

current period of accounts is as follows:

Adjusted Earnings per Share As restated

6 months 6 months Year

ended ended ended

31 December 31 December 30 June 2021

2021 2020

GBP'000s GBP'000s GBP'000s

Loss after taxation (5,734) (360) (6,954)

Adjusted for:

Previously unrecognised net deferred - (1,832) -

tax asset

Share based payment 100 1,243 1,367

Listing costs - 570 903

Non-recurring legal fees 198 - 257

Non-recurring employee redundancy

costs - - 188

Depreciation and amortisation 639 41 749

Finance costs 34 205 234

Adjusted Earnings (4,763) (133) (3,256)

-------------- ------------- ---------------

As restated

6 months 6 months Year

ended ended ended

31 December 31 December 30 June 2021

2021 2020

Adjusted earnings (GBP000s) (4,763) (133) (3,256)

Number of shares 279,428,969 248,082,324 262,926,110

Adjusted EPS (p) (1.70) (0.05) (1.25)

Number of dilutable shares 279,428,969 248,179,612 262,926,110

Adjusted diluted EPS (p) (1.70) (0.05) (1.25)

3. Impact of Department of Health and Social Care ("DHSC")

Contract on the Statement of Financial Position ("SFP")

Detailed commentary relating to the position with the DHSC was

outlined in our Group financial statements for the year ended 30

June 2021. This can be found in the accounts under note 16 where

the status was updated prior to the signing of the financial

statements on 17 November 2021.

The Group has the following overall carrying amounts on the SFP

as at 31 December 2021 and as at the date of approval of the

interim financial statements:

At At At

31 December 31 December 30 June

2021 (3) 2020 2021

(Excluding (Excluding (Excluding

VAT) VAT) VAT)

GBP'000 GBP'000 GBP'000

Inventories - title with DHSC 4,514 - 3,987

Trade receivables - recharge

of inventories (1) *2,745 - *2,116

Trade receivables - sale of

tests (including profit margin) *4,294 - *4,294

Contract liability (2) (5,936) - (5,308)

------------- ------------- -----------

Net impact of SFP 5,617 - 5,089

------------- ------------- -----------

(1) After deduction of GBP4.0m (excluding VAT) of cash received

from DHSC for purchase of inventories.

(2) This is net of GBP0.9m (excluding VAT) of inventories which

have been utilised in delivering 1 million tests recognised within

Revenue and Trade Receivables in the year ended 30 June 2021.

* These balances are held in Trade receivables including VAT

which total GBP8.4m as at 31 December 2021.

The Group is contractually entitled to late payment interest on

the overdue trade receivables, which is to be calculated at 8%

above base rate. This has not been recognised in the current

period's Group Income Statement, or on the SFP, as it remains

uncertain as to the settlement of this or certainty of ultimate

cash inflows. Any such element will be recognised in full once the

Group's entitlement to receipt is confirmed.

The Directors of the Group are of the opinion that all balances

are recoverable in full and have placed into the public domain a

number of documents and statements which justify and support this

position. These interim financial statements have been prepared on

the explicit assumption that all contractual provisions of the DHSC

contract have been met, and that DHSC will uphold their legal

responsibilities under this contract in respect of full cash

settlement of the contractually due balances. In this outcome, the

Group would receive full settlement of its receivables in cash,

plus late payment interest. The Directors, as at 31 December 2021,

consider that this balance is recoverable within one year and have

therefore presented it as a Debtor due in <1 year. No expected

credit loss provision is held against this balance for the reasons

set out above. Consideration was given as to whether any

discounting of the trade receivable should take place, but, based

on the Effective Interest Rate for the Trade Receivable being zero,

when billed, no discounting has been performed.

However, should any element of the trade receivable become

irrecoverable the Group would be entitled to recover the VAT paid

on that balance, equal to 20% of the net amount not recovered. Any

remaining balance would be recognised as an impairment to the Group

Income Statement, which would be entirely recognised within future

reported profits and losses. Any adjustments to inventories would

likely not impact the Group Income Statement as a result of the

Contract liability shown above, however this may bring certain

elements of those inventories into the Group's ownership. Such

inventories are expected to be utilisable in other product

production by the Group, but in the event that no such utilisation

can occur this may result in an inventory impairment for those

materials.

The Group continues to follow the Dispute Resolution Process

("DRP") set out in the DHSC contract, which as at the date of

approval of the financial statements is taking the form of a

mediation process and a non-binding agreement in principle was

reached in November 2021. Through this process the Group expects

that the monies owed will be substantially recovered, however the

exact timing of this remains uncertain as at the date of approval

of the financial statements. This mediation does not change the

Directors' opinion of the balances recognised on the SFP as at the

30 June 2021 year end or the interim period to 31 December

2021.

