TIDMAET

RNS Number : 2800J

Afentra PLC

26 April 2022

26 April 2022

AFENTRA PLC

ANNUAL RESULTS FOR THE YEARED 31 DECEMBER 2021

Afentra plc ('Afentra' or the 'Company'), is pleased to announce

its annual results for the year ended 31 December 2021.

2021 SUMMARY

Strategic

-- Established a new Executive team and Board, introduced new institutional and high net worth shareholders.

-- Rebranded Sterling Energy to Afentra ('African Energy

Transition') with a strategic imperative of capitalising on

opportunities resulting from the accelerating energy transition on

the African continent.

-- Established key focus areas with a comprehensive strategy to

capture production and development assets in Africa and create

value for all stakeholders.

-- Built a small, focused team with a history of identifying and

acquiring high quality assets, to rapidly assess business

development opportunities technically, operationally and

commercially.

-- Developed a robust Governance and ESG framework to support future growth ambitions.

Operations

-- Submitted a non-binding Expression of Interest to purchase

interests in Block 3/05 and Block 23 in Angola.

-- The Company continued to support the Operator of the Odewayne

block, Somaliland, in progressing the technical understanding of

the block; and continued to review its technical assessment and

outlook on block prospectivity.

Financial Highlights

-- Cash resources net to the Group at 31 December 2021 of $37.7 million (2020: $42.7 million).

-- Adjusted EBITDAX(1) : loss for the Group of $2.0 million (2020: $761k loss).

-- The Group remains debt free and fully carried for Odewayne

operations (Third and the Fourth Period).

(1) defined within the definitions and glossary of terms

Post year end highlights

-- In April, Afentra named preferred bidder to purchase interests in Block 3/05 and Block 23.

-- Afentra progressing final due diligence ahead of finalising

Sales and Purchase Agreement (SPA) with Sonangol.

Commenting, CEO Paul McDade, said:

"2021 was a year of transformation for Afentra. The Company

underwent a significant change of strategic focus and is now

extremely well placed to execute on our strategy to identify and

responsibly develop African opportunities and create value for all

stakeholders. Sonangol's recent announcement of our preferred

bidder status for Block 3/05 and Block 23 in Angola moved Afentra

one step closer to completing its first acquisition and we look

forward to moving ahead with that opportunity as we seek to

underpin the Company with stable cash flow and reserves.

As we look forward to 2022, our focus remains on the

implementation of our growth strategy, building scale and

stakeholder value within the Energy Transition in Africa. With a

strong balance sheet and an exceptional team behind us, the board

and management are excited for the journey ahead and look forward

to updating shareholders on our progress. "

For further information contact:

Afentra plc +44 (0)20 7405 4133

Paul McDade, CEO

Ian Cloke, COO

Anastasia Deulina, CFO

Buchanan (Financial PR) +44 (0)20 7466 5000

Ben Romney

Jon Krinks

Chris Judd

Peel Hunt LLP (Nominated Advisor and Joint Broker) +44 (0)20

7418 8900

Richard Crichton

David McKeown

Tennyson Securities (Joint Broker) +44 (0)20 7186 9033

Peter Krens

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

CHAIRMAN'S STATEMENT

Dear Shareholders

My first year as Chair of Afentra has been a period in which we

have seen significant changes in the industry landscape, and a

period where we have taken large strides to progress the strategic

objectives outlined when the Company was first launched in May

2021.

Starting with the industry macro backdrop, as the impact of

Covid abated during the second half of the year, and economies were

able to re-open, we observed a commensurate rebound in global

economic activity. In turn this has created a surge in global

demand for oil and gas, returning to and exceeding pre-pandemic

levels and leading to a considerable improvement in the commodity

price environment and overall confidence in the market. The easing

of travel restrictions has also enabled a better environment for

deal-making as counter-parties are able to meet in person which

always supports a better interaction and process for negotiating

and completing deals.

The recent shocking events in Ukraine have added further upward

pressure on energy prices as Russian crude is taken offline and

shunned by large swathes of the Western world and its allies.

Furthermore, the geopolitical uncertainty engendered by the crisis

has created major volatility in energy prices. This increase and

volatility in commodity prices is, however, a double edged sword.

