TIDMAEXG

RNS Number : 9516J

AEX Gold Inc

27 August 2021

("AEX" or the "Corporation")

AEX Gold Inc. Reports Second Quarter Financial Results,

Operational Update and Board Changes

TORONTO, ONTARIO - AUGUST 27, 2021 - AEX Gold Inc. (AIM: AEXG;

TSXV: AEX), an independent gold Corporation with a portfolio of

exploration licences in Greenland, announces its unaudited

condensed interim consolidated financial statements ("Financial

Statements") for the quarter ended June 30, 2021. All figures are

in Canadian dollars unless otherwise noted.

The Financial Statements and the accompanying Management

Discussion and Analysis are available on the Corporation's website

at www.aexgold.com and will be filed under the Corporation's SEDAR

profile at

www.sedar.com later today .

As previously communicated, the Nalunaq Project was put on hold

in February 2021 due to unforeseen cost increases associated with

the impacts of the COVID-19 global pandemic and as per the April

2021 announcement, the Corporation was focussing on four elements

to continue advancing and de-risking the Nalunaq Project:

-- Conducting a third-party engineering study to optimize the

Project costs and de-risk the Project schedule that will enable AEX

to re-assess the execution methodology (self-execution vs. EPC)

post completion;

-- Conducting fully funded 'early works' infrastructure and a

20,000-30,000m exploration program to expand the Nalunaq

Resource;

-- Continue to advance the EIA and SIA to obtain all permits;

-- Regional exploration targeting both gold and Green/Strategic

minerals through technical research, sampling and geophysical

surveys.

Corporate and Operational Update

-- The Corporation completed a tender process for the

third-party engineering study and have appointed Halyard Inc.

('Halyard') a boutique engineering consulting firm based out of

Toronto, Canada. Halyard was involved in the engineering and design

of most of the components in the Nalunaq processing plant and comes

with Greenlandic, project execution experience. The engineering

study on the process plant and associated infrastructure are

progressing according to plan and we still expect completion by Q4

2021. The study will advance engineering and significantly de-risk

project cost and schedule.

-- Legacy procurement and contracting commitments have been

reviewed and orders that were placed for the Process Plant and Site

Mobile fleet prior to the February 2021 announcement are ready for

delivery, and a strategy for logistics/storage is being

considered.

-- The third-party review of the Nalunaq Resource Model by

InnovExplo, a specialist in a wide range of exploration and

technical services in the metals and mining industry, has been

completed and has concluded that the existing resource model

contains no fatal flaws. The results of the review and

recommendations formed the framework of the 2021 exploration

program at Nalunaq. The drilling program will also leverage the

latest findings from the drilling campaigns of 2019 and 2020 to

test the down-dip extension of Main Vein in the Kirkspir Valley,

nearby the South and Valley Blocks. The drilling campaign has got

off to a slow start given the influence of COVID-19 and the high

demand placed on drilling contractors which has been caused by high

Commodity prices. Negotiations are currently underway with

additional international drilling companies to support our

exploration efforts this year, which will extend to our 2022

campaign.

-- A condition assessment of the Bulkhead will be conducted in

October 2021 to confirm the design parameters and the quality of

construction after which a remediation plan will be developed. The

assessment will include non-destructive pile integrity and

ultrasound tests to determine the Bulkhead thickness as well as an

unconfined compressive strength test of cored concrete samples.

-- In June 2021, site preparation for the 50-person exploration

camp commenced. Construction of the camp is progressing according

to plan with estimated completion by September 2021. The camp will

support continuing exploration activities at Nalunaq as the weather

conditions turn towards winter in the coming months. Following the

camp construction, the bridge crossing the Kirkespir River will be

upgraded to provide reliable access between the exploration camp

and historical mine site.

-- The Environmental Impact Assessment ("EIA") and Social Impact

Assessment ("SIA") are being advanced with no material update at

this stage.

-- In parallel to the exploration being conducted at Nalunaq,

regional exploration is predominately focused on the Vagar and

Nanoq gold targets as well as other evolving targets in licences

around Nalunaq. Furthermore, we are exploring for copper/base

metals and rare earth elements ("REE") in the Sava licence,

platinum group elements ("PGEs") in the Sagga dyke, graphite at

Norrearm and base metals across the Tartoq licences.

