TIDMAET

RNS Number : 9607Z

Afentra PLC

27 May 2021

27 May 2021

AFENTRA PLC

ANNUAL RESULTS FOR THE YEARED 31 DECEMBER 2020

Afentra plc is today issuing its annual results for the year

ended 31 December 2020.

OVERVIEW

Afentra plc ('Afentra' or the 'Company'), together with its

subsidiary undertakings (the 'Group'), is an upstream oil and gas

Company listed on the AIM market of the London Stock Exchange.

The Company has a refreshed strategy built around achieving

scale through the acquisition of both operated production assets

and discovered resources resulting from the accelerating energy

transition in Africa, where the Company and its new management has

extensive operational experience. The Company currently has the

high potential onshore Odewayne exploration block that is operated

by Genel Energy, where its 34% interest is fully carried.

2020 SUMMARY

Operations

-- Throughout 2020: Odewayne block, Somaliland - The Company

continued to support the Operator in progressing the technical

understanding of the block.

-- Afentra continued to review its technical assessment and

outlook on block prospectivity.

Financial

-- Cash resources net to the Group at 31 December 2020 of $42.7

million (2019: $44.9 million).

-- The Group remains debt free and fully funded for all commitments.

-- Adjusted EBITDAX(1) : loss for the Group of $761k (2019: $917k loss).

-- 2020 focus on capital discipline, general and administrative

overheads ('G&A') expenses reduced by 15% to $2.2 million

(2019: $2.6 million).

Post year end

-- 18 February 2021: Several institutional and high net worth

investors purchased the shares sold by Waterford Finance and

Investment Limited (equating to its entire 29.23% shareholding in

the Company) and Mistyvale Limited (equating to its entire 15.66%

shareholding in the Company).

-- 16 March 2021: Paul McDade and Ian Cloke join the Board of

Directors as CEO and COO respectively.

-- 30 March 2021: Jeffrey MacDonald and Gavin Wilson join the

Board of Directors as Independent non-executive Chairman and

Independent non-executive Director respectively.

-- 13 April 2021: The Company announced its intention to change

its name from Sterling Energy plc to Afentra plc and adopt new

articles of association. The proposed changes were approved at the

General Meeting held on 30 April 2021.

-- 5 May 2021: Afentra plc launched and Anastasia Deulina is

appointed as Chief Financial Officer.

(1) defined within the definitions and glossary of terms

Commenting, CEO Paul McDade, said:

"The last few months have been truly transformational for the

Company. I speak for the whole management & Board as I express

our excitement as we embark upon our updated strategy targeting

scale through the implementation of a buy and build model, focused

on the energy transition in Africa. In parallel to our updated

strategy we continue to work with our partners in Somaliland to

establish additional shareholder value from this existing early

stage asset". "I must also thank the Sterling Energy team who

despite an extremely challenging year have shown resilience and

have, like our shareholders, welcomed the new members to the team.

We look forward to 2021 and progressing our strategy as the new

Afentra team."

For further information contact:

Afentra plc +44 (0)20 7405 4133

Paul McDade, CEO

Ian Cloke, COO

Anastasia Deulina, CFO

Buchanan (Financial PR) +44 (0)20 7466 5000

Ben Romney

Chris Judd

James Husband

Peel Hunt LLP (Nominated Advisor and Joint Broker) +44 (0)20

7418 8900

Richard Crichton

David McKeown

Tennyson Securities (Joint Broker) +44 (0)20 7186 9033

Peter Krens

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

CHAIRMAN'S STATEMENT

Dear Shareholders

I am delighted to be providing the first statement in my role as

Chairman, and indeed the first statement for the Company in its new

form as Afentra. Your Company has undergone a complete

transformation in recent months following the arrival of the new

executive team led by CEO Paul McDade. This transformation has

resulted in a significant shift in the shareholder register and an

ongoing restructuring of the Board. This process of change

culminated in the recent General Meeting where you approved the

renaming of the Company to Afentra plc which was followed by its

successful relaunch.

The name Afentra, which stands for African Energy Transition,

reflects the Company's strategic imperative of capitalising on

opportunities resulting from the accelerating energy transition on

the African continent. Afentra has been established to support

sustainable change in the African energy industry, a sector that

needs further responsible, well managed, independent operators. The

new Executive team have presented this very clear strategy for the

Company and it is fully supported by the Board.