Whilst the macro factors have resulted in increased interest in the

sector from the investment community it has also emphasised the

importance of continued investment to secure the required supply to

stabilise commodity prices as we progress through the energy

transition. The price volatility has also the potential to make the

difference in seller and buyers price expectations more difficult

to bridge. During this time, Afentra will continue to place high

importance on taking a disciplined approach to business development

as we screen our opportunity pipeline to ensure we deliver

long-term value for our shareholders.

Afentra was set up with a clear objective; to capitalise on

opportunities presented by the energy transition on the African

continent and in doing so support a responsible transfer of asset

ownership that provides beneficial outcomes for all stakeholders.

This current macro environment continues to provide an attractive,

opportunity-rich landscape for ambitious independents like

Afentra.

In the past year, we have successfully established our new Board

and executive team and continued to build upon the robust

governance and ESG frameworks that underpin our future growth

ambitions. With regards to the Governance framework that we

established, we will continue to review and update our policies and

commitments in these areas to ensure that we fully meet, and, where

possible, exceed our obligations, in line with our updated

strategic objectives.

Vendors and host governments are increasingly seeking credible

and responsible counterparties for divested assets to ensure best

practice, environmental stewardship, and the highest standards of

governance so that local communities and all stakeholders can

continue to realise the socio-economic benefits from existing,

discovered resources. With ESG considerations at the heart of

Afentra's strategy, and the Executive team's significant experience

in this area, the Company is well positioned to be an acquirer of

choice.

Taken together, the strengthening of the oil price and the

increasing importance of ESG considerations for both vendors and

the capital markets, provide strong tailwinds for your Company in

the longer term. However in the short term oil price volatility and

geopolitical uncertainty may create a challenging M&A

environment so we will ensure we retain a very strong focus on

value creation for you our shareholders and will therefore maintain

a disciplined approach to valuation, especially in this challenging

environment.

Afentra's Executive team, led by your CEO Paul McDade, have the

necessary technical and commercial expertise, and industry and

government networks across the African continent to capitalise on

opportunities that meet the Company's criteria, and we are

convinced that over the period we have put in place the necessary

foundations to deliver long-term value for all our

stakeholders.

In conclusion, your Company finds itself in a strong position as

we enter the second fiscal year of operation as Afentra. The market

drivers that underpin the global energy transition and support our

long-term strategy are gaining momentum and we are confident that

we have the right team and strategy to capitalise on these

opportunities for the benefit of all our stakeholders.

It only remains for me to thank you, our shareholders, for your

ongoing support for the Company, the management team and our

strategy. We look forward to updating you with positive news as we

move through the rest of the year.

Jeffrey MacDonald - Chairman

CHIEF EXECUTIVE OFFICER'S STATEMENT

Creating a responsible new industry player

Dear Shareholders,

The year ended 31 December 2021 was a transformative period for

the Company with the inception of Afentra; a new E&P business

with a focused strategy tailored to the long-term structural

changes taking place within the global energy markets.

As set out at our launch in May 2021, Afentra has been

established as a responsible and credible independent E&P

company to capitalise on the opportunities that will result from

the accelerating divestment of producing assets and discoveries

from International Oil Companies ('IOCs') and host Governments in

Africa and to support an effective and just energy transition for

the continent.

Our focus since launch has been on developing the appropriate

corporate framework to support Afentra's long-term growth

objectives, ensuring Afentra is recognised in the region and the

industry as an attractive counterparty for divestments and identify

and pursue opportunities consistent with our well-defined strategy.

I am pleased to report that the team has made good progress in all

of these areas, as detailed below.

A tailored strategy

The oil market has changed considerably since our launch. The

oil price has rallied from around $60/bbl to well above $100/bbl as

a result of recovering and now growing demand, industry

underinvestment and of course the impact of the terrible events

that are ongoing in Ukraine. However, the market drivers that

support Afentra's growth strategy are unchanged. While the strong

commodity pricing environment has impacted the urgency of vendors

to divest, and the value they are seeking, the underlying market

drivers for major oil companies to decarbonise and high-grade their

portfolios remains.

At the outset, we adopted a highly disciplined approach to the

execution of our growth strategy to ensure any acquisitions were

strategically consistent with the criteria that we set ourselves.

As detailed within this report, those criteria covered technical,

operational and environmental considerations, and of course the

commercial requirement to deliver value accretive deals to our

shareholders. The latter remains a core focus in the current

market, and our disciplined approach dictates that we execute the

strategy with patience and in a manner that supports our

longer-term objectives. We are only too aware of the volatility

within our industry, with Brent trading below $30/bbl less than two

years ago and therefore we prioritise cost and value discipline

within our corporate mindset.

