ADM Energy PLC Barracuda Oil Field Option (0935B)

08 June 2021 - 4:00PM

UK Regulatory

TIDMADME

RNS Number : 0935B

ADM Energy PLC

08 June 2021

8 June 2021

ADM Energy PLC

("ADM" or the "Company")

Barracuda Oil Field Option

Further to the announcement of 23 March 2021, ADM Energy PLC

(AIM: ADME; BER and FSE: P4JC), a natural resources investing

company, provides the following clarification on the option rights

for a participating interest in the Barracuda oil field in OML 141,

offshore Nigeria ("the Field").

The investment in the Field was made by way of an acquisition of

a 51 per cent. interest in K.O.N.H. UK Limited ("KONH"), which

holds a 70 per cent. interest in a Risk Sharing Agreement ("RSA").

In the announcement, the Company advised that the RSA grants

investors in the RSA an option to acquire a participating interest

in the OML 141 licence, however, there are no option rights

attached to the RSA and, accordingly, to the benefit of ADM.

Enquiries:

ADM Energy plc +44 20 7459 4718

Osamede Okhomina, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Arden Partners plc +44 20 7614 5900

(Lead Broker)

Paul Shackleton, Daniel Gee-Summons

Hybridan LLP +44 20 3764 2341

(Joint Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Joe Quinlan

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria.

ADM Energy holds a 9.2% profit interest in the oil producing Aje

Field, part of OML 113, which covers an area of 835km(2) offshore

Nigeria. Aje has multiple oil, gas, and gas condensate reservoirs

in the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date.

The Company also holds an investment in the development of the

Barracuda Field, an existing discovery and near-term production

asset in the NW part of OML 141, which covers 103 km(2) in the

swamp/shallow waters of the Niger Delta. Four existing wells have

been drilled to date and a fifth is intended to be drilled in Q4

2021.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure and route to early

cash flow.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURUBUARAKUNRUR

(END) Dow Jones Newswires

June 08, 2021 02:00 ET (06:00 GMT)

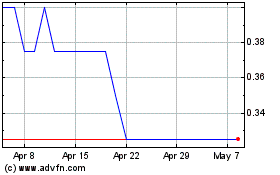

Adm Energy (LSE:ADME)

Historical Stock Chart

From Mar 2024 to Apr 2024

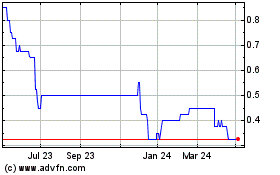

Adm Energy (LSE:ADME)

Historical Stock Chart

From Apr 2023 to Apr 2024