Assura PLC Trading Update (8386X)

10 January 2022 - 6:00PM

UK Regulatory

TIDMAGR

RNS Number : 8386X

Assura PLC

10 January 2022

10 January 2022

Assura plc

Trading Update

For the third quarter of the year ending 31 December 2021

Assura plc ("Assura"), the leading primary care property

investor and developer, today announces its Trading Update for the

third quarter of the year to 31 December 2021.

Jonathan Murphy, CEO, said:

"It has been another strong quarter of progress as we have

swiftly deployed the proceeds of our successful November equity

placing.

"Our experienced internal investment and development teams have

ensured activity continues apace. In the last quarter we completed

GBP105 million of acquisitions. We have also moved on site with two

new development schemes and are currently on site with 14 schemes

at a total cost of GBP97 million. These activities build on our

recent track record of growing our portfolio and driving further

scale benefits, and our replenished pipelines provide further

significant growth opportunities.

"As the booster and vaccination programmes continue - with some

of our buildings acting as major hubs - the urgent need for

high-quality primary care capacity to support the significant

effort required to address the backlog from the pandemic will be in

even sharper focus in the coming months. Assura continues to be a

partner of choice to the NHS in helping to deliver this critical

capacity."

Strong investment activity in quarter, deploying equity issue

proceeds

-- Growing portfolio of 634 properties with current annualised rent roll of GBP132.5 million

-- Nine acquisitions completed in the quarter for a total cost of GBP105 million

-- Two development schemes moved onto site with a combined

development cost of GBP25 million (medical centre in Cardiff and

private facility in Kettering for Ramsay)

-- On site with 14 developments with a total cost of GBP97

million (September 2021: 12, GBP72 million)

-- Four lease regears completed (representing GBP0.1 million of existing rent)

-- Three capital asset enhancement projects completed (total

spend GBP1.9 million), and currently on site with a further three

projects (total spend of GBP2.2 million)

Development and acquisition pipelines provide significant growth

opportunities

-- Immediate development pipeline of 22 schemes, where we expect

to be on site within 12 months, totalling a further GBP166 million

(September 2021: 20, GBP145 million)

-- Immediate acquisitions pipeline of GBP71 million in legal

hands, which we would normally expect to complete in 3-6 months

(September 2021: GBP102 million)

-- 62 lease re-gears covering GBP7.7 million of existing rent roll in the current pipeline

-- Pipeline of 16 capital asset enhancement projects (projected

spend GBP15.0 million) over the next 2 years

Strong financial position

-- At 31 December 2021 net debt stood at GBP957 million with a

weighted average interest rate of 2.3%

- ENDS -

For further information, please contact:

Assura plc: Tel: 01925 420 680

Jayne Cottam, CFO Email: Investor@assura.co.uk

David Purcell, Head of Investor

Relations

Finsbury: Tel: 0207 251 3801

Gordon Simpson Email: Assura@Finsbury.com

James Thompson

Notes to Editors

Assura plc, a constituent of the FTSE 250 and the EPRA* indices,

is a UK REIT and long-term investor in and developer of primary

care property. The company, headquartered in Warrington, works with

GPs, health professionals and the NHS to create outstanding spaces

for health services in our communities. At 30 September 2021,

Assura's property portfolio was valued at GBP2,595 million.

Further information is available at www.assuraplc.com

*EPRA is a registered trademark of the European Public Real

Estate Association.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSDLLIDIIF

(END) Dow Jones Newswires

January 10, 2022 02:00 ET (07:00 GMT)

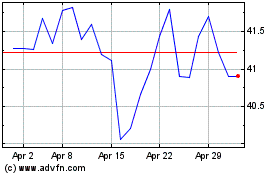

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

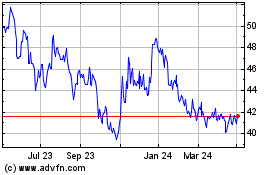

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024