During the year there has been a steady evolution of energy

market commentary, and sector dynamics, that supports the central

themes upon which Afentra was built. First, the need for continued

and responsible investment into the oil and gas sector to ensure

the necessary supply of oil and gas to meet growing global demand

as the transition to renewable energy gradually progresses around

the world. Increasing commodity prices, which are translating to

growing financial and social concerns about the economic impact to

consumers, is a direct result of industry underinvestment alongside

sustained supply and demand concerns. The growing acceptance that

oil and gas will continue to play an important role in the global

energy mix for the coming years and decades supports Afentra's

ambition to be a responsible producer of discovered resources.

Second, recognition of the social impact that the energy

transition will have on emerging markets, and particularly on

Africa, has grown. At launch, Afentra promoted the need to ensure

there is a "Just transition for Africa", a transition that

recognises the need for the social impact to be balanced against

the climate impact. The commentary that certain economies are

reliant on hydrocarbons and should be able to capitalise on the

socio-economic benefits associated with them has become more

prominent and more widely acknowledged. Further strengthening this

view is the fact that these emerging nations represent a small

contribution to the global impact of climate change compared with

more developed nations that champion the need for a speedy

transition. The fact that the current gas crisis can have such an

impact on western economies highlights the devastating risks and

social impacts that too rapid a transition could have on the

nations and people of Africa.

It is in this context that Afentra's purpose and model is

directly aligned to the creation of shared value for all

stakeholders. By committing to strong environmental stewardship,

responsible social impact, and strong governance, we have placed

the objectives of all stakeholders at the core of our business

model. Our ambition to be a credible counterparty for divesting

IOCs and host governments supports our growth strategy. The proven

operating track record of the team we have assembled should provide

trust in our ability to safely and responsibly manage acquired

assets, reducing the environmental impact through operating

techniques wherever possible, while maintaining the positive

socio-economic impact that any acquired assets have on the

communities and countries of operation. Our proposition will

increasingly meet the specific targets of the United Nations

Sustainable Development Goals as we progress from acquisition

through to operatorship, production and development.

Progress - strong framework to support future growth

As we reflect on our first year of existence, we are pleased

with the considerable progress that we have made. We have

successfully assembled a highly competent and credible team with

the full suite of expertise required to execute the growth

strategy. We have established the corporate framework to support

the long-term growth of the Company, underpinned by robust

Governance, policies and values.

Afentra's profile is now established within the industry and our

brand is recognised across our focus region of West Africa as a

competent, reputable, and ambitious counterparty. On the back of

this, our team has leveraged well-established relationships with

IOC's, debt providers and host governments as we seek opportunities

consistent with the growth strategy, and we have been involved in

ongoing market sales processes as well as proactively making

approaches to acquire "off-market" assets.

In October 2021, we submitted an Expression of Interest to

purchase interests in Block 3/05 and Block 23 in Angola from

Sonangol, and updated in February 2022 that negotiations are

ongoing as we seek to reach agreement on the detailed terms of the

transaction. In April 2022 Sonangol announced that Afentra is the

preferred bidder to purchase these interests. These are high

quality assets, in a jurisdiction that we know well, which meet our

acquisition criteria in terms of the scale of Oil in Place

providing significant upside, with the potential to invest to

increase reserves and production.

Afentra's involvement in this process unfortunately resulted in

the suspension of shares, in accordance with Rule 14 of the AIM

Rules for Companies, however we hope to progress this process to a

conclusion as soon as possible, ideally with a satisfactory outcome

that sees Afentra complete its first acquisition.

Afentra has been active in the pursuit of other production

assets in West Africa. The Company continues to appraise multiple

acquisition opportunities that support its growth strategy in terms

of acquiring assets in the region with solid low-cost production,

proven reserves and significant upside.

In parallel to the above, we will continue to appraise our

existing asset in Somaliland with a view to establishing additional

value on behalf of shareholders. Given the asset profile is early

stage exploration which benefits from a full carry by our partner,

we need to carefully consider its positioning within our strategy

and ensure that we maximise the value of this asset.

