TIDMACC

RNS Number : 5856F

Access Intelligence PLC

19 July 2021

ACCESS INTELLIGENCE PLC

("Access Intelligence", the "Company" or the "Group")

INTERIM RESULTS

Access Intelligence Plc, (AIM: ACC) the technology innovator

delivering Software-as-a-Service (SaaS) solutions for the global

marketing and communications industries, is pleased to announce its

unaudited half year results for the six months ended 31 May

2021.

Highlights:

-- Annual Contract Value ("ACV") base increased by GBP2.7

million (25% annualised) to GBP24.7 million (H1 2020: growth of

GBP1.1 million to GBP19.1 million). Over the 12 month period to 31

May 2021, ACV increased by GBP5.5 million (29% organic growth).

-- The Group's first half revenue increased by approximately 17%

to GBP11.0 million (H1 2020: GBP9.4 million).

-- The Group delivered an Adjusted EBITDA* loss in the period of

GBP135,000 (H1 2020: loss of GBP147,000), reflecting additional

investment in sales and marketing to drive global expansion.

-- Encouraging progress already being made in North America with

a number of blue chip customer contracts won in the period and the

region contributing 23% of total ACV growth in the period.

-- At 31 May 2021, cash balance was GBP8.8 million (H1 2020:

GBP2.6 million and FY 2020: GBP1.4 million).

-- In December 2020, the Group announced an oversubscribed

placing of 12,500,000 ordinary shares to raise gross proceeds of

GBP10.0 million. The net proceeds of GBP9.6 million are to be used

to enhance the Group's technology and platform of products, for

further geographic expansion, to continue to explore suitable

acquisition opportunities in line with the Group's strategy and to

further strengthen its balance sheet.

-- Post period end, in June 2021, the Group announced the terms

of a recommended acquisition of the entire issued and to be issued

ordinary share capital of Isentia Group Limited ('Isentia') for an

equity valuation of approximately AUD$35.6 million (GBP19.4

million). The acquisition will be funded by an oversubscribed

conditional placing of 39,847,658 ordinary shares and a conditional

subscription for 1,819,009 ordinary shares to raise aggregate gross

proceeds of GBP50.0 million. The proceeds will also be used to

repay Isentia's gross debt of approximately AUD$45 million (GBP24.6

million).

-- The acquisition of Isentia will enable the Company to benefit

from greater scale, a superior product offering and greater

geographic reach. It also represents an opportunity to scale Access

Intelligence's sales infrastructure into the fast-growing APAC

market and is an ideal platform for cross-selling opportunities for

Access Intelligence's Pulsar audience intelligence and social

listening platform.

-- Strengthened board as the company expands its geographic reach:

o Sarah Vawda appointed to the Board as Non-Executive Director

and Chair of the Group's Audit Committee in March 2021. Sarah is

currently Corporate Development Director for Johnson Matthey plc

and is a highly experienced executive and non-executive director

with expertise across corporate strategy, M&A, finance,

corporate governance and corporate development.

o Katie Puris appointed to the Board as Non-Executive Director

in June 2021. Katie is the Managing Director of Global Business

Marketing for TikTok, where she leads a creative marketing team and

drives awareness of TikTok's innovative digital marketing solutions

that give brands and marketers the tools to be creative

storytellers and challenge the status quo.

Christopher Satterthwaite, non-executive Chairman,

commented:

"I'm delighted that Access Intelligence continues to deliver

strong organic growth due to its exceptional people and products.

The expanding market opportunity and appetite for the Group's

products and services is clear with continued growth in both

revenue and customer retention.

Growth has been capitalised on with significant investment in

product innovation and operational scale accelerating expansion

into North America and APAC for the second half of the year and the

future."

* Adjusted EBITDA is earnings before interest, tax, depreciation

and amortisation and adjusted for share based payments, share of

losses of an associate and non-recurring expenses primarily

relating to acquisition costs in respect of the proposed Isentia

transaction in the current and prior periods, in addition to the

acquisition and integration of Pulsar in the prior period.

