TIDMAET

RNS Number : 6159J

Afentra PLC

28 April 2022

28 April 2022

AFENTRA PLC

Afentra signs Sale and Purchase Agreement with Sonangol

for Blocks 3/05 & 23 offshore Angola

Afentra plc ('Afentra' or the 'Company') is pleased to announce

that its wholly-owned subsidiary, Afentra (Angola) Ltd, has signed

a Sale and Purchase Agreement ('SPA') with Sonangol Pesquisa e

Produção S.A. ('Sonangol') to purchase interests in Block 3/05 and

Block 23, offshore Angola (the "Acquisition") for a firm

consideration of $80 million and contingent payments of up to $50

million (in aggregate) in the case of Block 3/05 and consideration

of $0.5 million in the case of Block 23.

Acquisition Highlights

-- Strategic rationale - facilitates a first entry for Afentra

into Angola, one of the Company's key target markets in West

Africa, with opportunities to build a material production business

and contribute to a sustainable transition

-- Block 3/05 - acquiring a 20% non-operated interest in a high-potential long-life asset

o Initial consideration of $80 million

o Additional contingent consideration of up to $50 million to be

paid in respect of each of the ten calendar years commencing 1

January 2023

o Stable production of c.4,000 bopd net with strong cashflow

o Net 2P reserves of c.20 million barrels(1)

o Oil in Place of over 3 billion barrels(1) provides significant

resource upside

o Highly attractive asset economics with low breakeven oil price

of $35/bbl

o To date, decommissioning costs have been pre-funded by

previous and existing JV partners

-- Block 23 - acquiring 40% non-operated interest in a highly

prospective deepwater exploration and appraisal opportunity for a

consideration of $0.5 million

-- Funding - expected to be financed through new debt facilities

and existing cash on the balance sheet. Discussions with

prospective debt providers well advanced

Transaction Overview

Afentra is acquiring a 20% non-operated interest in Block 3/05

and a 40% non-operated interest in Block 23 for a total

consideration of up to $130 million. The consideration is comprised

of $80 million cash up front, subject to customary completion

adjustments, up to $50 million in contingent payments, payable in

respect of each of the ten calendar years commencing January 1,

2023 and subject to certain oil price and production hurdles, and

$0.5 million in respect of Block 23. The Acquisition has an

effective date of 20 April 2022.

This represents a strategic entry into a highly attractive West

African jurisdiction with an implied acquisition cost of $4/boe,

based on 2P reserves 1 .

The Acquisition is expected to be funded with new debt

facilities and existing cash on the balance sheet. Discussions with

prospective providers of debt finance are well advanced and will be

finalised in due course.

While completion is expected in the third quarter of 2022, next

steps in the process include the conclusion of Afentra's due

diligence exercise, the provision of a bank guarantee in respect of

the 10% transaction deposit and the completion of the right of

first offer process by Sonangol. Government approvals and a license

extension for Block 3/05 are anticipated to be granted, with the

publication of the AIM re-admission document and resumption of

trading anticipated to occur mid-year. In addition to the

conditions described above relating to regulatory consents, right

of first offer, license extension and due diligence, the

Acquisition is subject to the receipt of shareholder approval

pursuant to an ordinary resolution to be proposed at a General

Meeting and re-admission of the enlarged group to trading on AIM.

Further details of the Acquisition and SPA will be set out in the

re-admission document.

Asset Overview: Block 3/05

Block 3/05, in which Afentra is acquiring a 20% non-operated

interest, is located in the Lower Congo Basin and consists of eight

mature producing fields. The discoveries were made by Elf Petroleum

(now part of TotalEnergies) in the early 1980s. Development was by

shallow-water (40-100m) platforms that included successful

waterflood activities with first oil in 1985. Sonangol assumed

operatorship from 2005 and has focused on sustaining production

through workovers and maintaining asset integrity. No infill

drilling campaigns have taken place in the last 15 years. The asset

has a diverse portfolio of over 100 wells and currently produces

from around 40 production wells and has nine active water

injectors. The facilities include 17 well-head and support

platforms and four processing platforms, with oil exported via the

Palanca FSO.