Outlook - building a platform for long-term growth

It has been an active period for your Company and we expect

momentum to accelerate through 2022 as we strive to deliver our

first value accretive transaction for our shareholders. Afentra's

strategy to build a material portfolio of operated and non-operated

assets requires a patient approach, especially as we seek to

navigate the challenges of transacting in a volatile and high oil

price environment.

The market drivers that underpin the energy transition and our

strategic intent continue to gather momentum and will undoubtedly

evolve over the coming years, as they did in more mature operating

regions such as the UK North Sea and the Gulf of Mexico. The

current high oil price may have slowed down ongoing processes and

deterred certain sellers to divest, given the inflated cash flows

being generated by the assets, but conversely it also creates a

window of opportunity to sell.

It is our responsibility to remain highly disciplined in our

approach to ensure any deals delivered today stand-up to

retrospective scrutiny in the years ahead. We are proactively

seeking opportunities and feel confident that we have the right

team and strategy to deliver our objectives. It is certainly our

expectation to deliver transactions this year that provide a

platform for long-term growth and value creation.

I'd like to thank all our shareholders for their support since

we began this exciting journey and I look forward to updating you

all with our progress through this year.

Paul McDade - Chief Executive Officer

ASSET SUMMARY

SOMALILAND

Somaliland offers one of the last opportunities to target an

undrilled onshore rift basin in Africa. The Odewayne block, with

access to Berbera deepwater port less than a 100km to the north, is

ideally located to commercialise any discovered hydrocarbons. A 2D

geophysical survey acquired in 2017 and reprocessed in 2019, along

with gravity modelling and legacy geological field studies, was the

focus of the Company's 2021 work programme to determine if a

Mesozoic age sedimentary basin is present in the block and its

prospectivity.

Odewayne (W.I. 34%) Exploration block

Overview

This large, unexplored, frontier acreage position covers

22,840km(2) , the equivalent of c.100 UK North Sea blocks.

Exploration activity prior to the 2017 regional 2D seismic

acquisition program has been limited to the acquisition of airborne

gravity and magnetic data and surface fieldwork studies, with no

wells drilled on block.

The Company's wholly owned subsidiary, Afentra (East Africa)

Limited ('A(EA)L'), holds a 34% working interest in the PSA (fully

carried by Genel Energy Somaliland Limited for its share of the

costs of all exploration activities during the Third and Fourth

Periods of the PSA).

The Odewayne production sharing agreement was awarded in 2005.

It is in the Third Period, with a 1,000km, 10km by 10km 2D seismic

grid acquired in 2017 by BGP. The Third Period has been further

extended, through the 8th deed of amendment (as mentioned in the

Licence Status, below).

In 2021 the operator carried out 2D & 3D gravity modelling

and a re-interpretation of the 2D seismic grid. The data is

interpreted to show fold and thrust structures beneath the

interpreted Base Cretaceous Unconformity ('BCU'). If the fold and

thrust belt model is correct the petroleum system analogous to this

would be of Cryogenian in age and produces about 40 kbo/d in

Oman.

FINANCIAL REVIEW

Selected financial data 2021 2020

Year end cash net to Group $million 37.7 42.7

Adjusted EBITDAX $million (2.0) (0.8)

Loss after tax $million (5.0) (1.9)

Year end Share price Pence 14.6 9.4

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures include capital

investment, debt and adjusted EBITDAX.

Income Statement

The loss from operations for 2021 was $5.0 million (2020: loss

$2.2 million) for the reasons described below.

During the year, net administrative expenditure increased to

$5.0 million (2020: $2.2 million) as a result of exceptional (one

off) items relating to costs associated with the migration to

Afentra, a change in management and an increase in contractors and

advisors.

In 2021, a portion of the Group's staff costs and associated

overheads have been expensed as pre-licence expenditure ($2.4

million), or capitalised/recharged ($77k) where they are directly

assigned to capital projects or recharged. This totalled $2.4

million in the year (2020: $1.3 million).

Finance income in the year of $36k (2020: $326k) represents

interest received ($13k) and foreign exchange gains ($23k) on cash

held by the Group. The reduction in interest received year on year

was as a result of the global pandemic amongst other factors

impacting interest rates.

Finance costs during 2021 totalled $45k (2020: $58k).

