TIDMAGR

RNS Number : 1426S

Assura PLC

11 November 2021

Legal Entity Identifier (LEI): 21380026T19N2Y52XF72

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR

ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN ASSURA PLC OR ANY OTHER ENTITY IN

ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF ASSURA PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION (EU NO.

596/2014) WHICH FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("UK MARKET ABUSE REGULATION").

11 November 2021

Assura PLC

("Assura" or the "Company" or the "Group")

Result of Placing

Assura announces the successful pricing of the placing of new

ordinary shares of 10p each in the share capital of the Company

(the "Ordinary Shares") announced earlier today (the "Placing")

which was oversubscribed.

A total of 267,554,740 new ordinary shares in the Company,

representing approximately 10 per cent of the Company's existing

issued share capital (the "Placing"), will be issued at a price of

68.0 pence per share (the "Placing Price"), raising gross proceeds

of approximately GBP182 million.

Combined with the Directors' subscription (194,117 Ordinary

Shares), a total of 263,350,195 new ordinary shares in the Company

(the "Placing Shares") have been placed with institutional

investors by Barclays Bank PLC ("Barclays"), J.P. Morgan Cazenove,

which conducts its UK investment banking activities as J.P. Morgan

Cazenove ("J.P. Morgan") and Stifel Nicolaus Europe Limited

("Stifel") at the Placing Price. Barclays, J.P. Morgan and Stifel

are acting as Joint Bookrunners (together, the "Joint Bookrunners")

in respect of the Placing.

In addition, retail investors have subscribed in the offer made

by the Company via the PrimaryBid platform for a total of 4,204,545

new ordinary shares in the capital of the Company (the "Retail

Shares") at the Placing Price (the "PrimaryBid Offer").

The Placing Shares and Retail Shares being issued together

represent approximately 10 per cent of the Company's issued share

capital immediately prior to the Placing and PrimaryBid Offer. The

Placing Price represents a discount of approximately 1.4 per cent

to the intraday price on 11 November 2021 at 12:00pm and 16.4 per

cent premium to Assura's EPRA NTA of 58.4p.

Assura consulted with a number of its major shareholders prior

to the Placing and has respected the principles of pre-emption

through the allocation process insofar as possible. The Company is

pleased by the strong support it has received from new and existing

shareholders, including retail shareholders via the PrimaryBid

Offer.

Applications have been made to the Financial Conduct Authority

(the "FCA") and London Stock Exchange plc (the "LSE") respectively

for the admission of the Placing Shares and the Retail Shares to

the premium listing segment of the Official List of the FCA and to

trading on the main market for listed securities of the LSE

(together, "Admission"). It is expected that Admission will become

effective on or before 8.00 a.m. on 15 November 2021. The Placing

is conditional upon, amongst other things, Admission becoming

effective and upon the placing agreement not being terminated in

accordance with its terms. The PrimaryBid Offer is also conditional

upon Admission becoming effective and upon the placing agreement

not being terminated in accordance with its terms.

The Placing Shares and Retail Shares will, when issued, be

credited as fully paid and will rank pari passu in all respects

with the existing Ordinary Shares (other than treasury shares which

are non-voting and do not qualify for dividends), including the

right to receive all dividends and other distributions declared,

made or paid in respect of Ordinary Shares after the date of

issue.

BlackRock, Inc. as agent for and on behalf of its discretionary

managed clients ("Blackrock") is a related party of the Company for

the purposes of Chapter 11 of the Listing Rules as a result of

being entitled to exercise, or to control the exercise of, over 10

per cent. of the votes able to be cast at general meetings of the

Company. Blackrock has agreed to subscribe for 15,356,899 Placing

Shares at an aggregate value of GBP10.4 million under, and on the

terms and conditions of, the Placing. This constitutes a smaller

related party transaction under Listing Rule 11.1.10R. Stifel, in

accordance with Listing Rule 11.1.10R (2)(b), has confirmed that

the terms of the proposed Placing with Blackrock are fair and

reasonable as far as the shareholders of the Company are

concerned.

Following Admission, the total number of shares in issue in the

Company will be 2,945,072,700. Therefore, following Admission, the

total number of voting shares in Assura in issue will be

2,945,072,700.

Director participation

The following Directors and other persons discharging managerial

responsibilities ("PDMR") and / or persons closely associated

("PCA") with them, have subscribed for a total of 194,117 Ordinary

Shares in the Placing, at the Placing Price, as follows:

Name Number of Ordinary Shares

Jonathan Davies 150,000

Louise Fowler 14,706

Sam Barrell 29,411

This announcement includes inside information as defined in

Article 7 of the UK Market Abuse Regulation and is being released

on behalf of Assura PLC by Orla Ball, Company Secretary.

For further information on the announcement, please contact:

Assura

Jonathan Murphy - CEO

Jayne Cottam - CFO

David Purcell - Head of Investor

Relations +44 1925 420660

Barclays (Joint Bookrunner)

Bronson Albery

Tom Macdonald

Dominic Harper +44 207 623 2323

J.P. Morgan (Joint Bookrunner)

Barry Meyers

Beau Freker

Jessica Murray +44 207 742 4000

Stifel (Joint Bookrunner)

Mark Young

Stewart Wallace

Jonathan Wilkes-Green +44 20 7710 7600

Finsbury

Gordon Simpson

James Thompson +44 20 7251 3801

IMPORTANT NOTICES

Neither this Announcement, nor any copy of it, may be taken or

transmitted, published or distributed, directly or indirectly, in

or into the United States, Australia, Canada, Japan, or the

Republic of South Africa or to any persons in any of those

jurisdictions or any other jurisdiction where to do so would

constitute a violation of the relevant securities laws of such

jurisdiction. This Announcement is for information purposes only

and does not constitute an offer to sell or issue, or the

solicitation of an offer to buy, acquire or subscribe for any

shares in the capital of the Company in the United States,

Australia, Canada, Japan or the Republic of South Africa or any

other state or jurisdiction in which such offer or solicitation is

not authorised or to any person to whom it is unlawful to make such

offer or solicitation. Any failure to comply with these

restrictions may constitute a violation of securities laws of such

jurisdictions.