Strengthening of the Board

The Corporation is pleased to announce the further strengthening

of its Board of Directors with the appointment of two additional

Non-Executive Directors, Liane Kelly and Warwick Morley-Jepson.

Liane brings a wealth of ESG experience to the Board having

enjoyed a successful career focused on advising companies on

sustainability and CSR initiatives. She currently sits on the Board

of B2Gold Corporation and acts as a CSR Advisor to Middle Ground

Consulting. Liane specialises in advising companies on community

engagement and social impact, both of which will be vital for AEX

as the Corporation continues to build on its strong engagement with

its Greenlandic stakeholders. Liane replaces George Fowlie, who

steps down from the Board, but will continue to provide his

invaluable expertise in corporate and business development to the

Corporation as well as supporting our Investor Relations in

Canada.

Warwick has significant experience in mining having spent just

under 40 years' in the industry, holding various managerial and

executive positions including his current roles as Chairman and

Independent Director of Wesdome Gold Mines and Karora Minerals

respectively. Warwick was previously the Executive Vice President

and Chief Operating Officer at Ivanhoe Mines and before that held

the same positions at Kinross Gold Corporation. His experience in

mine development and operations at global mining firms is highly

relevant to AEX as the Corporation continues to progress both the

Nalunaq mine and its various exploration targets.

Q2 2021 Financial Highlights

-- The Corporation had a strong cash balance of $49.6 million at

June 30, 2021 ($61.9 million at December 31, 2020), with no debt,

and total working capital of $48.5 million ($61.4 million at

December 31, 2020).

-- Capital asset purchase commitments, net of deposits on order

as at June 30, 2021 was $6.0 million. These commitments, as

previously reported, relate predominantly to the purchase of

components of the process plant and surface mobile vehicles.

Available liquidity, net of commitments as at June 30, 2021 was

$43.6 million.

-- Construction in progress increased by $2.1 million in H1 2021

(zero at December 31, 2020), as a result of capitalized engineering

costs on the Nalunaq Project prior to suspension on February 10,

2021.

-- Exploration and evaluation expenses during the quarter was

$2.0 million (Q2 2020: $0.9 million), predominantly on the Nalunaq

Property.

-- General and administrative expenses during the period were

$2.1 million (Q2 2020: $0.5 million), the result of increased

headcount, consulting and professional fees associated with

right-sizing the organizational structure to develop Nalunaq.

Selected Financial Information

The following selected financial data is extracted from the

Financial Statements for the three and six months ended June 30,

2021.

Financial Results

Three months Six months

ended June 30, ended June 30,

2021 2020 2021 2020

$ $ $ $

----------- ----------- ----------- -----------

Exploration and evaluation

expenses 1,998,049 912,676 3,245,196 1,524,451

General and administrative 2,093,578 498,639 3,678,649 881,550

Net loss and comprehensive

loss (4,576,963) (2,442,132) (7,866,015) (3,408,569)

Basic and diluted loss per

common share (0.03) (0.03) (0.04) (0.04)

----------- ----------- ----------- -----------

Financial Position

As at June 30, 2021 As at December 31,

2020

$ $

------------------- ------------------

Cash on hand 49,593,636 61,874,999

Total assets 58,772,695 65,944,682

Total current liabilities 1,248,048 897,799

Shareholders' equity 56,776,955 64,282,970

Working capital 48,500,792 61,411,208

------------------- ------------------

Eldur Olafsson, CEO of AEX, commented:

"I am pleased to report a strong set of results, with the

Company currently well capitalised and advancing on all our key

workstreams. In addition to the considerable progress made in the

de-risking and development of the Nalunaq project, we are very

excited to report on the wider scale exploration efforts that are

ongoing alongside the work on our gold targets, targeting green and

strategic minerals.

We believe that the current efforts to expand the Nalunaq

resource, in addition to the focus on our exploration portfolio

presents a unique opportunity to investors and we look forward to

updating the market in due course.