The loss for the year was $5.0 million (2020: loss $1.9

million):

$' Million

Loss for year 2020 (1.9)

Increase in G&A and pre-licence costs (2.8)

Decrease in finance income (0.3)

Loss for year 2021 (5.0)

Group adjusted EBITDAX loss totalled $2.0 million (2020: $761k

loss):

2021 2020

$' Million $' Million

Loss after tax (5.0) (1.9)

Interest and finance costs 0.0 (0.3)

Depletion and depreciation 0.2 0.2

Pre-licence costs 2.7 1.2

Total EBITDAX (Adjusted) (2.0) (0.8)

The basic loss per share was 2.3 cents per share (2020: loss 0.9

cents per share). No dividend is proposed to be paid for the year

ended 31 December 2021 (2020: $nil).

Statement of financial position

At the end of 2021, non-current assets totalled $22.0 million

(2020: $22.1 million) the majority of which relates to the Odewayne

block ($21.3 million).

Net assets/total equity stood at $58.9 million (2020: $63.9

million).

Net current assets reduced to $37.3 million (2020: $42.5

million).

At the end of 2021 cash and cash equivalents totalled $37.7

million (2020: $42.7 million), the reduction primarily being

related to spend on G&A.

Cash flow

Total net decrease in cash and cash equivalents in the year was

$4.9 million (2020: $2.2 million), a full reconciliation of which

is provided in the Consolidated Statement of Cash Flows.

During the year there were minimal cash investments on the

Odewayne Block in Somaliland due to the Group's interest being

fully carried by Genel Energy Somaliland Limited for its share of

the costs during the Third and Fourth Periods of the PSA.

Accounting Standards

The Group has reported its 2021 and 2020 full year accounts in

accordance with UK adopted international accounting standards.

Cautionary statement

This financial report contains certain forward-looking

statements that are subject to the usual risk factors and

uncertainties associated with the oil and gas exploration and

production business. Whilst the Directors believe the expectation

reflected herein to be reasonable in light of the information

available up to the time of their approval of this report, the

actual outcome may be materially different owing to factors either

beyond the Group's control or otherwise within the Group's control

but, for example, owing to a change of plan or strategy.

Accordingly, no reliance may be placed on the forward-looking

statements.

Anastasia Deulina - Chief Financial Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

31st December 31st December

2021 2020

$000 $000

Other administrative expenses (2,249) (953)

Pre-licence costs (2,734) (1,221)

Total administrative expenses (4,983) (2,174)

Loss from operations (4,983) (2,174)

Finance income 36 326

Finance expense (45) (58)

Loss before tax (4,992) (1,906)

Tax - -

Loss for the year attributable to

the owners of the parent (4,992) (1,906)

Other comprehensive (expense)/income

- items to be reclassified to the

income statement in

subsequent periods

Currency translation adjustments (5) 7

Total other comprehensive (expense)/income

for the year (5) 7

Total comprehensive expense for the

year attributable to the owners of

the parent (4,997) (1,899)

Basic and diluted loss per share

(US cents) (2.3) (0.9)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31st December 31st December

Note 2021 2020

$000 $000

Non-current assets

Intangible exploration and evaluation

assets 4 21,289 21,209

Property, plant and equipment 725 844

22,014 22,053

Current assets

Trade and other receivables 288 193

Cash and cash equivalents 37,727 42,674

38,015 42,867

Total assets 60,029 64,920

Equity

Share capital 28,143 28,143

Currency translation reserve (202) (197)

Retained earnings 30,953 35,945

Total equity 58,894 63,891

Current liabilities

Trade and other payables 518 209

Lease liability 234 205

752 414

Non-current liabilities

Lease liability 347 581

Long-term provision 36 34

383 615

Total liabilities 1,135 1,029

Total equity and liabilities 60,029 64,920

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Currency

Share translation Retained

capital reserve earnings Total

$000 $000 $000 $000

At 1 January 2020 28,143 (204) 37,851 65,790

Loss for the year - - (1,906) (1,906)

Currency translation adjustments - 7 - 7

Total comprehensive expense

for the year attributable to

the owners of the parent - 7 (1,906) (1,899)

At 31 December 2020 28,143 (197) 35,945 63,891

Loss for the year - - (4,992) (4,992)

Currency translation adjustments - (5) - (5)

Total comprehensive expense

for the year attributable to

the owners of the parent - (5) (4,992) (4,997)

At 31 December 2021 28,143 (202) 30,953 58,894

CONSOLIDATED STATEMENT OF CASH FLOWS

Note 2021 2020

$000 $000

Operating activities:

Loss before tax (4,992) (1,906)

