TIDMAET

RNS Number : 1897L

Afentra PLC

09 September 2021

09 September 2021

Afentra p l c

Results for the six months ending 30 June 2021

Overview

Afentra plc ('Afentra' or the 'Company'), together with its

subsidiary undertakings (the 'Group'), is an upstream oil and gas

company quoted on the AIM market of the London Stock Exchange.

The Company's strategy is to build an oil and gas business of

scale through the acquisition of both operated and non-operated

production assets and discovered resources in Africa, where its

management team have extensive operational experience. Afentra is

well positioned to take advantage of the energy transition and

associated market dynamics which is creating opportunities for

experienced operators with a strong track record to acquire quality

producing assets.

The Company currently has a position in the onshore Odewayne

exploration block that is operated by Genel Energy, where its 34%

interest is fully carried.

Operations summary

-- Odewayne Licence - new Afentra team continue its technical

assessment and outlook on block prospectivity in discussion with

the operator

-- Business Development - experienced team now in place and

actively pursuing potential deals in Africa, primarily focused on

operated and non-operated production assets

Corporate summary

-- 18 February 2021: Several institutional and high net worth

investors purchased shares sold by existing shareholders including

Waterford Finance and Investment Limited (equating to its entire

29.23% shareholding in the Company) and Mistyvale Limited (equating

to its entire 15.66% shareholding in the Company)

-- 16 March 2021: Paul McDade and Ian Cloke join the Board of

Directors as CEO and COO respectively

-- 30 March 2021: Jeffrey MacDonald and Gavin Wilson join the

Board of Directors as Independent non-executive Chairman and

Independent non-executive Director respectively

-- 13 April 2021: The Company announced its intention to change

its name from Sterling Energy plc to Afentra plc and adopt new

articles of association. The proposed changes were approved at the

General Meeting held on 30 April 2021

-- 5 May 2021: Afentra plc launched and Anastasia Deulina is

appointed as Chief Financial Officer

Financial s ummary

-- Cash resources as at 30 June 2021 of $ 40.8 million (30 June

2020 of $ 43.8 million).

-- A d j usted EBI T DAX loss of $ 1.5 million (1H 2020: loss $ 289 k).

-- Loss after tax of $ 2.4 million (1H 2020: loss $ 866k ).

-- The Group remains debt free and fully carried for Odewayne

operations (Third and the Fourth Period).

Paul McDade, Chief Executive Officer, Afentra plc commented:

"2021 has been an eventful period during which we have established

Afentra plc and set the company on an exciting strategic path. The

market drivers for the energy transition across Africa are

presenting a wide range of compelling opportunities and we believe

that our proven operating track record, focused ESG agenda, strong

balance sheet and supportive shareholder base put us in a unique

position to capitalise on these opportunities."

For further information contact:

Afentra plc +44 (0)20 7405 4133

Paul McDade, CEO

Anastasia Deulina, CFO

Buchanan (Financial PR) +44 (0)20 7466 5000

Ben Romney

Jon Krinks

James Husband

Peel Hunt LLP (Nominated Advisor and Joint Broker) +44 (0)20

7418 8900

Richard Crichton

David McKeown

Tennyson Securities (Joint Broker) +44 (0)20 7186 9033

Peter Krens

CEO Statement

I am pleased to provide an update on Afentra's progress in the

first half of 2021, a period in which we have launched with a new

name, management team and a clearly defined strategic vision. It is

also a period, after the economic and industry challenges caused by

the pandemic through 2020, in which we have begun to see a steady

strengthening of commodity prices and cautious optimism within the

sector and wider economies.

Afentra was launched in May 2021 with a clear agenda; to

capitalise on opportunities presented by the accelerating energy

transition in Africa and in doing so support a responsible transfer

of asset ownership that provides beneficial outcomes for all

stakeholders involved.

To deliver this vision, Afentra has assembled a high-quality

team with a proven track record for operational excellence,

commercial focus, environmental stewardship, transparent governance

and delivering a positive socio-economic impact. We have ambitious

plans for growth and aim to become a leading pan-African operator

of scale, delivering long-term value for our shareholders through

accretive transactions.

