TIDMAFM

RNS Number : 1119R

Alpha Fin Markets Consulting plc

04 July 2022

4 July 2022

Alpha Financial Markets Consulting plc

(' Alpha FMC ', 'Alpha', the 'Company' or ' Group ')

Issue of new shares, grant of incentive awards, PDMR dealing,

RSU vesting

and total voting rights

Alpha FMC (AIM: AFM), a leading global provider of specialist

consultancy services to the asset management, wealth management and

insurance industries, announces that certain Restricted Stock Unit

("RSU") awards have vested and the Company has made a grant of

staff incentive awards under the Company's Management Incentive

Plan ("MIP").

Following the vesting of RSU awards under the MIP, the Company

will use 202,030 existing shares held in the Alpha Employee Benefit

Trust ("EBT") to satisfy these vested awards.

On 1 July 2022, the Company granted 3,138,309 awards under its

MIP to its management team globally, comprising 1,327,338 UK Joint

Share Ownership Plan awards ("JSOP Shares") and 1,810,971 MIP share

options. There will be no voting rights attached to the JSOP Shares

while they are held in the EBT .

These JSOP Shares and MIP share options (i) have a nominal or

nil consideration, (ii) will vest after three to five years, (iii)

have a 10 year term, and (iv) are subject to certain individual or

Group performance conditions. The performance conditions of the MIP

awards and JSOP Shares include: (i) relevant country or divisional

FY23 budgetary performance targets, (ii) individual sales, delivery

excellence and behavioural targets, and (iii) total shareholder

return of a basket of comparable companies over three years, as

applicable.

A total of 1,800,000 ordinary shares of 0.075 pence per share in

the Company ("New Ordinary Shares") will be issued by the Company

to the EBT, of which 1,327,338 will be used for the JSOP Shares and

472,662 will be held by the EBT for the satisfaction of future

share option awards. Application has been made for the New Ordinary

Shares, which will rank pari passu with the Company's existing

issued Ordinary Shares, to be admitted to trading on AIM. It is

expected that admission will become effective and that trading in

the New Ordinary Shares will commence on or around 7 July 2022.

Following the JSOP Shares and MIP share option awards, the

Company will have 11,880,891 unvested MIP and Employee Incentive

Plan ("EIP") share options and JSOP Shares outstanding in total,

representing approximately 9.86% of the issued share capital of the

Company. Within this total, 11,477,465 unvested MIP options and

JSOP Shares are outstanding, including the 3,138,309 MIP options

and JSOP Shares awarded on 1 July 2022. Total unvested MIP options

and JSOP Shares outstanding represent approximately 9.52% of the

issued share capital of the Company, of which approximately 2.60%

was awarded on 1 July 2022.

As set out in the Company's AIM Admission Document, no more than

10 per cent of the total share capital of the Company from time to

time shall be subject to unvested JSOP Shares, Options and RSUs

that are granted under the MIP.

Of the 1 July 2022 MIP award grants, 209,000 have been granted

to Euan Fraser and 76,923 have been granted to John Paton, both

persons discharging managerial responsibilities ("PDMRs").

Following the grant of the MIP awards, Euan Fraser holds 1,064,372

MIP options and JSOP Shares awards and he and his immediate family

are beneficially interested in 563,485 Ordinary Shares representing

0.50% of the Company's total voting rights. Also, further to the

grant of the MIP awards, John Paton holds 375,503 MIP options and

JSOP Shares and he and his immediate family are beneficially

interested in 91,772 Ordinary Shares representing 0.08% of the

Company's total voting rights.

Following the above vesting, share awards and share issuance and

subsequent to admission of the New Ordinary Shares, the Company

will have 120,507,336 Ordinary Shares in issue, of which 7,628,611

are held in the Company's Employee Benefit Trust. No shares are

held in treasury. The total number of voting rights in the Company

will therefore be 112,878,725. The above figure of 112,878,725 may

be used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure and

Transparency Rules.

The notifications below, made in accordance with the

requirements of Article 19 of the UK Market Abuse Regulation,

provide additional detail.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities (PDMR) and persons closely

associated with them (PCA)

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Euan Fraser

Reason for the notification

2

a) Position/status Global Chief Executive Officer

b) Initial notification/Amendment Initial Notification

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

a) Name Alpha Financial Markets Consulting plc

b) LEI 2138003XGYCLWLC7GF39

Details of the transaction(s): section to be repeated for (i)

4 each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

a) Description of the Grant of share award over Ordinary Shares

financial instrument, of 0.075p each

type of instrument

Identification

code ISIN: GB00BF16C058

b) Nature of the transaction Share award granted under the Alpha Financial

Markets Consulting plc Management Incentive

Plan

Price and volume Price Volume

c) Nil 209,000

d) Aggregated information As above

Date of the transaction 1 July 2022

f) Place of the transaction Outside a trading venue

Notification and public disclosure of transactions by persons

discharging managerial responsibilities (PDMR) and persons closely

associated with them (PCA)

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name John Paton

Reason for the notification

2

a) Position/status Chief Financial Officer

b) Initial notification/Amendment Initial Notification

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

a) Name Alpha Financial Markets Consulting plc

b) LEI 2138003XGYCLWLC7GF39

Details of the transaction(s): section to be repeated for (i)

4 each type of instrument;

(ii) each type of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

a) Description of the Grant of share award over Ordinary shares

financial instrument, of 0.075p each

type of instrument

Identification

code

ISIN: GB00BF16C058

b) Nature of the transaction Share award granted under the Alpha Financial

Markets Consulting plc Management Incentive

Plan

Price and volume Price Volume

c) GBP1 total

consideration 76,923

d) Aggregated information As above

Date of the transaction 1 July 2022

f) Place of the transaction Outside a trading venue

Enquiries :

For further information, please contact:

Alpha Financial Markets Consulting plc +44 (0)20 7796 9300

Euan Fraser ( Global Chief Executive Officer )

John Paton ( Chief Financial Officer )

Investec Bank plc - Nominated Adviser, Joint Corporate Broker +44 (0)20 7597 4000

Patrick Robb

James Rudd

Harry Hargreaves

Berenberg - Joint Corporate Broker +44 (0)20 3207 7800

Chris Bowman

Toby Flaux

Alix Mecklenburg-Solodkoff

Camarco - Financial PR +44 (0)20 3757 4980

Ed Gascoigne-Pees

Georgia Edmonds

Prism Cosec - Company Secretary +44 (0)7407 733 518

Sally Chandler

About Alpha FMC:

Headquartered in the UK and quoted on the AIM of the London

Stock Exchange, Alpha is a leading global provider of specialist

consultancy services to the asset management, wealth management and

insurance industries.

Alpha has worked with all of the world's top 20 and 76% of the

world's top 50 asset managers by AUM, along with a wide range of

other buy-side firms. It has the largest dedicated team in the

industry, with over 750 consultants globally, operating from 16

client-facing offices spanning the UK, North America, Europe and

APAC.

-S -

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDFLFBLDLFBBV

(END) Dow Jones Newswires

July 04, 2022 02:00 ET (06:00 GMT)

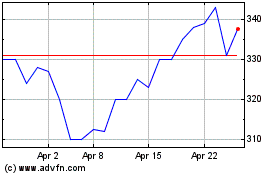

Alpha Financial Markets ... (LSE:AFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

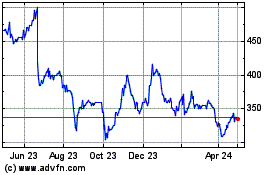

Alpha Financial Markets ... (LSE:AFM)

Historical Stock Chart

From Apr 2023 to Apr 2024