For further information:

Access Intelligence plc 020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

finnCap Limited (Nominated Adviser and Broker) 020 7220 0500

Corporate Finance:

Marc Milmo / Kate Bannatyne / Fergus Sullivan

Corporate Broking:

Alice Lane / Sunila de Silva

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ("MAR"). With the publication of this announcement,

this information is now considered to be in the public domain.

Chairman's statement

I am pleased to announce our unaudited interim results for the

six months ended 31 May 2021.

Access Intelligence has had a strong first half of 2021,

delivering sustained organic growth momentum alongside significant

progress against the Group's strategy, built around five key

pillars:

-- Innovation - Developing an integrated marketing intelligence

proposition that spans from analytics to activation and encompasses

the products we currently offer as well as the ongoing development

of our offering and technologies we are acquiring

-- Transformation - Leading and preparing the industry for a new

world of data-driven marketing and showing organisations and

practitioners what success looks like.

-- Expansion - Focusing on organic growth for the most mature

and sophisticated markets, while deploying partnerships and seeking

acquisitions in the newest, up-and-coming markets.

-- Customer experience - Optimising our suite of products to

deliver the best customer experience in the industry, underpinned

by empowering customers with a self-service model to maximise

operational gearing as we scale globally.

-- Ethics - Protecting the public and our customers by promoting

and developing market best practice in the use of data that support

privacy, consent, and transaction transparency as a priority.

Continued growth

The Group has delivered 25% annualised organic growth in ACV i n

the first half, with growth over the last 12 months exceeding 29%.

The growth in ACV has been underpinned by a 48% increase in new

business ACV compared to H1 2020, alongside an 8 percentage point

increase in renewal rates, and has contributed to a 17% increase in

revenue compared to H1 2020.

Throughout the pandemic, we have seen high demand for audience

understanding and intelligence, particularly via social listening,

alongside the means to operate complex marcoms strategies. Our

integrated platform supports brands, agencies, non-profits, and

public sector organisations as they deliver against their

increasingly demanding objectives. Now our technologies have been

proven in established markets, there is a clear opportunity to take

advantage of untapped markets in rapidly growing regions as part of

our global expansion strategy.

The Group's continued ACV growth enables sustained investment in

the technical capabilities of the Group's product platform

alongside further scaling of its commercial operations. The

investment made during 2021 into marketing, commercial enablement

and sales has specifically targeted enterprise sized clients and

prospects and is already showing fruition with an increased average

ACV of new business wins for both enterprise software and insights.

These high growth areas are a testament to the Group's new premium

positioning and are areas that we will keep investing in as we

continue to expand our global footprint.

The Group's pursuit of excellence is demonstrated by the type of

clients who have developed their relationships with us, either

internally or through advocating our services to their external

stakeholders. The Twitter partnership, for example, has resulted in

Pulsar's analytics being employed across clients including Google,

Spotify, and Verizon. Similarly, our Amazon relationship continues

to expand into new parts of its business, including live-streaming

platform Twitch.

Strategic progress

A key pillar of our strategy focuses on Expansion, primarily in

the European, North American & APAC markets.

The Group has its roots in the European market with a nascent

but fast-growing operation in North America and it is these two

markets that have contributed to the 29% ACV growth over the last

12 months. The Group is focused on delivering organic growth in

Europe and North America and, during the first half, completed a

GBP10m fundraise (before expenses) with a significant proportion of

the proceeds being allocated for expansion of the Group's North

America sales and marketing activity.

Progress in building out the North America sales and marketing

team is ahead of expectations with 13 new hires made in the period

and all key roles now filled. In addition, there are multiple

candidates for 'Phase 2' hiring that are in process with targeted

start dates in August and September 2021. This team is now building

an exciting pipeline of opportunities with North America having

already contributed 23% of total ACV growth in the first half.

As the fastest growing market for social, the Group's strategy

for APAC is focused on acquisitions and partnerships. In June 2021,

the Group announced the recommended acquisition of Isentia. Isentia

is the market leader for media intelligence and insights in APAC,

operating across eight geographical markets covering Australia, New

Zealand and South-East Asia working with c.2,400 customers.