As detailed in the recent launch communications, the structural

changes in the oil and gas industry across Africa present exciting

opportunities for agile, ambitious and credible operators such as

Afentra, but they also present significant risks and challenges to

the environment and the socio-economic impact for the countries and

people of the continent if the transition is not managed

responsibly. This critical point is both the opportunity and

purpose of the business. Afentra has been established to support an

efficient and responsible energy transition on the continent that

delivers positive outcomes for all the stakeholders, including the

investors who backed Afentra to achieve these objectives. Indeed, a

robust ESG agenda is embedded into the core fabric of our business

model and operating structure, as it reflects our purpose and will

support our ability to achieve our vision.

The energy transition globally is well documented and IOCs are

changing their business models as they pivot towards lower-carbon

footprints, driven by societal and investor pressure. This factor

does not alter the current importance of oil and gas within the

energy mix and the requirement for them to continue to be produced

to meet global demand, enable transition and allow the developing

countries in Africa to continue to benefit from the revenues they

generate. In order to enable a responsible transition, credible

operators must position themselves as appropriate acquirers of

these assets, so that the assets and host governments can continue

to realise the positive benefit and impact of quality operators

ensuring best practice, environmental stewardship and transparent

governance.

The Board is confident that it has an exceptional leadership

team with a proven track record for operational excellence, value

creation and stakeholder engagement across Africa. Their network

amongst the target stakeholder audiences of IOCs and host

governments, coupled with their experience of managing the

sub-surface and above ground risks on the continent, represent the

strong foundation of Afentra's investment proposition. The Company

has developed a clear, straightforward, yet impactful, strategy

that we believe this team is uniquely positioned to execute.

The team are presently screening a pipeline of assets to

identify opportunities that meet the strategic criteria. It is the

hope of the Board that we will be able to update you on our first

acquisition in the next 12 months and, rest assured, our priority

will be to ensure we execute the right deal for our

shareholders.

These recent changes are exciting developments for the Company

and I am wholly confident that Afentra has a well-defined strategy

tailored to the current and future outlook for the industry and a

leadership team with the requisite experience, drive and

capabilities to deliver long-term value for our shareholders and

positive outcomes for all the stakeholders involved in the African

energy transition.

I thank shareholders for their support through these changes and

the Board looks forward to engaging with all of you as we progress

our strategy.

Jeffrey MacDonald - Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

I would like to express how pleased I am to take on the role as

your new CEO and for the support that I have received from both

long-term shareholders and those who have more recently invested in

our Company. I am very excited about the journey we are embarking

upon and the opportunities that the global energy transition

combined with the changes in the African upstream environment

present. We are determined to use these opportunities to transform

(build) Afentra into a responsible, well managed, independent

upstream operator.

The global energy transition is rightly at the forefront of

global consciousness and the oil and gas industry is seeking to

play its part in terms of reducing carbon footprint and

transparently communicating the impact of its activities. Although

climate change is rightfully the principle consideration of the

global energy transition, there are other key factors that need to

be considered to enable a smooth and responsible transition. We

need to ensure that the continued global demand for hydrocarbons

can be delivered in a responsible manner, and that the developing

countries, whose socio-economic development relies on these

resources, can continue to benefit from the associated revenues.

This is particularly true in Africa, a continent with vast

discovered resources, where the population is growing fast and yet

where many hundreds of millions of people remain without access to

reliable power.

As the upstream industry in Africa progresses through its

natural cycle, assets will be divested by IOCs and there will be a

requirement for credible operators to acquire these assets. Our

vision is to establish Afentra as a leading pan-African operator

with an unwavering commitment to operational and subsurface

excellence, environmental stewardship, transparent governance,

positive socio-economic impact, and strong sustainable shareholder

returns.

To deliver this vision, Afentra has assembled a highly

experienced leadership team with a proven track record of oil and

gas operations across Africa. This team have witnessed previous

industry transition cycles in both the North Sea and Gulf of

Mexico, this provides valuable insights into how to capitalise on

the African transition. A simple review of the operating landscape

in the North Sea today, versus twenty years ago, demonstrates the

importance of many smaller independents established specifically to

capitalise on the North Sea energy transition. The African industry

transition is in its early stages, but it is expected to mirror

what has happened in the North Sea. I see Afentra being a key

player supporting a smooth transition to ensure the desired

outcomes for all stakeholders.

