TIDMAEG

RNS Number : 1295N

Active Energy Group PLC

28 September 2021

28 September 2021

Active Energy Group Plc

('Active Energy', 'AEG', the 'Company' or the 'Group')

Interim Results for the Six Months Ended 30 June 2021

Active Energy, the international biomass based renewable energy

business, is pleased to announce its interim results for the six

months ended 30 June 2021.

HIGHLIGHTS

Interim Financial Report for the six months ended 30 June 2021

and strategic update

Active Energy Group plc today announces its unaudited interim

results for the six months ended 30 June 2021 and provides a

strategic update for the Company's shareholders.

Operational Highlights:

-- Construction of a second CoalSwitch reference plant at

Ashland, Maine (the "Ashland Facility") as part of a joint venture

with Player Design Inc.

o First CoalSwitch production commenced at the Ashland Facility

in May 2021

o Transition from conceptual technology to production of next

generation biomass fuel

o Initial deliveries of CoalSwitch to University of Utah,

Brigham Young University and PacifiCorp in June 2021

o Samples of CoalSwitch delivered to twelve prospective

customers

-- Independent CoalSwitch analysis from University of New

Brunswick confirm the product's superior qualities to white pellets

as well as its suitability as a sustainable substitute for carbon

emitting fuels

-- Construction of CoalSwitch reference plant at Lumberton, N.C.

("Lumberton") Facility near completion but suspended and requiring

permit amendment

-- Company ceases lumber and saw log activities in order to

focus on strategy of delivering a next generation biomass

pellet

Financial Highlights:

-- Major balance sheet restructuring successfully completed

o Equity fundraise of GBP7.0 million (gross of expenses)

o Conversion and redemption of outstanding convertible loan

notes and removal of security over the Company's assets

-- Revenue for H1 21 of US$636,241 (H1 20: $499,893)

-- Loss for the reporting period of US$2,039,316 (H1 20: US$593,914)

Post Period End:

-- Design and engineering commenced for a larger proprietary

reactor that would be capable of accommodating production volumes

of up to 70,000 tonnes of CoalSwitch per annum

-- Component failure at Ashland Facility resulting in production

suspension - options to re-establish near-term production at

Ashland Facility currently being evaluated

Outlook:

-- AEG continues to be well placed to deliver on the growing

need for more sustainable power sources

-- The Board is more convinced than ever that CoalSwitch fuel

can form part of the energy transition process

-- The next key step: design and construction of a 70,000 tonne per annum CoalSwitch facility

Michael Rowan, CEO of Active Energy, said:

"I am pleased to report a successful period for AEG that saw the

first production volumes of CoalSwitch and the completion of

construction of a second reference plant in Maine. CoalSwitch has

now transitioned from a concept to a deliverable biomass fuel, and

the manufacturing process know-how obtained in the last three

months is invaluable.

We expect next generation biomass fuels will play a key role in

the transition toward the zero carbon economy. CoalSwitch's

superior qualities to white pellets as well as its suitability as a

sustainable substitute for carbon emitting fuels, positions AEG

extremely well in the evolving global shift towards renewable

energy. With product in hand and increasing market interest, AEG is

now providing CoalSwitch samples to prospective long term

customers.

With a restructured balance sheet, AEG's next key goal is to

expand its production capacity to become a leading biomass fuel

producer of next generation biomass fuels. The road to produce

CoalSwitch is challenging, but the achievements of 2021 to date

have provided confidence to the Board of the next phase for

growth."

Regulatory information

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Website LinkedIn Twitter

www.aegplc.com www.linkedin.com/company/activeenergy https://twitter.com/aegplc

@aegplc

-------------------------------------- ----------------------------

Enquiries

Active Energy Group Michael Rowan (Chief Executive info@aegplc.com

Plc Officer)

Andrew Diamond ( Chief

Financial Officer)

------------------------------- -------------------

Allenby Capital Limited Nick Naylor/James Reeve Office: +44 (0)20

Nominated Adviser (Corporate Finance) 3328 5656

and Joint Broker Amrit Nahal (Sales/Corporate

Broking)

------------------------------- -------------------

Panmure Gordon & Co John Prior/Harriette Johnson Office: +44 (0)20

Joint Broker (Corporate Finance) 7886 2500

Hugh Rich (Corporate Broking)

------------------------------- -------------------

Camarco Gordon Poole / Tom Huddart aeg@camarco.co.uk

Financial PR Adviser / Emily Hall Office: +44 (0)20

3757 4980

------------------------------- -------------------

CHAIRMAN & CEO'S LETTER

Dear Shareholders,

Introduction

AEG is focussed on developing next generation biomass products

and the manufacturing processes and technology required to produce

them.

The Directors believe that CoalSwitch represents a step change

for the pellet industry, utilising steam technologies to produce a

more efficient fuel addressing environmental and energy concerns

for the immediate future.

In the first half of 2021, AEG achieved a number of significant

milestones:

-- the successful financial restructuring of the Company's

balance sheet and raising of equity funding to construct the first

CoalSwitch reference plant;

-- sales and marketing activities moved from conceptual

discussions to testing and analysis of sample fuel quantities

produced at Ashland, Maine (the "Ashland Facility");

-- supply of CoalSwitch samples to twelve prospective customers,

with ongoing discussions with a number of interested parties,

including discussions for technology licensing; and

-- independent testing of initial CoalSwitch production has been

completed to show that CoalSwitch is a superior biomass pellet fuel

to existing white pellets in terms of heating value and bulk

density .

The role of biomass in future energy supply

In the shift towards sustainability, there is an increasing

recognition of the need for a balanced energy supply. The provision

of a consistent level of base-load electricity within existing

electricity grid systems currently requires a combination of energy

sources which includes biomass fuels.

The International Energy Agency's ("IEA") "Net Zero by 2050"

report shows a scenario of a global increase of 50 exajoules in

biomass power to 2050 (equivalent to one-third of China's current

annual electricity consumption). The IEA report noted that "Solid

bioenergy provides flexible low-emissions generation to complement

generation from solar PV and wind and it removes CO2 from the

atmosphere when equipped with CCUS (Carbon capture)".

To date, Europe's regulation has led the way in the use of

biomass power generation. Asia is fast adopting similar policies

and this is expected to lead to future growth in these markets. The

USA is now facing similar challenges to accommodate sustainability

and maintain power supplies within its existing infrastructure. The

interest in next-generation biomass fuels has never been greater.