In 2021, the average daily gross production was 17,000 bopd,

with an exit rate of 21,000 bopd, and gross 2P reserves of

approximately 100 million barrels 1 at year end 2021.

Block 3/05's existing Production Sharing Agreement (PSA) expires

in 2025 and this is expected to be extended to 2040. This extension

is a condition to completing the Acquisition. To date, the asset

decommissioning costs have been pre-funded.

Sonangol is an experienced operator with a sustained track

record across the leading and lagging indicators for safety and

environmental considerations, including CO 2 emissions and flaring

measurements. Afentra looks forward to working with Sonangol to

determine action plans to further reduce future emissions.

Post completion of the Acquisition, the JV will be comprised as

follows: Sonangol (Operator, 30%), Afentra (20%), M&P (20%),

ENI (12%), Somoil (10%), NIS-Naftagas (4%) and INA (4%).

Asset Overview: Block 23

Block 23 is a 5,000 km 2 exploration and appraisal block located

in the Kwanza basin in water depths from 600 to 1,600 metres and

has a working petroleum system. Whilst the large block is covered

by modern 3D and 2D seismic data sets, with no outstanding work

commitments remaining, the majority of the block remains

under-explored.

The block contains the Azul oil discovery, the first deepwater

pre-salt discovery in the Kwanza basin. This discovery made in

carbonate reservoirs has oil in place of around 150 mmbo and tested

at flow rates of around 3,000 - 4,000 bopd of light oil.

Post completion of the Acquisition, the JV is expected to be

comprised of: Namcor, Sequa and Petrolog(40% and operator); Afentra

(40%) and Sonangol (20%).

Strategic Rationale

The Acquisition is consistent with the strategic objective set

by Afentra at the time of its launch in May 2021 to build a

balanced cash flow generative portfolio of assets where the Company

can contribute to emissions reduction to drive a sustainable

transition. These assets give Afentra exposure to a high-quality

asset base with long-life, low-cost production, access to

additional production optimisation opportunities, upside potential

and opportunities to reduce future emissions.

Angola is a jurisdiction where the Afentra team have significant

knowledge and previous experience. It offers an attractive

operating environment, with good fiscal terms which have been

improved in recent years to attract new investment. It is a

material hydrocarbon province with a wealth of future opportunities

and was a key target country for the Company.

Afentra are acquiring a meaningful interest in Block 3/05

alongside an experienced and credible operator and an aligned JV.

Consistent with Afentra's Purpose and Strategy, Afentra will be

working alongside Sonangol to support its transition strategy which

is closely aligned with Afentra's ESG agenda. A key outcome of the

due diligence work to date has been to identify the opportunity to

work with the JV to enhance the environmental performance of Block

3/05 through emissions reductions.

Commenting on the update, CEO Paul McDade said:

"We are delighted to have agreed terms with Sonangol and signed

the SPA for our entry into Block 3/05, Lower Congo basin and Block

23, Kwanza basin in Angola. This transformative deal marks our

first acquisition since launch last year, and sees the Company

enter Angola, a major oil and gas jurisdiction with significant

opportunities ahead to build a material business and positively

impact the energy transition in Africa.

This highly accretive transaction gives Afentra exposure to a

high-quality asset base, underpinned by strong cash flow from

stable and long-life production and 20 million barrels 1 of net 2P

Reserves. The assets, containing over 3 billion barrels 1 of oil in

place, provide significant scope for further value creation from

production optimisation, infill drilling and incremental

developments. The attractive deal metrics and strong cashflow

generation demonstrate Afentra's commercial discipline and focus on

robust cash flow. The entry into Block 23 provides us the

opportunity to work with Sonangol to better understand and unlock

the potential of this exciting and highly prospective exploration

area.