The acquisition of Isentia will enable the Company to benefit

from greater scale, a superior product offering and greater

geographic reach. It will provide an established commercial and

operational infrastructure to enhance our organic expansion of

social media into the APAC market, alongside exceptional localised

knowledge, teams, products, and services. It also provides an

enviable blue chip and government client base for upsell and cross

sell opportunities. Indeed, Access Intelligence is already starting

to work with Isentia on specific opportunities to partner the

Group's social products with Isentia's existing media intelligence

products in the APAC region.

The Group has also made good progress against other elements of

its strategy. Innovation is being fueled through back-end data

processing and data science, with new releases including a first

party data solution for brands to be able to ingest primary text,

visual and statistical datasets, from customer feedback to sales

performance and stock market data. This enables clients to leverage

the Group's data mining, AI and visualisation technologies to

analyse their proprietary data alongside the Group's other data

sources, to provide a real 360 view of their customers and other

stakeholders, alongside their interactions with the organisation's

reputation, communications narratives, brands and products.

Additional data sets have also been added to the Group's product

offering to support accelerating international growth.

The appointment of a new Chief Operating Officer ('COO') during

the first half forms a key part of the Group's plan to enhance and

scale customer service operations globally. With a background in

scaling successful operations and customer service teams for global

data businesses, the COO's remit is to deliver best in industry

customer service whilst enabling a self-service model to maximise

operational gearing as the Group scales into new geographies.

Board changes

The Group is delighted to have welcomed Sarah Vawda and Katie

Puris to the Board as Non-Executive Directors. Both pioneers within

their respective industries, Sarah and Katie bring vast experience

while maintaining a desire to drive real change from a company

performance and corporate responsibility standpoint. They are

already providing invaluable insight to the board and the wider

organisation .

Sarah brings tremendous strategic, M&A and finance

experience from a range of positions and industries that will help

Access Intelligence develop on the foundations that have been built

in recent years. As Chair of the Audit Committee she will play a

key role in ensuring good corporate governance as the Group

continues to expand both organically and through acquisition.

Sarah is passionate about and engaged in the diversity debate

and is a Trustee and Audit Committee Chair of The Girls Network, a

charity that provides mentoring to girls from disadvantaged

backgrounds. She will enable the Group's accessmatters initiative

for diversity and organisational inclusion, designed to encourage

listening, sharing of experience and best practice while promoting

collaboration around the actions that will have greatest positive

impact on our industry and our society.

Katie couldn't be more aptly placed to contribute to our vision

and purpose as she's at the forefront of how the explosion of

digital content generated by audiences is changing how brands and

society behave. Her role as Managing Director of Global Business

for TikTok and history at Google, Facebook and BBDO has uniquely

aligned her with our vision and how we bring it to different

markets around the world.

Katie also serves on the board of two education-based

non-profits - the Windward School, supporting children with

learning disabilities, and Hudson Link, providing higher education

to incarcerated men and women.

The welcome addition of Sarah and Katie is also a phenomenal

milestone for something that we deeply care about, which is to

increase the diversity of genders and ethnicities, and their

representation within the Group. The first milestone for this is

that we now have a gender balanced board. This is vital for

inspiring the next generation of leaders within the company and is

something that we are taking to the industry too by joining the 30%

club, which sets the goal for all companies to have at least 30%

female representation on their boards. This will be finalised after

the acquisition of Isentia, however we are already providing

pro-bono services to the organisation.

Results for the half year

The primary key performance indicator monitored by the Board is

the growth in the ACV base year-on-year. This reflects the annual

value of new business won, together with upsell into the Company's

existing customer base as it delivers against its land and expand

strategy, less churn. It is an important metric for the Group as it

is a leading indicator of future revenue.

During the period, the Group's ACV base grew by GBP2.7 million

(25% annualised) to GBP24.7 million (H1 2020: growth of GBP1.1

million to GBP19.1 million). Over the full 12 month period to 31

May 2021, ACV increased by GBP5.5 million (29% organic growth).

Revenue for the period grew by 17% to GBP11.0 million (H1 2020:

GBP9.4 million). The year-on-year increase was primarily driven by

ACV growth resulting from strong new business performance alongside

continued improvements in the Group's renewal rates. Recurring

revenue comprised 94% of total revenue (H1 2020: 94%).