Against this backdrop, CoalSwitch is well positioned.

Strategy

The Board has drawn further confidence from:

-- the utilisation of waste biomass material as a core feedstock;

-- the validation of the steam explosion production process in

scale from running the test reactors at Ashland;

-- the additional technical product knowledge and know-how

obtained during the first production cycles at Ashland; and

-- the positive market interest in CoalSwitch received to date.

The Board is watching regulatory and technology developments,

where recent supply challenges have identified potential power

shortages. Next generation biomass fuels (such as CoalSwitch) will

play an important part in addressing the shortcomings of renewable

energies within existing electricity grid systems.

Developing a new technology has inevitable challenges and

CoalSwitch is no different - notably the recent suspension of

production at Ashland in August. However, we have now produced

CoalSwitch through an industrial scale facility providing

considerable manufacturing data and know-how. Design improvements

for the reactors have already been identified alongside ways to

simplify the manufacturing process to reduce costs of

production.

The market requires a scalable solution to produce next

generation pellets and the Directors believe that AEG now has the

technical solutions to deliver pellets that have been produced via

steam technologies. The Company's strategy is to construct scalable

production facilities starting with the design and build of the

first 70,000 tonne per year CoalSwitch plant in Ashland.

Operational update

During the first six months of the year, AEG focused its

operational activities in two centres on the US East Coast, namely

Ashland, Maine and Lumberton, North Carolina. AEG remains focussed

on developing manufacturing capacity in the USA, which is at the

heart of the current global biomass manufacturing industry. Our

locations also allow AEG to make the greatest impact toward the

industry changes that the biomass industry needs to make in the

coming years.

Operations at Ashland, Maine

During construction of the Lumberton reference plant, AEG and

Player Design Inc. ("PDI") received additional commercial enquiries

about the possibility of combining CoalSwitch production facilities

within existing lumber mill operations in North Eastern USA. This

model aligned with the strategy being pursued in Lumberton and the

Group was keen to expand into this region. In April 2021, AEG and

PDI worked with the State of Maine to obtain a temporary operating

permit to allow a second CoalSwitch reference plant to be

constructed at PDI's facility at the Ashland Facility.

AEG had sufficient equipment to build a second facility when

combined with PDI's existing operating infrastructure at the

Ashland Facility. The Board therefore decided to proceed with this

development before the permitting and construction issues arose in

Lumberton during May 2021. With the subsequent events at Lumberton,

resources within AEG and PDI were refocused toward completion of

construction of the second reference plant and for it to become

operational within the existing timetables. As a result, the

reference plant at the Ashland Facility was completed and

operational within 14 weeks from the date of issuance of the

relevant temporary operating permit. First CoalSwitch fuel

production commenced in May 2021 and first deliveries of CoalSwitch

to the program organised by the University of Utah, Brigham Young

University ("BYU") and PacifiCorp ("PacifiCorp") were made in June

2021.

The Ashland Facility reference plant continued to operate until

5 August 2021 when a monitoring component failure resulted in a

suspension of production, rendering both reactors inoperable and

requiring replacement. All other equipment at the Ashland Facility

remains operable and capable of recommencing CoalSwitch production

operations at any time. More importantly, production from the

second reference plant validated the steam explosion process to

produce next generation biomass fuels on an industrial scale.

During the production period, valuable manufacturing and product

data was acquired which provides key information to allow the

construction of larger scale production facilities.

Operations at Lumberton, North Carolina

Lumberton (the "Lumberton Site") was purchased in 2019 to become

a strategic hub for a variety of lumber activities, including the

production of next generation biomass fuels, such as CoalSwitch,

and performing various ancillary lumber activities, including the

production of rail ties and other lumber products. These activities

were seen as complementary given AEG's aim to demonstrate that

biomass fuel production must work within sustainability goals. By

situating all the activities within one facility, AEG sought to

demonstrate that biomass fuel manufacture can be successfully

accommodated within an integrated lumber producing facility. This

model has attracted increasing interest from prospective lumber

partners throughout the USA and Canada during 2021 and remains a

core component of the Company's strategy.

In respect of the lumber activities during the period, the first

quarter provided a number of operational issues for Active Energy

Renewable Power LLP ("AERP"), the Company's operating subsidiary at

Lumberton. These issues included adverse weather conditions which

disrupted log supplies to the Lumberton Site, ongoing supply chain

disruption for product distribution and the continuing operational

limitations occurring as a result of COVID-19. The Board had set

modest goals to operate AERP's lumber and saw log activities at

breakeven by the 2020 year-end but did not achieve the operational

scale to attain these targets. The Board's review of the lumber and

saw log activities at the Lumberton Site determined that they

neither aligned with the Group's strategic intent of utilising

residual materials in the production of biomass fuels, nor could

the investment required to achieve scale for these businesses be

justified at the expense of developing CoalSwitch. As a result, the

Board took the decision to cease the Company's lumber and saw log

activities in AERP.

Since the fourth quarter of 2020, AEG's focus at the Lumberton

Site has been the production of CoalSwitch where relevant permits

had been issued by the North Carolina Department of Environmental

Quality ("NCDEQ") in August 2020. Preparatory engineering work

commenced in the third quarter of 2020 using the engineering

services of PDI. The Board set a target for first production by May

2021 and fuel available for customer delivery by June 2021.

Construction activities commenced in early February 2021, with

regular monitoring carried out by the NCDEQ.

In May 2021, AEG received a notice of violation from NCDEQ in

respect of the installation of additional control devices to

enhance emissions reduction which required an amendment to the

existing air quality permits issued by NCDEQ in 2020. AEG and its

representatives immediately submitted the relevant amendments to

ensure construction might remain on schedule. Subsequent to this,

the NCDEQ requested additional information on emissions including

data from an operational facility in order to revise and re-issue

the permits. AEG was required to suspend construction activities of

the reference plant at the Site.

AERP has continued dialogue with the NCDEQ and the NCDEQ has

made clear that AEG cannot resume the permit approval process

without the independent emissions analysis being submitted.

Nonetheless, it remains AEG's intention to develop the Lumberton

Site given its optimal location in South-Eastern USA. Sales and

marketing activities continue in the region with the aim of

securing sizeable CoalSwitch offtake agreements. In the past AERP

has leased out parts of the Lumberton Site. AERP continues to

examine options to create economic value from the Lumberton

Site.