We are looking forward to partnering with Sonangol, which has

run a very pragmatic and transparent process, and supporting them

in delivering an effective energy transition strategy. We are also

looking forward to demonstrating our commitment to the ESG

principles upon which Afentra was launched and working to create

value for all of our stakeholders.

The next steps will be to complete our due diligence process and

to conclude our discussions on the debt facility to fund the

acquisition, with a view to completing the transaction in the third

quarter of 2022.

I would like to thank our shareholders for their patience

through this process and hope they share the management's

excitement about the value creation implications of this deal. We

look forward to communicating on our progress as we move towards

the publication of the re-admission document and the recommencement

of trading thereafter."

1. OIIP and 2P Reserves are currently determined by Afentra and

subject to ongoing independent Competent Persons Report.

Management Presentation - 10am Thursday 28 April

Afentra's management team will host a live audiocast

presentation today at 10am to provide further details on the

Acquisition and the assets.

The live audiocast can be accessed via the following link:

https://webcasting.buchanan.uk.com/broadcast/625eab44841dd838fd0be737

A playback of the audiocast will be made available on the

website: www.afentraplc.com

Analysts and investors wishing to participate in the Q&A

session can do so by submitting questions to

afentra@buchanan.uk.com , or via the chat function of the live

audiocast, and these will be addressed by management during the

audiocast.

For further information contact:

Afentra plc

+44 (0)20 7405 4133

Paul McDade, CEO

Anastasia Deulina, CFO

Buchanan (Financial PR)

+44 (0)20 7466 5000

Ben Romney

Jon Krinks

James Husband

Peel Hunt LLP (Nominated Advisor and Joint Broker)

+44 (0)20 7418 8900

Richard Crichton

David McKeown

Tennyson Securities (Joint Broker)

+44 (0)20 7186 9033

Peter Krens

About Afentra

Afentra plc (AIM:AET) is an upstream oil and gas company focused

on opportunities in Africa. The Company's purpose is to support

a responsible energy transition in Africa by establishing itself

as a credible partner for divesting IOCs and Host Governments.

Afentra has a current carried interest in the Odewayne Block

onshore southwestern Somaliland.

Inside Information

This announcement contains inside information for the purposes

of article 7 of Regulation 2014/596/EU (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018) ('UK MAR'). Upon publication of this announcement, this

inside information (as defined in UK MAR) is now considered to be

in the public domain. For the purposes of UK MAR, the person

responsible for arranging for the release of this announcement on

behalf of Afentra is Paul McDade, Chief Executive Officer.

Technical Information

The technical information contained in this announcement has

been reviewed and approved by Robin Rindfuss, Head of Sub-Surface

at Afentra plc. Robin Rindfuss has over 25 years of experience in

oil and gas exploration, production and development and is a member

of the Society of Petroleum Engineers (SPE). The OIIP and 2P

Reserves information set out herein are currently determined by

Afentra and are subject to the ongoing preparation of an

independent Competent Persons Report.

Continued suspension of trading

The Acquisition constitutes a reverse takeover in accordance

with Rule 14 of the AIM Rules for Companies. An AIM re-admission

document setting out, inter alia, details of the Acquisition

(including a competent person's report on the assets being

acquired) will be published and sent to Afentra's shareholders with

a notice of general meeting. Accordingly, the Company's ordinary

shares will remain suspended from trading on AIM until either the

publication of an AIM admission document or until confirmation is

given that the Acquisition is not proceeding. The Company will

release further announcements as and when appropriate.

Standard

Estimates of reserves and resources have been prepared in

accordance with the June 2018 Petroleum Resources Management System

("PRMS") as the standard for classification and reporting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRDZGZDGNNGZZZ

(END) Dow Jones Newswires

April 28, 2022 02:02 ET (06:02 GMT)

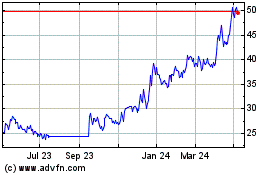

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024