Depreciation, depletion & amortisation 241 193

Finance income and gains (13) (326)

Finance expense and losses 45 59

Operating cash flow prior to working

capital movements (4,719) (1,980)

(Increase)/decrease in trade and

other receivables (95) 57

Increase/(decrease) in trade and

other payables 309 (230)

Increase in provision 2 4

Net cash flow used in operating activities (4,503) (2,149)

Investing activities

Interest received 13 326

Purchase of property, plant and equipment (127) (12)

Exploration and evaluation costs 4 (80) (90)

Net cash used in investing activities (194) 224

Financing activities

Principal paid on lease liability (234) (237)

Interest paid on lease liability (39) (46)

Net cash used in financing activities (273) (283)

Net decrease in cash and cash equivalents (4,970) (2,208)

Cash and cash equivalents at beginning

of year 42,674 44,851

Effect of foreign exchange rate changes 23 31

Cash and cash equivalents at end

of year 37,727 42,674

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. General information

The results announcement is for the year ended 31 December

2021.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2021

or 2020, but is derived from those accounts. Statutory accounts for

2020 have been delivered to the Registrar of Companies and those

for 2021 will be delivered following the Company's Annual General

Meeting. The auditors have reported on those accounts; their

reports were unqualified, did not draw attention to any matters by

way of emphasis without qualifying their report and did not contain

statements under s498(2) or (3) Companies Act 2006.

While the financial information included in this announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs.

The Annual Report and Accounts and the notice for the Company's

Annual General meeting, which is to be held at 10.00 a.m. on 24 May

2022, will be posted to Shareholders on 29 April 2022.

2. Going concern

The Group business activities, together with the factors likely

to affect its future development, performance and position are set

out in the Asset summary. The financial position of the Group and

Company, its cash flows and liquidity position are described in the

Financial Review.

The Group has sufficient cash resources for its working capital

needs and its committed capital expenditure programme at least for

the next 12 months. As a consequence, the Directors believe that

both the Group and Company are well placed to manage their business

risks successfully despite the ongoing pandemic and uncertain

economic outlook.

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. This assessment has been made by the Directors who remain

confident the Group has sufficient cash resources at the date of

signing the annual report to meet its liabilities as they fall due

for a period of at least 12 months from the date of signing these

financial statements, notwithstanding; the impact COVID-19 has had,

and continues to have internationally and the current situation in

Ukraine and the impact to commodity prices and foreign exchange

rates. The Group currently has no unconditional, legally binding

commitments in relation to the disclosed transaction in Note 5. The

Directors believe that the Group is in a strong position to absorb

any potential impact on the Group arising from COVID-19, and thus,

they continue to adopt the going concern basis of accounting in

preparation of the financial statements.

3. Operating segments

Africa operations in 2021 focused on exploration and appraisal

activities in Somaliland. The UK corporate office is a technical

and administrative cost centre focused on new ventures. The

operating results of each segment are regularly reviewed by the

Board of Directors in order to make decisions about the allocation

of resources and to assess their performance.

The following tables present income, expense and certain asset

and liability information regarding the Group's operating segments

for the year ended 31 December 2021 and for the year ended 31

December 2020.

Corporate Africa Total

2021 2020 2021 2020 2021 2020

$000 $000 $000 $000 $000 $000

Other administrative

expenses (2,249) (953) - - (2,249) (953)

Pre-licence costs (2,734) (1,221) - - (2,734) (1,221)

Loss from operations (4,983) (2,174) - - (4,983) (2,174)

Finance income 36 326 - - 36 326

Finance expense (45) (58) - - (45) (58)

Segment loss before

tax (4,992) (1,906) - - (4,992) (1,906)

Other segment information

Depreciation 241 193 - - 241 193

Segment assets

and liabilities

Non-current assets

(1) 725 844 21,289 21,209 22,014 22,053

Segment assets

(2) 38,015 42,867 - - 38,015 42,867

Segment liabilities

(3) (1,121) (1,016) (14) (13) (1,135) (1,029)

(1) Segment non-current assets of $21.3 million in Somaliland

(2020: $21.2 million).

(2) Corporate segment assets include $37.7 million cash and

cash equivalents (2020: $42.7 million). Carrying amounts of

segment assets exclude investments in subsidiaries.

(3) Carrying amounts of segment liabilities exclude intra-group

financing.