AERP has received legal challenges from the Southern

Environmental Law Centre ("SELC") based in North Carolina regarding

alleged permit breaches at the Site from an existing wastewater

treatment plant. This action correlates to the period when the

Group first assumed ownership of the property in 2019. The

Directors are confident that the Group fully complies with its

environmental and permit obligations and wholly refutes SELC's

claims. The Group has requested a dismissal of the legal challenge

and awaits the verdict of this application.

Development of sales and marketing activities for CoalSwitch

fuel and production technology

With the development plans for production of CoalSwitch underway

through the first half of the year, the Group focussed on sales

activities to look for long term supply contracts both in North

America and internationally.

New personnel have been retained both in the USA and Japan to

develop sales and marketing in each region. Within the USA, the

prime focus has been to examine opportunities with existing power

utilities and other key manufacturing industries who remain current

users of coal, such as cement and aggregate industries. The

interest remains to focus on co-firing opportunities with these

industries that want to address their immediate environmental

concerns in the consumption of coal.

The opportunity in Japan is different in that Japan has publicly

stated its goals for future biomass consumption, which provides AEG

with the opportunity to present its fuels to an incentivised

audience. Our marketing efforts in Japan are progressing and

samples of CoalSwitch fuel have been delivered and tested with

favourable results. AEG is working toward securing long term supply

contracts but it is acknowledged that this will take time and

dedicated resources.

To date, AEG has supplied fuels to twelve prospective clients

and universities for independent analysis within North America and

internationally. The first test results, published by the Wood

Science and Technology Centre at the University of New Brunswick on

2 September 2021, demonstrate, for the first time in three years,

the premier qualities of CoalSwitch as a biomass pellet compared to

white pellets.

The CoalSwitch delivered to BYU and PacifiCorp in June 2021

allowed the first stage of the test program (the "Test Program") to

commence. The Test Program is designed to facilitate the analysis

and co-firing qualities of CoalSwitch in both PacifiCorp and BYU

facilities. Having completed the ball mill testing, the next stage

of the Test Program is testing of the co-firing process. Additional

quantities of CoalSwitch will be required for this next stage and,

at this point, we are unable to supply sufficient volumes to

complete this test. In the meantime, AEG is working with BYU to

focus on an additional co-firing program to provide performance

data on CoalSwitch utilising some of the existing fuel supplies in

Utah. AEG is also in discussions with other commercial partners for

additional co-firing opportunities within North America.

Intellectual property progress during the period

During the 2021, AEG has continued to develop its intellectual

property portfolio and production know-how in regard to CoalSwitch

and its manufacture. The award of the patent in the USA (Patent No:

10,858,607) has accelerated an additional patent application in the

USA. On 4 June 2021, AEG was notified by the Canadian Intellectual

Property Office of the grant of notice of allowance confirming the

award of the Canadian patent. Since that announcement, AEG has

completed the administrative formalities and awaits the formal

award of the Canadian patent.

Production data and know-how acquired in recent weeks will

further accelerate the intellectual property program for AEG within

North America and internationally. Finally, throughout the period,

AEG has continued to focus on opportunities for technology

licensing using existing and recently developed intellectual

property. Recent enquires from South-East Asia, South Africa and

India have all demonstrated the underlying interest in steam

technologies to produce biomass fuels. Progress has been slowed by

the COVID-19 travel restrictions, but we are working with each of

these partners to develop these opportunities.

Corporate

In January 2021, Andrew Diamond was appointed as the Group's

Finance Director and in February 2021 Antonio Esposito resigned as

Executive Director of the Company.

The Company's application to be listed on Nasdaq OTCQB is

complete subject to compliance with the existing trading rules.

When the Company's share price complies with these rules, the

commencement of trading is expected to be formalised and a further

announcement will be provided at that time.

Going concern

The Directors have given careful consideration to the

appropriateness of the going concern basis in the preparation of

the Unaudited Interim Condensed Consolidated Financial Statements.

Further details of our current financial position and uncertainties

which may affect the Company's ability to continue operating as a

going concern are to be found in the Financial Review and in Note 3

of the Unaudited Interim Condensed Consolidated Financial

Statements set out below.

Summary

The first half of 2021 has brought some challenges and a number

of steps forward. With the support of our shareholders, CoalSwitch

has moved from concept to the production of a next generation

biomass fuel, which we have successfully produced and supplied to

prospective customers. In addition, our balance sheet has been

restructured and the Company is largely debt free.

The next key step for the Company is the design and construction

of a facility to produce up to 70,000 tonnes of CoalSwitch per

annum, to show that AEG can produce commercial volumes of

CoalSwitch and meet market volume demand. Engineering activities

are underway to improve the reactor and process designs are

underway, following which the Group will seek to obtain the

appropriate permits from the State of Maine. It is imperative that

we move quickly to achieve these steps.

To maintain our positive momentum, we are examining all options

to re-establish limited production at Ashland as soon as

practicable, subject to relevant operating permits being granted.

Suitable existing test reactors remain available at Lumberton and

we are analysing moving and modifying these, as a temporary

measure, whilst new reactors are designed and fabricated.

Recent events within the global power industry have highlighted

the need for stable and diverse sources of energy supply, including

biomass, which of itself needs to evolve to meet increasing

environmental criteria and regulation. The Board is more convinced

than ever that CoalSwitch has these properties and has an important

future role to play. The Board views the prospects of the Company

with confidence.

James Leahy Michael Rowan

Non-executive Chairman CEO

27 September 2021

FINANCIAL REVIEW

The Unaudited Interim Condensed Consolidated Financial

Statements for the six-month period ended 30 June 2021 ("reporting

period" or "H1 21") is compared to the six-month period ended 30

June 2020 ("prior period" or "H1 20") as required by International

Financial Reporting Standards ("IFRS")

The Group has made significant progress during H1 21. In

February 2021, the convertible loan note ("CLN") holders agreed to

either convert their CLN's or have them redeemed. Furthermore, the

CLN holders agreed to a release of the security previously held

over the Group's assets by the CLN holders. At the same time, the

Company raised GBP7.0 million in an equity fundraising (before

expenses), principally to progress the final stages of construction

of the first reference plant at Lumberton Facility. These actions

restructured the Group's balance sheet and positioned the Company

to advance its CoalSwitch product.