As International Oil Companies (IOCs) seek to meet the

expectations of certain stakeholders to rationalise and diversify

their portfolios away from carbon intensive activities, they are

starting to divest parts of their African upstream assets. This is

creating an opportunity rich landscape for responsible companies

like Afentra. We are looking at a wide range of operated and

non-operated opportunities and, with our experienced team, are well

positioned as a credible counterparty for both IOCs seeking to

divest assets and an experienced partner for host governments to

work with.

Afentra's strong balance sheet and cost discipline also puts the

company in an excellent position to review and compete for

acquisition opportunities as they arise. The cash at hand also

provides optionality with regards to the funding structure for any

acquisitions, enabling us to consider smaller compelling

opportunities without the need to raise capital.

The strengthening of the oil price is obviously welcomed by the

industry, but does not alter the divestment agenda, nor does it

have a material impact on the valuations or competitive landscape

for our target acquisitions. It does however improve the economics

of target assets which will in turn enhance the appetite within the

capital markets to fund acquisitions.

Afentra is built upon an effective ESG framework. We have

aligned ourselves with the UN Sustainable Development Goals

(UNSDGs) and will increasingly meet the specific targets of the

UNSDGs as we progress from acquisition through to operatorship and

production.

At the heart of our approach is the conviction that African

countries must be able to benefit from the positive socio-economic

impact of their natural resources during the energy transition,

while also upholding the highest possible environmental standards.

We believe that it is important for all stakeholders that divested

assets end up in the hands of quality operators that are committed

to transparent disclosure of environmental data. Afentra believes

that through strong environmental stewardship and a focused

operating approach, we will be able to reduce the carbon emissions

of any acquired assets over time.

With regard to our existing asset in Somaliland, we are

currently progressing the technical assessment of Odewayne

alongside our partner Genel. Afentra remains fully carried on this

asset by Genel and we look forward to gaining a deeper

understanding of the appropriate forward work program as that

technical evaluation progresses through the second half of the

year.

Overall, it has been a very active first half of the year for

Afentra and we are making headway with our stated growth ambitions.

The market drivers are gathering momentum and your company feels

particularly well placed to capitalise on the array of upstream

opportunities that will be presented as a result of the energy

transition across Africa. We remain patient in our approach and

believe we have put in place all the required building blocks to

deliver long-term value. We thank our shareholders for their

support and look forward to delivering positive outcomes for all

our stakeholders through the second half of the year and

beyond.

Operations Review

Somaliland

Somaliland offers one of the last great opportunities to target

an undrilled onshore rift basin in Africa. The Odewayne block, with

access to Berbera deepwater port less than a 100km to the north, is

ideally located to commercialise any discovered hydrocarbons. The

company has continued to work the reprocessed 2D seismic survey

along with field data and legacy geological field studies to

determine if a Mesozoic age sedimentary basin is present in the

block and its prospectivity.

Odewayne (W.I. 34%) Exploration block

Overview

This large, unexplored, frontier acreage position covers

22,840km2, the equivalent of c. 100 UK North Sea blocks.

Exploration activity prior to the 2017 regional 2D seismic

acquisition program has been limited to the acquisition of airborne

gravity and magnetic data and surface fieldwork studies, with no

wells drilled on block.

The Company's wholly owned subsidiary, Afentra (East Africa)

Limited ('A(EA)L'), holds a 34% working interest in the PSA (fully

carried by Genel Energy Somaliland Limited for its share of the

costs of all exploration activities during the Third and Fourth

Periods of the PSA). The Odewayne production sharing agreement is

in the Third Period, with a 1,000km, 10km by 10km 2D seismic grid

acquired in 2017 by BGP. The Third Period has been further

extended, through the 8th deed of amendment. This data was

reprocessed in 2019 and is currently being reviewed after the

disruption caused by Covid in 2020-21.

In 2H 2021 the Company will review the reprocessed 2D seismic

data set and will update its technical assessment and outlook on

block prospectivity accordingly. Alongside the seismic reprocessing

review, the Operator is undertaking a number of work streams and it

is anticipated that these will aid the JV partnership in developing

an appropriate forward work program to further evaluate the

prospectivity of the licence.

Outlook on buy and build strategy

In March 2021 the Company shifted focus to support a responsible

energy transition in Africa by establishing itself as a credible

partner for divesting IOCs and Host Governments. The Company is

specifically targeting producing assets and discovered resources in

Africa. The focus will be on operated positions but will also

consider non-operated positions alongside credible operators with

shared standards and within a joint venture where we can leverage

our operating experience to influence outcomes and add value to

operator plans. The Company has developed a rigorous ESG agenda

which is being utilised in the screening process to ensure any

acquisition opportunities meet our risk criteria and provide scope

to reduce emissions through focused operational excellence.