I would also like to welcome Liane and Warwick onto the AEX

Board. On behalf of the Corporation, we look forward to leveraging

their experience as we continue to execute our development

strategy.

Warwick's experience across the mining value chain will be

essential as the Corporation advances the engineering study and

evaluates the Nalunaq Project execution methodology in the near

future.

Liane's appointment together with the promotion of Joan Plant to

Vice President - Environmental, Social & Governance is a strong

recognition of AEX's commitment to being a responsible corporate

citizen of Greenland. I would also like to thank George for the

incredible work he has done throughout the years as a Board member

and I look forward to continuing working with him as AEX

develops"

AIM Rule Disclosures

In relation to the appointment to the board, there is no further

information required to be disclosed pursuant to paragraph (g) of

Schedule 2 of the AIM Rules for Companies save what is disclosed

below.

Liane Catherine Kelly, aged 57, has held the following

directorships and/or partnerships in the past five years:

Current Directorships/Partnerships Previous Directorships/Partnerships

B2Gold Corporation Geosoft Inc now Seequent Ltd

Cheetah Conservation Fund

Warwick Peter Morley-Jepson, aged 63, has held the following

directorships and/or partnerships in the past five years:

Current Directorships/Partnerships Previous Directorships/Partnerships

Wesdome Gold Mines Limited

Karora Resources Inc (formally

RNC Minerals)

Enquiries:

AEX Gold Inc.

Eldur Olafsson, Executive Director and CEO

+354 665 2003

eo@aexgold.com

Eddie Wyvill, Investor Relations

+44 (0)7713 126727

ew@aexgold.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Broker)

Callum Stewart

Simon Mensley

Ashton Clanfield

+44 (0) 20 7710 7600

Panmure Gordon (UK) Limited (Joint Broker)

John Prior

Hugh Rich

Dougie Mcleod

+44 (0) 20 7886 2500

Camarco (Financial PR)

Gordon Poole

Nick Hennis

+44 (0) 20 3757 4980

AEX Gold Inc: Unaudited Condensed Interim Consolidated Financial

Statements for the three and six Months Ended June 30, 2021

AEX Gold Inc.

Consolidated Statements of Financial Position

(Unaudited, in Canadian Dollars)

As at As at December

June 30, 31,

Notes 2021 2020

-------------------------------------------- ----- ------------ ---------------

$ $

ASSETS

Current assets

Cash 49,593,636 61,874,999

Sales tax receivable 64,482 62,750

Prepaid expenses and others 90,722 371,258

Total current assets 49,748,840 62,309,007

Non-current assets

Deposit on order 4 5,186,000 1,711,970

Escrow account for environmental monitoring 434,159 460,447

Mineral properties 3 62,244 62,244

Capital assets 4 3,341,452 1,401,014

Total non-current assets 9,023,855 3,635,675

-------------------------------------------- ----- ------------ ---------------

TOTAL ASSETS 58,772,695 65,944,682

-------------------------------------------- ----- ------------ ---------------

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 1,198,466 831,899

Lease liabilities - current portion 5 49,582 65,900

-------------------------------------------- ----- ------------ ---------------

Total current liabilities 1,248,048 897,799

Non-current liabilities

Lease liabilities 5 747,692 763,913

Total non-current liabilities 747,692 763,913

Total liabilities 1,995,740 1,661,712

Equity

Capital stock 88,500,205 88,500,205

Contributed surplus 3,285,952 2,925,952

Accumulated other comprehensive loss (36,772) (36,772)

Deficit (34,972,430) (27,106,415)

-------------------------------------------- ----- ------------ ---------------

Total equity 56,776,955 64,282,970

-------------------------------------------- ----- ------------ ---------------

TOTAL LIABILITIES AND EQUITY 58,772,695 65,944,682

-------------------------------------------- ----- ------------ ---------------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Comprehensive Loss

( Unaudited, i n Canadian Dollars)

Three months Six months

ended June 30, ended June 30,

----------------------------- ----- ---------------------------- -------------------------------

Notes 2021 2020 2021 2020

----------------------------- ----- --------------- ----------- ------------------ -----------