A key driver of our approach is to ensure the African countries

can continue to benefit from the positive impact of their natural

resources through this accelerating energy transition. This social

aspect is not as well understood or publicised, yet it is a

critical factor when considering the broader aspects of ESG and

ethical investment. The environmental aspect of the global energy

transition is better understood, and Afentra will strive to balance

both the socio-economic and environmental implications of the

energy transition. Our approach is simple, we intend to position

the Company as a credible counterparty for IOCs to divest to, and a

quality partner for host governments to work with to enhance the

benefits from their upstream assets.

Ultimately, we are seeking to acquire quality producing assets

and discovered resources that can be optimised through innovative

operating techniques to enhance production, extend field life,

realise hidden value and reduce their environmental impact. Through

this diligent approach, Afentra can turn "legacy" producing fields

and discovered resources into highly profitable assets capable of

delivering strong cash flow for reinvestment and shareholder

returns.

The assets we are targeting are mid to late life producing

assets or discovered resources across Africa, with a particular

focus on West Africa. We are seeking operated positions, but will

also consider non-operated opportunities alongside credible

operators with shared standards. We are largely commodity agnostic,

however anticipate that oil will be the main emphasis given the

opportunities we know to exist in our target markets. Our goal is

to announce a transaction in the next twelve months.

In parallel to the growth strategy we will continue to appraise

our existing asset in Somaliland with a view to establishing

additional value on behalf of shareholders. Given the asset profile

is early stage exploration we need to carefully consider its

positioning within our stated strategy and ensure that we maximise

the value of this asset which benefits from a full carry by our

partner.

We see a clear market driver for our business model and believe

we have assembled the right team, with a clear and focused

strategy, capable of capitalising on this opportunity for the

benefit of all stakeholders. Importantly, we remain pragmatic about

the challenges that are facing the oil and gas industry and have

factored these into the establishment of our business model, to

ensure we mitigate risks and meet stakeholder expectations.

I'd like to thank the Sterling Energy team that have endured a

very difficult 2020 due to the challenges caused by the global

covid pandemic, this was combined by the uncertainties surrounding

the changes within the Company. They have shown dedication and

professionalism throughout this period and have been very

supportive and welcoming to myself and the new members of the team.

We are all looking forward to working as the new Afentra team and

share our excitement about the journey we are embarking on

together.

Paul McDade - Chief Executive Officer

OPERATIONS REVIEW

Since late 2015 the Company has exited non-core exploration

portfolio assets and removed outstanding liabilities, to provide a

simpler and rejuvenated platform for M&A led growth. The Group

retains a fully carried exposure to the frontier Odewayne block in

Somaliland and a clear strategy for future M&A growth.

SOMALILAND

Somaliland offers one of the last opportunities to target an

undrilled onshore rift basin in Africa. The Odewayne block, with

access to Berbera deepwater port less than a 100km to the north, is

ideally located to commercialise any discovered hydrocarbons. A 2D

geophysical survey acquired in 2017 and reprocessed in 2019, along

with field data and legacy geological field studies, are the focus

of the Company's 2021 work programme to determine if a Mesozoic age

sedimentary basin is present in the block and its

prospectivity.

Odewayne (W.I. 34%) Exploration block

Overview

This large, unexplored, frontier acreage position covers

22,840km(2) , the equivalent of c. 100 UK North Sea blocks.

Exploration activity prior to the 2017 regional 2D seismic

acquisition program has been limited to the acquisition of airborne

gravity and magnetic data and surface fieldwork studies, with no

wells drilled on block.

The Company's wholly owned subsidiary, Sterling Energy (East

Africa) Limited ('SE(EA)L'), holds a 34% working interest in the

PSA (fully carried by Genel Energy Somaliland Limited for its share

of the costs of all exploration activities during the Third and

Fourth Periods of the PSA).

The Odewayne production sharing agreement was awarded in 2005.