An experienced technical and commercial team, of staff and

consultants, with deep knowledge of the West African region has

been assembled and is screening a number of opportunities.

Financial Rev iew

Selected financial data

1H 2021 1H 2020 FY 2020

Cash and cash equivalents net to Group ($m) 40.8 43.8 42.7

--------------------------------------------- -------- -------- --------

Adjusted EBITDAX (1) ($m) (1.5) (0.3) (0.8)

--------------------------------------------- -------- -------- --------

Loss after tax ($m) (2.4) (0.9) (1.9)

--------------------------------------------- -------- -------- --------

Debt ($m) - - -

--------------------------------------------- -------- -------- --------

NAVPS (2) (at period end) (GBP pence) 20.2 23.9 21.3

--------------------------------------------- -------- -------- --------

Share price (at period end) (GBP pence) 15.0 11.5 9.4

--------------------------------------------- -------- -------- --------

(1) Adju s t ed EBITDAX is cal c u lat ed as earnings be f ore

int ere s t, taxat i on, depreciation, amor t i sat i on, impa i r

m ent, pr e - l i cence expend i tur e, pr ov isio ns and shar e

-ba s ed pa y m ents.

(2) Net asset value per share

Loss from operations

T he loss from operations for 1H 2021 was $2.5 million (1H 2020:

loss $1.1 million) for the reasons described below.

During the period, net administrative expenditure increased to

$2.5 million (1H 2020: $1.1 million) as a result of exceptional

(one off) items relating to costs associated with the migration to

Afentra, a change in management and an increase in contractors and

advisors. Pre-licence costs for 1H 2021 was $862k (1H 2020:

$716k).

Adjusted EBITDAX and loss after tax

A d j usted EBI T DAX totalled a loss of $1.5 million (1H 2020:

loss $289k).

Finance inco me of $46k r epre sents inter est r e c eived

($11k) and foreign exchange gains ($35k) on cash h eld by the Group

(1H 2020: $288k).

Finance costs totalled $ 23k (1H 2020: $ 56k).

T he loss after tax totalled $ 2.4 million (1H 2020: loss $ 866k

). Basic loss per share was 1.11 USc per share ( 1H 2020: 0.39 USc

loss per share ). No dividend is propos ed to be paid for the six

months to 30

June 2021 (30 June 2020: nil).

Cash flow

Net cash outflow from operating activities (pre -working capital

move ments) totalled $2.3 million (1H 2020: outflow $988k ). A fter

working capital, net cash outflow from operating activities

totalled $ 1.8

million (1H 2020: outflow $ 1.2 million).

Statement of financial position

At 30 June 2021, Afentra held $40.8 million cash and cash

equivalents available for its own use (30 June 2020: $43.8

million).

Group net assets at 30 June 2021 were $61.4 million (30 June

2020 were $64.9 million). Non-current assets totalled $22.0 million

(30 June 2020: $22.0 million) with net current assets reducing to

$40.1 million (30 June 2020: $43.7 million).

Going Concern

T he Group's business activitie s, togeth er with the factors

likely to af f ect its future de v elop ment, performance and

position are s et out in the CEO State ment and in the Op erations

Re vie w. The financial position of the Group is de scribed in the

Financial R e vie w.

T he Co mpany has s u fficient cash re sources for its working

capital needs for at l east the n e xt 12 months. As a cons

equence, the Dir ectors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. This assessment has been made by the

Directors who remain confident the group has sufficient cash

resources to meet its liabilities as they fall due for a period of

at least 12 months from the date of signing these financial

statements, and notwithstanding the impact that Covid-19 has had

internationally. The Directors believe that the Group is in a

strong position to absorb any potential impact on the Group arising

from Covid-19. Accordingly, th ey continue to adopt the going

concern basis in preparing the re sults for the s ix months ended

30 June 2021.

Disclaimer

T his document contains ce r tain forward-looking statements

that are subj ect to the usual risk factors and uncertainties

associated with the oil and gas e xploration and production busines

s. Whilst the Group beli e v es the e xpectation re flected he r

ein to be reasonable in light of the information available to it at

this time, the actual outcome may be materially diff erent owing to

factors eith er beyond the Group's control or oth erwise within the

Group's control but where, for e xample, the Group decides on a

change of plan or strategy. Acco rdingly, no reliance may be plac

ed on the figures contained in such for ward -looking

statements.