Gross profit increased by 22% year-on-year to GBP8.1 million (H1

2020: GBP6.6 million) with the Group delivering a gross margin of

74% (H1 2020: 71%). Gross margin improved compared to the prior

period as the Group is able to leverage fixed cost data feeds more

effectively as its revenue increases.

Adjusted earnings before interest, tax, depreciation and

amortisation ("EBITDA") were a loss of GBP135,000 compared to a

loss GBP147,000 in H1 2020. Adjusted EBITDA excludes certain

non-recurring items totalling GBP1,332,000 for the period (H1 2020:

GBP730,000), in addition to the Group's share of loss of an

associate of GBP71,000 (H1 2020: GBP74,000) and a share-based

payments charge of GBP72,000 (H1 2020: GBP46,000).

Non-recurring items in the period included acquisition related

legal and due diligence costs of GBP1,332,000 (H1 2020: GBPNil) and

transition and migration costs in respect of acquisitions of GBPNil

(H1 2020: GBP730,000). Reported EBITDA loss was GBP1,610,000 (H1

2020: loss of GBP997,000).

The Group increased its investment in the Vuelio and Pulsar

platforms with identifiable new product development activity being

capitalised. The Group capitalised development costs of

GBP1,248,000 for the period (H1 2020: GBP958,000), with a further

GBP723,000 (H1 2020: GBP782,000) of product, research and

development costs being expensed through profit and loss.

The Group's operating loss was GBP3,263,000 (H1 2020: loss

GBP2,683,000). The Group incurred GBP1,653,000 of depreciation and

amortisation charges (H1 2020: GBP1,686,000).

The basic loss per share was 4.07p (H1 2020: loss 3.91p).

On 9 December 2020, the Group announced a placing of 12,500,000

ordinary shares at a price of 80 pence per share to raise gross

proceeds of GBP10,000,000. The net proceeds of GBP9,630,000 are to

be used to enhance the Group's technology and platform of products,

for further geographic expansion, to continue to explore suitable

acquisition opportunities in line with the Group's strategy and to

further strengthen its balance sheet.

The Group also announced on 9 December 2020 that it had secured

a GBP2 million, three year facility under the Coronavirus Business

Interruption Loan Scheme (CBILS). The facility was drawn down

during December 2020, has a 12-month interest-free period following

drawdown and an interest rate of 2.03% plus LIBOR or replacement

benchmark rate per annum on the drawn down amount thereafter. The

funds are repayable in equal monthly instalments over 36 months and

there will be no penalty for making early repayment of the

facility. The CBILS loan will be repaid in full on completion of

the acquisition of Isentia.

The Group held cash at the end of the period of GBP8,773,000 (H1

2020: GBP2,647,000).

Events after the reporting date

On 15 June 2021, the Group announced that the boards of Access

Intelligence and Isentia have agreed the terms of an acquisition

pursuant to which Access Intelligence will acquire Isentia for an

equity valuation of approximately AUD$35.6 million (GBP19.4

million).

The acquisition also means that the Company will acquire

Isentia's existing senior debt and other indebtedness. To fund the

equity consideration of the acquisition and repay the full amount

of the drawn down debt of Isentia, the Group also announced a

placing of 39,847,658 ordinary shares and a subscription for

1,819,009 ordinary shares to raise aggregate gross proceeds of

GBP50.0 million.

The acquisition is being effected by a Court approved scheme of

arrangement between Isentia and Isentia shareholders in New South

Wales, Australia. The fundraise and acquisition of Isentia were

approved at a General Meeting of the Company on 9 July 2021. The

Australian court process is ongoing.

On 14 June 2021, the Company entered into a spot exchange option

to protect against fluctuations in foreign currency exchange rates

in respect of the risk of the proceeds of the placing being payable

in sterling but the consideration due under the acquisition being

payable in AUD$. The agreement provides the Company with a foreign

exchange option to sell GBP and buy AUD$70.0 million.