On 20 May 2021, the Company announced its 50/50 joint venture

arrangement with PDI. Under this joint venture, AEG and PDI jointly

own a CoalSwitch plant in Ashland, Maine. The second reference

plant was completed and production commenced in May 2021.

On 5 August 2021, a monitoring component failure resulted in an

unexpected interruption in a production cycle. As a result of this

failure, both reactors at the Ashland Facility are inoperable and

will require replacement. All other equipment remains operable and

capable of resuming CoalSwitch production operations at any

time.

The Company has engaged sales and marketing representatives to

establish CoalSwitch supply contracts in North America and

internationally. Aside from initial deliveries to BYU and

PacifiCorp, CoalSwitch samples have been sent to several

prospective customers who have expressed an interest in the fuel

and wish to test independently.

In January 2021, Advanced Biomass Solutions Plc ("ABS"), a

subsidiary of the Company, agreed a debt facility up to GBP1

million and has drawn down GBP550,000 to date. The debt instrument

is repayable within twelve months based on monthly capital

repayments following a four-month repayment holiday. Initiation

fees of 7% were payable, and interest is charged at 10% per annum

payable quarterly in arrears. The Company has provided a corporate

guarantee as security. The Company has been repaying the amounts

drawn down and the balance outstanding at the date of reporting is

GBP284,167.

Going concern

The Interim Financial Statements have been prepared on a going

concern basis. Note 3 of the Interim Financial Statements lays out

the material uncertainties relating to the Group's ability to

continue as a going concern. The net proceeds of the fundraise in

February 2021 received by the Company, after CLN redemptions, have

been used to construct the CoalSwitch plants at Lumberton and

Ashland. The Directors anticipate that further funding will be

required in the coming twelve-month period in order to finance

plant modifications, expand CoalSwitch production capacity,

undertake additional research and testing programs and for

marketing activities.

Whilst there can be no guarantee that funding will be available

on terms that are acceptable to the Company or at all, the

Directors are confident, based on the progress made to date on the

production of CoalSwitch, and the restructured balance sheet of the

Group, that it will be able to secure the funding required. The

Directors are considering a number of options for securing the

additional funding including debt and equity or a combination of

both.

Performance

During H1 21, the Board has reassessed AEG's strategy and

determined that the saw log export business, which involved loading

saw logs into containers to be shipped to South-East Asia, did not

align with AEG's environmental strategy to focus on the use of

residual and waste forestry products from the lumber industry. In

addition, the Company has not been able to operate the saw log

export business at a scale to produce profitable returns. The level

of capital investment required to scale up and operate profitably,

to the detriment of CoalSwitch development, was deemed unacceptable

and the Board decided it was in the best interests of the Company

to cease the operations of this business.

Furthermore, the sawmill business struggled to operate

profitably. With a limited pool of capital the Board believes that

it is in the best interests of the Group to focus its time and

capital allocations on the opportunities presented by CoalSwitch

and therefore ceased sawmill activities.

Revenue for H1 21 was US$636,241 (H1 20: US$499,893). With the

closure of the saw log and sawmill businesses, the Company does not

anticipate further revenues from these businesses in H2 21.

Gross loss for H1 21 was US$496,588 (H1 20: profit of

US$357,835) reflecting the difficulties in both trading conditions

and the lack of scaled operations in the saw log and sawmill

businesses.

Administrative costs were US$1,486,064 (H1 20: US$1,080,087).

Costs associated with the operations and closure of the saw log and

sawmill businesses have been fully accounted for. The ongoing costs

associated with maintaining the Lumberton property have been

reduced as far as possible.

The full conversion of the CLN's, which incurred interest

charges to 31 January 2021, has reduced the interest cost charge.

Foreign exchange costs, which are included in disclosed finance

costs resulted in an increase in costs for the reporting

period.

Loss for the reporting period was US$2,039,316 (H1 20:

US$593,914), and basic and diluted loss per share was 0.06 cents

(H1 20: 0.05 cents).

Financial Position

Non-current assets

Additions to plant and equipment of US$4,251,496 relate to the

development of the Lumberton and Ashland CoalSwitch plants. The

termination of leases following the cessation of the sawmill

business resulted in a deemed disposal of US$435,066 of plant and

equipment.

Liabilities

Trade and other payables of US$1,573,733 (31 December 2020:

US$2,091,657) includes an accrual of approximately US$700,000 for

Lumberton and Ashland construction costs which have not yet been

invoiced.

Loans and borrowings of US$852,471 (31 December 2020:

US$22,127,323) reflects the impact of the removal of the CLN

obligation. The remaining balance mainly reflects the ABS debt

facility referred to above.

Net debt

The Group reports a net cash position at 30 June 2021 of

US$1,135,058 compared to a net debt of US$21,127,692 at 31 December

2020 (see note 11). The strong reduction in the liabilities of the

Group reflects the actions taken to strengthen the balance sheet

following the conversion and redemption of CLN obligations and the

equity raised at the beginning of the year.

Cash Flows

Operating cash outflows of US$3,409,601 (H1 20: US$172,038)

included US$1,047,804 of working capital reductions, reflected in

the reduction of trade and other payables.

Investing outflows of US$3,543,036 (H1 20: US$95,420) relate to

the purchase of equipment related to the CoalSwitch facilities in

Lumberton and Ashland.

Financing activities included US$8,994,643 of net equity raised

in the fundraising in February 2021, less US$1,484,728 of CLNs

redeemed as part of the balance sheet restructuring process. Funds

of US$750,296 were raised via the ABS facility in January 2021.

Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge the

unaudited Interim Financial Statements have been prepared in

accordance with IAS 34 'Interim Financial Reporting'.