Glossary

$ US Dollars

2D two dimensional

------------------------------------------------------

Adjusted EBITDAX earnings before interest, taxation, depreciation,

amortisation, impairment, pre-

licence expenditure, provisions and share based

payments

------------------------------------------------------

AIM Alternative Investment Market of the London Stock

Exchange

------------------------------------------------------

Group Afentra plc, together with its subsidiary undertakings

(the 'Group')

------------------------------------------------------

km kilometre

------------------------------------------------------

NAVPS Net asset value per share

------------------------------------------------------

Petrosoma Petrosoma Limited (JV partner in Somaliland)

------------------------------------------------------

PSA production sharing agreement

------------------------------------------------------

Seismic Geophysical investigation method that uses seismic

energy to interpret the geometry of rocks in the

subsurface

------------------------------------------------------

km(2) square kilometre

------------------------------------------------------

WI working interest

------------------------------------------------------

Condensed consolidated income statement for the six m onths to

30 June 2021

Restated

Six months Six months

to to Year ended

30th June 30th June 31st December

2021 2020 2020

$000 $000 $000

(unaudited) (unaudited) (audited)

------------------------------------------- ------------------------------------------- -------------------------------------------

Other

administrative

expenses (1,605) (382) (953)

Pre-licence costs (862) (716) (1,221)

------------------- ------------------------------------------- ------------------------------------------- -------------------------------------------

Total

administrative

expenses (2,467) (1,098) (2,174)

Loss from

operations (2,467) (1,098) (2,174)

Finance income 46 288 326

Finance expense (23) (56) (58)

Loss before tax (2,444) (866) (1,906)

Tax - - -

Loss for the

period

attributable

to the owners of

the parent (2,444) (866) (1,906)

------------------------------------------- ------------------------------------------- -------------------------------------------

Other

comprehensive

expense

- items to be

reclassified to

the income

statement in

subsequent

periods

Currency

translation

adjustments (5) 6 7

Total

comprehensive

(expense)/income

for the period (5) 6 7

------------------------------------------- ------------------------------------------- -------------------------------------------

Total

comprehensive

expense

for the period

attributable

to the owners of

the parent (2,449) (860) (1,899)

=========================================== =========================================== ===========================================

Basic and diluted

loss per

share (US cents) (1.11) (.39) (.87)

Condensed consolidated statement of financial position as at 30

June 2021

Restated

As at As at As at

30th June 30th June 31st December

Note 2021 2020 2020

$000 $000 $000

(unaudited) (unaudited) (audited)

------------ ---------------------------------------- --------------

Non-current assets

Intangible exploration and

evaluation assets 3 21,252 21,142 21,209

Property, plant and equipment 746 848 844

21,998 21,990 22,053

------------ ---------------------------------------- --------------

Current assets

Trade and other receivables 228 148 193

Cash and cash equivalents 40,772 43,798 42,674

41,000 43,946 42,867

------------ ---------------------------------------- --------------

Total assets 62,998 65,936 64,920

============ ======================================== ==============

Equity

Share capital 28,143 28,143 28,143

Currency translation reserve (202) (198) (197)

Retained earnings 33,501 36,985 35,945

Total equity 61,442 64,930 63,891

------------ ---------------------------------------- --------------

Current liabilities

Trade and other payables 825 178 209

Lease liability 120 98 205

945 276 414

------------ ---------------------------------------- --------------

Non-current liabilities

Lease liability 576 700 581

Long-term provision 35 30 34

611 730 615

------------ ---------------------------------------- --------------

Total liabilities 1,556 1,006 1,029

------------ ---------------------------------------- --------------

Total equity and liabilities 62,998 65,936 64,920

============ ======================================== ==============

Condensed consolidated statement of changes in equity for the

six months ended 30 June 2021

Currency

Share translation Retained

capital reserve earnings Total

$000 $000 $000 $000

--------------------- ------------ --------- --------

At 1 January 2020 28,143 (204) 37,851 65,790

------------------------------- --------------------- ------------ --------- --------