It is in the Third Period, with a 1,000km, 10km by 10km 2D seismic

grid acquired in 2017 by BGP. The Third Period has been further

extended, through the 8th deed of amendment. This data was

reprocessed in 2019 and is currently being reviewed after the

disruption caused by Covid in 2020.

In 2H 2021 the Company will review the reprocessed 2D seismic

data set in and will update its technical assessment and outlook on

block prospectivity accordingly. Alongside the seismic reprocessing

review, the Operator is undertaking a number of work streams and it

is anticipated that these will aid the JV partnership in developing

an appropriate forward work program to further evaluate the

prospectivity of the licence.

Outlook on buy and build strategy

In March 2021 the Company shifted focus to support a responsible

energy transition in Africa by establishing itself as a credible

partner for divesting IOCs and Host Governments. The Company is

specifically targeting producing assets and discovered resources in

Africa. The focus will be on operated positions but will also

consider non-operated positions alongside credible operators with

shared standards.

FINANCIAL REVIEW

Selected financial data 2020 2019

Adjusted EBITDAX $million (0.8) (0.9)

Loss after tax $million (1.9) (1.6)

Year end cash net to the Group $million 42.7 44.9

Year end share price Pence 9.4 8.7

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures include capital

investment, debt and adjusted EBITDAX.

Income Statement

Group G&A decreased by 15% during the year to $2.2 million

(2019: $2.6 million). The reduction in the Group's administrative

overhead is in keeping with the Board's 2020 mandate for cash

preservation.

In 2020, a portion of the Group's staff costs and associated

overheads have been expensed as pre-licence expenditure ($1.2

million), or capitalised/recharged ($74k) where they are directly

assigned to capital projects or recharged. This totalled $1.3

million in the year (2019: $1.4 million).

Interest received during the year was $326k (2019: $1.1

million). The reduction year on year was as a result of the global

pandemic amongst other factors including, banks increasing their

liquidity levels which resulted in a reduction on deposit rates.

Net finance income (finance income less finance expenses) totalled

$268k in the year (2019: $1.0 million).

The loss for the year was $1.9 million (2019: loss $1.6

million):

$' Million

Loss for year 2019 (1.6)

Decrease in G&A and pre-licence costs 0.4

Decrease in finance income (0.7)

Loss for year 2020 (1.9)

===========

Group adjusted EBITDAX loss totalled $761k (2019: $917k

loss):

2020 2019

$' Million $' Million

Loss after tax (1.9) (1.6)

Interest and finance costs (0.3) (1.0)

Depletion and depreciation 0.2 0.2

Pre-licence costs 1.2 1.4

Total EBITDAX (Adjusted) (0.8) (0.9)

=========== ===========

The basic loss per share was 0.9 cents per share (2019: loss 0.7

cents per share). No dividend is proposed to be paid for the year

ended 31 December 2020 (2019: $nil).

Statement of financial position

At the end of 2020, non-current assets totalled $22.1 million

(2019: $22.1 million) the majority of which relates to the Odewayne

block ($21.2 million).

Net assets/total equity stood at $63.9 million (2019: $65.8

million).

Net current assets reduced to $42.5 million (2019: $44.5

million). At the end of 2020 cash and cash equivalents totalled

$42.7 million (2019: $44.9 million), the reduction being related to

G&A overheads offset by interest received.

Cash flow

Total net decrease in cash and cash equivalents in the year was

$2.2 million (2019: $1.5 million), a full reconciliation of which

is provided in the Consolidated Statement of Cash Flows.

During the year there were minimal cash investments on the

Odewayne Block in Somaliland due to the Group's interest being

fully carried by Genel Energy Somaliland Limited for its share of

the costs during the Third and Fourth Periods of the PSA.

Accounting Standards

The Group has reported its 2020 and 2019 full year accounts in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006.

Cautionary statement

This financial report contains certain forward-looking

statements that are subject to the usual risk factors and

uncertainties associated with the oil and gas exploration and

production business. Whilst the Directors believe the expectation

reflected herein to be reasonable in light of the information

available up to the time of their approval of this report, the

actual outcome may be materially different owing to factors either

beyond the Group's control or otherwise within the Group's control

but, for example, owing to a change of plan or strategy.