On 15 June 2021 the Group and Spheria Asset Management Pty

entered into a share purchase agreement whereby the Group agreed to

purchase 39,708,447 fully paid ordinary shares in Isentia Group

Limited from Spheria Asset Management Pty for an aggregate purchase

price of AUD$6.9 million.

On 15 June 2021, the Company also announced a retail offer via

PrimaryBid of up to GBP2.0 million to facilitate retail

participation in the company's shares. Following the successful

closing of the retail offer, the Company raised gross proceeds of

approximately GBP1.45 million.

On 16 July 2021, the First Court Hearing was held at which the

Supreme Court of New South Wales approved, inter alia, the

distribution of the scheme booklet to Isentia's shareholders which

includes the notice of the scheme meeting, the recommendation of

the board of Isentia and the independent expert's report. The

independent expert, KPMG, has determined that, in the absence of a

superior proposal, the scheme is fair and reasonable and therefore

in its opinion in the best interests of Isentia shareholders.

Further information on events after the reporting date is

contained within Note 5.

Outlook

The Group's focus in 2021 is about putting a platform in place

to expand our product proposition globally whilst continuing to

scale in our established markets through increased sales and

improved customer retention.

The Group's ongoing investment in its products and operations

will provide customers with a better user experience and a more

diverse range of services, while the expansion of our North America

commercial team is expected to drive a significant increase in ACV

from that market.

Completion of the acquisition of Isentia in September 2021 will

demonstrate the expanded Group's ambition to leverage its

proprietary technology for broadcast inputs, extensive global

client roster and reach into markets seeking the combination of

traditional media insight combined with the latest in social

intelligence.

The directors remain very positive about the outlook for the

Group. The first half has seen sustained growth momentum whilst we

have implemented further enhancements to the Group's products and

operations to facilitate accelerated expansion into North America

and APAC in the second half and beyond.

Christopher Satterthwaite

Non-executive Chairman

Access Intelligence Plc

Consolidated Statement of Comprehensive Income

for the six months ended 31 May 2021

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

31-May-21 31-May-20 30-Nov-20

GBP'000 GBP'000 GBP'000

Revenue 11,000 9,379 19,070

Cost of sales (2,875) (2,733) (5,314)

--------------- --------------- -----------

Gross profit 8,125 6,646 13,756

Recurring administrative expenses (8,260) (6,793) (13,070)

--------------- --------------- -----------

Adjusted EBITDA (135) (147) 686

Non-recurring administrative expenses (1,332) (730) (2,479)

Share of loss of associate (71) (74) (160)

Share-based payments (72) (46) (107)

--------------- --------------- -----------

EBITDA (1,610) (997) (2,060)

Depreciation of tangible fixed assets (110) (109) (228)

Depreciation of right-of-use assets (325) (321) (645)

Amortisation of intangible assets

- internally generated (672) (525) (1,162)

Amortisation of intangible assets

- acquisition related (546) (731) (1,280)

--------------- --------------- -----------

Operating loss (3,263) (2,683) (5,375)

Financial income 10 2 6

Financial expense (169) (187) (377)

--------------- --------------- -----------

Loss before tax (3,422) (2,868) (5,746)

Taxation credit 50 48 660

--------------- --------------- -----------

Loss for the period (3,372) (2,820) (5,086)

Other comprehensive income (13) - (8)

--------------- --------------- -----------

Total comprehensive loss for the

period attributable to the owners

of parent company (3,385) (2,820) (5,094)

--------------- --------------- -----------

Earnings per share:

