Sterling Energy PLC Major Shareholding Changes & Board Appointments (6479P)

19 February 2021 - 4:34AM

UK Regulatory

TIDMSEY

RNS Number : 6479P

Sterling Energy PLC

18 February 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019. UPON

THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS

NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

18 February 2021

S terling Energy p lc

Changes in major shareholdings

Board appointments

Sterling Energy plc ('Sterling' or the 'Company') an upstream

oil and gas company listed on the AIM market of the London Stock

Exchange (Ticker Symbol: SEY) announces that the Company has been

informed that that Waterford Finance & Investment Limited and

Mistyvale Limited have agreed to sell their shareholdings in the

Company (representing 29.23% and 15.66% of the issued share capital

respectively).

The Company also confirm that it has provisionally agreed to

appoint Paul McDade, the former CEO of Tullow Oil plc, and Ian

Cloke, the former EVP at Tullow Oil plc, as executive directors of

the Company. Paul and Ian have extensive experience and knowledge

of identifying and developing oil and gas assets in West Africa and

intend to refocus the Company's strategy on producing assets in

this region.

Change in major shareholders

The Company has been advised that Waterford Finance &

Investment Limited ("Waterford") has agreed to sell 64,315,517

ordinary shares in the Company (equating to its entire 29.23%

shareholding in the Company) and that Mistyvale Limited

("Mistyvale") has agreed to sell 34,467,790 ordinary shares in the

Company (equating to its entire 15.66% shareholding in the

Company).

The Company and Waterford were parties to a Relationship

Agreement dated 10 June 2016 which governed the appointment of Mr.

Michael Kroupeev to the Board in May 2016. Following the sale of

Waterford's ordinary shares in the Company as set out above, the

Relationship Agreement has automatically terminated.

The Company understands that a number of institutional and high

net worth investors have agreed to purchase the shares being sold

by Waterford and Mistyvale. Following the sale, neither Waterford

nor Mistyvale will hold any interest in any ordinary shares in the

Company.

New directors

Paul McDade : A Petroleum engineer who has over 35 years'

experience in the oil & gas industry gaining broad operational,

commercial and management experience in the North Sea, Latin

America and Africa. He joined Tullow Oil in 2001 and was a one of

the Executive team who built Tullow Oil to be Africa's leading

independent oil & gas company, initially as COO and latterly as

CEO, before retiring from this role in December 2019.

Ian Cloke : A Geoscientist who has over 25 years' experience in

the oil and gas industry gaining broad, technical, operational,

commercial and management experience in Africa, North & South

America, the North Sea and South East Asia. He joined Tullow Oil in

2005 after 10 years at ExxonMobil and built operated businesses

across the group as a key member of the leadership team and

latterly as EVP New Ventures Business, before leaving in September

2020.

The appointments of Paul McDade and Ian Cloke as directors

remain subject to formally confirming shareholder opinions,

pre-appointment due diligence and the approval of the Company's

nominated adviser. A further announcement will be made in due

course.

Company update

As at 30 November 2020, the Company had cash reserves of $42.9

million (unaudited), with expenditure in the ordinary course of

business since 30 November 2020.

The Company's CEO, Mr. Tony Hawkins, said:

"I'd like to recognise the contributions of Waterford and

Mistyvale to the stability of the Company over a number of years.

Waterford and Mistyvale have been cornerstone investors in the

Company since 2009, when they helped re-capitalise the Company so

that it could drill exciting exploration wells in Kurdistan and

Cameroon, manage and cleanly exit its joint ventures in Madagascar

and Mauritania (including the Chinguetti oil field) and enter into

a fully funded carry for the Odewayne block in Somaliland.

We look forward to working with our new shareholders and our

existing shareholders to reconstitute the Board and move forward

with a refreshed strategy for the business. We will update the

market as to each of these items in due course. "

For furth er information c ontact:

Ticker Symbol: SEY

S terling Energy p lc + 44 (0)20 7405 4133

www.ster li n g ener g y p l c.com

Tony Hawkins, CEO

Leo Koot, Senior Independent Director

Peel Hunt LLP (Nominated Adviser) +44 (0)20 7418 8900

Richard Crichton

David McKeown

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOABRGDDDXBDGBI

(END) Dow Jones Newswires

February 18, 2021 12:34 ET (17:34 GMT)

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

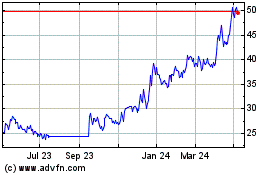

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024