$ $ $ $

Expenses

Exploration and evaluation

expenses 7 1,998,049 912,676 3,245,196 1,524,451

General and administrative 8 2,093,578 498,639 3,678,649 881,550

Stock-based compensation 6 360,000 1,031,650 360,000 1,031,650

Foreign exchange loss (gain) 157,092 3,830 647,691 (21,567)

Operating loss 4,608,719 2,446,795 7,931,536 3,416,084

Other expenses (income)

Interest income (41,859) (4,873) (85,929) (9,915)

Finance costs 10,103 210 20,408 2,400

----------------------------- ----- --------------- ----------- ------------------ -----------

Net loss and comprehensive

loss (4,576,963) (2,442,132) (7,866,015) (3,408,569)

----------------------------- ----- --------------- ----------- ------------------ -----------

Weighted average number of

common shares outstanding

- basic and diluted 177,098,737 81,176,725 177,098,737 77,307,646

Basic and diluted loss per

common share (0.03) (0.03) (0.04) (0.04)

----------------------------- ----- --------------- ----------- ------------------ -----------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Changes in Equity

( Unaudited, i n Canadian Dollars)

Accumulated

Number of other

common shares Capital Contributed comprehensive Total

Notes outstanding Stock Warrants surplus loss Deficit Equity

-------------- ------- ------------- ---------- ----------- ----------- ------------- ------------ -----------

$ $ $ $ $ $

Balance at

January 1,

2020 70,946,394 13,883,611 1,459,604 1,535,400 (36,772) (14,767,303) 2,074,540

Net loss and

comprehensive

loss - - - - - (3,408,569) (3,408,569)

Warrants

exercised 11,387,626 6,140,518 (1,010,418) - - - 5,130,100

Warrants

expired - - (210,437) 210,437 - - -

Options

exercised 100,000 60,000 - (22,000) - - 38,000

Stock-based

compensation - - - 1,031,650 - - 1,031,650

-------------- ------- ------------- ---------- ----------- ----------- ------------- ------------ -----------

Balance at

June 30, 2020 82,434,020 20,084,129 238,749 2,755,487 (36,772) (18,175,872) 4,865,721

-------------- ------- ------------- ---------- ----------- ----------- ------------- ------------ -----------

Balance at

January 1,

2021 177,098,737 88,500,205 - 2,925,952 (36,772) (27,106,415) 64,282,970

Net loss and

comprehensive

loss - - - - - (7,866,015) (7,866,015)

Stock-based

compensation 6 - - 360,000 - - 360,000

-------------- ------- ------------- ---------- ----------- ----------- ------------- ------------ -----------

Balance at

June 30, 2021 177,098,737 88,500,205 - 3,285,952 (36,772) (34,972,430) 56,776,955

-------------- ------- ------------- ---------- ----------- ----------- ------------- ------------ -----------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Consolidated Statements of Cash Flows

( Unaudited, i n Canadian Dollars)

Six months

Notes ended June 30,

---------------------------------------------- ----- -------------------------

2021 2020

---------------------------------------------- ----- ------------ -----------

$ $

Operating activities

Net loss for the period (7,866,015) (3,408,569)

Adjustments for:

Depreciation 4 143,723 114,317

Stock-based compensation 6 360,000 1,031,650

Finance costs - 2,400

Foreign exchange loss (gain) 644,430 (19,112)

---------------------------------------------- ----- ------------ -----------

(6,717,862) (2,279,314)

Changes in non-cash working capital items:

Sales tax receivable (1,732) (14,067)

Prepaid expenses and others 280,536 93,561

Trade and other payables 231,188 293,916

509,992 373,410

---------------------------------------------- ----- ------------ -----------

Cash flow used in operating activities (6,207,870) (1,905,904)

---------------------------------------------- ----- ------------ -----------

Investing activities

Acquisition of mineral properties 3 - (13,737)

Acquisition of capital assets 4 (2,084,161) -

Deposit on order 4 (3,474,030) -

Cash flow used in investing activities (5,558,191) (13,737)

