TIDMADME

RNS Number : 5582W

ADM Energy PLC

23 December 2021

23 December 2021

ADM Energy PLC

("ADM" or the "Company")

Posting of Circular and Notice of General Meeting

Further to the announcement of 14 December 2021, ADM Energy PLC

(AIM: ADME; BER and FSE: P4JC), a natural resources investing

company, announces that it will shortly be posting a circular to

shareholders convening a General Meeting (the "Circular"). This

follows receipt of a letter on behalf of a shareholder who holds in

excess of five per cent. of the Company's issued share capital to

requisition a general meeting ("GM") of the Company

("Requisition").

The General Meeting will be held at the offices of Luther

Pendragon, 48 Gracechurch St, EC3V 0EJ at 10:00 am GMT on 17

January 2022.

The Requisition proposes that shareholders be asked to consider

the following resolutions:

1. that Osamede Okhomina be removed as a director of the Company

with immediate effect;

2. that Richard Carter be removed as a director of the Company

with immediate effect;

3. that Oliver Andrews be removed as a director of the Company

with immediate effect; and

4. that Richard Jennings be appointed as a Director of the

Company with immediate effect.

The Board's unanimous recommendation is for shareholders to vote

AGAINST the proposed resolutions.

The Board has received irrevocable undertakings from a number of

shareholders, including its largest shareholder, to vote against

ALL the Jennings' Resolutions. In addition, each of the directors

intends to vote their respective shares AGAINST all of the

Jennings' Resolutions giving an aggregate total AGAINST the

Jennings' Resolutions of 66,963,742 ordinary shares representing

32.75 per cent. of the issued share capital of the Company as at

the date of this announcement.

Osamede Okhomina, CEO of ADM Energy plc, said: "On behalf of the

Board we urge all shareholders to vote against the proposed

resolutions. We have a strong board and excellent technical team in

place, which combines decades of expertise in the oil and gas

arena, aligned with extensive local knowledge of Nigeria and West

Africa.

"Our strategy remains to build shareholder value through the

pursuit of quality, value-accretive assets in West Africa, adding

de-risked 2P reserves at attractive valuations, with significant

potential upside. With our technical know-how and access to capital

through strong partners such as Trafigura, ADM is very well

positioned and we are confident we can deliver our growth strategy

for the benefit of all shareholders."

Extracts from the Circular are set out below and should be read

in conjunction with the Circular. A copy of the Circular will

shortly be available from the Company's website:

www.admenergyplc.com

Enquiries:

ADM Energy plc +44 20 7459 4718

Osamede Okhomina, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Luther Pendragon +44 20 7618 9100

(Financial PR)

Harry Chathli, Alexis Gore, Tan Siddique

LETTER FROM THE CHAIRMAN

Dear Shareholders

Notice of General Meeting as requisitioned by Align Research Ltd

and Fiske Nominees for and on behalf of Align Research Ltd, Richard

Jennings and Catherine Jennings

1. Introduction

On 14 December 2021, the Company announced that it had received

a notice ("Requisition Notice") by Fiske Nominees, on behalf of

Richard and Catherine Jennings, and Align Research Limited ("ARL"),

a company controlled by Mr Jennings, (together "the

Requisitionists" ) requiring the Company to convene a general

meeting ("Requisitioned General Meeting") to vote on resolutions

proposed by them by virtue of their holding of 10,904,031 shares

representing 5.33 per cent. of the Company's issued share

capital.

The Company had understood the Requisitionists to hold

11,813,122 ordinary shares, as per the notification of major

holdings received on 18 November 2020. The Board notes the

shareholding used in the Requisition Notice is lower than notified

by the Requisitionists and, in the absence of accurate shareholder

notifications advises that this position may be higher than

declared. Nevertheless, the Board considers that the documentation

received is valid and, accordingly, is posting this letter to

shareholders to give notice of its intention to convene a general

meeting for the sole purpose of proposing the resolutions proposed

by the Requisitionists.