Total comprehensive expense

for the period attributable

to the owners of the parent - 6 (866) (860)

---------

At 30 June 2020 - restated 28,143 (198) 36,985 64,930

------------------------------- --------------------- ------------ --------- --------

Total comprehensive expense

for the period attributable

to the owners of the parent - (1) (1,040) (1,039)

At 31 December 2020 28,143 (197) 35,945 63,891

------------------------------- --------------------- ------------ --------- --------

Total comprehensive expense

for the period attributable

to the owners of the parent - (5) (2,444) (2,449)

At 30 June 2021 28,143 (202) 33,501 61,442

------------------------------- --------------------- ------------ --------- --------

Condensed consolidated statement of cash flows for the six

months ended 30 June 2021

Restated

Six months Six months

to to Year ended

30th June 30th June 31st December

Note 2021 2020 2020

$000 $000 $000

(unaudited) (unaudited) (audited)

------------ ------------------------------------------- --------------

Operating activities:

Loss before tax (2,444) (866) (1,906)

Depreciation, depletion

& amortisation 119 166 193

Finance income and

gains (46) (288) (326)

Finance expense and

losses 23 - 59

------------ ------------------------------------------- --------------

Operating cash outflow

prior to working capital

movements (2,348) (988) (1,980)

(Increase)/decrease

in trade and other

receivables (35) 84 57

Increase/(decrease)

in trade and other

payables 616 (262) (230)

Increase in provision 1 - 4

Net cash outflow from

operating activities (1,766) (1,166) (2,149)

Investing activities

Interest received 11 284 326

Purchase of property,

plant and equipment (9) - (12)

Exploration and evaluation

costs 3 (43) (23) (90)

Net cash (used)/generated

from investing activities (41) 261 224

Financing activities

Principal paid on

lease liability (121) (108) (237)

Interest paid on lease

liability (20) (29) (46)

Net cash used in financing

activities (141) (137) (283)

Net decrease in cash

and cash equivalents (1,948) (1,042) (2,208)

Cash and cash equivalents

at beginning of period 42,674 44,851 44,851

Effect of foreign

exchange rate changes 46 (11) 31

Cash and cash equivalents

at end of period 40,772 43,798 42,674

============ =========================================== ==============

Notes to the consolidated results for the six months ended 30

June 2021

1. Basis of preparation

T he financial information contained in this announcement does

not constitute statutory financial statements within the meaning of

S ection 435 of the Co mpanies Act 2006.

T he financial information for the six months ended 30 June 2021

is unaudited. In the opinion of the Directors, the financial

information for this period fairly repre s ents the f inancial

position of the Group. R e sults of operations and cash flo ws for

the period are in compliance with International Financial Reporting

Standards (IFRSs). T he accounting policie s, e stimat es and judg

e ments applied are consistent with those disclos ed in the annual

financial statements for the year ended 31 De c e mber 2020. The se

financial statem ents should be read in con junction with the

annual financial statem ents for the year ended 31 De c em b er

2020.

The financial information for the six months ended 30 June 2020

has been restated as a consequence of an IFRS 9 adjustment by the

Group.

A ll financial information is pres ented in USD, unle ss oth

erwise disclos ed.

An unqualified audit opinion was expressed for the year ended 31

December 2020, as delivered to the Registrar.

The Directors of the Company approved the financial information

included in the results on 09 September 2021.

2. Results & dividends

T he Group has r etained earnings at the end of the p eriod of

$33.5 million (30 June 2020: $37.0 million r etained earnings) to

be carried forward. The Directors do not recom mend the paym ent of

a dividend (1H 2020: nil ).

3. Intangible exploration and evaluation (E&E) assets

Total

$000

(unaudited)

------------

Net book value at 31 December 2019 21,119

------------

Additions during the period 23

Net book value at 30 June 2020 21,142

------------

Additions during the period 67

Net book value at 31 December 2020 21,209

------------

Additions during the period 43

Net book value at 30 June 2021 21,252

------------

Group intangible assets:

Odewayne PSA, Somaliland: SE(EA)L 34%, Genel Energy Somaliland

Limited 50%, Petrosoma 16%

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGGLLRMGMZM

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

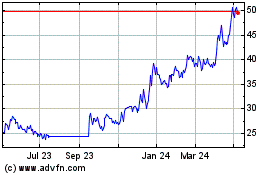

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024