Basic loss per share (4.07)p (3.91)p (7.06)p

Diluted loss per share (4.07)p (3.91)p (7.06)p

Access Intelligence Plc

Consolidated Statement of Financial Position

at 31 May 2021

Unaudited Unaudited Audited

As at As at As at

31-May-21 31-May-20 30-Nov-20

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 15,786 15,880 15,732

Investment in associate 873 43 57

Property, plant and equipment 411 641 496

Right-of-use assets 2,005 2,624 2,329

Deferred tax assets 18 21 18

----------- ----------- ---------

Total non-current assets 19,093 19,209 18,632

----------- ----------- ---------

Current assets

Trade and other receivables 7,786 6,429 5,976

Current tax receivables 548 617 548

Cash and cash equivalents 8,773 2,647 1,403

Total current assets 17,107 9,693 7,927

----------- ----------- ---------

TOTAL ASSETS 36,200 28,902 26,559

----------- ----------- ---------

Current liabilities

Trade and other payables 3,516 4,941 4,412

Accruals 2,138 836 1,209

Contract assets 9,928 8,105 8,122

Lease liabilities 796 277 558

Interest bearing loans and

borrowings 667 12 -

Total current liabilities 17,045 14,171 14,301

----------- ----------- ---------

Non-current liabilities

Provisions 213 213 213

Lease liabilities 2,003 2,626 2,441

Interest bearing loans and

borrowings 1,064 - -

Deferred tax liabilities 474 595 520

----------- ----------- ---------

Total non-current liabilities 3,754 3,434 3,174

----------- ----------- ---------

TOTAL LIABILITIES 20,799 17,605 17,475

----------- ----------- ---------

NET ASSETS 15,401 11,297 9,084

----------- ----------- ---------

Equity

Share capital 4,382 3,961 3,757

Treasury shares (148) (148) (148)

Share premium account 26,247 17,242 17,242

Capital redemption reserve 395 191 395

Share option reserve 590 457 518

Other reserve 502 502 502

Retained earnings (16,567) (10,908) (13,182)

----------- ----------- ---------

TOTAL EQUITY ATTRIBUTABLE TO

EQUITY SHAREHOLDERS 15,401 11,297 9,084

----------- ----------- ---------

Access Intelligence Plc

Consolidated Statement of Changes in Equity

for the six months ended 31 May 2021

Share Treasury Share Capital Share Other Retained Total

capital Shares premium redemption option reserve earnings

account reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 December

2019 3,961 (148) 17,242 191 411 502 (8,088) 14,071

Total comprehensive

income for the

period - - - - - - (2,820) (2,820)

Share-based

payments - - - - 46 - - 46

At 31 May 2020 3,961 (148) 17,242 191 457 502 (10,908) 11,297

-------- --------- -------- ----------- -------- -------- ---------- --------

Total comprehensive

income for the

period - - - - - - (2,274) (2,274)

Share-based

payments - - - - 61 - - 61

Repurchase of

share capital (204) - - 204 - - - -

At 30 November

2020 3,757 (148) 17,242 395 518 502 (13,182) 9,084

-------- --------- -------- ----------- -------- -------- ---------- --------

Total comprehensive

income for the

period - - - - - - (3,385) (3,385)

Share-based

payments - - - - 72 - - 72

Issue of share

capital 625 - 9,005 - - - - 9,630

At 31 May 2021 4,382 (148) 26,247 395 590 502 (16,567) 15,401

-------- --------- -------- ----------- -------- -------- ---------- --------

Access Intelligence Plc

Consolidated Statement of Cash Flow

for the six months ended 31 May 2021

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31-May-21 31-May-20 30-Nov-20

GBP'000 GBP'000 GBP'000

Loss for the year attributable

to shareholders (3,385) (2,820) (5,094)

Adjustments for:

Taxation (50) (48) (660)

Depreciation and amortisation 1,653 1,686 3,315

Share based payments 72 46 107

Share of loss of associate 71 74 160

Financial income (10) (2) (6)

Financial expense 169 187 377

Operating cash outflow before

working capital changes (1,480) (877) (1,801)

(Increase)/decrease in trade and

other receivables (1,810) 1,408 1,764

Increase in trade and other payables 1,838 1,171 1,308

----------- ----------- ---------

Net cash (outflow)/inflow from

operations (1,452) 1,702 1,271

Tax received - 378 987

----------- ----------- ---------

Net cash (outflow)/inflow from

operating activities (1,452) 2,080 2,258

----------- ----------- ---------

Investing

Interest received 10 2 6

Acquisition of property, plant

and equipment (26) (118) (128)

Acquisition of software licences

and other intangible assets (19) (34) (58)

Cost of software development (1,248) (958) (1,973)

Investment in associate (887) - -

Loan to associate - (100) (100)

----------- ----------- ---------

Net cash outflow from investing

activities (2,170) (1,208) (2,253)