Changes in Directors during the period is discussed in the

Corporate section of the Chairman's letter. A list of the current

Directors is available on the Company's website: www.aegplc.com

Andrew Diamond

Finance Director

27 September 2021

CONDENSED CONSOLIDATED STATEMENT OF INCOME AND OTHER

COMPREHENSIVE INCOME

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

30 June

30 June 2021 2020

Unaudited Unaudited

Note US$ US$

REVENUE 6 636,241 499,893

============= ============

GROSS (LOSS)/PROFIT (496,588) 357,835

Other operating income 411,178 -

Administrative expenses (1,486,064) (1,080,087)

------------- ------------

OPERATING LOSS (1,571,474) (722,252)

Finance costs (469,237) 111,844

------------- ------------

LOSS FROM OPERATIONS (2,040,711) (610,408)

Tax 1,395 16,494

LOSS FOR THE PERIOD - attributable

to Parent 6 (2,039,316) (593,914)

============= ============

Basic and Diluted loss per share

(US cent) 5 (0.06) (0.05)

OTHER COMPREHENSIVE (LOSS) / INCOME

Items that may be subsequently

reclassified to profit or loss:

Exchange differences on translation

of operations (1,185,420) (247,604)

Revaluation of other financial

assets - (106,366)

TOTAL COMPREHENSIVE LOSS FOR THE

PERIOD (3,224,736) (947,884)

============ ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

30 June 31 December

2021 2020

Unaudited Audited

Note US$ US$

NON-CURRENT ASSETS

Intangible assets 7 5,259,024 5,259,024

Property, plant and equipment 8 14,277,041 10,443,641

Other financial assets 945,803 931,312

20,481,868 16,633,977

------------- -------------

CURRENT ASSETS

Inventory 241,347 237,506

Trade and other receivables 84,107 270,755

Cash and cash equivalents 1,987,529 999,631

-------------

2,312,983 1,507,892

------------- -------------

TOTAL ASSETS 22,794,851 18,141,869

============= =============

CURRENT LIABILITIES

Trade and other payables 9 1,573,733 2,091,657

Lease liabilities - 136,891

Other current liabilities 150,000 150,000

Loans and borrowings 10 852,471 21,772

2,576,204 2,400,320

------------- -------------

NON-CURRENT LIABILITIES

Deferred income tax liabilities 148,744 150,139

Lease liabilities - 202,417

Loans and borrowings 10 - 22,105,551

-------------

148,744 22,458,107

------------- -------------

TOTAL LIABILITIES 2,724,948 24,858,427

------------- -------------

NET ASSETS / (LIABILITIES) 2 0,069,903 (6,716,558)

============= =============

EQUITY ATTRIBUTABLE TO OWNERS

OF THE PARENT

Share capital - Ordinary shares 12 5 50,694 219,436

Share capital - Deferred shares 12 18,148,898 18,148,898

Share premium 5 1,158,499 18,711,637

Merger reserve 2,350,175 2,350,175

Foreign exchange reserve ( 1,370,395) (184,975)

Own shares held reserve (268,442) (268,442)

Convertible debt / warrant reserve 8 58,069 3,701,803

(5 1,862,241

Retained earnings ) (49,899,736)

Revaluation reserve 504,646 504,646

------------- -------------

TOTAL EQUITY 2 0,069,903 (6,716,558)

============= =============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

Own Convertible

Foreign shares debt and

Share Share Merger exchange held warrant Retained Revaluation Total

capital premium reserve reserve reserve reserve earnings Reserve equity

US$ US$ US$ US$ US$ US$ US$ US$ US$

At 31 December

2019 17,265,379 17,303,159 2,350,175 (67,274) (268,442) 3,490,621 (40,206,405) 504,646 371,859

Total

comprehensive

loss - - - (353,970) - - (593,914) - (947,884)

Issue of share

capital 802,467 - - - - - (452,467) - 350,000

Conversion of

CLN 172,413 4,578 - - - (21,160) - - 155,831

Embedded

derivative

on CLN issue - - - - - 208,532 - - 208,532

Share based

payments - - - - - - 69,632 - 69,632

At 30 June

2020 18,240,259 17,307,737 2,350,175 (421,244) (268,442) 3,677,993 (41,183,154) 504,646 207,970

=========== =========== ========== ========== ========== ============ ============= ============ ==========

At 31 December

2020 18,368,334 18,711,637 2,350,175 (184,975) (268,442) 3,701,803 (49,899,736) 504,646 (6,716,558)

Total

comprehensive

loss - - - (1,185,420) - - (2,039,316) - (3,224,736)

Issue of share

capital 98,218 8,896,425 - - - - - - 8,994,643

Conversion of

CLN 233,040 23,550,437 - - - (2,843,734) - - 20,939,743

Share based

payments - - - - - - 76,811 - 76,811

At 30 June

2021 18,699,592 51,158,499 2,350,175 (1,370,395) (268,442) 858,069 (51,862,241) 504,646 20,069,903

=========== =========== ========== ============ ========== ============ ============= ======== ============

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

30 June

30 June 2021 2020

Unaudited Unaudited

Note US$ US$

Cash flows from operating activities

Loss for the period (2,039,316) (593,914)

Adjustments for:

Non-cash / separately disclosed items (403,481) (37,393)

Working capital (outflow) / inflow (1,043,577) 459,269

------------- ----------

Net cash outflow from operating activities 15 (3,490,601) (172,038)

Cash flows from investing activities

Purchase of intangible assets - (50,250)

Purchase of property, plant and equipment (3,543,036) (45,170)

Sale of property, plant and equipment - -

------------- ----------

Net cash outflow from investing activities (3,543,036) (95,420)

------------- ----------

Cash flows from financing activities

Issue of equity share capital, net

of share issue costs 8,994,643 -

Redemption of CLNs (1,484,728) -

Loans repaid (97,251) -

P roceeds from loans advanced 750,296 -

Principal elements of lease payments (57,900) -

Finance expenses paid (87,752) -

------------- ----------

Net cash inflow from financing activities 8,017,308 -

------------- ----------

Net increase/(decrease) in cash and

cash equivalents 987,898 (267,458)

Cash and cash equivalents at beginning

of the period 999,631 397,323

Exchange gains on cash and cash equivalents 4,227 5,527

------------- ----------

Cash and cash equivalents at end of

the period 1,987,529 135,392

============= ==========

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

1. GENERAL INFORMATION

Active Energy Group plc is a London quoted (AIM: AEG) renewable

energy company focused on the production and development of next

generation biomass products that have the potential to transform

the traditional coal fired-power industry and the existing

renewable biomass industry.

The Company is incorporated in England and Wales (Company number

03148295) and the address of the registered office is 27-28

Eastcastle Street, London, W1W 8DH, United Kingdom.