---------------------------------------------- ----- ------------ -----------

Financing activities

Principal repayment - lease liabilities 5 (32,539) -

Exercise of warrants - 5,130,100

Exercise of stock options - 38,000

Deferred share issuance costs - (324,293)

Cash flow from (used in) financing activities (32,539) 4,843,807

---------------------------------------------- ----- ------------ -----------

Net change in cash before effects of exchange

rate changes on cash during the period (11,798,600) 2,924,166

Effects of exchange rate changes on cash (482,763) 1,517

---------------------------------------------- ----- ------------ -----------

Net change in cash during the period (12,281,363) 2,925,683

Cash, beginning of period 61,874,999 1,515,406

---------------------------------------------- ----- ------------ -----------

Cash, end of period 49,593,636 4,441,089

---------------------------------------------- ----- ------------ -----------

Supplemental cash flow information

Interest received 85,929 9,915

Exercise of warrants credited to capital

stock - 1,010,418

Exercise of stock options credited to capital

stock - 22,000

Deferred share issuance costs included in

trade and other payables - 851,228

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

AEX Gold Inc.

Condensed Notes to the interim Consolidated Financial

Statements

Three and six months ended June 30, 2021 and 2020

( Unaudited, i n Canadian Dollars)

1. NATURE OF OPERATIONS, BASIS OF PRESENTATION

AEX Gold Inc. (the "Corporation") was incorporated on February

22, 2017 under the Canada Business Corporations Act. The

Corporation's head office is situated at 3400, One First Canadian

Place, P.O. Box 130, Toronto, Ontario, M5X 1A4, Canada. The

Corporation operates in one industry segment, being the

acquisition, exploration and development of mineral properties. It

owns interests in properties located in Greenland. The

Corporation's financial year ends on December 31. Since July 2017,

the Corporation's shares are listed on the TSX Venture Exchange

(the "TSX-V") under the AEX ticker and since July 2020, the

Corporation's shares are also listed on the AIM market of the

London Stock Exchange ("AIM") under the AEXG ticker.

These unaudited condensed interim consolidated financial

statements for the three and six months ended June 30, 2021

("Financial Statements") were approved by the Board of Directors on

August 26, 2021.

1.1 Basis of presentation

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards as issued by the

International Accounting Standards Board ("IFRS") including

International Accounting Standard ("IAS") 34, Interim Financial

Reporting. The Financial Statements have been prepared under the

historical cost convention.

The Financial Statements should be read in conjunction with the

annual financial statements for the year ended December 31, 2020

which have been prepared in accordance with IFRS. The accounting

policies, methods of computation and presentation applied in these

Financial Statements are consistent with those of the previous

financial year ended December 31, 2020.

2. CRITICAL ACCOUNTING JUDGMENTS AND ASSUMPTIONS

The preparation of the Financial Statements requires Management

to make judgments and form assumptions that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and reported amounts of expenses during the reporting

period. On an ongoing basis, Management evaluates its judgments in

relation to assets, liabilities and expenses. Management uses

historical experience and various other factors it believes to be

reasonable under the given circumstances as the basis for its

judgments. Actual outcomes may differ from these estimates under

different assumptions and conditions.

In preparing the Financial Statements, the significant

judgements made by Management in applying the Corporation

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the Corporation's audited

annual financial statements for the year ended December 31, 2020.

Estimates and assumptions are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

3. MINERAL PROPERTIES

As at December

31, 2020 As at

June 30,

Additions 2021

--------------------------------------- -------------- --------- ---------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq 7,348 - 7,348

Anoritooq 6,389 - 6,389

Sava (previously called Kangerluarsuk) 6,562 - 6,562

Total mineral properties 62,244 - 62,244

--------------------------------------- -------------- --------- ---------

.