----------- ----------- ---------

Financing

Interest paid (169) (187) (377)

Drawdown of loans 2,000 - -

Repayment of loans (269) (11) (23)

Lease liabilities paid (200) (28) (203)

Issue of shares (net of expenses) 9,630 - -

Net cash inflow/(outflow) from

financing activities 10,992 (226) (603)

----------- ----------- ---------

Net increase/(decrease) in cash 7,370 646 (598)

Opening cash and cash equivalents 1,403 2,001 2,001

----------- ----------- ---------

Closing cash and cash equivalents 8,773 2,647 1,403

----------- ----------- ---------

Notes

1. Unaudited notes

Basis of preparation and accounting policies

The financial information for the six months to 31 May 2021 is

unaudited and was approved by the Board of Directors on 18 July

2021.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements for the year ended 30 November 2020.

The interim financial information for the six months ended 31

May 2021, including comparative financial information has been

prepared on the basis of the accounting policies set out in the

last annual report and accounts.

The preparation of the interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expense. Actual results

may subsequently differ from those estimates.

In preparing the interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and key sources of estimation uncertainty were the same,

in all material respects, as those applied to the consolidated

financial statements for the year ended 30 November 2020.

The Group has elected to present comprehensive income in one

statement.

Going concern assumption

The Group meets its day to day working capital requirements

through its cash balance. During the period the Group has put in

place a GBP2,000,000 CBILS loan of which GBP1,731,000 was

outstanding at 31 May 2021. In addition, the Group raised

GBP9,630,000 net of expenses during the period to enhance the

Group's technology and platform of products, for further geographic

expansion, to continue to explore suitable

acquisition opportunities in line with its strategy and to

further strengthen its Balance Sheet.

Consequently, after making enquires, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis of

accounting in preparing the interim financial statements.

Information extracted from the Group's 2020 Annual Report

The financial figures for the year ended 30 November 2020, as

set out in this report, do not constitute statutory accounts but

are derived from the statutory accounts for that financial

year.

The statutory accounts for the year ended 30 November 2020 were

prepared under IFRS and have been delivered to the Registrar of

Companies. The auditors reported on those accounts. Their report

was unqualified, did not draw attention to any matters by way of

emphasis and did not include a statement under Section 498(2) or

498(3) of the Companies Act 2006.

2. Earnings per share

The calculation of earnings per share is based upon the loss

after tax for the respective period. The weighted average number of

ordinary shares used in the calculation of basic earnings per share

is based upon the number of ordinary shares in issue in each

respective period.

The impact of share options granted under the company's share

option are anti-dilutive due to the Group being in a loss-making

position, so the weighted average number of ordinary shares used in

the calculation of diluted earnings per share is the same as for

basic earnings per share.

This has been computed as follows:

6 months 6 months 6 months 6 months Year Year

ended ended ended ended ended ended

31-May-21 31-May-21 31-May-20 31-May-20 30-Nov-20 30-Nov-20

----------- ----------- ----------- ----------- ---------- ----------

Basic Diluted Basic Diluted Basic Diluted

----------- ----------- ----------- ----------- ---------- ----------

Loss after

tax (GBP'000) (3,385) (3,385) (2,820) (2,820) (5,094) (5,094)

----------- ----------- ----------- ----------- ---------- ----------

Number of

shares ('000)* 83,190 83,190 72,180 72,180 72,180 72,180

----------- ----------- ----------- ----------- ---------- ----------

Loss per

share (pence) (4.07) (4.07) (3.91) (3.91) (7.06) (7.06)

----------- ----------- ----------- ----------- ---------- ----------

3. Investment in associate

During the period, the Group increased its investment in Track

Record Holdings Limited by GBP887,000 (H1 2019: GBPNil) through

participation in a fundraise. The Group now holds 21.4% of Track

Record Holdings Limited's allotted share capital.

4. Share capital

On 9 December 2020, the Group announced a placing of 12,500,000

ordinary shares at a price of 80 pence per share to raise gross

proceeds of GBP10,000,000, with net proceeds after expenses being

GBP9,630,000.