2. BASIS OF PRESENTATION

On 31 December 2020, IFRS as adopted by the European Union at

that date was brought into UK law and became UK-adopted

International Accounting Standards, with future changes being

subject to endorsement by the UK Endorsement Board. Active Energy

Group Plc transitioned to UK-adopted International Accounting

Standards in its consolidated financial statements on 1 January

2021. This change constitutes a change in accounting framework.

However, there is no impact on recognition, measurement or

disclosure in the period reported as a result of the change in

framework.

The condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2021 has been prepared in

accordance with the UK-adopted International Accounting Standard

34, 'Interim Financial Reporting' and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

The Interim Financial Statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

consolidated financial statements for the year ended 31 December

2020. The Interim Financial Statements are presented in US Dollars,

except as otherwise indicated. The Interim Financial Statements

have been prepared on a going concern basis, under the historical

cost convention, except for the revaluation of certain financial

instruments.

The Interim Financial Statements is unaudited and does not

constitute full statutory accounts under Section 434 of the

Companies Act 2006. The financial information in respect of the

year ended 31 December 2020 has been extracted from the statutory

accounts which have been delivered to the Registrar of Companies.

The Group's Independent Auditor's report on those accounts was

unqualified and did not contain a statement under section 498(2) or

498(3) of the Companies Act 2006. The auditor's report on those

accounts included a material uncertainty in relation to the going

concern assumptions detailed in the notes to those accounts. The

auditor did not qualify their report in respect of this matter. The

financial information for the half years ended 30 June 2021 and 30

June 2020 is unaudited and the twelve months to 31 December 2020 is

audited.

The accounting policies applied by the Group in this financial

information are the same as those applied by the Group in its

financial statements for the year ended 31 December 2020 and which

will form the basis of the 2021 financial statements, except for a

number of new and amended standards which have become effective

since the beginning of the previous financial year. These new and

amended standards are not expected to materially affect the

Group.

The preparation of financial statements in compliance with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise judgment in the most appropriate

application in applying the Group's accounting policies. The areas

where significant judgments and estimates have been made in

preparing these interim financial statements are not materially

different from those disclosed in the financial statements for the

year ended 31 December 2020.

These Interim Financial Statements were approved by the Board of

Directors on 27 September 2021.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

3. GOING CONCERN

The Directors are required to give careful consideration to the

appropriateness of the going concern basis in the preparation of

the interim financial statements.

In February 2021, the Company restructured its balance sheet by

securing the conversion and redemption of the entire convertible

loan note obligation ("CLN"). Furthermore, the securities in place

for the CLN holders have been revoked. At the same time the Company

recapitalised the business by raising GBP7.0 million (gross) to be

used principally for the construction of the Lumberton CoalSwitch

reference plant ("Lumberton Facility"), certain CLN redemptions and

improvement of the working capital position.

During the six-month period ending 30 June 2021 ("current

period") the Group progressed with the construction of the first

reference plant at the Lumberton Facility. Construction of the

reference plant was suspended owing to a requirement to amend the

existing air quality permits to accommodate the installation of

additional control devices. The Company signed a joint venture

agreement with Player Design Inc., on a 50/50 basis, and

constructed the second CoalSwitch reference plant in Ashland, Maine

("Ashland Facility"). The Ashland Facility is strategically located

near to several large lumber product manufacturers who have

significant wood residuals to dispose of. It commenced production

in May 2021 and delivered the first CoalSwitch product to

PacifiCorp in Utah in June 2021. On 5 August 2021, a monitoring

component failure resulted in an unexpected interruption in a

production cycle. As a result of this failure, both reactors at the

Ashland Facility are inoperable and will require replacement. All

other equipment remains operable and capable of resuming CoalSwitch

production operations at any time.

Preliminary testing by the University of New Brunswick of

CoalSwitch produced at the Ashland Facilty has validated the

technical merits of the product, and sales and marketing activities

both in the USA and internationally are currently underway with

CoalSwitch samples sent to a number of prospective customers for

independent testing.

At the reporting date the Group has sufficient funding for

near-term administration, working capital costs and debt servicing

but will need to seek additional funding to finance further plant

expansions and modifications and/or new plant developments.

Uncertainties exist in relation to the commercial viability of

CoalSwitch, the completion of the Lumberton and Ashland CoalSwitch

Facilities, the Group's ability to locate and secure long-term

off-take agreements for CoalSwitch and the Company's ability to

secure additional funding, either equity or debt, to support these

activities. These conditions indicate the existence of a material

uncertainty which may cast significant doubt over the Group's

ability to continue as a going concern.

The Directors have reviewed the cash forecasts in respect of the

Group's operating and planned growth activities. The expected cash

flows, plus available cash on hand, after allowing for funds

required and allowing for existing debt facilities, are not

sufficient to cover these activities. The Company will need to

raise funding to support operations in the twelve-month period from

the date of approval of these interim financial statements. The

Directors are confident, based on the CoalSwitch progress made to

date, and the restructured balance sheet of the Group, that it will

be able to secure the funding required.

On the basis of the considerations set out above, the Directors

have concluded that it is appropriate to prepare the interim

financial statements on a going concern basis. These Interim

Financial Statements do not include any adjustments to the carrying

amount and classification of assets and liabilities that may arise

if the Group or the Parent Company was unable to continue as a

going concern.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

4. Basis of consolidation

The financial information incorporates the results of AEG plc

and entities controlled by the AEG plc (its subsidiaries). Control

is achieved when the Group has power over relevant activities, is

exposed, or has rights, to variable returns from its involvement

with the entity and has the ability to affect those returns through

its power over the entity. The consolidated interim financial

statements present the financial results of AEG plc and its

subsidiaries (the Group) as if they formed a single entity. Where

necessary, adjustments are made to the results of subsidiaries to

bring the accounting policies used into line with those used by the

Group. All intra-Group transactions, balances, income and expenses

are eliminated on consolidation.

5. LOSS PER SHARE

30 June 30 June

2021 2020

Unaudited Unaudited

Weighted average ordinary shares in

issue (Number) 3,206,905,598 1,239,618,243

Loss for the period (US$) (852,471) (22,127,323)

-------------- --------------

Basic and diluted loss per share (US

cent) (0.06) (0.05)

============== ==============

Basic and diluted loss per share are the same where the effect

of any potential shares is anti-dilutive and is therefore

excluded.

6. SEGMENTAL INFORMATION

The Group reports three business segments:

-- "CoalSwitch (TM)" denotes the Group's renewable wood pellet business.