Accordingly, no reliance may be placed on the forward-looking

statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

31st December 31st December

2020 2019

$000 $000

Other administrative expenses (953) (1,108)

Pre-licence costs (1,221) (1,444)

--------------------------------------------- -------------- --------------

Total administrative expenses (2,174) (2,552)

Loss from operations (2,174) (2,552)

Finance income 326 1,068

Finance expense (58) (116)

Loss before tax (1,906) (1,600)

Tax - -

Loss for the year attributable to

the owners of the parent (1,906) (1,600)

-------------- --------------

Other comprehensive income/(expense)

- items to be reclassified to the

income statement in

subsequent periods

Currency translation adjustments 7 (3)

Total other comprehensive income/(expense)

for the year 7 (3)

-------------- --------------

Total comprehensive expense for the

year attributable to the owners of

the parent (1,899) (1,603)

============== ==============

Basic and diluted loss per share

(US cents) (0.9) (0.7)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31st December 31st December

Note 2020 2019

$000 $000

Non-current assets

Intangible exploration and evaluation

assets 4 21,209 21,119

Property, plant and equipment 844 975

22,053 22,094

-------------- --------------

Current assets

Trade and other receivables 193 250

Cash and cash equivalents 42,674 44,851

42,867 45,101

-------------- --------------

Total assets 64,920 67,195

============== ==============

Equity

Share capital 28,143 28,143

Currency translation reserve (197) (204)

Retained earnings 35,945 37,844

Total equity 63,891 65,783

-------------- --------------

Current liabilities

Trade and other payables 209 439

Lease liability 205 208

414 647

-------------- --------------

Non-current liabilities

Lease liability 581 735

Long-term provision 34 30

615 765

-------------- --------------

Total liabilities 1,029 1,412

-------------- --------------

Total equity and liabilities 64,920 67,195

============== ==============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Currency

Share translation Retained

capital reserve earnings Total

$000 $000 $000 $000

At 1 January 2019 28,143 (201) 39,444 67,386

-------- ------------ --------- --------

Loss for the year - - (1,600) (1,600)

Currency translation

adjustments - (3) - (3)

--------

Total comprehensive

expense for the year

attributable to the

owners of the parent - (3) (1,600) (1,603)

At 31 December 2019 28,143 (204) 37,844 65,783

-------- ------------ --------- --------

Adjustment to IFRS

9 - - 7 7

At 1 January 2020 28,143 (204) 37,851 65,790

-------- ------------ --------- --------

Loss for the year - - (1,906) (1,906)

Currency translation

adjustments - 7 - 7

--------

Total comprehensive

expense for the year

attributable to the

owners of the parent - 7 (1,906) (1,899)

At 31 December 2020 28,143 (197) 35,945 63,891

======== ============ ========= ========

CONSOLIDATED STATEMENT OF CASH FLOWS

Note 2020 2019

$000 $000

Operating activities:

Loss before tax (1,906) (1,600)

Depreciation, depletion & amortisation 193 191

Finance income and gains (326) (1,068)

Finance expense and losses 59 55

Operating cash flow prior to working

capital movements (1,980) (2,422)

Decrease in trade and other receivables 57 140

Decrease in trade and other payables (230) (35)

Increase in provision 4 30

Net cash flow used in operating

activities (2,149) (2,287)

Investing activities

Interest received 326 1,068

Purchase of property, plant and

equipment (12) -

Exploration and evaluation costs 4 (90) (26)

Net cash used in investing activities 224 1,042

Financing activities

Principal paid on lease liability (237) (201)

Interest paid on lease liability (46) (54)

Net cash used in financing activities (283) (255)

Net decrease in cash and cash equivalents (2,208) (1,500)

Cash and cash equivalents at beginning

of year 44,851 46,312

Effect of foreign exchange rate

changes 31 39

Cash and cash equivalents at end

of year 42,674 44,851

======== ========

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. General information

The results announcement is for the year ended 31 December

2020.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2020

or 2019, but is derived from those accounts. Statutory accounts for

2019 have been delivered to the Registrar of Companies and those

for 2020 will be delivered following the Company's Annual General

Meeting. The auditors have reported on those accounts; their

reports were unqualified, did not draw attention to any matters by

way of emphasis without qualifying their report and did not contain

statements under s498(2) or (3) Companies Act 2006.