7,922,280 ordinary shares were allotted and admitted to trading

on AIM on 15 December 2020 and 4,577,720 ordinary shares were

allotted and admitted to trading on AIM on 5 January 2021.

5. Events after the reporting date

On 15 June 2021, the Group announced that the boards of Access

Intelligence and Isentia Group Limited ('Isentia') have agreed the

terms of an acquisition pursuant to which Access Intelligence

(through its Australian subsidiary) will acquire the entire issued

and to be issued ordinary share capital of Isentia for an equity

valuation of approximately AUD$35.6 million (GBP19.4 million),

valuing each Isentia share at AUD$0.175 (GBP0.095).

As the acquisition will see the Company acquire Isentia, the

acquisition also means that the Company will acquire Isentia's

existing senior debt and other indebtedness. The Company will

procure the repayment of Isentia's senior debt and other

indebtedness as soon as practicable following implementation.

In order to fund the equity consideration of the acquisition and

repay the full amount of the drawn down debt of Isentia, the Group

announced a placing of 39,847,658 ordinary shares and a

subscription for 1,819,009 ordinary shares at the placing price of

120 pence per new ordinary share to raise aggregate gross proceeds

of GBP50.0 million.

The acquisition is being effected by a Court approved scheme of

arrangement between Isentia and Isentia shareholders in New South

Wales, Australia. The scheme will become effective and will be

binding on Isentia and Isentia shareholders once a copy of the

court order approving the scheme is lodged with the Australian

regulator, ASIC.

The fundraise and acquisition of Isentia are conditional, inter

alia, on:

-- approval of the Scheme by Isentia shareholders;

-- approval of the Court;

-- Isentia continuing to operate its business in the ordinary

course and no material change to its business occurring; and

-- the parties' respective warranties being true and correct in all material respects.

The fundraise and acquisition of Isentia were approved at a

General Meeting of the Company on 9 July 2021. The Australian court

process is ongoing.

On 14 June 2021 the Company entered into a spot exchange option

through Silicon Valley Bank to protect against fluctuations in

foreign currency exchange rates in respect of the risk of the

proceeds of the Placing being payable in sterling but the

consideration due under the Acquisition being payable in AUD$. The

agreement provides the Company with a foreign exchange option to

sell GBP and buy AUD$70.0 million.

In addition to and separately from the Scheme, on 15 June 2021

the Group and Spheria Asset Management Pty entered into a share

purchase agreement whereby the Group, through its subsidiary Vuelio

Australia Pty Ltd agreed to purchase 39,708,447 fully paid ordinary

shares in Isentia Group Limited from Spheria Asset Management Pty

for an aggregate purchase price of AUD$6.9 million.

On 15 June 2021, the Company also announced a retail offer via

PrimaryBid of up to GBP2.0 million to facilitate retail

participation in the company's shares. Following the successful

closing of the retail offer, the Company raised gross proceeds of

approximately GBP1.45 million at 120 pence per ordinary share.

On 16 July 2021, the First Court Hearing was held at which the

Supreme Court of New South Wales approved, inter alia, the

distribution of the scheme booklet to Isentia's shareholders which

includes the notice of the scheme meeting, the recommendation of

the board of Isentia and the independent expert's report. The

independent expert, KPMG, has determined that, in the absence of a

superior proposal, the scheme is fair and reasonable and therefore

in its opinion in the best interests of Isentia shareholders.

6. Availability of interim results

The interim results will not be sent to shareholders but will be

available at the Company's registered office at The Johnson

Building, 79 Hatton Garden, London, EC1N 8AW and on the Company's

website: www.accessintelligence.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFETDSITLIL

(END) Dow Jones Newswires

July 19, 2021 02:00 ET (06:00 GMT)

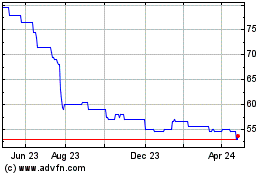

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Mar 2024 to Apr 2024

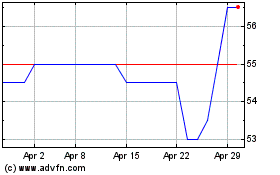

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Apr 2023 to Apr 2024