4. Share capital

31 December 31 December 30 June

2021 2020 2021

Ordinary share capital

Authorised Number Number Number

Ordinary shares of 0.025p each 121,699,114 95,699,114 95,699,114

Deferred ordinary shares of

0.025p each 182,316,812 182,316,812 182,316,812

------------ ------------ ------------

304,015,926 278,015,926 278,015,926

------------ ------------ ------------

Allotted and fully paid Number Number Number

Ordinary shares of 0.025p each 121,699,114 95,699,114 95,699,114

Deferred ordinary shares of

0.025p each 182,316,812 182,316,812 182,316,812

------------ ------------ ------------

304,015,926 278,015,926 278,015,926

GBP'000 GBP'000 GBP'000

Ordinary shares of 0.025p each 31 24 24

Deferred ordinary shares of

0.025p each 45 45 45

------------ ------------ ------------

76 69 69

------------ ------------ ------------

Reconciliation of movements during the periods:

Ordinary A Ordinary Deferred

Number Number Ordinary

Number

At 1 July 2020 11,406,826 3,916,450 -

Bonus issue of shares funded

by share premium - - 45,969,828

Exercise of share options 1,322,440 - -

Conversion of loan notes 1,159,271 - -

A Ordinary reclassification 390,625 - (390,625)

A Ordinary reclassification 3,916,450 (3,916,450) -

4:1 share split 54,586,836 - 136,737,609

Issue of shares for cash 22,916,666 - -

At 31 December 2020 and 30

June 2021 95,699,114 - 182,316,812

------------ ------------ ------------

Issue of shares for cash 26,000,000 - -

At 31 December 2021 121,699,114 - 182,316,812

------------ ------------ ------------

5. Share options

The following movements on share options have been recognised in

the period:

Number of share options Weighted average exercise

price

31 December 31 December 30 31 December 31 December 30

2021 2020 June 2021 2020 June

2021 2021

Number Number Number GBP GBP GBP

Outstanding

at start of

period 729,467 287,440 287,440 0.5071 0.001 0.001

Granted - 1,145,000 2,049,275 - 0.001 0.2191

Exercised - (1,322,440) (1,322,440) - 0.001 0.0080

Lapsed - - (80,000) - - 0.0010

Forfeited (129,273) (30,000) (204,808) 0.5139 0.001 0.3355

4:1 bonus issue - 240,000 - - 0.00025 -

Outstanding

at end of period 600,194 320,000 729,467 0.5057 0.00025 0.5071

------------ ------------ ------------ ------------ ------------ -------

Exercisable

at end of period - - - - - -

------------ ------------ ------------ ------------ ------------ -------

The options outstanding at 31 December 2021 had an exercise

price ranging from GBP0.00025 to GBP0.70 and a remaining

contractual life of between 2 years 9 months and 9 years 9 months.

The options exist at 31 December 2021 across the following share

option schemes:

Number Exercise Fair value Vesting

of shares price per of scheme period

share (GBP)

Options issued in April 2021 166,682 0.00025 129,137 1 year

SAYE scheme commenced in

March 2021 433,512 0.70 254,941 3 years

600,194 384,078

----------- -----------

The fair value of the scheme represents the reduced fair value

after adjusting for leavers, and is being expensed over the vesting

period. All share options expire 10 years after the date of

issue.

6. Restatement

A restatement has been made to the 31 December 2020 interim

period to correct a provisional fair value of share options which

was subsequently finalised in the audited financial statements for

the year ended 30 June 2021. All options had vested prior to 31

December 2020 and were exercised as part of the Group's admission

to AIM.

The adjustment made to the 31 December 2020 interim period is as

follows:

As previously Adjustment As restated

reported

6 months to 31 December 2020 GBP'000 GBP'000 GBP'000

Operating loss before adjusting

items (55) - (55)

Share-based payment expenses (741) (502) (1,243)

Listing costs (570) - (570)

Operating loss (1,366) (502) (1,868)

Corresponding adjustments have also been recognised within the

Statement of Changes in Equity, in respect of the exercise of these

share options.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFIRVTIAFIF

(END) Dow Jones Newswires

March 29, 2022 02:11 ET (06:11 GMT)

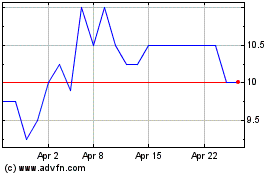

Abingdon Health (LSE:ABDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abingdon Health (LSE:ABDX)

Historical Stock Chart

From Apr 2023 to Apr 2024