While the financial information included in this announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs.

The Annual Report and Accounts and the notice for the Company's

Annual General meeting, which is to be held at 10.00 a.m. on 30

June 2021, will be posted to Shareholders on 1 June 2021.

2. Going concern

The Group business activities, together with the factors likely

to affect its future development, performance and position are set

out in the Operations review. The financial position of the Group

and Company, its cash flows and liquidity position are described in

the Financial Review.

The Group has sufficient cash resources for its working capital

needs and its committed capital expenditure programme at least for

the next 12 months. As a consequence, the Directors believe that

both the Group and Company are well placed to manage their business

risks successfully despite the ongoing pandemic and uncertain

economic outlook.

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. This assessment has been made by the Directors who remain

confident the Group has sufficient cash resources at the date of

signing the annual report to meet its liabilities as they fall due

for a period of at least 12 months from the date of signing these

financial statements, and notwithstanding the impact that COVID-19

has had, and continues to have internationally. The Directors

believe that the Group is in a strong position to absorb any

potential impact on the Group arising from COVID-19, and thus, they

continue to adopt the going concern basis of accounting in

preparation of the financial statements.

3. Operating segments

Africa operations in 2020 focused on exploration and appraisal

activities in Somaliland. The UK corporate office is a technical

and administrative cost centre focused on new ventures. The

operating results of each segment are regularly reviewed by the

Board of Directors in order to make decisions about the allocation

of resources and to assess their performance.

The following tables present income, expense and certain asset

and liability information regarding the Group's operating segments

for the year ended 31 December 2020 and for the year ended 31

December 2019.

Corporate Africa Total

2020 2019 2020 2019 2020 2019

$000 $000 $000 $000 $000 $000

Other administrative

expenses (953) (1,108) - - (953) (1,108)

Pre-licence costs (1,221) (1,444) - - (1,221) (1,444)

-------- -------- ------- ------- -------------------- --------

Loss from operations (2,174) (2,552) - - (2,174) (2,552)

Finance income 326 1,068 - - 326 1,068

Finance expense (58) (116) - - (58) (116)

-------- -------- ------- ------- -------------------- --------

Segment loss

before tax (1,906) (1,600) - - (1,906) (1,600)

-------- -------- ------- ------- -------------------- --------

Other segment

information

Depreciation 193 191 - - 193 191

Segment assets

and liabilities

Non-current assets

(1) 844 975 21,209 21,119 22,053 22,094

Segment assets

(2) 42,867 45,101 - - 42,867 45,101

Segment liabilities

(3) (1,016) (1,396) (13) (16) (1,029) (1,412)

(1) Segment non-current assets of $21.2 million in Somaliland

(2019: $21.1 million).

(2) Corporate segment assets include $42.7 million cash and

cash equivalents (2019: $44.9 million). Carrying amounts of

segment assets exclude investments in subsidiaries.

(3) Carrying amounts of segment liabilities exclude intra-group

financing.

4. Intangible Exploration and Evaluation assets

Group

$000

Net book value at 1 January 2019 21,093

Additions during the year 26

Net book value at 31 December

2019 21,119

-------

Additions during the year 90

Net book value at 31 December

2020 21,209

-------

Group intangible assets at the year end 2020:

Odewayne PSA, Somaliland: SE(EA)L 34%, Genel Energy Somaliland

Limited 50%, Petrosoma 16%

Classified as a joint arrangement in accordance with IFRS

11.

5. Subsequent events

Changes in major shareholdings and Board appointments

On the 18 February 2021 the Company announced that a number of

institutional and high net worth investors had agreed to purchase

the following shares:

Waterford Finance & Investment Limited - 64,315,517 ordinary

shares in the Company (equating to its entire 29.23% shareholding

in the Company); and

Mistyvale Limited - 34,467,790 ordinary shares in the Company

(equating to its entire 15.66% shareholding in the Company).

The Company and Waterford were parties to a Relationship

Agreement dated 10 June 2016. Following the sale of Waterford's

ordinary shares in the Company as set out above, the Relationship

Agreement automatically terminated.

On the 16 March 2021 the Company announced that Paul McDade had

joined as the Company's Chief Executive Officer with Ian Cloke

joining as Chief Operating Officer. The Company's existing CEO, Mr.