-- "Wood processing" denotes the Group's sawmill and saw log activities.

-- "Corporate and other" denotes the Group's corporate and other costs.

The business segments are aligned to the Group's strategy. The

comparative segmental information has been restated to align with

the current reporting segments.

Factors that management used to identify the Group's reportable

segments

The Group's reportable segments are strategic business units

that offer different products or services.

Measurement of operating segment profit or loss

The Group evaluates segmental performance on the basis of profit

or loss from operations calculated in accordance with IFRS but

excluding non-recurring losses, such as goodwill and asset

impairments.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

6. SEGMENTAL INFORMATION (continued)

Six months to 30 June Corporate

2021 CoalSwitch Wood processing & Other Total

(Unaudited) US$ US$ US$ US$

Revenue - 636,241 - 636,241

Operating segment (loss) (110,467) (571,476) (889,531) (1,571,474)

Segment (loss) before

tax (216,463) (596,982) (1,227,266) (2,040,711)

Tax credit/(charge) - 1,395 - 1,395

----------------- ---------------- ------------------ -------------

Segment (loss) for

the period (216,463) (595,587) (1,227,266) (2, 039,316)

================= ================ ================== =============

Total Assets 15,418,397 691,664 6,684,790 22,794,851

================== =============

Total Liabilities (1,418,977 (427,230) (878,741) (2,724,948)

================== =============

Other segmental information:

Capital Expenditure 4,235,999 12,500 2,997 4,251,496

Depreciation & amortisation - 163,769 554 164,323

Six months to 30 June Wood Corporate

2020 CoalSwitch processing & Other Total

(Unaudited) US$ US$ US$ US$

Revenue - 499,893 - 499,893

Operating segment (loss) (48,664) (210,986) (462,602) (722,252)

Segment (loss) before

tax (48,664) (210,986) (350,758) (610,408)

Tax credit/(charge) - - 16,494 16,494

----------------- ---------------- ---------------- -------------

Segment (loss) for

the period (48,664)) (210,986) (334,264) (593,914)

================= ================ ================ =============

Total Assets 10,955,003 1,232,142 11,087,960 23,275,105

================ =============

Total Liabilities (761,265) (862,645) (21,443,225) (23,067,135)

================ =============

Other segmental information:

Capital Expenditure: 463,651 776,099 970 1,240,720

Additions to Intangibles 61,654 151,298 50,444 263,396

Depreciation & amortisation - 17,547 75,495 93,042

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

7. INTANGIBLE ASSETS

Six months to 30 June Intellectual Timber

2021 (Unaudited) Goodwill property licences Total

US$ US$ US$ US$

Cost

At 31 December 2020

and

30 June 2021 567,668 5,259,386 6,503,975 12,331,029

========= ============= ========== ===========

Accumulated amortisation

At 31 December 2020

and

30 June 2021 567,668 362 6,503,975 7,072,005

========= ============= ========== ===========

Net book value

At 31 December 2020

and

30 June 2021 - 5,259,024 - 5,259,024

========= ============= ========== ===========

Twelve months to 31 Intellectual Timber

December 2020 (Audited) Goodwill property licences Total

US$ US$ US$ US$

Cost

At 31 December 2019 - 5,028,061 6,314,713 11,342,774

Additions 567,668 231,325 189,262 988,255

------------- ---------- -----------

At 31 December 2020 567,668 5,259,386 6,503,975 12,331,029

========= ============= ========== ===========

Accumulated amortisation

At 31 December 2019 - 362 2,161,946 2,162,308

Impairment charge 567,668 - 4,191,039 4,758,707

Amortisation charge

for the year - - 150,990 150,990

--------- ------------- ---------- -----------

At 31 December 2020 567,668 362 6,503,975 7,072,005

========= ============= ========== ===========

Net book value

At 31 December 2020 - 5,259,024 - 5,259,024

========= ============= ========== ===========

Intellectual property comprises costs incurred to secure the

rights and knowledge associated with the CoalSwitch and PeatSwitch

technologies.

Recoverability of intellectual property assets is dependent on

successfully commercialising CoalSwitch, which is subject to a

number of uncertainties including the ability of the Group to

access financial resources to develop the projects and bring the

product to economic maturity and profitability. Commercial

production of CoalSwitch has recently commenced and based upon

forward projections of production growth, management determined

that no impairment was required. Management will continue to

monitor the recoverability of these assets.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

8. PROPERTY, PLANT AND EQUIPMENT

Furniture

Land & Plant and and office

Buildings equipment equipment Total

US$ US$ US$ US$

Cost

----------- ----------- ------------ -----------

At 31 December 2019 4,017,645 5,247,016 42,097 9,306,758

----------- ----------- ------------ -----------

Additions 281,829 1,281,071 1,222 1,564,122

Disposals (5,614) - - (5,614)

Transfers (12,031) 45,168 (33,137) -

Foreign exchange differences - - 167 167

----------- ----------- ------------ -----------

At 31 December 2020 4,281,829 6,573,255 10,349 10,865,433

=========== =========== ============ ===========

Additions - 4,248,499 2,997 4,251,496

Disposals - (435,066) - (435,066)

Foreign exchange differences - - 161 161

----------- ----------- ------------ -----------

At 30 June 2021 4,281,829 10,386,688 13,507 14,682,024

=========== =========== ============ ===========

Accumulated depreciation

----------- ----------- ------------ -----------

At 31 December 2019 54,000 5,428 15,587 75,015

----------- ----------- ------------ -----------

Charge for the year 111,977 201,198 33,486 346,661

Transfers 39,740 (39,740) -

Foreign exchange differences - - 116 116

----------- ----------- ------------ -----------

At 31 December 2020 165,977 246,366 9,449 421,792

=========== =========== ============ ===========

Charge for the period 64,184 99,585 554 164,323

Disposals (181,277) - (181,277)

Foreign exchange differences - - 145 145

----------- ----------- ------------ -----------

At 30 June 2021 230,161 164,674 10,148 404,983

=========== =========== ============ ===========

Net book value

At 30 June 2021 4,051,668 10,222,014 3,359 14,277,041

=========== =========== ============ ===========

At 31 December 2020 4,115,852 6,326,889 900 10,443,641

=========== =========== ============ ===========

Plant and equipment additions relate to CoalSwitch equipment

acquired for the Lumberton production facility. Right of use assets

included within Plant and equipment, with a cost of US$435,066, and

accumulated depreciation of US$181,277, are reflected as a disposal

following termination of the lease at the end of the current

period.