2. Proposed Resolutions

The Requisition Notice requires the Company, pursuant to the

provisions set out in section 303 of the Companies Act 2006, to

proceed to convene a general meeting of the Company to consider

and, if thought fit, pass the resolutions set out below ( all of

which your Board recommends you vote AGAINST ):

1. THAT Osamede Okhomina be removed as a director of the Company with immediate effect.

2. THAT Richard Carter be removed as a director of the Company with immediate effect.

3. THAT Oliver Andrews be removed as a director of the Company with immediate effect.

4. THAT Richard Jennings be appointed as a director of the Company with immediate effect.

(the above resolutions are hereinafter referred to as the

"Jennings' Resolutions")

The Board's unanimous recommendation is for shareholders to vote

AGAINST the proposed resolutions.

The Board has received irrevocable undertakings from a number of

shareholders, including its largest shareholder, to vote against

ALL the Jennings' Resolutions. In addition, each of the directors

intends to vote their respective shares AGAINST all of the

Jennings' Resolutions giving an aggregate total AGAINST the

Jennings' Resolutions of 66,963,742 ordinary shares representing

32.75 per cent. of the issued share capital of the Company as at

the date of this letter.

3. The Board's assumption on the background to receipt of notice

The Requisition Notice did not set out the reasons why the

Requisitionists wish to move resolutions at the Requisitioned

General Meeting to remove the executive directors and Chairman of

the Company but the timing of its receipt coincides with an

emerging financial dispute between the Company and ARL (acting

through Mr Jennings).

The dispute concerns the terms of a debt facility agreement

entered into between ARL and the Company in August 2020 (as amended

by an amendment letter) in June 2021 ("Debt Facility Agreement")

and the terms of warrants issued to ALR in connection with the Debt

Facility Agreement. In summary, the Debt Facility Agreement

provides for the debt to be convertible at the lower of 4.25p per

share or the share price of any subsequent fundraise for the term

of the Debt Facility Agreement. In addition to repricing the

conversion price, ARL is seeking to re-price the 4,705,882 warrants

associated with the Debt Facility Agreement down to 1.5p from 4.25p

as well as rebasing its existing warrants with the effect of

seeking an additional grant of 8,842,451 warrants to an aggregate

total of 13,548,333 warrants. On top of the potential dilution for

shareholders, by way of example, were the Company to re-price the

4,705,882 warrants currently held by ARL from 4.25p to 1.5p, upon

exercise there would be unfavourable loss for the Company of

approximately GBP130,000. The Company has received clear,

unequivocal legal advice that neither the Debt Facility Agreement

nor the terms of the warrants provide for an adjustment to the

warrant exercise price or the number of warrants and as such is not

prepared to meet ALR's demands and will continue to resist

them.

It is the Board's opinion that, not having met the forceful

demands of Mr Jennings, it is being asked to requisition a general

meeting in order to replace certain key directors with himself.

4. Reasons to vote AGAINST ALL of the Resolutions

For the reasons mentioned below, the Board urges Shareholders to

vote AGAINST the Requisitionists' proposed resolutions .

Progress made by the Company will be in jeopardy

The Board believes, that should the resolutions pass, all the

progress made by the Company will be in jeopardy.

Under the leadership of Mr Osa Okhomina, the Company has:

a) Increased ADM's position in the highly strategic asset of OML

113. The Aje Field gives the Company access to reliable oil

production and contains significant wet and dry gas reserves which

command a premium in the local markets. The deal struck by the

management nearly doubled its interests. The Board believes that Mr

Jennings would not have been able to strike such a deal and does

not have the ability to advance the development of the Aje

investment.

The Company has announced plans to develop Aje. The Board

maintains that there is significant potential value in the Aje

field. However, the nature of the assets requires an intricate

knowledge of the field and the operating environment. The Board

asserts that it is the current management team that is best suited

to represent the Company's interests amongst the Aje partners as

they seek to extract the best possible outcome of this undervalued

asset.

b) Formed key partnerships with renowned companies such as

Trafigura, who could be a key funding partner for the Aje expansion

and other investment opportunities that should deliver shareholder

value in the mid to long term. As far as the Board can assess, Mr

Jennings has no such partnerships in the oil and gas sector nor

does he appear to have the ability to fund large scale

projects.

c) Assembled a high-quality technical team that has the ability

to assess multiple projects simultaneously due to their experience

gathered over several decades. They saw the opportunity and agreed

to work with the Company as a result of previous history of working

with the management team and the Board in other companies. They

have expressed to the Board they do not have any desire to work for

Mr Jennings. It is the Board's assertion that Mr Jennings does not

have the ability to recruit a technical team of such calibre and

consequently will lose the ability to assess projects

appropriately.

d) Local knowledge and expertise . Mr Okhomina has formed

several strategic alliances with local service providers that could

be utilised to significantly reduce the company's development

costs. He has also built a network of local partners that has

resulted in ADM being shown several business development

opportunities which it is currently evaluating. This local

knowledge extends across the West African region. The Board

believes that without this local knowledge and expertise, Mr

Jennings, alone, will be unable to assess the viability of future

projects.