Tony Hawkins, stepped down from the Board.

On the 30 March 2021 the Company announced the appointments of

Jeffrey MacDonald as Independent non-executive Chairman and Gavin

Wilson as Independent non-executive Director. These appointments

replaced the non-executive Chairman (Michael Kroupeev) and

non-executive Directors (Leo Koot and Ilya Belyaev).

On the 13 April 2021 the Company announced its intention to

change its name to Afentra plc and adopt new articles of

association. The proposed change of name and new articles were

approved at a General Meeting held on 30 April 2021.

On the 5 May 2021 Afentra plc is launched and the Company

announced the appointment of Anastasia Deulina as Chief Financial

Officer.

DEFINITIONS AND GLOSSARY OF TERMS

$ US dollars

Companies Act or Companies The Companies Act 2006, as amended

Act

2006

2D Two dimensional

AIM AIM, a SME Growth market of the London

Stock Exchange

AGM Annual general meeting

Articles The Articles of Association of the

Company

Board The Board of Directors of the Company

Company Afentra plc

Directors The Directors of the Company

E&E Exploration and evaluation assets

E&P Exploration and production

EBITDAX (Adjusted) Earnings before interest, taxation,

depreciation, depletion and amortisation,

impairment, share-based payments,

provisions, and pre-licence expenditure

EITI Extractive industries transparency

initiative

Farm-in & farm-out A transaction under which one party

(farm-out party) transfers part of

its interest to a contract to another

party (farm-in party) in exchange

for a consideration which may comprise

the obligation to pay for some of

the farm-out party costs relating

to the contract and a cash sum for

past costs incurred by the farm-out

party

FCA Financial Conduct Authority of the

United Kingdom

G&A General and administrative

G&G Geological and geophysical

GBP Pounds sterling

Genel Energy Genel energy somaliland limited

Group The Company and its subsidiary undertakings

HSSE Health, Safety, Security and Environment

hydrocarbons Organic compounds of carbon and hydrogen

IAS International accounting standards

IFRS International financial reporting

standards

IOCs International oil company

JV Joint venture

k Thousands

km Kilometre(s)

km(2) Square kilometre(s)

KPIs Key performance indicators

lead Indication of a potential exploration

prospect

London Stock Exchange or London stock exchange plc

LSE

LTIP Long-term incentive plan

M&A Mergers and acquisitions

m Metre(s)

OECD Organisation for Economic Cooperation

and Development

Ordinary Shares Ordinary shares of 10 pence each

Petroleum Oil, gas, condensate and natural

gas liquids

Petrosoma Petrosoma Limited (JV partner in

Somaliland)

Prospect An area of exploration in which hydrocarbons

have been predicted to exist in economic

quantity. A group of prospects of

a similar nature constitutes a play.

PSA Production sharing agreement

QCA Code Corporate Governance Code for Small

and Mid-Size Quoted Companies 2018

Reserves Reserves are those quantities of

petroleum anticipated to be commercially

recoverable by application of development

projects to known accumulations from

a given date forward under defined

conditions. Reserves must satisfy

four criteria; they must be discovered,

recoverable, commercial and remaining

based on the development projects

applied. Reserves are further categorised

in accordance with the level of certainty

associated with the estimates and

may be sub-classified based on project

maturity and/or characterised by

development and production status

Seismic Data, obtained using a sound source

and receiver, that is processed to

provide a representation of a vertical

cross-section through the subsurface

layers

Shares 10p ordinary shares

Shareholders Ordinary shareholders of 10p each

in the Company

Subsidiary A subsidiary undertaking as defined

in the 2006 Act

United Kingdom or UK The United Kingdom of Great Britain

and Northern Ireland

Waterford Waterford Finance and Investment

Limited

Working Interest or WI A Company's equity interest in a

project before reduction for royalties

or production share owed to others

under the applicable fiscal terms

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UNURRANUVUUR

(END) Dow Jones Newswires

May 27, 2021 02:00 ET (06:00 GMT)

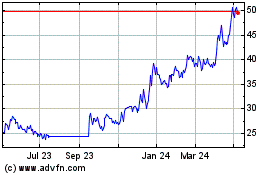

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024