Recoverability of plant and equipment assets is dependent on

successfully commercialising CoalSwitch, which is subject to a

number of uncertainties including the ability of the Group to

access financial resources to develop the projects and bring the

product to economic maturity and profitability. Commercial

production of CoalSwitch has recently commenced and based upon

forward projections of production growth, management determined

that no impairment was required. Management will continue to

monitor the recoverability of these assets.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

9. TRADE AND OTHER PAYABLES

30 June 31 December

2021 2020

Unaudited Audited

US$ US$

Trade payables 517,706 1,340,213

Social security and other taxes 213,434 383,664

Accruals and deferred income 842,593 367,780

---------- ------------

1,573,733 2,091,657

========== ============

Accruals includes an amount of $700,000 relating to Lumberton

and Ashland construction costs which have not yet been

invoiced.

The carrying value of trade and other payables approximates to

fair value.

10. LOANS AND BORROWINGS

The book value and fair value of loans and borrowings are as

follows:

30 June 31 December

2021 2020

Unaudited Audited

US$ US$

Secured convertible debt - 21,914,723

Unsecured loans 165,888 212,600

Secured loans 686,583 -

---------- ------------

852,471 22,127,323

========== ============

Secured convertible debt

In February 2021, the convertible loan note ("CLN") holders

agreed to either convert their CLN's or have them redeemed.

Furthermore, the CLN holders agreed to a release of the securities

held over the Companies assets in favour of the CLN holders.

Secured loans

In January 2021, Advanced Biomass Solutions Plc, a subsidiary of

the Company, completed a debt facility of GBP1.0 million and drew

upon GBP550,000. The debt instrument is repayable within twelve

months based on monthly capital repayments following a four-month

repayment holiday. Initiation fees of 7% were payable, and interest

is charged at 10% p.a. payable quarterly in arrears. The Company

has provided a corporate guarantee as security.

The carrying value of loans and borrowings approximates to fair

value.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

11. NET CASH/(DEBT)

30 June 31 December

2021 2020

Unaudited Audited

US$ US$

Cash and cash equivalents 1,987,529 999,631

Loans and borrowings (852,471) (22,127,323)

---------- -------------

1,135,058 (21,127,692)

========== =============

12. SHARE CAPITAL

Number of

shares US$

Allotted, called up and fully paid

At 1 January 2020 1,201,906,951 17,265,379

Issue of shares 339,271,092 1,102,955

-------------- -----------

At 31 December 2020 1,541,178,043 18,368,334

Issue of shares 700,000,001 98,218

Conversion of CLNs 1,660,873,700 233,040

-------------- -----------

At 30 June 2021 3,902,051,744 18,699,592

============== ===========

This is split as follows between:

Ordinary shares (0.01p each) 3,902,051,744 550,694

Deferred shares (0.99p each) 1,287,536,163 18,148,898

-----------

Total share capital 18,699,592

===========

On 7 September 2020 the 1,287,536,163 Ordinary shares of 1p each

in issue at that time were sub-divided into the same number of new

Ordinary Shares of 0.01p each and one Deferred Share of 0.99p. The

Deferred Shares were not admitted to trading on AIM, carry no

voting rights and are purchasable at GBP1 in aggregate. At the

company's Annual General Meeting on 8 July 2021 the shareholders

approved the reduction of the Deferred Shares.

13. RELATED PARTY DISCLOSURES

During 2021, the Group paid $8,680 to INJ London Ltd for sales

and marketing services. This company is owned by Max Aitken.

14. CAPITAL COMMITMENTS

There were no capital commitments at 30 June 2021.

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED 30 JUNE 2021

15. RECONCILIATION OF LOSS FOR THE PERIOD TO CASH OUTFLOWS FROM OPERATING ACTIVITIES

30 June 30 June

2021 2020

Unaudited Unaudited

US$ US$

Loss for the period (2,039,316) (593,914)

Adjusted for:

Share based payment expense 76,811 69,631

Depreciation 164,323 17,547

Amortisation of intangible assets - 75,495

Gains on disposal of right of use assets (49,884)

Gain on redemption of CLNs (411,177)

Foreign currency translations (292,176) (1,525,962)

Finance expenses 110,017 1,342,390

Income tax (1,395) (16,494)

------------ ------------

(2,442,797) (631,307)

Increase in inventories (3,841) (103,702)

Decrease in trade and other receivables 186,648 491,067

Increase in trade and other payables (1,230,611) 71,904

------------ ------------

Net cash outflow from operating activities (3,490,601) (172,038)

============ ============

16. SUBSEQUENT EVENTS

The key business developments since 30 June 2021 were as

follows:

-- The Company was notified that its commercial cutting permit

had been cancelled in the Province of Newfoundland and Labrador

(the "Province"), owing to the requisite volume allocation not

having been harvested within specified time limits. Covid-19 travel

restrictions had further prevented AEG or any of its advisers from

accessing the Province in the last 16 months. The permit was fully

impaired in 2020.

-- The Company held its AGM on 8 July 2021. All of the resolutions were passed.

-- On 5 August 2021, a monitoring component failure resulted in

an unexpected interruption in a production cycle. As a result of

this failure, both reactors at the Ashland Facility are inoperable

and will require replacement. All other equipment remains operable

and capable of resuming CoalSwitch production operations at any

time.

17. COPIES OF THE INTERIM FINANCIAL STATEMENTS

Copies of the Consolidated Interim Financial Statements will be

made available on the Company's website at www.aegplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCRSDDGBR

(END) Dow Jones Newswires

September 28, 2021 01:59 ET (05:59 GMT)

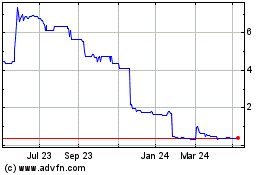

Active Energy (LSE:AEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

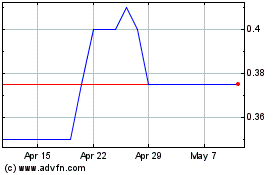

Active Energy (LSE:AEG)

Historical Stock Chart

From Apr 2023 to Apr 2024