Corporate governance issues will arise as Mr Jennings' Board

position is unclear

The Board has been substantially strengthened over recent years

and now comprises a balanced and diverse group of individuals, with

a wide range of experience of the oil and gas industry, Africa and,

importantly given the location of the Company's principal

investment, Nigeria.

Mr Jennings has not indicated that he wishes to join the Board

as Chairman, Executive Director or Non-executive Director. The

Board believes that Mr Jennings has not thought this through

properly and demonstrates his lack of PLC board experience and

understanding of corporate governance issues. The Company could be

seen to fail its corporate governance commitments under the QCA

code.

In addition, in the event that all of the Jennings' Resolutions

are passed, it is likely that the Company will be unable to

discharge its management and operating duties which may have

broader regulatory and operational consequences.

5. The Requisitioned Meeting

Set out at the end of this document is a notice convening the

Requisitioned General Meeting to be held at 48 Gracechurch Street,

London EC3V 0EJ at 10:00 a.m. on Monday 17 January 2022 at which

the Jennings' Resolutions will be proposed.

The independent directors, together with the remaining Board,

consider that the Jennings' Resolutions are NOT in the best

interests of the Company, its shareholders as a whole and other

stakeholders. Accordingly, the Board, including the independent

directors who are not subject to a resolution to remove them as a

director, recommend that shareholders VOTE AGAINST each of the

resolutions to be proposed at the General Meeting.

6. Action to be taken by Shareholders

Shareholders will find with the Notice of Requisitioned General

Meeting in this document a Form of Proxy for use in connection with

the Requisitioned General Meeting. You are urged to complete, sign

and return the Form of Proxy in accordance with the instructions

printed thereon as soon as possible, but in any event to so as to

be received by post or, during normal business hours only, by hand,

by the Company's registrars, Computershare Investor Service PLC, at

The Pavilions, Bridgwater Road, Bristol, BS99 6ZY, as soon as

possible and by no later than 10:00 a.m. on 13 January 2022 (or in

the case of an adjourned Requisitioned General Meeting, not later

than 48 hours before the time fixed for the holding of the

adjourned meeting (excluding any day that is not a business

day)).

Given the current heightened risk of COVID-19 infections (and

the resultant regulatory changes) which could endure during the

period in which this Notice of Requisitioned General Meeting is

sent and the date of the General Meeting and to protect our

employees, local community and shareholders' welfare we are

encouraging all shareholders to vote on all resolutions by

appointing the chairman of the Requisitioned General Meeting as

their proxy.

7. Recommendation

For the reasons given above, the Board, including the

independent directors who are not subject to a resolution to remove

them as a director, consider that the Jennings' Resolutions are not

in the best interests of the Company, its shareholders as a whole

and its other stakeholders. Accordingly, the Board, including the

independent directors, therefore recommend that shareholders VOTE

AGAINST each of the Jennings' Resolutions to be proposed at the

Requisitioned General Meeting. Your Board will be voting AGAINST

the Jennings' Resolutions to be proposed at the Requisitioned

General Meeting.

Yours faithfully

Oliver Andrews

Chairman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGFELEFEEFSEDE

(END) Dow Jones Newswires

December 23, 2021 02:00 ET (07:00 GMT)

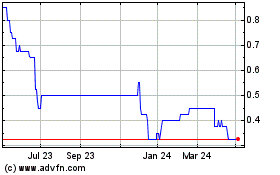

Adm Energy (LSE:ADME)

Historical Stock Chart

From Mar 2024 to Apr 2024

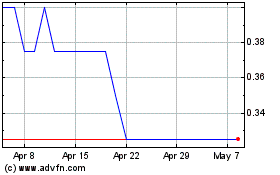

Adm Energy (LSE:ADME)

Historical Stock Chart

From Apr 2023 to Apr 2024