The Placing Shares have not been, and will not be, registered

under the US Securities Act of 1933, as amended (the "US Securities

Act"), or under any securities laws of any state or other

jurisdiction of the United States and may not be offered, sold,

resold, transferred or delivered, directly or indirectly, in or

into the United States except pursuant to an applicable exemption

from, or in a transaction not subject to, the registration

requirements of the US Securities Act and in compliance with the

securities laws of any state or other jurisdiction of the United

States. There is no intention to register any portion of the

Placing in the United States or to conduct any public offering of

securities in the United States or elsewhere.

Members of the public are not eligible to take part in the

Placing. This Announcement and the terms and conditions set out in

the Appendix are for information purposes only and are directed

only at: (a) persons in Member States of the Economic European Area

who are qualified investors within the meaning of article 2(e) of

the EU Prospectus Regulation ("EU Qualified Investors"); (b) in the

United Kingdom, qualified investors within the meaning of article

2(e) of the UK Prospectus Regulation ("UK Qualified Investors") who

are persons who (i) have professional experience in matters

relating to investments falling within the definition of

"investments professional" in article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order"); (ii) are persons falling within article

49(2)(a) to (d) ("high net worth companies, unincorporated

associations, etc") of the Order; (c) in Israel, qualified

investors listed in the first addendum to the Israeli Securities

Law, 5728-1968; and (d) persons to whom it may otherwise be

lawfully communicated (all such persons together being referred to

as "Relevant Persons"). This Announcement must not be acted on or

relied on by persons who are not Relevant Persons.

Barclays Bank PLC ("Barclays") and J.P. Morgan Securities plc

(which conducts its UK investment banking services as "J.P. Morgan

Cazenove") are authorised by the Prudential Regulation Authority

("PRA") and regulated in the United Kingdom by the FCA and the PRA.

Stifel Nicolaus Europe Limited ("Stifel", and together with

Barclays and J.P. Morgan Cazenove, the "Joint Bookrunners") is

authorised and regulated in the United Kingdom by the FCA.

Barclays, J.P. Morgan Cazenove and Stifel are each acting

exclusively for the Company in connection with the Placing. None of

Barclays, J.P. Morgan Cazenove or Stifel will regard any other

person (whether or not a recipient of this Announcement) as a

client in relation to the Placing and will not be responsible to

anyone other than the Company for providing the protections

afforded to their respective clients or for providing advice in

relation to the Placing or any transaction, matter or arrangement

described in this announcement. Apart from the responsibilities and

liabilities, if any, which may be imposed upon Barclays, J.P.

Morgan Cazenove and Stifel by the Financial Services and Markets

Act 2000, as amended or the regulatory regime established

thereunder, none of Barclays, J.P. Morgan Cazenove and Stifel nor

any of their respective affiliates, directors, officers, employees,

agents or advisers accepts any responsibility whatsoever, and no

representation or warranty, express or implied, is made or

purported to be made by any of them, or on their behalf, for or in

respect of the contents of this Announcement, including its

accuracy, completeness, verification or sufficiency, or concerning

any other document or statement made or purported to be made by it,

or on its behalf, in connection with the Company, the Placing

Shares, the Placing, and nothing in this announcement is, or shall

be relied upon as, a warranty or representation in this respect,

whether as to the past or future. Each of the Joint Bookrunners and

each of their respective affiliates directors, officers, employees,

agents and advisers disclaim, to the fullest extent permitted by

law, all and any liability whether arising in tort, contract or

otherwise which they might otherwise be found to have in respect of

this announcement or any such statement.

No person has been authorised to give any information or to make

any representations other than those contained in this Announcement

and, if given or made, such information or representations must not

be relied on as having been authorised by the Company or Barclays,

J.P. Morgan Cazenove or Stifel. Subject to the Listing Rules, the

Prospectus Regulation Rules and the Disclosure Guidance and

Transparency Rules of the FCA, the issue of this Announcement shall

not, in any circumstances, create any implication that there has

been no change in the affairs of the Company since the date of this

Announcement or that the information in it is correct as at any

subsequent date.

Information to Distributors

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Requirements")

and/or any equivalent requirements elsewhere to the extent

determined to be applicable, and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the UK Product Governance

Requirements and/or any equivalent requirements elsewhere to the

extent determined to be applicable) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that such Placing Shares are: (i)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each defined in Chapter 3 of the FCA

Handbook Conduct of Business Sourcebook; and (ii) eligible for

distribution through all permitted distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors should note that: the price of the Placing

Shares may decline and investors could lose all or part of their

investment; the Placing Shares offer no guaranteed income and no

capital protection; and an investment in the Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, the Joint Bookrunners will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIGPGUWGUPGGQG

(END) Dow Jones Newswires

November 11, 2021 11:32 ET (16:32 GMT)

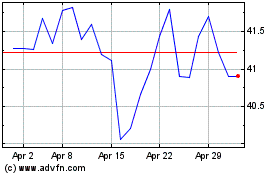

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

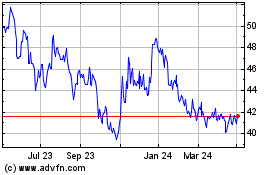

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024