As at December

31, 2019 As at

December 31,

Additions 2020

--------------------------------------- -------------- --------- -------------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq - 7,348 7,348

Anoritooq - 6,389 6,389

Sava (previously called Kangerluarsuk) - 6,562 6,562

Total mineral properties 41,945 20,299 62,244

--------------------------------------- -------------- --------- -------------

4. CAPITAL ASSETS

Field Vehicles Equipment Construc-tion Right-of-use Total

equipment and rolling (including In Progress assets

and infrastruc- stock intangible)

ture

$ $ $ $ $ $

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Six months ended

June 30, 2021

Opening net book

value 146,203 256,865 177,052 - 820,894 1,401,014

Additions - - - 2,084,161 - 2,084,161

Depreciation (61,220) (31,610) (10,521) - (40,372) (143,723)

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Closing net book

value 84,983 225,255 166,531 2,084,161 780,522 3,341,452

As at June 30,

2021

Cost 387,323 533,800 185,878 2,084,161 841,080 4,032,242

Accumulated depreciation (302,340) (308,545) (19,347) - (60,558) (690,790)

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

Closing net book

value 84,983 225,255 166,531 2,084,161 780,522 3,341,452

-------------------------- ----------------- ------------- ------------- -------------- ------------- ----------

4. CAPITAL ASSETS (CONT'D)

Depreciation of capital assets related to exploration and

evaluation properties is being recorded in exploration and

evaluation expenses in the consolidated statement of comprehensive

loss, under depreciation. Depreciation of $98,632 ($ 114,317 for

the six months ended June 30, 2020) was expensed as exploration and

evaluation expenses during the six months ended June 30, 2021.

As at June 30, 2021, the Corporation had capital asset purchase

commitments, net of deposit on order, of $6,030,167. These

commitments relate to purchases of equipment, infrastructure and

vehicles.

5. LEASE LIABILITIES

As at

June 30,

2021

---------------------------------------- ------------

$

Balance beginning 829,813

Principal repayment (32,539)

---------------------------------------- ------------

Balance ending 797,274

Non-current portion - lease liabilities (747,692)

Current portion - lease liabilities 49,582

---------------------------------------- ------------

6. STOCK OPTIONS

An incentive stock option plan (the "Plan") was approved

initially in 2017 and renewed by shareholders on June 9, 2021. The

Plan is a "rolling" plan whereby a maximum of 10% of the issued

shares at the time of the grant are reserved for issue under the

Plan to executive officers and directors, employees and

consultants. The Board of directors attributes the stock options

and the exercise price of the options shall not be less than the

closing price on the last trading day preceding the grant date. The

options have a maximum term of ten years. Options granted pursuant

to the Plan shall vest and become exercisable at such time or times

as may be determined by the Board, except options granted to

consultants providing investor relations activities shall vest in

stages over a 12 month period with a maximum of one-quarter of the

options vesting in any three-month period. The Corporation has no

legal or constructive obligation to repurchase or settle the

options in cash.

On June 9, 2021, the Corporation granted to the CFO 900,000

stock options exercisable at an exercise price of $0.59, with an

expiry date of December 31, 2027. The stock options vested 100% at

the grant date. Those options were granted at an exercise price

equal the closing market value of the shares the previous day of

the grant. Total stock-based compensation costs amount to $360,000

for an estimated fair value of $0.40 per option. The fair value of

the options granted was estimated using the Black-Scholes model

with no expected dividend yield, 75.85% expected volatility, 1.07%

risk-free interest rate and 6.6 years options expected life. The

expected life and expected volatility were estimated by

benchmarking comparable companies to the Corporation.

6. STOCK OPTIONS (CONT'D)

Changes in stock options are as follows:

Six months ended Year ended December

June 30, 2021 31, 2020

------------------- ---------------------------- ----------------------------

Weighted Weighted

Number of average exercise Number of average exercise

options price options price

------------------- --------- ----------------- --------- -----------------

$ $

Balance, beginning 7,745,000 0.51 5,650,000 0.43

Granted 900,000 0.59 2,195,000 0.70

Exercised - - (100,000) 0.38

Expired (10,000) 0.38 - -

------------------- --------- ----------------- --------- -----------------

Balance, end 8,635,000 0.52 7,745,000 0.51

------------------- --------- ----------------- --------- -----------------

Stock options outstanding and exercisable as at June 30, 2021

are as follows:

