AIM Schedule One - Access Intelligence PLC (2373H)

02 August 2021 - 7:30PM

UK Regulatory

TIDMACC

RNS Number : 2373H

AIM

02 August 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Access Intelligence plc ("Access Intelligence")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES):

The Johnson Building, 79 Hatton Garden, London, EC1N 8AW

COUNTRY OF INCORPORATION:

United Kingdom

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://www.accessintelligence.com/investors/aim-rule-26/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Access Intelligence is a Software-as-a-Service (SaaS) technology

company, incorporated in November 2000 in England and Wales,

with its ordinary shares admitted to trading on AIM in November

2003 by way of a reverse takeover of Readymarket Ltd.

Access Intelligence's software portfolio consists of three

solutions - Vuelio, ResponseSource and Pulsar. Together the

portfolio provides a range of cloud-based reputation management

applications for over 3,500 customers across the PR, marketing

and communication industries.

Headquartered in London, Access Intelligence also has operations

in the UK, USA and Australia, with its main country of operation

being the United Kingdom.

On 15 June 2021, Access Intelligence announced the proposed

acquisition of the entire issued and to be issued ordinary

share capital of Isentia Group Limited ("Isentia") (the "Acquisition")

(Access Intelligence and Isentia, together the "Enlarged Group").

Isentia is a media intelligence and insights company headquartered

in Sydney, Australia and listed on the ASX. Isentia operates

in eight geographical markets across Australia, New Zealand

and South-East Asia serving approximately 2,400 customers.

The Enlarged Group will provide a broad suite of technology

products for marketing intelligence, reputation management,

and data insights and the Enlarged Group's main country of

operation will be Australia.

The Acquisition constitutes a reverse takeover under AIM Rule

14 and the Acquisition is being undertaken by way of a scheme

of arrangement in Australia and is subject to, inter alia,

Isentia shareholder approval and approval of the courts in

Australia.

The resolutions put to Access Intelligence shareholders at

the general meeting on 9 July 2021 were duly passed. Isentia's

shareholder meeting is expected to be held on 17 August 2021.

It is anticipated that the new Ordinary Shares to be issued

pursuant to the fundraising will be admitted to trading on

23 August 2021 (being the business day after the scheme of

arrangement becomes effective but prior to the scheme implementation

date). Nevertheless, if the scheme of arrangement is approved

at the second court hearing planned for 20 August 2021, there

will be no remaining conditions to the Acquisition, save for

the payment of the consideration to the Isentia shareholders

on the implementation date (the second court hearing, effective

date and implementation dates are pursuant to a scheme of arrangement

proposed to be made under Part 5.1 of the Corporations Act

2001 (Cth) (Australia)).

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

130,524,386 ordinary shares of 5 pence each ("Ordinary Shares").

2,966,666 Ordinary Shares are held in treasury.

No restrictions as to the transfer of the securities.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

GBP50.0 million to be raised on admission of the fundraising

shares.

Anticipated market capitalisation on re-admission of the Enlarged

Group: GBP153.1 million (based on the placing price of 120

pence)

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

35.5 per cent.

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Marguarite Joanna Arnold (Chief Executive Officer)

Christopher James Satterthwaite (Non-Executive Chairman)

Mark Stephen Fautley (Chief Financial Officer)

Sarah Bibi Vawda (Non-Executive Director)

Chris topher Charles Pilling (Non-Executive Director)

Katie Ellen Puris (Non-Executive Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder % of Existing % of Enlarged

Issued Share Issued Share

Capital* Capital**

Kestrel Partners LLP 24.97% 23.67%

Canaccord Genuity Group Inc 13.79% 11.90%

Draper Esprit VCT Plc 8.30% 5.59%

Unicorn AIM VCT 7.59% 5.11%

Gresham House Asset Management

Limited 7.29% 7.32%

Herald Investment Management Limited 7.19% 7.23%

Chelverton Asset Management Limited 6.74% 6.77%

Octopus Investments Ltd 3.44% 2.53%

Lombard Odier Asset Management

(Europe) Limited 2.84% 3.28%

Janus Henderson Group plc 0.00% 3.92%

*Excluding the 2,966,666 Ordinary Shares held in treasury

**Assuming admission of the shares pursuant to the fundraising

undertaken in conjunction with the proposed acquisition of

Isentia and excluding the 2,966,666 Ordinary Shares held in

treasury

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 30 November

(ii) Isentia Group Limited - Audited interim results for the

six months ended 30 December 2020

Access Intelligence plc - Audited results for the year ended

30 November 2020 / unaudited interim results for the six months

ended 31 May 2021

(iii) 31 May 2022 (12 month audited full year accounts to 30

November 2021)

31 August 2022 (six month unaudited accounts to 31 May 2022)

31 May 2023 (12 month audited full year accounts to 30 November

2022)

EXPECTED ADMISSION DATE:

2 September 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

finnCap Ltd

1 Bartholomew Close

London

EC1A 7BL

NAME AND ADDRESS OF BROKER:

finnCap Ltd

1 Bartholomew Close

London

EC1A 7BL

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

https://www.accessintelligence.com/investors/aim-rule-26/

The Admission Document contains full details about the Company,

the Acquisition and the admission of its securities.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA Corporate Governance Code

DATE OF NOTIFICATION:

2 August 2021

NEW/ UPDATE:

New

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAUUSWRAWUWRRR

(END) Dow Jones Newswires

August 02, 2021 05:30 ET (09:30 GMT)

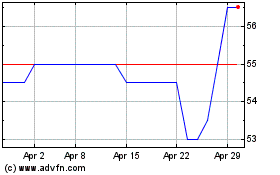

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Mar 2024 to Apr 2024

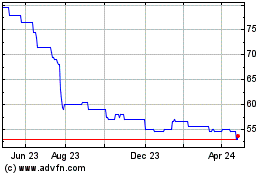

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Apr 2023 to Apr 2024