4. Intangible Exploration and Evaluation assets

Group

$000

Net book value at 1 January 2020 21,119

Additions during the year 90

Net book value at 31 December

2020 21,209

Additions during the year 80

Net book value at 31 December

2021 21,289

Group intangible assets at the year end 2021:

Odewayne PSA, Somaliland: A(EA)L 34%, Genel Energy Somaliland

Limited 50%, Petrosoma 16%.

Classified as a joint arrangement in accordance with IFRS

11.

5. Subsequent events

On the 11 April 2022 the Company confirmed that Sonangol had

announced Afentra had been selected as preferred bidder to purchase

interests in Block 3/05 and Block 23. The next steps in the process

have involved finalising a sale and purchase agreement that

contains a number of conditions precedent that will need to be

satisfied or waived before the Acquisition can be completed. In

addition, a final due diligence exercise is required to be

completed in connection therewith. If Afentra ultimately proceeds

with the Acquisition, it would be classified as a reverse takeover

transaction in accordance with Rule 14 of the AIM Rules for

Companies. There is, however, no guarantee at this stage that the

Acquisition will be completed.

DEFINITIONS AND GLOSSARY OF TERMS

$ US dollars

Companies Act or Companies Act the Companies Act 2006, as amended

2006

2D two dimensional

AIM AIM, a SME Growth market of the London Stock Exchange

AGM Annual General Meeting

Articles the Articles of Association of the Company

Board the Board of Directors of the Company

Company Afentra plc

Directors the Directors of the Company

E&E exploration and evaluation assets

E&P exploration and production

EBITDAX (Adjusted) earnings before interest, taxation,

depreciation, depletion and amortisation, impairment, share-based

payments, provisions, and pre-licence expenditure

EITI Extractive Industries Transparency Initiative

Farm-in & farm-out a transaction under which one party

(farm-out party) transfers part of its interest to a contract to

another party (farm-in party) in exchange for a consideration which

may comprise the obligation to pay for some of the farm-out party

costs relating to the contract and a cash sum for past costs

incurred by the farm-out party

G&A general and administrative

G&G geological and geophysical

GBP pounds sterling

Genel Energy Genel Energy Somaliland Limited

Group the Company and its subsidiary undertakings

HSSE Health, Safety, Security and Environment

hydrocarbons organic compounds of carbon and hydrogen

IAS International Accounting Standards

IFRS International Financial Reporting Standards

IOCs international oil company

JV joint venture

k thousands

km kilometre(s)

km(2) square kilometre(s)

KPIs key performance indicators

lead indication of a potential exploration prospect

London Stock Exchange or LSE London Stock Exchange Plc

LTIP Long-term incentive plan

M&A mergers and acquisitions

m metre(s)

OECD Organisation for Economic Cooperation and Development

Ordinary Shares ordinary shares of 10 pence each

Petroleum oil, gas, condensate and natural gas liquids

Petrosoma Petrosoma Limited (JV partner in Somaliland)

Prospect an area of exploration in which hydrocarbons have been

predicted to exist in economic quantity. A group of prospects of a

similar nature constitutes a play.

PSA production sharing agreement

QCA Code Corporate Governance Code for Small and Mid-Size Quoted

Companies 2018

Reserves reserves are those quantities of petroleum anticipated

to be commercially recoverable by application of development

projects to known accumulations from a given date forward under

defined conditions. Reserves must satisfy four criteria; they must

be discovered, recoverable, commercial and remaining based on the

development projects applied. Reserves are further categorised in

accordance with the level of certainty associated with the

estimates and may be sub-classified based on project maturity

and/or characterised by development and production status

Seismic data, obtained using a sound source and receiver, that

is processed to provide a representation of a vertical

cross-section through the subsurface layers

Shares 10p ordinary shares

Shareholders ordinary shareholders of 10p each in the

Company

Subsidiary a subsidiary undertaking as defined in the 2006

Act

United Kingdom or UK the United Kingdom of Great Britain and

Northern Ireland

Working Interest or WI a Company's equity interest in a project

before reduction for royalties or production share owed to others

under the applicable fiscal terms

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UVAKRURUSUAR

(END) Dow Jones Newswires

April 26, 2022 10:01 ET (14:01 GMT)

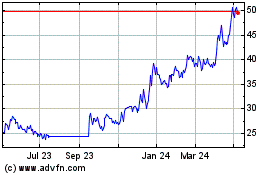

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024