Number of options

outstanding and Exercise

exercisable price Expiry date

----------------- -------- -----------------

$

1,360,000 0.50 July 13, 2022

1,660,000 0.45 August 22, 2023

2,520,000 0.38 December 31, 2025

2,195,000 0.70 December 31, 2026

900,000 0.59 December 31, 2027

----------------- -------- -----------------

8,635,000

----------------- -------- -----------------

7. EXPLORATION AND EVALUATION EXPENSES

Three months Six months

ended June 30, ended June 30,

---------------------------- -------------------- --------------------

2021 2020 2021 2020

---------------------------- ----------- ------- --------- ---------

$ $ $ $

Geology 562,416 524,863 705,954 795,423

Lodging and on-site support 64,523 3,663 64,523 3,663

Underground work 18,588 23,040 18,589 45,847

Drilling 287,760 33,950 287,760 33,315

Safety and environment - 6,568 - 6,568

Analysis 5,362 43,205 84,581 67,068

Transport 21,455 9,923 22,413 70,656

Helicopter charter 109,024 - 109,024 -

Logistic support 64,913 84,223 86,114 162,710

Insurance 45 3,287 8,707 4,513

Project Engineering costs 804,267 102,442 1,736,133 187,297

Government fees 10,380 20,353 22,766 33,074

Depreciation 49,316 57,159 98,632 114,317

---------------------------- ----------- ------- --------- ---------

Exploration and evaluation

expenses 1,998,049 912,676 3,245,196 1,524,451

---------------------------- ----------- ------- --------- ---------

8. GENERAL AND ADMINISTRATION

Three months Six months

ended June 30, ended June 30,

--------------------------- -------------------- --------------------

2021 2020 2021 2020

--------------------------- ----------- ------- ----------- -------

$ $ $ $

Salaries and benefits 667,453 - 1,054,961 -

Management and consulting

fees - 166,369 - 282,441

Director's fees 116,879 25,000 236,379 50,000

Professional fees 690,594 194,349 1,246,949 318,104

Marketing and industry

involvement 190,609 60,606 356,332 146,981

Insurance 148,377 10,561 266,342 21,122

Travel and other expenses 172,156 16,606 302,365 31,180

Regulatory fees 84,965 25,148 170,230 31,722

Depreciation 22,545 - 45,091 -

General and administration 2,093,578 498,639 3,678,649 881,550

--------------------------- ----------- ------- ----------- -------

Further Information:

About AEX

AEX's principal business objectives are the identification,

acquisition, exploration and development of gold properties in

Greenland. The Corporation's principal asset is a 100% interest in

the Nalunaq Project, an advanced exploration stage property with an

exploitation license including the previously operating Nalunaq

gold mine. The Corporation has a portfolio of gold assets covering

3,870km(2) , the largest portfolio of gold assets in Southern

Greenland covering the two known gold belts in the region. AEX is

incorporated under the Canada Business Corporations Act and wholly

owns Nalunaq A/S, incorporated under the Greenland Public Companies

Act.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable securities legislation, which reflects

the Corporation's current expectations regarding future events and

the future growth of the Corporation's business. In this press

release there is forward-looking information based on a number of

assumptions and subject to a number of risks and uncertainties,

many of which are beyond the Corporation's control, that could

cause actual results and events to differ materially from those

that are disclosed in or implied by such forward-looking

information. Such risks and uncertainties include, but are not

limited to the factors discussed under "Risk Factors" in the Final

Prospectus available under the Corporation's profile on SEDAR at

www.sedar.com. Any forward-looking information included in this

press release is based only on information currently available to

the Corporation and speaks only as of the date on which it is made.

Except as required by applicable securities laws, the Corporation

assumes no obligation to update or revise any forward-looking

information to reflect new circumstances or events. No securities

regulatory authority has either approved or disapproved of the

contents of this press release. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Inside Information

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No. 596/2014 on

Market Abuse ("UK MAR"), as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFLTRIRFIL

(END) Dow Jones Newswires

August 27, 2021 02:00 ET (06:00 GMT)

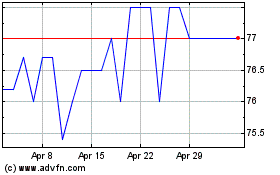

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024